Bitcoin price prediction has shifted from bullish to bearish as the BTC/USD pair consolidates in a narrow range of $16,000 to $17,250 due to ongoing FUD. The demise of FTX has sent shockwaves through the cryptocurrency market, fueling fears that a major player is in financial trouble.

Binance Joins Rescue Fund – $2 Billion

When FTX, a major cryptocurrency exchange, went bankrupt, it sent shockwaves through the industry. Following the devastating damage, the largest cryptocurrency exchange is at the forefront of efforts to restore the sector. Binance has launched the $1 billion Industry Recovery Initiative to aid failing cryptocurrency companies.

Yesterday, #Binance allocated ANOTHER $1 billion to the industry recover initiative. All in BUSD.

— CZ Binance (@cz_binance) November 25, 2022

Speaking to Bloomberg on November 24, crypto billionaire Changpeng “CZ” Zhao said that the fund would have a “loose” structure, be publicly available on the blockchain, and accept contributions from other industry participants.

Binance has already contributed $1 billion in cryptocurrency and may donate an additional $2 billion if more is needed. The firm claims it has received over 150 requests for assistance from various failing businesses.

#Binance SAFU insurance fund ($1 billion USD equ) is roughly split between BTC, BUSD, and BNB. Just that BNB price rose faster than BTC since last rebalance.

Yesterday, #Binance allocated ANOTHER $1 billion to the industry recover initiative.

Both publicly on the blockchain. https://t.co/Dpu9tNx5NQ

— CZ Binance (@cz_binance) November 25, 2022

Furthermore, CZ confirmed the fund might be interested in purchasing troubled cryptocurrency projects purchased by the defunct FTX exchange.

Several participants who have already invested over $50 million in the initiative include Polygon Ventures, Animoca Brands, Jump Crypto, Aptos Labs, GSR Markets, Kronos, and Brooker Group. This is another attempt by Binance to support the cryptocurrency market. The rise in the BTC/USD value is a direct result of this news.

BTC, ETH, and other Digital Assets are not Securities, Belgium Claims

Bitcoin, Ether, and other cryptocurrencies issued solely in computer code are not considered securities, according to Belgium’s financial regulator. The justification was presented in a report by the Belgian Financial Services and Markets Authority (FSMA) on November 22; a draft of the report was made available for public review and comment in July 2022.

The FSMA states that the clarification is necessary because of the increase in inquiries into the applicability of existing financial rules and regulations in Belgium to digital assets. The criteria for asset classification under the FSMA are not dependent on the underlying technology. It shows that the asset is security regardless of whether or not it was created on a blockchain.

Belgium Govt. says instruments created by computer code like #BTC or $ETH not considered as securities but may be subject to other regulations.

SEC on the other hand can treat BTC a commodity but proof of stake coins like ETH may be considered security as per the Howey Test pic.twitter.com/RY1iYVjJ1z

— Crypto India (@CryptooIndia) November 25, 2022

The more likely outcome is that digital assets issued by a central authority will be regulated as securities. Even though cryptocurrencies are not considered securities, the Belgian regulatory agency noted that if used as a medium of exchange by a company, they may be subject to other laws.

When compared to Belgium’s transparent regulations, the approach taken by the US Securities and Exchange Commission (SEC), which is currently competing with the US Commodity Futures Trading Commission (CFTC) for regulatory authority over digital assets, is “regulation by enforcement.”

Bitcoin Price Prediction – Daily Technical Levels

Support Resistance

16452 16776

16298 16946

16128 17100

Pivot Point: 16622

Bitcoin Price Prediction

The current Bitcoin price is $16,458, with a $23 billion 24-hour trading volume. In the last 24 hours, Bitcoin has remained mostly unchanged. With a live market cap of $316 billion, CoinMarketCap has risen to first place. There are 21,000,000 BTC coins in total, with 19,216,643 BTC coins in circulation.

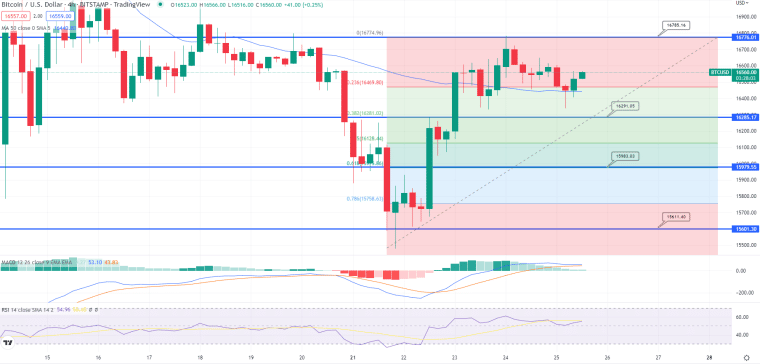

Bitcoin is currently consolidating sideways and has yet to break out of a narrow range of $16,000 to $16,750. The BTC/USD pair is currently descending towards the 38.2% Fibonacci retracement level of $16,300. On the 4-hour timeframe, it has already crossed below the 50-day moving average line, indicating a selling bias.

BTC/USD Price Chart – Source: Tradingview

Similarly, the RSI and MACD are close to entering a selling zone, which would indicate that BTC could drop below $16,300 and find support at $16,000. For those who need more help, the next tier starts at $15,600.

In contrast, if BTC were to break out to the upside from $16,785, it might be able to reach the $17,000 or $17,550 level.

Related news:

- Bitcoin Price Prediction 2022 – 2030

- How FTX Could Have Been Spotted by This Intelligent Trading Platform

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof Audited, CoinSniper KYC Verified

- Trading Community of 70,000+ Members