The much-anticipated Bitcoin halving last week wasn’t just about reducing mining rewards.

It also marked the launch of an intriguing new token protocol called Bitcoin Runes, sparking an unprecedented frenzy of activity and token creation on the world’s largest blockchain.

Continue with us to explore the innovative token standard and uncover the most promising Bitcoin Runes tokens shaping the future.

Key Takeaways: Bitcoin Halving and Runes Protocol

- Miner Revenue Boosted by Fees: Despite the halving’s reduction in block rewards, Bitcoin miners saw a windfall in transaction fees, thanks to the Runes Protocol.

- Runes Take Over Bitcoin Transactions: Runes transactions dominated the Bitcoin network, accounting for over 81% of all transactions at their peak, drastically reducing the share of traditional BTC transactions .

- Speculation and Congestion: The speculative frenzy surrounding Runes tokens has led to high transaction fees and network congestion, but miners have benefited significantly from this increased activity .

What Are Bitcoin Runes?

Runes is a groundbreaking new token standard created by Casey Rodarmor, the developer behind last year’s wildly popular Bitcoin Ordinals protocol for minting non-fungible tokens (NFTs).

Building on that success, Runes aims to streamline the process of creating and managing fungible tokens directly on the Bitcoin network.

Unlike previous token systems like BRC-20 hosted on the Bitcoin blockchain in the past, Runes utilizes the blockchain’s unique UTXO model and OP_RETURN transaction outputs in an innovative way. By embedding token data into these small OP_RETURN fields, Runes allows for efficient token operations without excessively bloating the Bitcoin blockchain.

“Runes is defined as a newly introduced token standard in Bitcoin that simplifies and improves the efficiency of creating fungible tokens on the blockchain,” explained Bill Barhydt, CEO of the cryptocurrency trading platform Abra.

The Runes Protocol leverages Bitcoin’s UTXO model and OP_RETURN transaction code to facilitate the creation and management of tokens.

Barhydt says that each Runes operation can describe multiple token actions like creation, transfers, and supply changes through lightweight “edict” transactions. This streamlined approach promises faster and cheaper token operations compared to the complexities of standards like BRC-20. This is a nice addition because Bitcoin is rather slow, prioritizing security over scalability.

What makes Runes different from Ordinals is that the latter are non-fungible assets, meaning that each Ordinal is unique and cannot be replicated. Meanwhile, Runes are fungible, meaning that they are totally mutually interchangeable like a US dollar. This opens up a new window of opportunity for minting assets on the Bitcoin blockchain like the meme coins that we have gained so much popularity in the Solana ecosystem.

Transaction Fees Surge to All-Time Highs Following Halving Event

The Runes protocol’s launch on April 20th, coinciding with Bitcoin’s latest halving event, immediately triggered an unprecedented level of activity on the pioneering blockchain. Fueled by immense interest and speculation around the new token capabilities, Bitcoin’s transaction fees skyrocketed to never-before-seen highs.

Last week, we saw two historic moments in #Bitcoin – the 4th Bitcoin Halving, and the launch of Bitcoin Runes!

Which Runes projects are you interested in and why? 👇

— Ledger (@Ledger) April 23, 2024

Data from crypto analysts at YCharts reveals that transaction fees averaged a staggering $127.97 on April 20th – more than double the previous record set three years ago.

The single-day spike represents over 7 times the average fee rate from just the day prior.

“The Runes asset issuance has overridden almost every other use case on Bitcoin at the moment”, commented Bitcoin developer Jimmy Song, highlighting just how overwhelmingly dominant the new protocol has been for the network’s activity. Runes are so popular that they are entirely congesting the network, pushing fees up.

This is all fantastic for Bitcoin miners, because total miner revenue, including transaction fees, soared to an all-time high of $107.8 million on April 20th according to YCharts data. This unexpected windfall for Bitcoin miners could have significant implications amid the halving event, which cut their per-block rewards in half.

“If transaction fees normalize at a level higher than in the past, the impact of the halving on miner revenue will be dampened,” noted analysts at Grayscale, the company behind the popular GBTC Bitcoin Trust, in their investor newsletter.

While analysts celebrated these short-term gains, they also warned that the surge could be unsustainable without the widespread adoption of scaling solutions like the Lightning Network to handle increased demand.

The Runes Token Frenzy

In the days following Runes’ launch, a diverse array of new token projects has flooded the market as developers and investors eagerly position themselves at the forefront of this potential paradigm shift for Bitcoin.

Fehu is the first rune created on bitcoin through the public etching process. It will be #1 for as long as bitcoin exists. Team communication will be done through @RuneFehu twitter. We have no affiliation with any other entities.

ᚠ Z•Z•Z•Z•Z•FEHU•Z•Z•Z•Z•Z ᚠ

— Fehu (@RuneFehu) April 20, 2024

One of the most notable Runes tokens to emerge is called Z•FEHU, which was created during the pivotal block 840,000 Bitcoin halving.

According to data from cryptocurrency exchange OKX’s NFT marketplace, Z•FEHU is currently trading at around 25,999 satoshis (or sats) – around $17.21 per token.

With a circulating supply of over 110 million tokens and nearly 4,000 holders already, Z•FEHU’s fully diluted market valuation would be a staggering $2.07 billion at this price level. The token’s price has already demonstrated volatility, having briefly spiked to as much as 64,999 sats ($42) per coin just one day after launch.

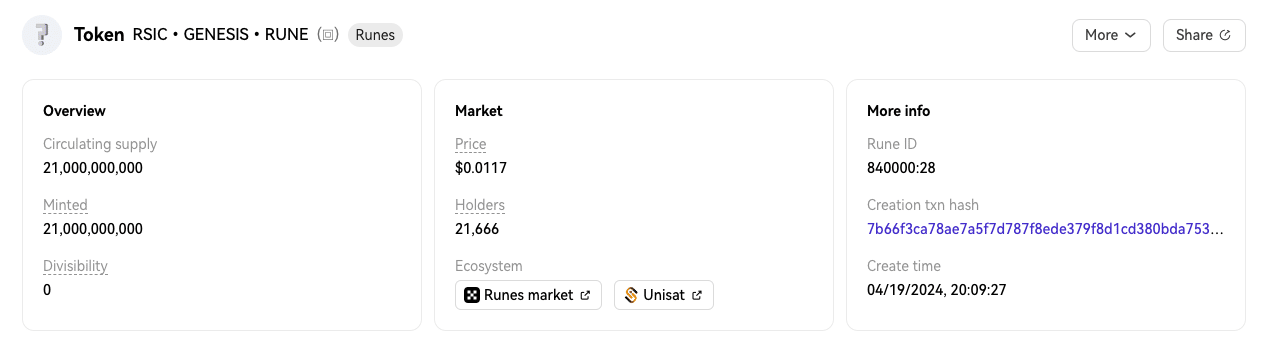

Another prominent Runes project is RSIC•GENESIS•RUNE, trading at 19.6 satoshis or $0.012 per token on OKX. Despite its relatively modest price, this token has an extraordinary maximum supply of 21 billion coins that were all pre-mined by the creator.

This puts RSIC’s fully diluted market cap at a potential $267 million.

While the scarcity and maximum supplies of many Runes tokens remain unclear, the frenzy of speculation is palpable. Even SATOSHI•NAKAMOTO (SN), a token named after Bitcoin’s pseudonymous founder, has already logged over 5,200 sales on OKX with a trading price of 9,550 sats ($6.21) and an approximate $132 million market capitalization.

The enthusiasm around Runes has extended beyond just new projects. Existing BRC-20 tokens anticipated to convert to Runes standards have seen an increase in trading volumes and value this week.

One prime example is the PUPS meme coin, which did millions of dollars in daily trading volume in April as investors positioned themselves for an upcoming conversion to Runes. According to blockchain data tracker CryptoSlam, PUPS was the second highest volume NFT/BRC-20 collection over the past week.

Also read: PUPS, The Hottest Meme Coin on Bitcoin, Skyrockets 700%

The PUPS website is upfront that the project is simply a meme coin without inherent utility. However, its very lack of fundamentals may be fueling the speculative fervor from traders seeking to capitalize on the next Dogecoin-like phenomenon, this time supported by the power of the Bitcoin blockchain.

Scalability and Cost Issues May Hamper the Growth of the Runes Protocol

While the unbridled hype around Bitcoin Runes has been evident, the novel protocol is not without its risks and potential roadblocks in its path to long-term success. Perhaps the most immediate issue is the skyrocketing transaction fees that have priced out smaller users.

“The Runes asset issuance has made it nearly impossible to get a transaction included into certain blocks without paying an exorbitantly high transaction fee”, warned developer Jimmy Song.

Bitcoin’s high fees during periods of network congestion have long been an issue that prevents the network from scaling and becoming the home of decentralized apps (dApps), tokens, and NFTs.

The quadrennial halvings, which reduce miner rewards, have historically increased this strain as the economics incentivize miners to prioritize high-fee transactions.

If the Runes token mania persists, ongoing high fees could be an obstacle to the widespread adoption of the protocol and limit its use cases to speculative trading by wealthy investors and enterprises. This could trigger renewed debates around raising Bitcoin’s block size to increase capacity, which have raged for many years.

Beyond fees, the sheer proliferation of new Runes tokens and the partially-secured nature of the protocol itself raise security and scalability questions. Bitcoin (BTC) was designed primarily as a simple payments rail, not for hosting potentially hundreds or thousands of new speculative token economies.

Runes appear to be a “game of greater fools in which essentially everybody loses.” criticized the pseudonymous authors of the Bitcoin Layer newsletter. In addition, they emphasized that Runes “accentuate the need for hastening the development of and further expansion of liquidity on layer-2 scaling solutions like the Lightning Network.”

Recent Developments in Runes

- Runes Protocol’s Impact on Fees: Following the halving, Bitcoin’s transaction fees surged to unprecedented levels, peaking at over $127.97 per transaction, generating more than $107 million in fees for miners. This spike was largely fueled by the frenzy around minting Runes tokens, which now account for the majority of Bitcoin network transactions .

- Network Congestion and Miner Windfall: The launch of Runes led to severe network congestion, with backlogs reaching over 237,000 pending transactions. Despite this, miners benefited tremendously, as nearly 75% of their revenue during this period came from transaction fees .

- Runes Token Frenzy: Popular tokens like Z•FEHU and RSIC•GENESIS gained massive attention, driving high trading volumes and contributing to the speculative fervor. These tokens are viewed as pivotal in enhancing the utility and long-term value of Bitcoin’s blockchain .

Are Runes the Next Big Crypto Idea?

Only time will tell if Runes tokens represent a legitimate paradigm shift that expands Bitcoin’s utility or merely another fleeting mania fueled by speculation around the latest shiny innovation in the crypto space – a phenomenon seen so many times that it is just hard to keep track.

Whichever way the market evolves, Bitcoin has once again captured the imagination of investors, developers, and the broader crypto community with this latest breakthrough.

“The overall Runes ecosystem will likely be worth many billions of dollars”, predicted blockchain researcher Saurabh Deshpande.

For proponents of Bitcoin’s long-term dominance, the Runes explosion demonstrates how the pioneer blockchain continues to prove its versatility and ability to evolve with the times through the development of new protocols and use cases.

Whether Runes establishes itself as a durable standard or gets replaced by the next groundbreaking innovation, one thing is certain – the world’s largest cryptocurrency has ensured it will remain squarely at the center of the tokenization narrative.