Bitcoin price prospects for a bullish 2023 continue to gain momentum, with the possibility of blasting through the crucial hurdle at $17,000. Some experts say investors have a lifetime chance to buy BTC at a bargain, although a December report from Coinbase predicted a longer crypto winter, perhaps to the end of 2023.

The largest cryptocurrency now trades at $16,815 while holding firmly to short-term support at $16,800. On a wider scope, BTC dances between a rock and a hard place, with support at $16,400 and resistance at $17,000.

According to Wu Blockchain, a cryptocurrency reporter, the latest Federal Reserve meeting minutes could be the most hawkish since May 2022. The central bank’s officials stressed the need to fight inflation by holding interest rates at higher levels.

Fed officials worry that they may only be able to curb inflation if the economy is continuously slowed down by tightening financial conditions like increasing the cost of borrowing and pushing down stock prices.

Although investors are optimistic about Bitcoin in 2023, they may need to manage their expectations as they wait for the Fed’s decision on interest rates, which will greatly depend on price pressure.

Crypto markets struggled through 2023 as the Fed progressively tightened monetary measures to fight inflation. With no influx of funds into the crypto market, it becomes easier to sustain price recovery. Possibly, this is the reason behind Coinbase’s grim prediction for 2023.

Bitcoin Price Must Reclaim $17,000 for Bullish Outcome

Bitcoin price will hang in the balance as long as it is trading below $17,000. The world’s top two largest crypto assets prices remained relatively unchanged this week compared to the relief rallies posted by most altcoins like Litecoin, Solana and Lido DAO.

According to Rekt Capital, a team of renowned analysts, the uptick in altcoin prices follows a drop in Bitcoin’s market dominance. The analysts warn that the relief rallies would cool off when the BTC market dominance rises again.

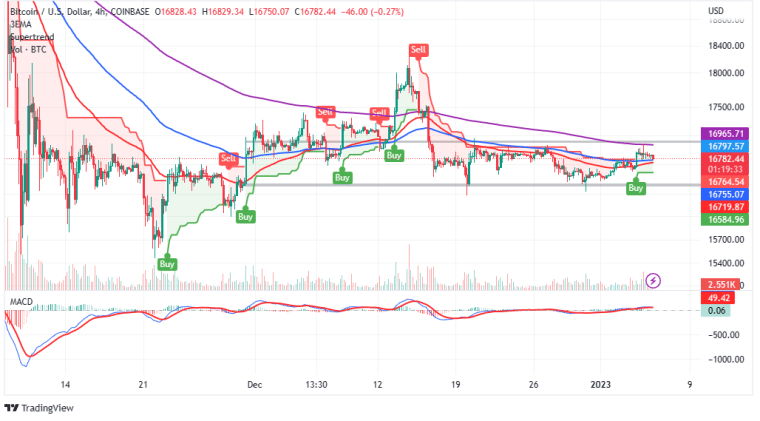

Bitcoin price banks on short-term support provided by the 100-day Exponential Moving Average (EMA) (in blue at $16,814) to keep the uptrend intact. The 50-day EMA (in red) at $16,764 will come in handy if BTC corrects below $16,800.

The Super Trend indicator reinforces Bitcoin price northbound outlook with a buy signal in the same four-hour timeframe. This indicator overlays the chart like a moving average but incorporates the average true range (ATR) to gauge market volatility. Investors are compelled to buy BTC when the Super Trend sends a buy signal and flips below the price.

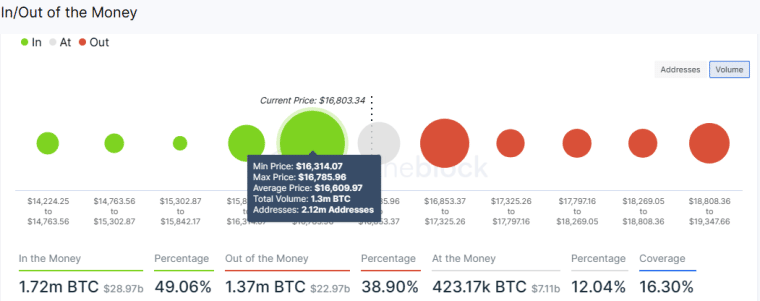

Bitcoin will likely return a bullish outcome if insight from IntoTheBlock’s IOMAP model is considered. The region between $16,314 and $16,785 represents 2.12 million addresses that bought 1.3 million in the past. In case of a price correction, investors in this range would do everything possible to protect the uptrend. Hence, BTC’s path with the least resistance remains to the upside.

Price action toward $20,000 will gain momentum as BTC makes way above $17,000. Notice the absence of strong hurdles between the support range above and the minor seller congestion between $18,808 and $19,347.

Another forecast from Rekt Capital says that the bear market is gradually ending based on Bitcoin’s four-year cycle principles. However, BTC may need to post another bottoming candle for the third year.

Key Takeaways:

Support 1: $16,400

Support 2: $15,500

Resistance 1: $17,000

Resistance 2: $18,400

SuperTrend: Bullish

Related Articles:

Fight Out - Next Big Train-to-Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $5M Raised

- Real-World Community, Gym Chain