Financial lenders have long turned to property and real estate as the de facto asset class of choice to secure as collateral against borrowing, while it remains among the most popular and surefire long-term investment vehicles.

Both individuals and institutions have long put money into real estate to beat inflation and secure wealth – people will always need a place to live, after all.

Cryptocurrencies have been the fastest-growing asset class in the world in recent years, with trillions of dollars of investment flowing into the market.

Many investors have now turned to crypto to secure assets and attempt to break the cycle of fiat inflation – but despite ever-increasing adoption and popularity it is estimated only between 20 and 25% of the global population owns crypto.

Widespread institutional adoption is still, seemingly, a little way off, with critics often pointing to the volatility of Bitcoin and its lack of consistent real-world utility as the two biggest barriers to increased adoption.

However, as set out in an editorial by Leon Wankum in Bitcoin Magazine, Bitcoin should become a prime collateral for lenders in the near future.

The Case for Bitcoin as Lending Collateral

Real estate and property are the top forms of collateral for banks, brokers and lenders, whether that is when trying to secure a mortgage, personal loan or business loan.

Stocks, bonds and sometimes cash can also be used as collateral, although the practice is much less common.

The strengths of Bitcoin as a store of value are very well known and well documented, drawing some parallels to real estate and some advantages over it, making it ripe for use as a collateral against lending.

Bitcoin Strengths

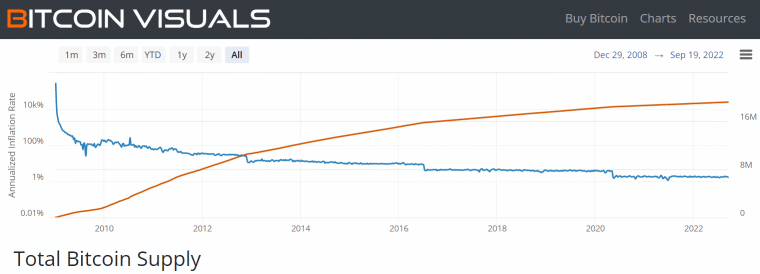

It has a maximum supply that will never inflate, on a pre-determined schedule, which gives investors an incentive to hold rather than spend and also draws capital gains tax to sell.

Although it can be used as a currency, and has been encouraged by many, as long as inflation keeps rising and Bitcoin keeps outperforming it, individuals will continue to spend fiat currency over BTC.

Hedge Against Inflation

Bitcoin has a final maximum supply of 21 million that will never inflate and is released on a pre-determined schedule, giving investors an incentive to hold rather than spend.

Although it can be used as a currency, and has been encouraged by many, as long as inflation keeps rising and Bitcoin keeps outperforming it, individuals will continue to spend fiat currency over BTC.

It is easily one of the most profitable cryptos ever and as the original crypto has never been off the top spot by market cap. Other altcoins have come close, but BTC still retains market dominance and a near 40% share of the market.

Bitcoin, like real estate, is also the subject of taxation when selling, meaning many investors are loath to get rid of it.

USD, like many currencies around the world, has been subject to huge inflation hikes this year and is currently at 7.9% – the highest since 1982.

Transparency and Privacy

Every single Bitcoin transaction, and the contract addresses that sent and received them, are completely public and fully verifiable.

That takes an enormous amount of risk out of the financial system with lenders and borrowers able to know exactly where finances are coming from and going to.

This lessened risk works for both lenders and borrowers – lenders can easily find proof of reserves before deciding to hand over money, while borrowers will know if their capital is being used inappropriately by an institution, avoiding practices such as Rehypothecation.

For individuals Bitcoin is not only transparent but also more private, with there being no need to reveal or verify personal information to know if the assets are there.

Storage and Security

Unlike with traditional assets, and especially real estate, Bitcoin does not need continued maintenance or vast resources – physical labor and space – to maintain, store or transport.

Bitcoin and other cryptos only need to be safe against cyber-attacks, with cold wallets (those that are not connected to a network) carrying zero threat of attack.

1/ Mid-year crypto crime update!

In this thread, we look into the effects that the market downturn has had on illicit #cryptocurrency activity. https://t.co/DdfHNjRotU

— Chainalysis (@chainalysis) August 16, 2022

Cybercrime draws lots of negative headlines in the space with scammers stealing a record $14 billion in crypto in 2021 and laundering around $9 billion through crypto the same year, according to research from crypto security firm Chainalysis.

The same firm also revealed that as of July 2022, crypto-related crime was mostly down across the board, with scams down 65% on the same period the previous year as security improves and investors become more aware of the risks.

By comparison, a 2020 report by the UK’s National Crime Agency branded previous estimates of £90 billion of money laundering in the country as a “significant underestimate” and stated that property was the biggest launderer – with legal professionals and real estate agents “likely” to be aiding criminal purchases.

Valuation and Fluidity

While real estate needs constant appraisal and audit, which can be time consuming and costly, and is subject to ever changing market conditions, Bitcoin is a fluid asset with real time market value that can be instantly seen and verified by all.

For lenders this could offer real advantages.

For example. if an individual defaults on a payment and a property is repossessed, it takes time for the lender to recoup their money.

The house would need to be appraised and put on sale at auction, while a buyer would also need to be found.

On the other hand, if Bitcoin was the collateral, the lender could simply repossess the BTC and put it back onto a liquid market that – unlike the stock market – operates 24/7.

The Real Estate Bubble

The growth of the global real estate market has been exponential in recent decades with some many investors making significant gains on their properties and others building million- and billion-dollar property empires.

However, many commentators now accept that real estate and housing markets now exist in a bubble, with prices far exceeding its fair value based on actual utility.

While everyone needs somewhere to live, it has become extremely difficult to get onto the property ladder because of the huge deposits needed to secure mortgages, with many instead turning to a rental market that is extemely unfair and inflated in many parts of the world.

Real estate is an increasingly less accessible and exclusive asset class and has been linked to social inequality and financial and class divisions.

Bitcoin, meanwhile, is accessible to anyone in the world and can be bought for as little as $1.

There has been rapid uptake of the asset in developing countries in Africa, Latin America and Southeast Asia, where investors not only buy Bitcoin to use as a currency, but increasingly as a savings tool – with lending collateral the logical next step.

Bitcoin Volatility

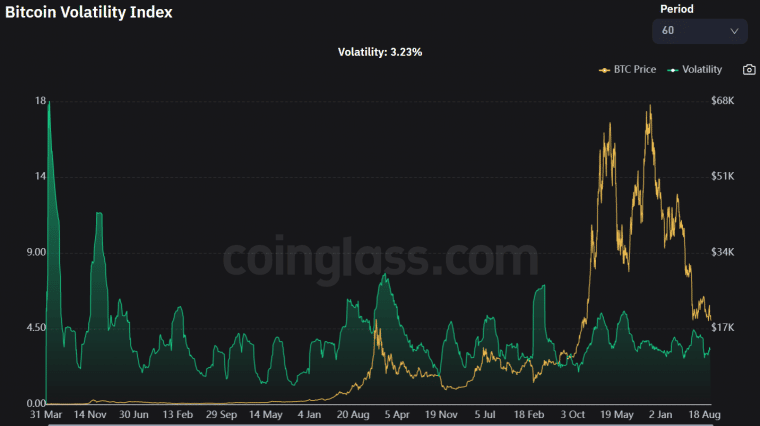

The biggest case against Bitcoin’s wider adoption and potential as a long-term investment vehicle is its volatility – after all, this is an asset that is currently down more than 70% from its all-time high.

However, as mentioned above, adoption and faith in the coin continues to grow despite its performance and volatility has remained at between 3 and 5% for the last two years, despite peaks and troughs in price.

As adoption becomes more widespread, volatility will decrease and while there will always be Bitcoin traders, over a longer period most are expected to hold and accumulate BTC.

Fiat currency and real estate are also subject to market volatility and changes in pricing – inflation the most obvious one.

Bitcoin is, of course, subject to wider market conditions but unlike fiat currency cannot be externally manipulated.

Conclusion

As set out above, a logical next step for Bitcoin is to not only see wider adoption but to become an institutional store of value and see wide use as a collateral lender.

Already described as ‘digital gold’, Bitcoin is a fairer, more easily managed and more transparent asset class – for both lender and borrower – than real estate.