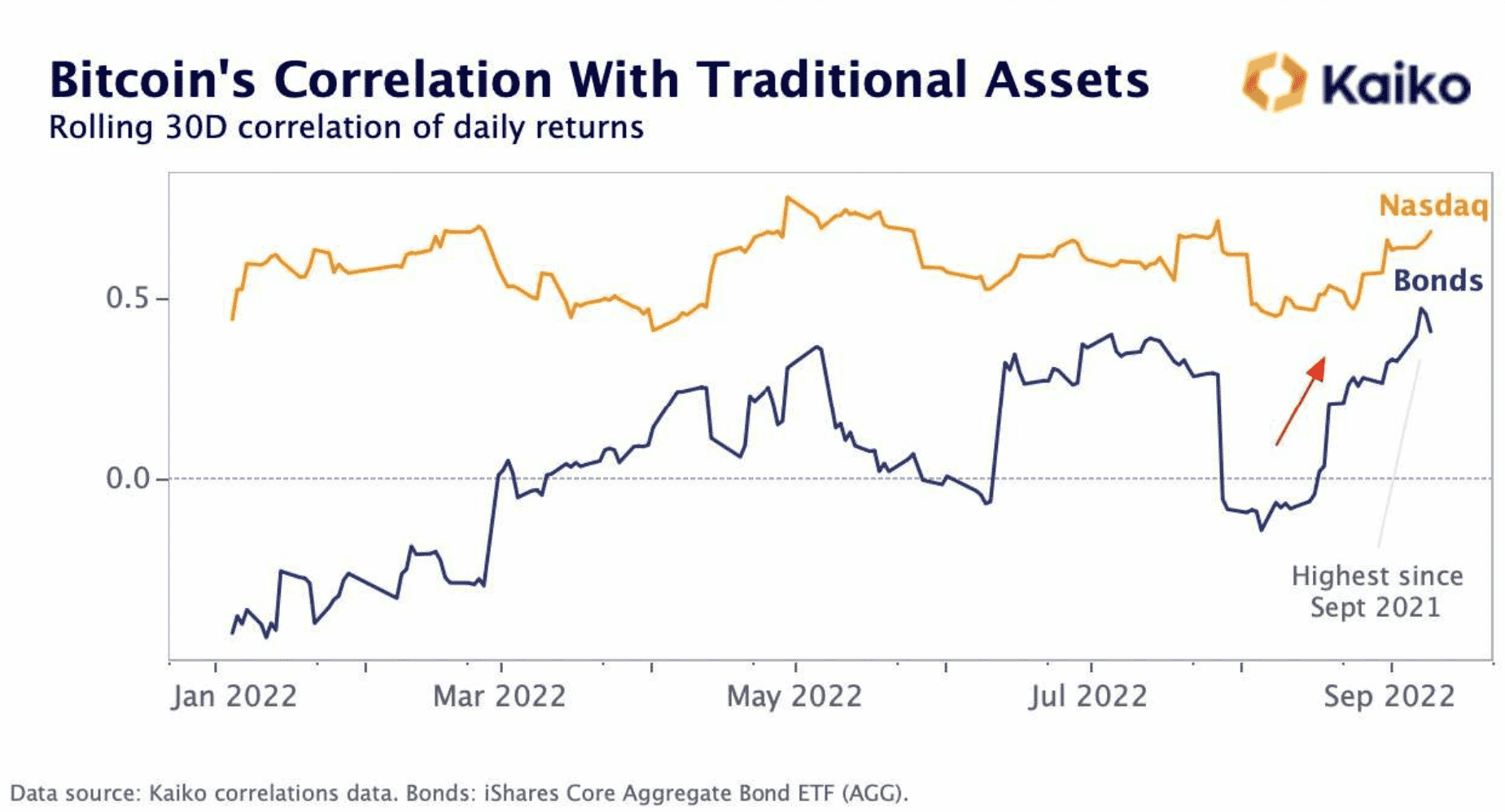

Bitcoin’s increasing correlation with stocks and bonds seems to signify longer crypto winter. According to data from cryptocurrency research firm Kaiko, Bitcoin’s relationship with stocks and bonds is strengthening once more.

The Kaiko team pointed out that inflation worries and Fed tightening have always led to a drop in risky assets and fixed-income assets.

Bitcoin’s Correlation with Stocks and Bonds

The Federal Reserve has been raising interest rates to slow the economy and control the recent spike in inflation. The inflation rate in the United States has not decreased as much as analysts predicted. The stock and cryptocurrency markets were impacted by market dissatisfaction with the CPI report.

Stocks fell after August’s key inflation data came in higher than expected, undermining market expectations for falling prices and a more aggressive Federal Reserve. Furthermore, the future may be more difficult for riskier assets such as cryptocurrencies.

The Nasdaq 100 has lost 28% of its value, the iShares Aggregate Bonds ETF, which tracks the US investment-grade bond market, has lost 12% year to date, and Bitcoin has lost more than 50% of its value.

Risk and fixed-income assets have historically fallen as a result of the Fed’s tightening monetary policy and inflation uncertainty, putting traditional asset allocation strategies to the test.

Bitcoin’s correlation with bonds and stocks increased again in September after declining during the summer. Inflation has a negative impact on all asset classes. As a result, recent research suggests that continued high and volatile price growth may be one of the reasons for the positive relationship between bonds and risk assets (stocks and cryptos).

Longer Crypto Winter on the Way

The price of bitcoin is now falling, particularly as the labor market continues to deteriorate. Bitcoin has long been lauded as an inflation-resistant asset. It is a claim that is still valid, depending on when the token was purchased. Stocks and bonds have seen extremely high declines since the beginning of 2022, but bitcoin has fared worse.

"Bitcoin's correlation with stocks has turned higher than that between stocks and assets such as gold, investment grade bonds, and major currencies, pointing to limited risk diversification benefits in contrast to what was initially perceived." #IMFblog https://t.co/0EhROZfX88 https://t.co/Bgn2QZVJxD

— Gita Gopinath (@GitaGopinath) January 11, 2022

According to global risk sentiment, Bitcoin has lost more than half its value this year. Since early August, the return on US inflation-indexed bonds has risen by 100 basis points (bps), raising concerns about riskier assets such as cryptocurrencies. Furthermore, the so-called real yield may increase even further in the coming months, much to the chagrin of bitcoin (BTC) enthusiasts.

Furthermore, when it comes to correlations, investors can discover that crypto-correlated stocks are sensitive to bitcoin price fluctuations. Companies with a significant amount of bitcoin, bitcoin miners, and other fintech firms with a growing crypto presence are among them.

Some observers argue that an increase in inflation did not cause the recent drop in cryptocurrency prices. However, it was caused by the skyrocketing interest rates. Furthermore, higher interest rates result in higher Treasury returns and more foreign bond purchases. As a result, changing the current trend may be more difficult, indicating that extended crypto winter is on the way.

Related

- Best Crypto Winter Tokens – Top Coins to Invest in

- Best Beginner Crypto to Invest in 2022

- Attribution 101: Understanding Correlation and Causation in Attribution

- Best Crypto To Buy Now

- Best Crypto Presales – Compare Pre-ICO Projects

- New Cryptocurrencies to Invest in 2024

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption