Bitcoin price prediction turned bearish today, as the Bitcoin price is at $21,897 with a 24-hour trading volume of $32 billion. As you can see, it’s been under downward pressure in the last 24 hours with a relative price change of -4.50%.

Bitcoin is currently ranked 1st on CoinMarketCap, with a total market cap of $422 billion. It has a circulating supply of 19 million BTC coins and a maximum of 21 million BTC coins.

Williams Says Expected Rates Between 5-5.25% Are Reasonable.

On February 8, Federal Reserve Bank of New York President John Williams stated that financial conditions appear to be roughly in line with the expected forecast for monetary policy during a moderated interview with The Wall Street Journal in New York.

1)John Williams, president of the Federal Reserve Bank of New York, said last night that there are still many uncertainties in the future of inflation, so he supports raising interest rates by more than 5%!

— EltonCrypto (@Elton_Crypto) February 9, 2023

The US Federal Reserve aims to set the inflation target at 2%, with officials suggesting a rate increase of up to 5.1% by the end of 2023. Williams mentioned that expected rates of 5-5.25% are still reasonable. He also noted that this seems like a fair estimate of what needs to be done this year to manage inflation and restore balance between supply and demand.

Jerome Powell, @federalreserve Chair, shared his thoughts on the US economy & the #Fed's plan to bring inflation to 2% target.

The market reacted well, with S&P 500 & #Bitcoin up, & employment numbers strong.

Unemployment hits 54-year low at 3.4% with 517K job increase in Jan.— Orion M. Depp (@OrionDepp) February 7, 2023

Additionally, Williams mentioned that rates were just starting to enter the restrictive zone and that the Fed might have to increase rates more if inflation stays high or financial conditions worsen. In light of weak inflation and strong employment data, the US Fed raised interest rates by 25 basis points last week, bringing them to a range of 4.5% to 4.75%. Williams stated that any future rate hikes would depend on the latest data.

Furthermore, the Fed’s pivot has been lost sight of because inflation still needs to fall. After John Williams acknowledged that the Fed’s forecast of rates in the 5-5.25% range for 2023 is still reasonable, the entire cryptocurrency market and BTC/USD lost some value.

Affirm to Close its Crypto Program

Max Levchin, CEO of the buy-now-pay-later startup Affirm (AFRM), issued a letter to shareholders on February 8. Affirm, according to the letter, is canceling the cryptocurrency service it launched in 2021.

Max Levchin confirmed that the company’s “Affirm Crypto Program” would be discontinued. It occurs as a result of declining consumer spending and a changing macroeconomic environment. The CEO made the letter to investors public, along with a 19%, or approximately 500, job cut.

Payments provider Affirm to sunset crypto program after 19% staff cut

Users will not be able to buy Bitcoin after March 2, and the “Affirm Crypto Program” will officially shut down on March 31. pic.twitter.com/66iMylTdD0— susan (@BraylonCook4) February 9, 2023

Furthermore, Max emphasized the project’s two main drivers as an unprecedented macroeconomic situation and the need to make up for a few liabilities on the firm’s balance sheet. According to the statement, the company concentrated on its core operations while slowing initiatives with uncertain revenue projections.

As a result, the company decided to discontinue a few projects, including Affirm Crypto, as well as reduce the number of employees.

Furthermore, users will be unable to purchase Bitcoin after March 2, according to the Affirm website, and the “Affirm Crypto Program” will be formally closed on March 31. Last year, many cryptocurrency miners cut costs or merged to survive the crypto winter caused by falling prices. The announcement of the closure of another cryptocurrency program may have a negative impact on BTC/USD.

The Digital Pound: What Is It And How Can You Benefit From It?

The Bank of England and HM Treasury published a new paper on February 7 that outlines the implementation of a central bank digital currency (CBDC). The joint report suggests that a digital currency will be needed in the future, but cautions that it is too early to start developing the infrastructure to support it.

The plan aims to provide security and stability as the United Kingdom transitions to a more modern and digital financial future.

Yesterday we published our Consultation Paper on the digital pound. But we are still committed to the future of cash, and we will play our part in ensuring that anyone who wants or needs to use cash in the future is able to do so. Find out more here: https://t.co/pNryjpDH4J pic.twitter.com/yZda89EvI4

— Bank of England (@bankofengland) February 8, 2023

The Bank of England is considering imposing a 10,000-20,000 pound limit on the amount of digital currency that any individual may own. This consultation is open to all interested members of the public, professionals, and organizations. Respondents have until June 7, 2023, to submit their responses.

Conspiracy theory digital currency will have a limit of £10,000 – £20,000 announced the @bankofengland in a consultation paper.

But they're "still committed to the future of cash, & ensuring that anyone who wants or needs to use cash is able to do so." https://t.co/UGRlQ9mUVm

— David Atherton (@DaveAtherton20) February 9, 2023

The incorporation of digital currencies into the economic system, as well as the potential restriction on digital currency ownership, is a significant financial development. It may have an impact on the larger crypto market and BTC, as it may influence how transactions are carried out in the future.

Bitcoin Price Prediction

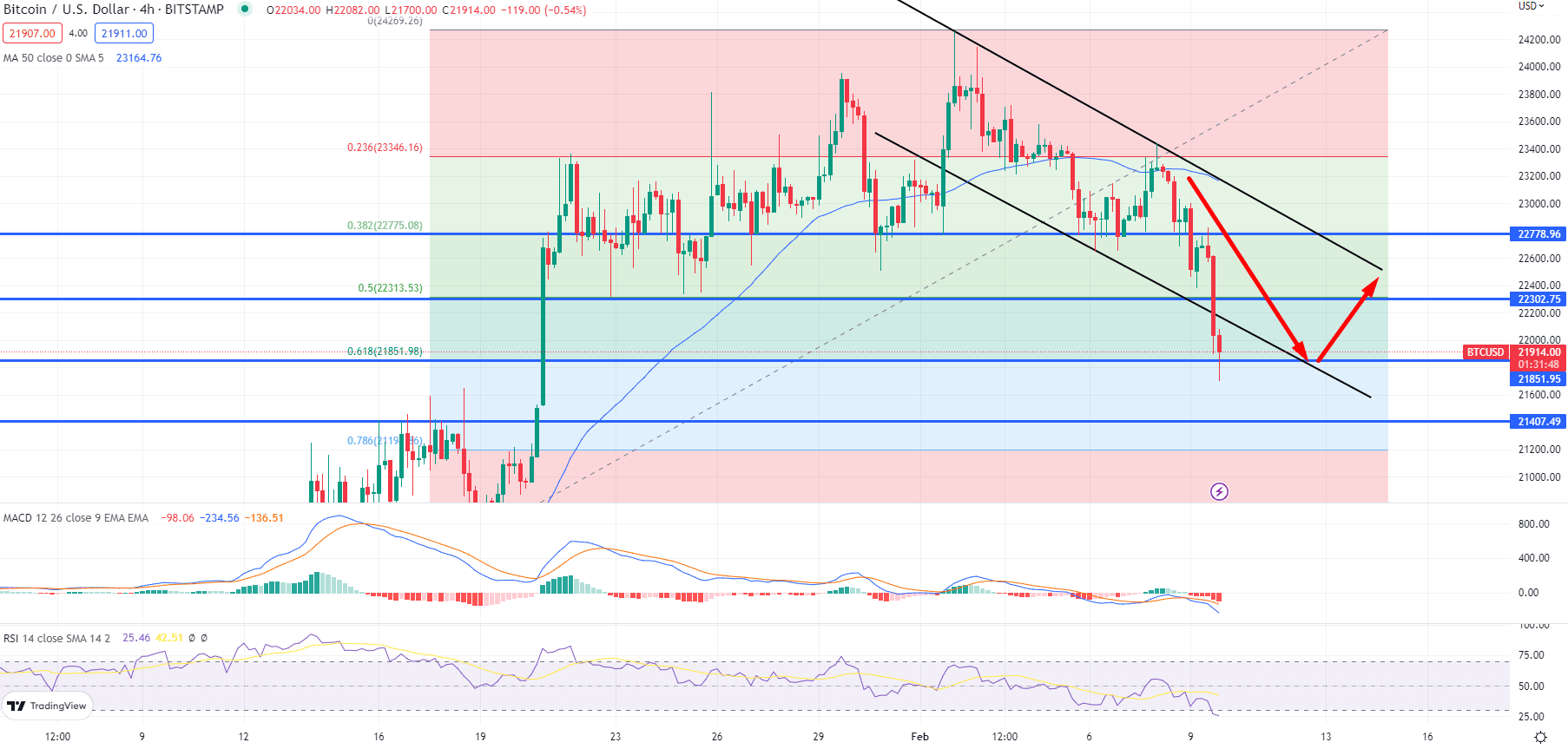

On the technical front, the BTC/USD pair is trading sharply bearish, having fallen from $22,300 to $21,900. Bitcoin has completed a 61.8% Fibonacci retracement at the $21,900 level in the 4-hour timeframe, and closing above this level has the potential to drive a pullback in BTC price. In the event of a bullish bounce, Bitcoin’s immediate resistance is expected to remain near $22,300 or $22,775.

Bitcoin Price Chart – Source: Tradingview

Overall, leading technical indicators like the RSI and MACD are in a selling zone. The RSI is at 25, and the MACD is forming histograms below zero, indicating a strong selling bias. Furthermore, the formation of a bearish engulfing candle indicates a strong bearish bias among investors.

However, a break of the $21,800 level may trigger another round of selling until the $21,400 level. Bitcoin’s next support levels are expected to remain around $21,400 or $21,000.

Bitcoin Alternatives

The cryptocurrency market made a slight slump recently, but it’s still advantageous to purchase alternative currencies during their presale stage. Let’s take a look.

Meta Masters Guild (MEMAG)

Meta Masters Guild (MEMAG) is on its way to becoming the Web3 ecosystem’s largest mobile gaming guild. The project’s ultimate goal is to develop entertaining and compelling games with playable NFTs that enable players to stake, trade, and receive rewards.

The platform is now the play-to-earn platform with the quickest growth for 2023, and based on current developments, it will surpass Web3’s largest mobile gaming guild this year.

The presale has raised more than $3.6 million and is in stage 6. The token will cost more in Stage 7 of the presale, going from $0.021 to $0.023. Stage 7 will begin in only three days.

Fight Out (FGHT)

Fight Out (FGHT) is a cryptocurrency initiative that aims to employ advanced technology to pay users for various activities. The user may create a profile on the FGHT app and get workouts through video-customized lessons to their unique fitness requirements.

FGHT tokens are still available for presale. Users pay for their subscriptions using FGHT, which will eventually support its price.

The current price of Fight Club is $0.0208. After the presale concludes on March 31, the price will increase until it reaches a maximum of $0.033 USDT. Additionally, the Fight Out presale provides early investors with bonuses of up to 50%.

Fight Out - Next 100x Move to Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $4M+ Raised

- Real-World Community, Gym Chain