Ether (ETH), which powers the smart-contract-enabled Ethereum blockchain and is the world’s second-largest cryptocurrency in terms of market capitalization, is nearing a retest of a key long-term uptrend.

The ether price was last around $1,840, having seen significant volatility in the last three days in wake of dual lawsuits announced by the US Securities and Exchange Commission (SEC) against two of the world’s largest cryptocurrency exchanges, Binance and Coinbase.

For now, ETH continues to find solid support at its 100-Day Moving Average, which was last around $1,813, having now bounced from this support level three times in under one month.

However, if this support is to break, ETH risks breaking below an uptrend that has been supporting the bull market since late 2023, which would likely come into play in the upper $1,700s.

A break below here would open the door to a retest of the 200-Day Moving Average, last around $1,610, and potentially a drop all the way back to the March lows in the $1,371 area.

That would mark a more than 25% drop from current levels.

SEC Refrains from Labelling ETH a Security… For Now

A key assumption made by the SEC in its lawsuit against Coinbase and Binance, which principally accuses them of operating as unlicensed securities exchanges, is that a number of the cryptocurrencies being traded on their platforms are actually securities.

The SEC went on to overtly name the likes of BNB, BUSD, Cardano (ADA), Solana (SOL), Cosmos (ATOM) and many more as so-called crypto securities.

The SEC has now labelled a total of 64 crypto assets as securities.

Unsurprisingly, the SEC’s lawsuits have weighed more heavily on these cryptocurrencies than the broader market.

For now, the SEC labelling a cryptocurrency as a security doesn’t mean it’s the end of the world for that crypto.

It just means that if the SEC wins its court battles versus Coinbase and Binance, exchanges offering these cryptocurrencies would have to register as securities exchanges (a big cost in terms of compliance), and that the groups who issued them would need to come into compliance as issuers of a public security (again, another big cost in terms of compliance).

But that’s a big uncertainty hanging over these cryptos that could deter substantial amounts of investment in the coming years as the lawsuits play out.

ETH bulls are breathing a sign of relief that, for now, the SEC hasn’t gone as far as labelling ether a security.

But that doesn’t mean they will.

SEC Chairman Gary Gensler has in the past given lectures where he has overtly stated that he thinks ether is a security, owing in part to its initial distribution (a public and private presale).

Regulators who don’t understand blockchain consensus mechanisms may also think simplistically about proof-of-stake chains that offer a yield to stakers as “just another yield producing assets” like a bond.

These Factors Can Keep the ETH Bull Market Alive

One saving grace for ether might be the fact that past SEC Chairs have explicitly stated that they do not view ether as a security.

That might deter the current SEC from making such a classification, out of fear of being inconsistent.

So long as ether can avoid being classified as a security, that may be one factor to keep the bull market alive.

Two other factors relate to the blockchain’s underlying fundamentals.

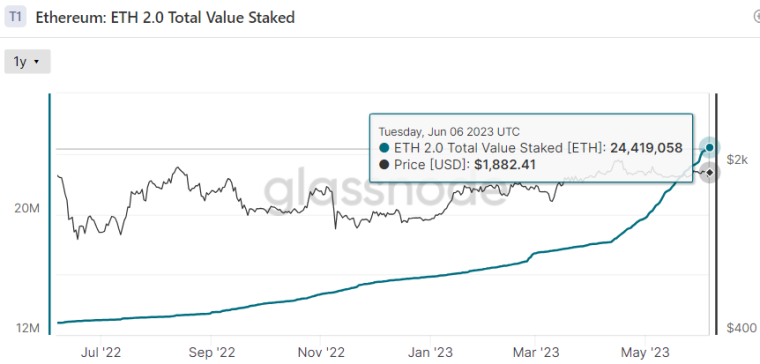

Firstly, in light of the Ethereum blockchain’s upgrade in April that enabled staked ETH withdrawals, a flood of ETH tokens have been entered into the staking contract (withdrawals mean staking is now less risky).

As per Glassnode data, more than 24.419 million ETH tokens were locked up in the staking contract on Tuesday, amounting to over 20% of the token’s total supply of just under 120 million.

That’s a jump of more than 6 million since prior to the upgrade.

It means that the supply of readily available unstaked ETH tokens is in rapid decline, which could act to boost the price.

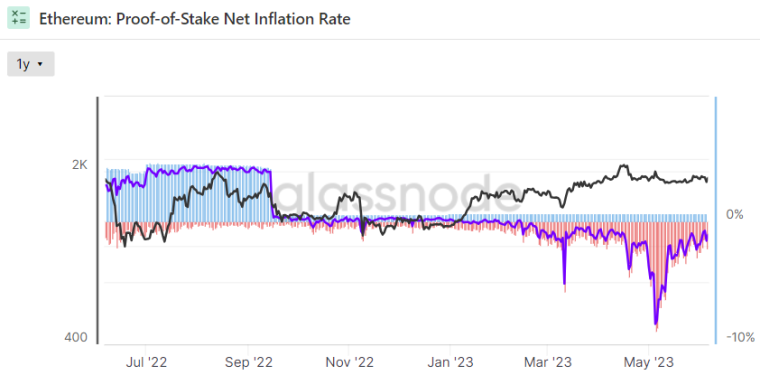

Meanwhile, the ETH supply has pretty much been in constant deflation since the end of January, with the annualized rate of deflation reaching as high as 9% in early May when transaction fees spiked.

In wake of the passage of Ethereum Improvement Proposal (EIP) 1559 back in August 2021, transaction fees (paid in ETH) are burnt from the supply, so transaction fee spikes mean a higher ETH deflation rate.

Deflation should add another long-term tailwind to the ETH price.

Related Articles

- Ethereum Price Prediction 2023-2025

- Where to Buy Ethereum – Beginner’s Guide

- 10+ Best Crypto To Buy Now

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards