In the ever-evolving Bitcoin market, a new chapter is seemingly about to unfold that could complete alter the Bitcoin price prediction sentiment.

The stage is being set for a potential liquidity shock that could notably impact Bitcoin’s short-term pricing dynamics.

Throughout this year, enhanced liquidity conditions have bolstered risk assets, including cryptocurrencies.

But a twist in the tale is imminent. As the U.S. debt ceiling is set to be raised, the Treasury and the Federal Reserve are expected to initiate tightening measures. This shift could instigate a downturn in the crypto sphere.

The early-year crypto rally saw Bitcoin, the premier cryptocurrency, soar to significant highs, this surge was fuelled by the influx of liquidity and a consequent wave of speculative trading.

However, as the U.S. government gears up to boost its debt issuance, this buoyant atmosphere could be replaced with a decidedly more challenging market climate.

It’s crucial to note that cryptocurrencies, being risk assets, have a heightened sensitivity to liquidity conditions compared to traditional safe-haven assets like bonds and equities.

As liquidity dries up, the crypto market could face an uphill battle.

Tightening Liquidity: A Plot Twist in Bitcoin’s Narrative

Adding to the storm is the Federal Reserve’s planned continuation of its quantitative tightening campaign.

This dual squeeze on liquidity could usher in a period of heightened market volatility and calls for prudent investing, especially caution against excessive leverage.

Currently, crypto markets are in a phase of record-low volatility, creating a paradoxical calm before a potential storm.

As these market shifts loom, the astute investor must remain vigilant and ready to navigate the upcoming changes.

Stay with us for a comprehensive Bitcoin price prediction analysis in the following sections as we delve deeper into these unfolding dynamics.

Bitcoin Technical Analysis: Reasons to be Cheerful?

Looking at Bitcoin (BTC) technical structure, ongoing price action depicts a fourth day of retracement from a tough area of local resistance level at $28,000.

Now trading at $26,904 (a 24 hour change of -1.11%), Bitcoin bulls are fighting to re-gain a foothold of support at $27,000.

The 5.5% multi-day slide has seen Bitcoin return to a well-established consolidation area, familiar to many May traders that endured almost a month of tight fought ranging.

However, the perilous position of Bitcoin cannot be underestimated here, as the loss of MA20 support could see BTC trapped once again under a descending capstone of local resistance.

Indeed, following two months of mid-trend action, a decisive retest of the lower trendline or topside resistance seems overdue.

The RSI provides some room for comfort, the retracement move has seen the oscillator cool off to 45 – an oversold signal that suggests a return to the upside could come soon.

And this receives confirmation from the MACD which sits with significant bullish divergence at 94, affirming a bullish technical sentiment for Bitcoin price prediction.

Bitcoin On-Chain: Will Accumulation Window Hold?

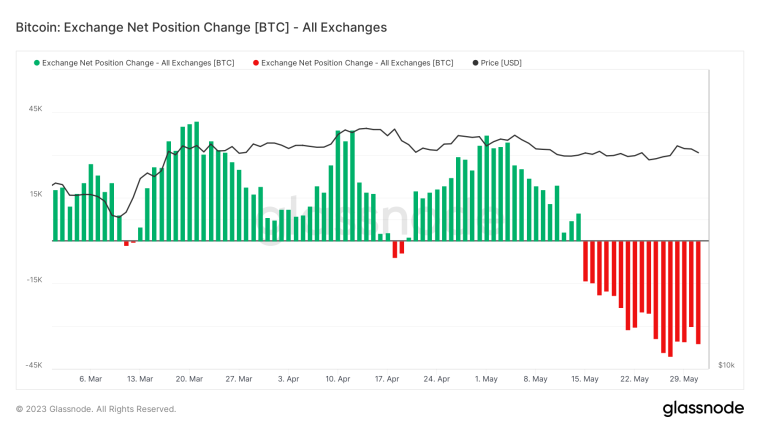

Despite the fears of an incoming liquidity shock, a glance at Exchange Net Position Change reveals that Bitcoin On-Chain has seen a continuation of an accumulation window.

Now in the 18th day of net outflows (across a 30D average), the bigger picture depicts huge swathes of coin moving into cold storage as investors continue to buy the FUD.

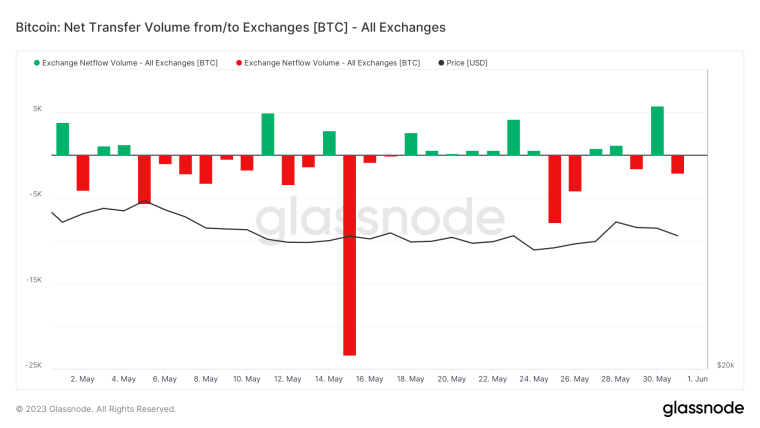

A closer examination of Net Transfer Volume to/from Exchanges, which shows the day-to-day netflow of Bitcoin movements, clouds our image of a significant accumulation.

The chart reveals a major outflow on May 15 of -23,340 BTC (with a value of $630m) that has substantially skewed the 30D average shown on the first chart.

This could be providing camouflage for careful distribution by bigger players in the space amid the day-to-day chop.

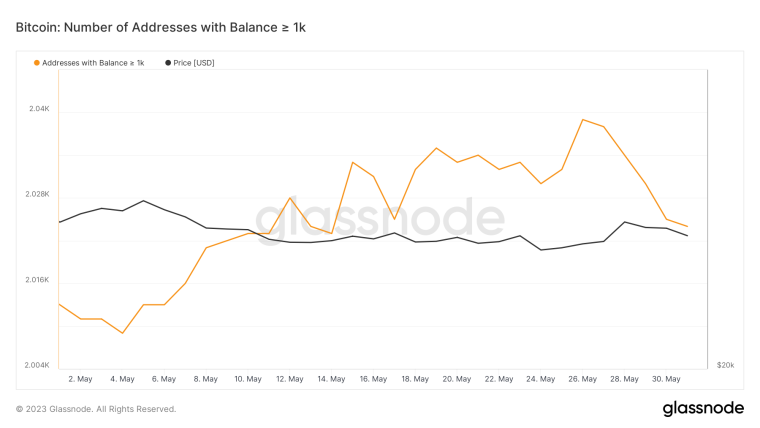

To investigate, take a look at the movements of Bitcoin wallet addresses containing >1,000 Bitcoin (valued at more than $25m).

A startling image of address decline in recent weeks is revealed, highlighting that the biggest players in the space are actually distributing into the show of strength by Bitcoin price action.

This leaves some to wonder, what do they know that you don’t?

Bitcoin Open Interest: Trader Sentiment in the Spotlight

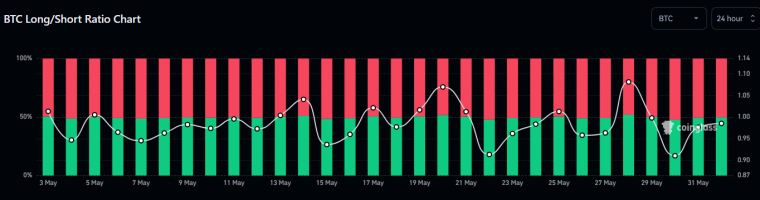

With Bitcoin on-chain analysis revealing a mixed image of big whales in distribution against a significant market accumulation window, open interest can reveal trader sentiment underpinning Bitcoin price action

Open Interest currently sits at quite high levels, despite yesterday’s shift down in price action knocking off some overextended longs, providing little relief for the Bitcoin price prediction.

When open interest becomes stacked up beyond $12bn, Bitcoin markets typically see periods of significant volatility – adding weight to the idea of an incoming liquidity shock.

Looking at the Long vs Short ratio underpinning Bitcoin derivatives contracts, at 0.98 trader sentiment is seemingly shifting back towards a neutral sentiment from a significant long-side divergence.

This could be indicative of an incoming period of consolidation.

Bitcoin Price Prediction: Technical Structure Holds True?

With Bitcoin on-chain depicting a battle between retail accumulation and whale distribution, as Bitcoin open interest shifts into neutral, Bitcoin technical structure seems to be the dominant clarity with a consolidation period likely on the cards.

This leaves Bitcoin with a short-time frame upside target of a re-test of $28,000 (a potential +3.95%)

However, downside risk could see a significant tumble here, with a fall to $25,000 (-7.2%) a distinct possibility.

Overall, this leaves the Bitcoin Price Prediction with a risk: reward ratio of 0.55, a characteristic bad entry with disproportionate risk structure.

Stay tuned with Business2Community for the latest crypto price predictions.

RELATED:

Love Hate Inu - Next Big Meme Coin

- First Web3 Vote to Earn Platform

- Latest Meme Coin to List on OKX

- Staking Rewards

- Vote on Current Topics and Earn $LHINU Tokens