With cryptocurrency hitting the mainstream amidst massive, prolonged institutional inflows into spot Bitcoin ETF products, BlackRock’s tempered approach toward Ethereum ETF prospects has sparked significant discourse – with some suggesting the SEC’s reluctant approach to an ETH ETF is spooking adoption. While some experts are predicting eventual approval of Spot ETH ETFs after months of delays, others think that the SEC won’t approve them at all this time around.

While Bitcoin (BTC) continues to capture the lion’s share of client interest, Ethereum’s potential in mainstream US markets remains a topic of nuanced deliberation, with a lack of clarity over whether ETH is a ‘security’ tempering investor appetite.

Asymmetrical Interest: Bitcoin’s Precedence Over Ethereum Among BlackRock Clients

At the heart of BlackRock’s crypto narrative is the stark contrast in client interest between Bitcoin and Ethereum.

Robert Mitchnick, BlackRock’s head of digital assets, shed light on this during a recent conference, highlighting a predominant inclination towards Bitcoin.

While Ether garners attention, it pales in comparison to the overwhelming client demand for Bitcoin-oriented products. This may simply boil down to a lack of understanding of the crypto space outside of Bitcoin but no one knows for sure why it’s happening.

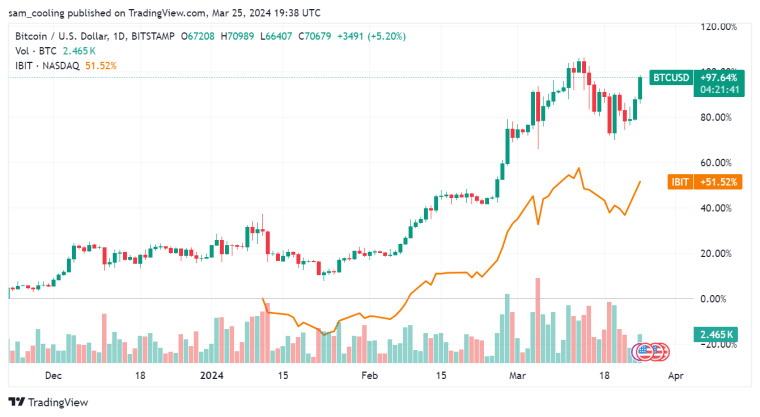

This was further exemplified by the success of BlackRock’s Bitcoin Fund (IBIT), which rapidly ascended to become a market leader among ETFs, amassing a substantial $15 billion in assets.

(IBIT USD)

The firm’s venture into asset tokenization with the Ethereum-based BUIDL fund signifies a cautious yet strategic exploration of ERC-20 (a type of token on Ethereum) capabilities.

However, Mitchnick’s remarks on the industry’s overestimated expectations from BlackRock indicate a deliberate, focused strategy rather than a broad crypto service expansion.

SEC’s Stance and Ethereum ETF Applications: A Regulatory Conundrum

The crypto community is on tenterhooks as the US Securities and Exchange Commission (SEC) navigates the terrain of Ethereum ETF applications.

The approval of Bitcoin ETFs has set a precedent, fueling speculation about the potential for Ethereum-centric products. Spot ETH ETFs seem like the obvious next step for the SEC as Ethereum is the only other cryptocurrency that the SEC has long considered a currency and not a security.

Notably, financial titans like BlackRock and Fidelity are in the queue, awaiting the SEC’s verdict on their Ethereum ETF filings.

closing words on ETH/BTC (fuck this frfrfr)

New set of "deadlines" coming up next week for ETF issuers, some ETF experts saying that the fact there are no comments or discussions happening is bearish

some are saying that It is basically copy+paste application from BTC spot ETF pic.twitter.com/sPegBhM7sF

— RunnerXBT (@RunnerXBT) March 18, 2024

However, the regulator’s protracted decision-making process and historical reluctance to greenlight similar Bitcoin products have cast a shadow of uncertainty over Ethereum’s ETF prospects.

Potential Impacts and the Road Ahead: Ethereum’s Market Dynamics in Focus

The overarching question remains: What would the ramifications be if the SEC decided against Ethereum ETFs?

Conventional wisdom suggests a negative market reaction, yet some analysts propose a more tempered impact, drawing parallels with Bitcoin’s resilience in the face of previous ETF rejections. The writing may already be on the wall, making it impossible for the SEC to put off spot ETH ETFs for too long.

Nonetheless, Ethereum’s unique position and its intertwined relationship with the burgeoning field of decentralized finance (DeFi) and smart contracts lend an additional layer of complexity to its market trajectory.

Why Caution Prevails: Analyzing BlackRock’s Ethereum Strategy

As 2024 unfolds, the crypto market is witnessing a resurgence, with Ether taking a prominent role alongside Bitcoin.

Yet, despite this upward trend, the anticipation for an ETH ETF is met with a blend of optimism and realism.

BlackRock’s cautious stance reflects a broader industry perspective that carefully weighs the innovative potential against regulatory and market uncertainties.

The firm’s strategic moves in the digital asset sector, particularly its engagement with Ethereum through the BUIDL fund, underscore a recognition of Ether’s importance, albeit tempered by a pragmatic approach to expansion and client demand.