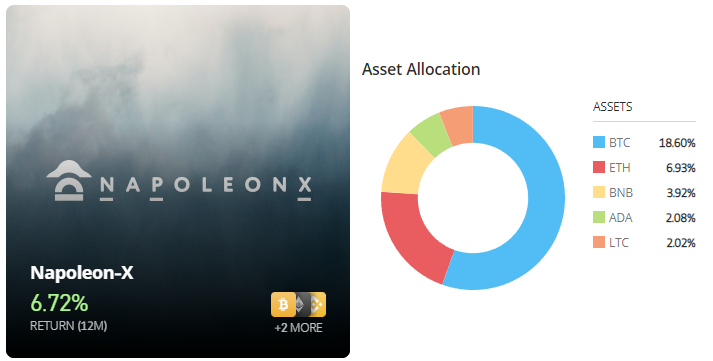

The eToro Smart Portfolio Napoleon-X which uses crypto trade bot strategies has a positive winrate in the past year, over the crypto winter.

It achieved a 6.72% return on investment (ROI) for those copytrading it – eToro allows investors to copy trade various bespoke investment portfolios. Although many others are currently in the red with the current bear market, affecting both cryptocurrency and stocks. Napoleon-X is one of the few to be in the green.

Crypto Trade Bot Napoleon-X

Napoleon-X achieved that return despite its main asset being Bitcoin. The Bitcoin price was around $33,000 this time a year ago – mid July 2021 – and currently is trading at around $19,000, a loss of 42.5%. Many altcoins are down by larger percentages.

Rather than passively hold Bitcoin however – alongside its other main cryptos Ethereum, Binance Coin, Cardano, Litecoin and others – the crypto trade bot managing the portfolio makes automated decisions to buy and sell based on the market conditions.

The description on eToro.com reads:

‘Napoleon Crypto is a regulated French asset manager which designs low frequency systematic trading strategies.

It has designed a long-term quantitative machine-learning based investment strategy using the following assets: BTC/USD, ETH/USD, LTC/USD, XRP/USD and EOS/USD. Each asset allocation is given equal exposure and rebalanced daily.

The strategy has been developed using advanced machine-learning technology by a team of experts with vast asset management experience from tier 1 investment banks.’

Some traders are rightly skeptical of Bitcoin robots, automated trading platforms and similar software – most are unregulated and some are scams.

However this particular AI trading platform is offered on a regulated crypto exchange operating for over a decade – eToro – with 27 million users. Currently over 6,000 of those copy trade the Napoleon-X bot with a total of $5 million in assets under management.

That process can also be switched on and off at any time, and doesn’t involve copytraders needing to use the trading robot tools themselves. The amount of funds used to automatically copytrade the bot portfolio can also be continually adjusted.

For those looking for a safe, legitimate trading bot Napoleon-X may be one option – as the actual bot trading is done by those managing the portfolio, with a verified winrate over the past 12 months.

Another way to beat the bear market is to invest in a crypto presale, rather than trading – or even copy trading a portfolio managed by professionals. Any type of new financial assets tend to perform well as they are early in their Gartner Hype cycle, which also applies to cryptocurrency.

eToro states that 68% of retail traders lose money when CFD trading – using leverage – so it’s often a more stable option to either copy trade, make use of some kind of algorithmic trading platform, or buy and hold an asset from a cheap price level – buy low, sell high.

eToro copytrading, by contrast, achieved a 30.4% positive ROI based on the top 50 most copied traders in 2021 and their average profitability.

Related

eToro CopyTrader™ Tool

- Buy Crypto & Copy Trade Professionals

- Copy a DeFi or Metaverse Portfolio

- Free to Use, Automated Trading

- Mimic From 1 - 100 Traders