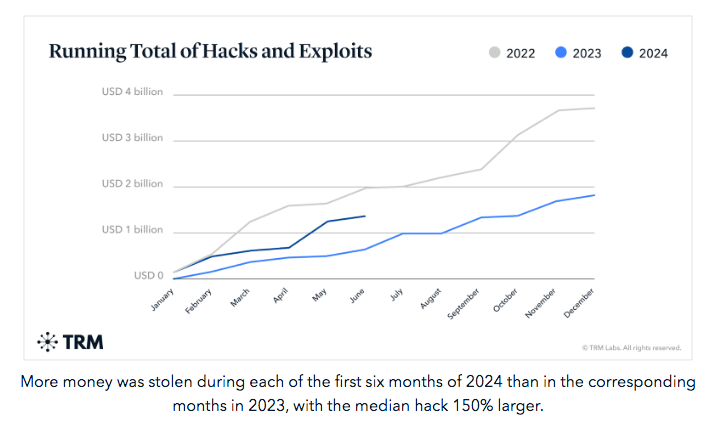

A new report from a crypto research firm named TRM Labs uncovers that crypto crime is once again surging as the number of hacks globally has more than doubled in the first six months of the year compared to 2023.

According to its investigation, criminals managed to steal a staggering total of $1.38 billion from individuals and organizations up until June 24 resulting in a 110% increase compared to 2023.

The top five most notable incidents were responsible for 70% of that figure, including the hack of DMM Bitcoin, a cryptocurrency exchange based in Japan that suffered a breach where 4,5000 Bitcoin (BTC) were stolen.

Ari Redbord, global head of policy at TRM Labs, commented on the findings: “While we have not seen any fundamental changes in the security of the cryptocurrency ecosystem, we have seen a significant increase in the value of various tokens – from bitcoin to ETH (ether) and Solana – compared to the same time last year.”

The Amount of Stolen Crypto Surges Alongside Prices

One of the primary factors contributing to this alarming trend is the overall recovery of cryptocurrency prices from the lows experienced in late 2022 following the collapse of FTX.

Bitcoin, the world’s largest cryptocurrency by market capitalization, reached an all-time high of $73,803.25 in March 2024. This positive performance has made crypto assets attractive targets for cybercriminals once again.

Redbord explained: “This means that cybercriminals are more motivated to attack crypto services, and can steal more when they do.”

TRM Labs identified private key and seed phrase compromises as top attack vectors in 2024. A seed phrase is a sequence of random words that is used to access or recover a crypto wallet.

Once hackers get ahold of these credentials they can easily access an investor’s wallet and make transactions with it including selling or transferring the assets to other wallets.

Another emerging trend is “address poisoning” which involves sending a small amount of crypto from a wallet with a similar-looking address crafted to mimic the victim’s or recipient’s address.

This tactic is designed to trick users into sending funds to the wrong wallet, exploiting the complexity of crypto addresses, which are long strings of characters that are difficult to memorize and that can be easily miswritten.

Evolution of Crypto Crime in the Past Few Years

While 2024 has seen a significant increase in stolen funds, it’s important to note that 2023 marked the highest number of theft incidents with 286 reported cases that supposed a total of over $2.3 billion in losses. This indicates that, while the value of stolen assets has increased in 2024, the frequency of the attacks has not expanded proportionally.

In terms of total losses, 2022 still holds the record as the most profitable year for crypto criminals as they managed to steal nearly $4.2 billion. This year also saw the highest number of DeFi (Decentralized Finance) hacks with 132 reported incidents.

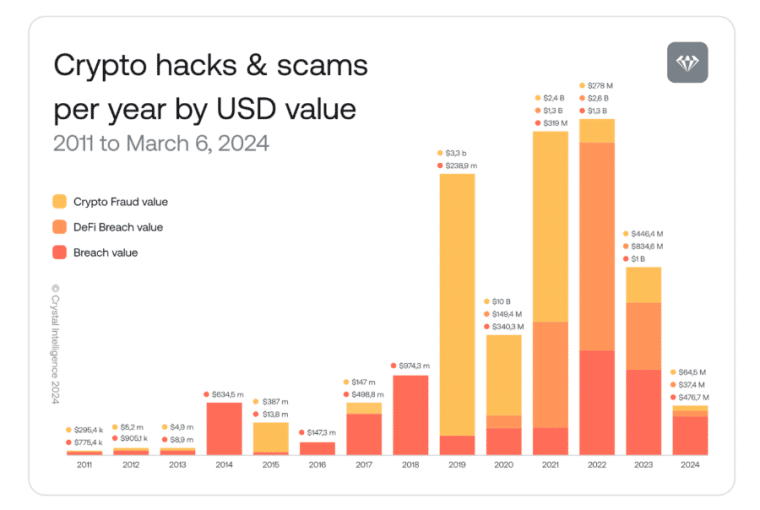

Meanwhile, another report by Crystal Intelligence titled “Adolescent Anarchy: Thirteen Years of Crypto Crimes Unveiled” provides a broader perspective on the evolution of crypto crime from 2011 to 2024. The study analyzed 785 incidents over this period, revealing that nearly $19 billion in crypto has been stolen in the past thirteen years.

These $19 billion are broken down into categories with $6 billion being siphoned from system breaches, nearly $5 billion coming out of hacked DeFi protocols, and almost $8 billion attributed to other types of fraud.

The largest incident on record involves the 2019 Plus Token fraud, which resulted in criminals getting ahold of $2.9 billion worth of cryptocurrencies.

Patterns and Schemes Have Evolved in The Past Decade

The report highlights how crypto crime has evolved over the years. In the first few years of the crypto space, most crimes involved breaching a crypto exchange security. However, DeFi hacks and more sophisticated fraud schemes are now the most frequent method to steal money from investors.

Among the number of incidents registered and tracked by Crystal Intelligence, five categories stand out and are considered major threats to the community. The first comes alongside the rise of artificial intelligence as criminals are resorting to sophisticated deepfakes, voice cloning tools, and forged documents to blackmail and steal users’ personal information.

Meanwhile, when crypto prices are high, this usually results in a higher number of initial coin offerings (ICO) hitting the market. Many of these crypto projects are fraudulent. They take advantage of all the hype to attract investors to then disappear with their hard-earned money once they have hit a certain funding milestone.

Phishing campaigns are also becoming more and more frequent. They typically consist of using fake websites and offerings to prompt investors to share their private keys and access credentials to wallets and exchanges to drain their accounts.

In some cases, these scams may offer giveaways or requests for financial assistance and have expanded to include airdrop scams that lure users with promises of free tokens from well-known cryptocurrencies.

Finally, with the rise in popularity of meme coins, pump-and-dump schemes are gaining traction as the easiest method to steal money from investors. Criminals have managed to hack the social media accounts of celebrities lately to promote tokens that are easily minted via platforms like the Solana-based Pump.fun.

They take advantage of the huge fan base of these individuals to get people to buy the tokens and, once the price is high enough, they dump their holdings on these unwary investors who are left holding worthless digital assets and facing significant losses.

Law Enforcement Agencies Are Doing What They Can to Keep Up

Authorities have been cracking down on crypto crime with more severity than ever and have been effective at capturing and bringing to justice individuals who engage in high-profile criminal activities in the sector.

The promoter of the Oyster Pearl Token, Amir Bruno Elmaani, was sentenced to five years in prison for committing tax fraud while Sam Bankman-Fried, the founder of FTX and once a poster child of the industry, received a 25-year sentence for his role in the collapse of the exchange.

Moreover, regulatory bodies worldwide are working to strengthen their oversight of the cryptocurrency industry. This includes implementing more robust Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements for crypto exchanges and service providers.

On the other hand, the report of Crystal Intelligence highlights the critical need for improved security measures within the crypto industry. As crimes become more sophisticated, the protocol’s defenses must be strengthened as well.

The increasing complexity of crypto crimes presents new challenges for compliance teams. First, there is a growing need for more targeted threat assessments and region-specific security protocols.

If these issues are not handled and dealt with appropriately, they could potentially erode investors’ confidence in the market.

Protecting Yourself Against Crypto Crime

In light of these trends, experts recommend that individuals and organizations take some of the following steps to protect their assets:

- Stay informed about the latest developments in the crypto industry and common scam tactics.

- Use hardware wallets or reputable exchanges with strong security measures and activate two-factor authentication (2FA).

- Be skeptical of unsolicited offers, airdrops, or investment opportunities, especially those promoted through social media or emails from unknown senders.

- Conduct thorough research before investing in any cryptocurrency or participating in an ICO.

The dramatic increase in criminal activities in the crypto sector in the first semester of 2024 emphasizes the importance of staying safe, implementing the latest security enhancements, and avoiding devious offerings that appear to come out of nowhere.

The crypto industry continues to face a critical juncture in this particular area. Its ability to address these security challenges effectively will play a significant role in shaping its future growth and mainstream adoption.