DeFi Coin Wing Finance is on a bullish run, pumping 31% in seven days. The WING/USD pair opened at $12.99 and currently trading at $11.30 after reaching a high of $13.19 and a low of $11.15.

In one day, the coin dropped by 1.67%, with a 20% APY; AAX is currently the exchange with the highest yield to stake and earn Wing Finance (WING).

DeFi Coin Wing Finance – Everything You Should Know

Wing Finance is a credit-based cross-chain decentralized lending network. Because it is a DeFi platform specifically designed for the loan market for digital assets, the network facilitates cross-chain interactions between various DeFi products.

In collaboration with the Wing DAO, the platform’s decentralized governance approach and risk control mechanism promote positive interactions among lenders, creditors, and guarantors. Wing Finance also offers a cutting-edge credit assessment module that rewards users for establishing good credit on the blockchain.

Wing Finance is the governance token used by Wing Finance. WING users can vote on and decide how WING Improvement Proposals will be implemented. WING may also be staked in the Wing’s Insurance pool to provide protocol/supplier security/insurance. In addition, the protocol offers stake benefits to stakes.

DeFi Coin Wing Finance Offers Fair Loans

A new listing on Binance called Wing Finance (WING) aims to change the current crypto financing market. Right now, getting a large crypto loan needs a lot of collateral. Wing Finance wants to offer fair loans to all by using a credit monitoring system. Still, it’s possible that a project like Wing Finance, which builds on this idea, could be successful.

Support NFT Down Payment

Medium shared an official blog post about wing finance. The post states that customers can now buy blue-chip NFTs in the Wing NFT Pool with a 60% down payment. A user can select the NFT they want to buy, and the platform will lend them 40% of the NFT’s floor price, meaning they need to cover the remaining 60% themselves. The Wing NFT pool will then require the NFT to be used as collateral.

Users can sell NFTs without first validating them in the Wing NFT Pool. Users can also sell NFTs in a Sell Limit and Sell Stop manner by deploying the Market Receiver Contract when they collateralize their NFTs in the NFT pool.

The protocol will issue the NFTs that users have listed on the exchange page once they have selected the listing price and listing period for their sell orders.

Moreover, the protocol will refund the ETH of selling revenues to users after subtracting the debt after the sell order is complete. Using the Wing NFT Pool to buy blue-chip NFT will enhance demand for WING. Therefore, this news is also positive for WING/USD.

Regarding DeFi Coins, DEFC is yet another popular coin to invest in.

What is DeFi Coin (DEFC)?

DeFi Coin is an alternative cryptocurrency developed on top of the Binance Smart Chain. Token holders have access to the DeFi Swap ecosystem, a decentralized exchange featuring numerous crypto-centric services. Check out our primer to learn why this token is a top pick this season.

It is predicted that DeFi Coin (DEFC) will have a stellar year, ranking among the top-performing cryptocurrencies. This cryptocurrency is the backbone of the recently released Defi Swap ecosystem, enabling users to earn a desirable interest rate on various tokens.

Overview of DeFi Coin’s Most Important Features

Tokens can be instantly converted on this decentralized network without the need for a central authority.

DEFC has the ability to:

- Provide funds in exchange for a cut of the profits made by DeFi Swap trades.

- Boost your income with a high annual percentage rate by cultivating cryptocurrencies.

- Digital tokens can be traded directly for one another in real-time, bypassing the requirement for a middleman.

- Buying cryptocurrency on DeFi Swap is crucial since it can be done anonymously and independently from any central authority.

As a DeFi Coin holder, you gain access to a wide range of perks.

DeFi Swap

When it comes to the decentralized trading platform DeFi Swap, the cryptocurrency token known as DeFi Coin is what holds everything together. In addition to allowing for quick token swaps without a third party, this DEX also allows you to profit from your cryptocurrency holdings through yield farming and liquidity.

DeFi Coin (DEFC) Staking

While the price of DeFi tokens is now low, many investors are buying in anticipation of a future price increase. As a result, staking cryptocurrency and DeFi token assets can create income rather than realizing losses by selling assets for fiat currency or stablecoins. DeFi Coin (DEFC), the native token of the decentralized exchange DeFi Swap, offers up to 75% APY returns.

The DeFi Coin staking lockup periods are:

- 30 days – 30% APY

- 90 days – 45% APY

- 180 days – 60% APY

- 360 days – 75% APY

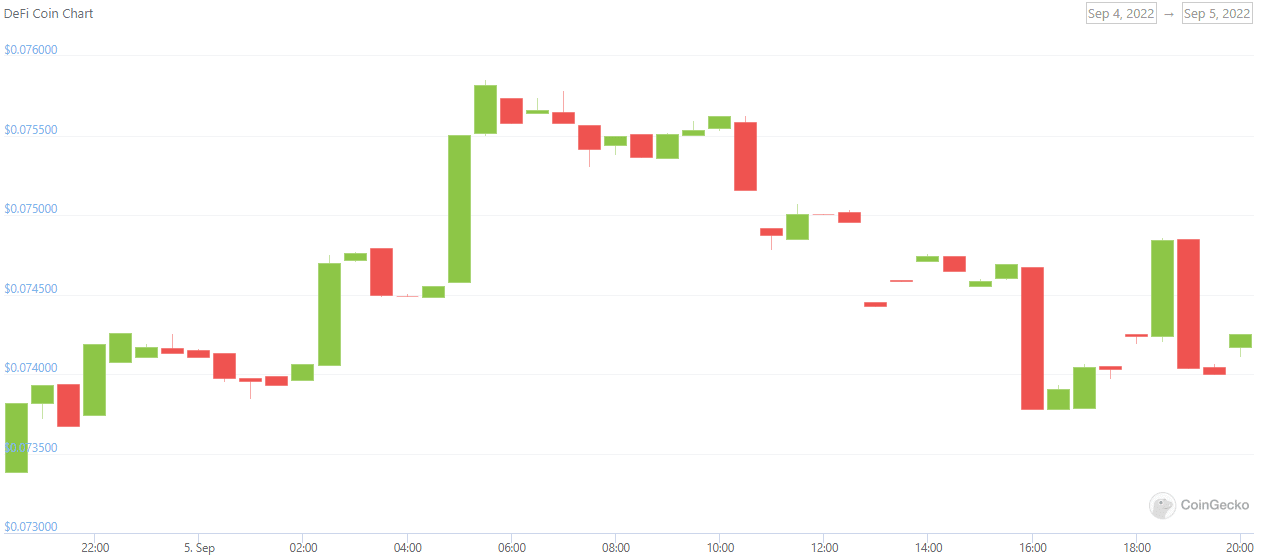

Defi Coin’s current price is $0.074037, with a 24-hour trading volume of $912.39. Defi Coin has increased by 0.73% in the last 24 hours. CoinMarketCap is currently ranked #6129, with a live market capitalization of not provided. The circulating supply is not available, and a max. supply of 100,000,000 DEFC coins. Looking at the technical side of DEFC, the coin has gained some traction, having bounced off the $0.07378 support level.

On the upside, DEFC is likely to face immediate resistance at $0.07484, with a break above this level potentially exposing the DEFC coin to $0.07550. So let’s consider buying over the $0.07400 level and vice versa.

Related

- DeFi Coin Price Prediction 2022 – 2025

- Best Yield Farming Crypto Platforms 2022 – How to Yield Farm Crypto

- How to Buy Tamadoge

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption