Bitcoin (BTC) is rallying into the weekend amid renewed adoption hopes ignited by BlackRock’s application to create a spot bitcoin Exchange Traded Fund (ETF) that could make it easier for financial institutions to invest in the cryptocurrency.

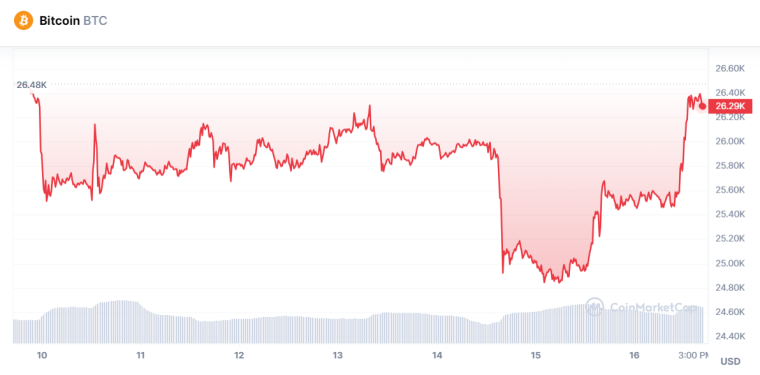

BTC was last trading in the $26,300s, up around 3% on the day and now up more than 6% from Thursday’s post-hawkish Fed meeting sub-$25,000 lows.

That means the cryptocurrency is on course to snap a two-week losing streak.

It also means that BTC has bounced from 2023’s key uptrend, suggesting hope for the near-term technical outlook.

With the US Securities and Exchange Commission (SEC) having so far refused all other spot bitcoin ETF requests, why all the optimism all of a sudden?

Well, it appears that BlackRock has a trick up its sleeve.

According to reports in the crypto press, BlackRock’s spot bitcoin ETF application will come alongside a new so-called “surveillance-sharing agreement” designed to bolster spot market transparency and reduce the scope for market manipulation.

The fact that cryptocurrency exchanges like Binance and Coinbase, where most spot bitcoin trade takes place, are unregulated has been cited as a key reason by the SEC for its past refusals to approve a spot bitcoin ETF.

However, under BlackRock’s ETF application, Nasdaq will enter into a surveillance-sharing agreement with a bitcoin spot trading platform.

Nasdaq is the exchange that BlackRock has proposed launching the ETF on.

It should also be noted that BlackRock is the world’s largest assets manager and holds huge sway on Wall Street, over regulators and over the US government.

Spot Bitcoin ETF Could Open the Flood Gates

If Blackrock can bulldoze through their ETF, this could open the floodgates to a surge of institution-driven investment into bitcoin – hence why prices are rallying on Friday.

That’s because the lack of a regulated investment vehicle that give direct exposure to bitcoin (like a spot ETF) is commonly cited as a barrier to investment by financial institutions.

Surveys have also shown that a majority of institutional investors are highly interested on getting involved in crypto markets.

According to a survey conducted by Laser Digital, the digital assets division of Japanese banking giant Nomura, and cited by CoinDesk, 96% said they think crypto represents a diversification opportunity.

The survey of investment fund, hedge fund, pension fund and wealth management offices found that institutional investors were keen to invest as much as 5% of their wealth into crypto.

How High Can BTC Go If Institutions Start Buying?

As per Statista, total assets under management (AUM) in the US amounted to $54 trillion in 2021.

Globally, AUM is more than double this.

Let’s be conservative and say that, globally, institutions eventually allocate as much as 3% of their portfolios to bitcoin.

That’s a possible $3 trillion in inflows.

$3 trillion in inflows would undoubtedly be a huge tailwind for the BTC price.

With bitcoin viewed by many as “digital gold”, some target an eventual market cap for bitcoin as the same as real gold.

As per companiesmarketcap.com, gold’s market cap was last around $13 trillion.

Given the maximum token supply of 21 million, that would imply a BTC price of north of $600,000.

But that doesn’t take into account the many millions of lost bitcoins – i.e. tokens that reside in wallets that no one has access to anymore.

Recently, crypto analyst Timothy Peterson estimated that as many as 6 million of the existing 19.3 million BTC supply have been lost.

Now these kinds of institutional inflows won’t happen all at once, but they could be a key tailwind for the market in the coming decades.

Related Articles

- Bitcoin (BTC) Price Prediction 2023 – 2040

- How to Buy Bitcoin in 2023

- 15+ Best Crypto To Buy Now 2023

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards