Cryptocurrency enthusiasts have been keeping a close eye on Bitcoin’s price movements, as the world’s most well-known digital asset has recently seen significant fluctuations. Bitcoin (BTC) failed to maintain its strong gains and fell below $24,000 after reaching a high of $25,216, for the first time since August.

The latest decline in BTC’s price may be attributed to strong US economic statistics and hawkish statements from Federal Reserve members indicating more interest rate hikes.

After a 12% increase the previous day, the price of #Bitcoin drops below $24,000. Currently trading at $23,700 (as of writing).#bitcoinprice $BTC pic.twitter.com/C21ZJgFwOc

— P2E News (@P2ENewsOfficial) February 17, 2023

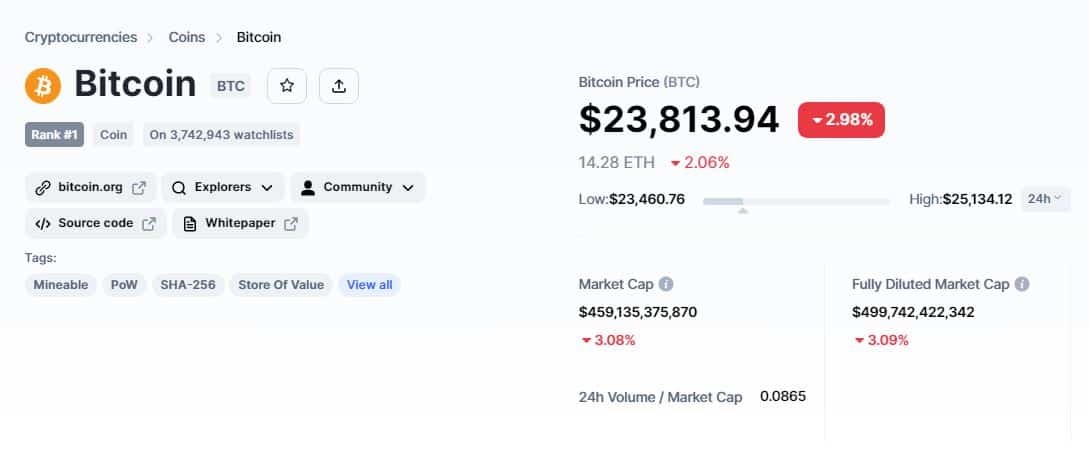

The current price of Bitcoin is $23,773, with a 24-hour trading volume of $39,728,270,521. In the past 24 hours, Bitcoin has fallen nearly 3%.

Cryptocurrency pricing was further weighed down by the strength of the US dollar, which regained lost ground and reached a six-week high. Additionally, investors are still reeling from the impact of increased regulatory pressure in the cryptocurrency industry.

Notably, the Securities and Exchange Commission (SEC) recently censured Kraken, one of the major cryptocurrency exchanges, for its failure to register its staking-as-a-service program.

SEC's ban on #Kraken's staking services is a step backward for #crypto innovation in the US. It drives innovation overseas, increases appeal of DEXs, stifles regulation & dialogue. Stifling staking won't protect investors, it will only drive growth out of the US #cryptoregulation pic.twitter.com/snFOJHpQUE

— Digital Economy Insights (@ahmedzein12) February 13, 2023

On a positive note, the cryptocurrency industry has received support from Dubai through the establishment of strong regulations, attracting domestic Web3 and crypto organizations, as well as traditional businesses incorporating new technologies like NFTs, cryptocurrencies, and the metaverse into their operations.

Abu Dhabi’s Hub71 just launched a $2B initiative to back Web3 startups and #blockchain technologies

The initiative will be based in Abu Dhabi Global Market (ADGM) and will provide startups with access to a range of programs pic.twitter.com/Wd8yIvYg0M

— Crypto Hunters Elite ✪ (@coincatch1) February 17, 2023

This was seen as one of the most significant factors that could help drive the growth of the cryptocurrency industry.

Strong US Dollar Weighs on Bitcoin Prices

In early European trading on Friday, the US dollar reached a six-week high, buoyed by strong US economic data and hawkish statements from Federal Reserve governors indicating potential interest rate hikes. The Dollar Index, which measures the dollar against a basket of six other currencies, rose 0.5% to 104.345.

The US dollar rose on Friday to a 6-week high after strong US economic data and hawkish comments from Federal Reserve policymakers.#Dollar #Fed #Inflation #USDollar #USEconomy #Economy #BusinessNews #GlobalMarkets #MarketUpdate #USEconomyData #CenturyFinancial pic.twitter.com/JsaGhDA8tC

— Century Financial (@Century_Fin) February 17, 2023

On Thursday, figures were released showing an unexpected drop in the number of people claiming unemployment benefits, while producer prices rose in January, pointing towards a strong US economy. This followed stronger-than-expected consumer inflation data earlier in the week, as well as a sharp rebound in retail sales in January after two straight monthly declines.

The US. dollar surged to a six-week high ❗️In early European trade this Friday, after strong U.S economic data and hawkish comments from Federal Reserve policymakers pointed to more interest rate hikes. #Forexmarket #trading #Tradingtips #traders #TraderSpirits pic.twitter.com/y5zyao9mD6

— _.Trapskade_ (@Bolton47444016) February 17, 2023

The positive data provides further support for the Federal Reserve to continue with its current hawkish stance, and the market is now anticipating two to three additional 25 basis point interest rate hikes by the summer. The robust US economy appears capable of supporting the Fed’s efforts to combat inflation by implementing more aggressive interest rate increases.

As a result, this was regarded as a significant factor that bolstered the US dollar and contributed to the decline in BTC prices.

Oman and Dubai Boost Digital Asset Support with New Framework and Funding

The Capital Market Authority (CMA), Oman’s financial markets regulator, is currently developing a new regulatory framework for the virtual asset sector, according to a press release issued on February 14. The proposed laws aim to monitor virtual asset operations, establish a licensing system for virtual asset service providers (VASPs), and create a framework to identify and mitigate risks associated with this emerging asset class.

#CBDC #Cryptocurrencies Oman to establish regulatory framework for virtual assets https://t.co/TSaAQStDv0 – https://t.co/HzksZFGgpd pic.twitter.com/U0BF6LiByt

— Crypto News (@dumbwire) February 17, 2023

On a positive note, Hub71, an IT firm based in Abu Dhabi, has launched an initiative to promote the development of Web3 technologies. The “Hub71+ Digital Assets” project will provide eligible Web3 entrepreneurs with access to funding, partnerships, and programs. As part of this project, there is a $2 billion fund available to support qualified entrepreneurs in the space.

Abu Dhabi's Hub71, has launched Hub71+ Digital Assets, a dedicated Web3 specialist ecosystem, with more than $2 billion of capital committed to funding Web3 startups and blockchain technologies from the UAE's capital, in partnership with First Abu Dhabi Bank. #crypto #UAE #banks pic.twitter.com/spj8YZOZFi

— White Tiger Advisory (@WTAdvisory) February 17, 2023

The initiatives taken by the UAE to support the development of Web3 technologies and the cryptocurrency industry have undoubtedly played a significant role in its growth. With the establishment of strong rules and regulations, as well as funding and support for entrepreneurs, the UAE is becoming a hub for cryptocurrency and blockchain innovation.

These efforts not only benefit the domestic Web3 and crypto organizations but also attract traditional businesses that are beginning to incorporate novel technology into their operations, such as NFTs, cryptocurrencies, and the metaverse.

Bitcoin Price Prediction

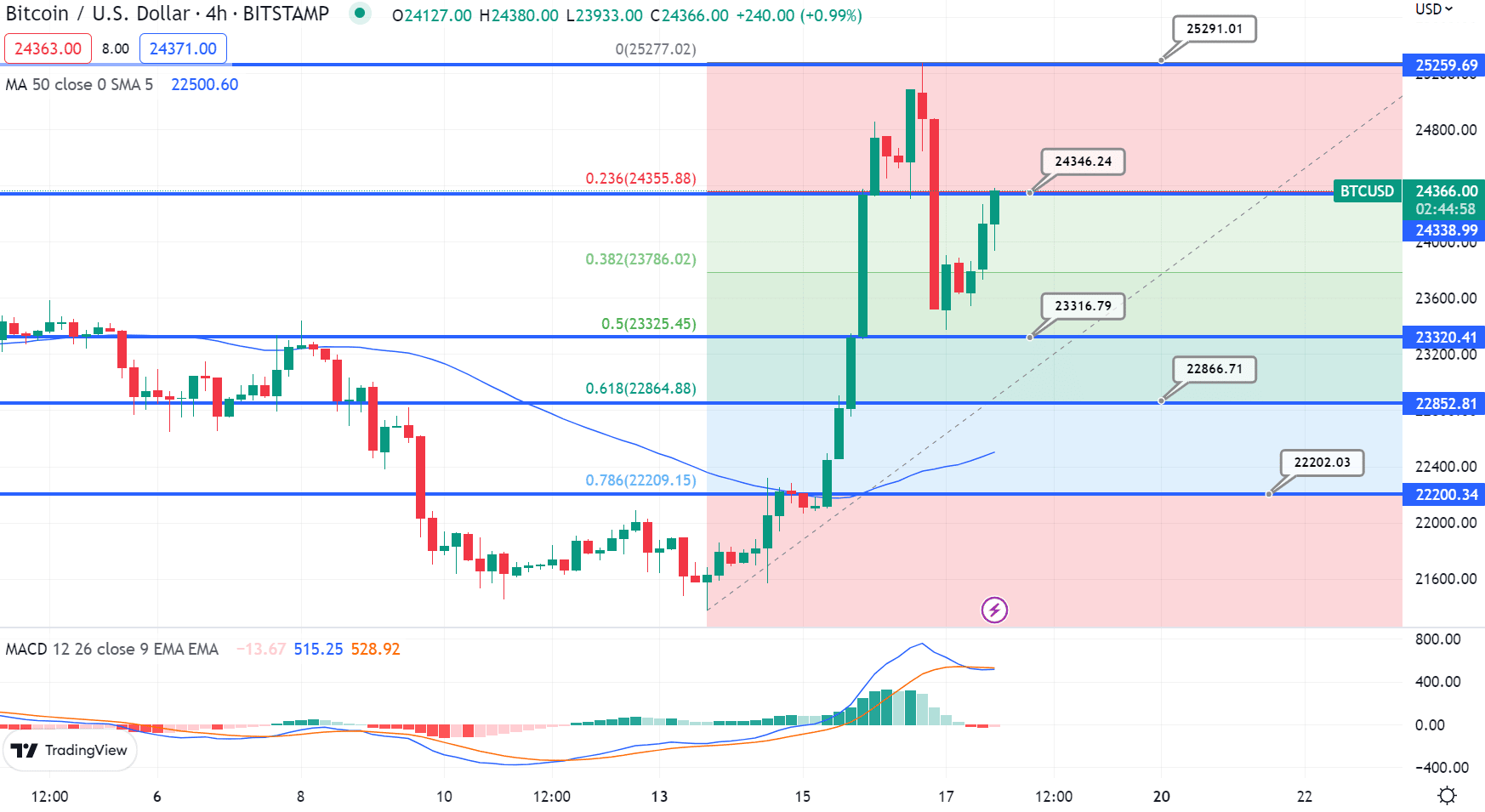

In technical terms, Bitcoin has bounced back after finding support near the 50% Fibonacci retracement level of $23,325. The closing of candles above this level has triggered a buying trend in Bitcoin.

Looking forward, Bitcoin’s immediate resistance is at $24,350, and a bullish crossover above this level may lead the BTC price toward $25,300. On the 4-hour timeframe, the formation of a “three white soldiers” pattern may trigger an uptrend in BTC.

Additionally, the 50-day moving average is supporting the chances of an uptrend continuation in Bitcoin. Investors may want to keep an eye on the $23,700 level to take a buy position and vice versa.

Top Cryptocurrencies to Invest in Today as Alternatives to Bitcoin

Aside from BTC, numerous altcoins in the market exhibit considerable potential. The B2C team has conducted an analysis and created a list of the top cryptocurrencies for 2023.

See Best Crypto to Invest in 2023

Related

Fight Out - Next Big Train-to-Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $5M Raised

- Real-World Community, Gym Chain