Pressure on Bitcoin’s price and the broader crypto market has been increasing due to regulatory actions and the upcoming U.S. Consumer Price Index (CPI) data. The largest cryptocurrency is currently up 0.87% for the day, trading at $21,835. Support at $21,600 is key for the uptrend to continue, potentially reaching $24,000 and $28,000, respectively.

Bitcoin Price Balances On a High Cliff As Regulatory Pressure Mounts

The crypto market’s value has for the first time since January slipped below the $1 trillion market according to live data from CoinMarketCap. Regulators from the greenback nation have been on the offensive against the industry with Kraken exchange being the latest victim.

Kraken resolved to pay up to $30 million in fines to the Securities and Exchange Commission (SEC) for allegedly not registering its staking-as-a-service program offered to retail customers.

According to the SEC’s point of view, staking platforms that result in the holders of the assets handing over control to a centralized entity like a crypto exchange amounts to security offerings that must be registered in accordance with the law. Experts like Edward Moya of OANDA, a trading platform, investors are worried about who the SEC could be targeting next.

“Cryptos are weakening as every trader worries about how crippling this SEC wave will be with the cracking down on staking products and stablecoins. The news flow has been rather bearish for crypto, and you can’t forget about tomorrow’s inflation report that could be hot and spell trouble for risky assets,” Moya told Forbes.

In addition to cryptocurrencies losing the gist seen in January, fund flows have generally been negative, thus stifling growth. It could take longer to see a comeback from buyers, especially with the US CPI data expected later in the day.

“It might be hard for buyers to emerge until we see how Wall Street reacts with tomorrow’s inflation data,” the analyst added.

Remember Paxos ceased the issuance of BUSD stablecoin on Monday. BUSD is a version of the stablecoin created in collaboration with Binance. According to a statement from Paxos, -the move followed conversations with the New York Department of Financial Services (NYDFS) and had resolved to “end its relationship with Binance for the branded stablecoin.”

The State Of Bitcoin Price Ahead of US CPI

Bitcoin price is trading at $21,835 at the time of writing and moments after bouncing off support provided by the 200-day Exponential Moving Average (EMA) (in purple) on the daily time frame chart.

Slightly below this support line, lies the 50-day EMA (in red), as highlighted by the lower yellow band. If push comes to shove and declines intensify, Bitcoin price might be forced to seek support at $20,000, an area reinforced by the 100-day EMA (in blue).

The same daily chart elucidates a sell signal from the Moving Average Convergence Divergence (MACD) indicator. As observed, the rain started beating BTC price as soon as the MACD line in blue slipped beneath the signal line in red. The bearish grip on Bitcoin price is bound to stiffen up as the momentum indicator slides under the mean line at 0.00.

Meanwhile, the most critical levels traders should keep in mind support at the 200-day EMA (in purple), the next buyer congestion at the 50-day EMA (in red) around) $21,057 and the last line of defense at $20,000. Note that holding above the 100-day EMA (in blue) would against all odds, prevent Bitcoin price from spiraling to $18,000.

On the upside, Bitcoin price must uphold recovery from the 200-day EMA (in purple) at $21,391 to validate an expected move to $24,000. If the bellwether cryptocurrency beats the anticipated volatility due to the US CPI data, a break and hold beyond $24,000 could clear the path to $28,000.

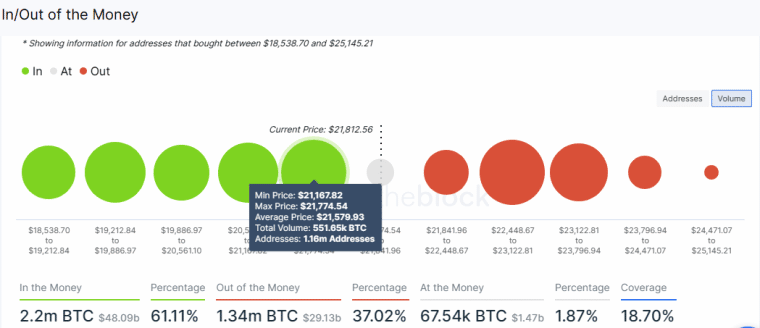

Insight from on-chain data as presented in the IOMAP model from IntoTheBlock hints at Bitcoin price holding onto the sideways trading, possibly for a few days. The tug-of-war around support at $21,600 is bound to take precedence until either bulls or bears carry the day.

The big green circle running from $21,167 to $21,774 represents 1.16 million addresses that previously bundled up 551.65k BTC in this range. In other words, all these addresses are in profit and may want to see Bitcoin carry on with the uptrend to $24,000 in the short term and $28,000 in the medium term.

As long as Bitcoin price stays above that support area, the path with the least resistance would stick to the upside. On the other, the odds are not entirely on the bullish side, considering a massive seller congestion zone between $22,448 and $23,122.

Approximately, 1.35 million addresses bought 562.46k BTC in that range. If Bitcoin price manages to sustain a recovery from support at $21,600 and the 200-day EMA, investors in this cohort may choose to sell at various breakeven points, thus intensifying overhead pressure and stifling growth.

Market watchers are looking forward to the release of January’s US CPI data later today at 8:30 am Eastern Time. Experts say this CPI data is critical for the health of the market going forward. Moreover, past CPI results have been volatility catalysts, especially for asset classes considered risky like digital assets.

Traders are looking forward to making the most out of the volatility with extremes of $25,000 and $19,000 on the table. Venturefounder, an on-chain analyst associated with CryptoQuant chimed in reference to the CPI data placing Bitcoin price between $24,000 and $25,000 after the release of the US CPI numbers.

However, Venturefounder warned investors not to be surprised if Bitcoin dropped to $20,000 or revisited the upper range of $19,000. In other words, this is “a very important day. Expect volatility.”

Market watchers expect the US CPI year-on-year figure to hold at 6.2% against the backdrop of the 6.4% recorded in the previous month. As for the month-on-month reading, experts are looking forward to an uptick to 0.5% from 0.1%. However, insights from QCP Capital highlight the huge gap between market expectations and reality.

“As the regulatory hammer is still out against the industry (possibly until the 2024 election), the upside on crypto’s market cap looks even more subdued from that perspective now, QCP reckoned in the latest market update.

Crypto markets and other risky assets need time to adjust to the recent changes in interest rates. According to QCP, “risk assets have clearly not adjusted to this increase in rate expectations, and we expect today’s print to bring all markets in line.” Meanwhile, the next decision on interest rate hikes is not until late March when the Federal Reserve will sit in the FOMC meeting.

Bitcoin Alternatives To Buy Today

Investors seem worried that the crypto winter never really left and that ongoing declines will continue in the coming months. However, there are selected best altcoins to buy for 2023, as investors mull over the contents of their crypto prices.

All the tokens listed are in their presales and give investors a chance to be early adopters. Similarly, they are selling out fast because of the solid fundamental they possess along with the ability to shape the future of their niche sectors. Follow the link provided below to learn more about one of these fast-selling altcoins, Meta Masters Guild.

Related Articles:

- SEC Draft Rules Will Make it Harder for Crypto Firms to be ‘Qualified Custodians’ in Blow to Fund Industr

- Top Selling NFTs This Week – DigiDaigaku Dragon Eggs NFTs Take The Top Rank

Fight Out - Next 100x Move to Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $4M+ Raised

- Real-World Community, Gym Chain