Bitcoin price slipped below $17,000 last week a few moments after spiking to $18,400. Crypto markets led by BTC looked poised to rally at the time, bolstered by better-than-expected United States Consumer Price Index (CPI) figures.

Later in the same week, the Federal Open Markets Committee (FOMC) acknowledged inflation was easing by hiking interest rates by an expected 0.5%.

Despite the positive outlook from external macro factors, Bitcoin dumped, retesting support at $16,000. Considering the apparent market conditions, the largest cryptocurrency could not uphold the uptrend to $20,000.

The FTX contagion is still spreading and attracting unwanted attention to the market, hurting investor confidence and risk appetite. As crypto businesses affected by the collapse of FTX work to turn things around, Bitcoin price exchanges hands slightly above $16,800.

Although the short-term technical outlook may seem bearish, investors are looking forward to a Christmas rally that may reclaim ground above $17,000 and pave the way for another run-up to $20,000.

Assessing the Possibility of a Bitcoin Price End-Year Rally

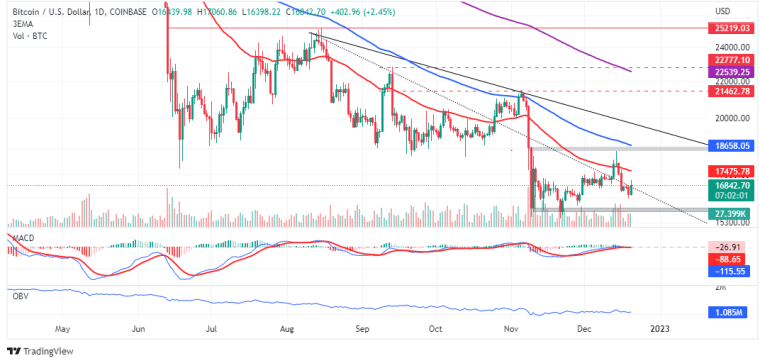

Bitcoin price is preparing to deal with resistance at $17,000 as buyers position themselves for a potential rally during the Christmas and New year celebrations. The pioneer crypto faces resistance at the first trend line (dotted). With a bullish green candle printed on the daily chart, BTC may close the day’s trading above the coveted psychological resistance at $17,000.

Moreover, on several occasions, the largest cryptocurrency broke out above the same trend line, which means that it is not a robust hurdle and can be broken. Traders wishing to buy and long Bitcoin may do so when the price makes a clear break out above the dotted trend line. In that case, profit booking could start at $17,474, as highlighted by the 50-day Exponential Moving Average (EMA) (in red).

The On-Balance Volume’s (OBV) upward trending position may be used to validate Bitcoin’s uptrend. Investor confidence may improve as the OBV lifts in tandem with the price. The OBV tracks the volume of Bitcoin being traded and is useful when confirming the trend.

A daily close above $17,000 is also needed to keep investor interest intact. Remember, crypto markets are still edgy; hence any signs of the trend weakening might result in another sell-off.

For Bitcoin price to be safe, buyers must push past the hurdle at $18,658, presented by the 100-day EMA (in blue). Further validation for the uptrend will come as the price lifts above the upper trend line (continuous), as illustrated on the daily timeframe chart.

AltcoinSherpa, a popular crypto analyst and trader, says market conditions are unfavorable for a Bitcoin rally. However, he expects its dominance to keep rising relative to the altcoins. He told his 187,000 followers that such a move would suggest that Bitcoin price is closer to a bottom.

$BTC.D: Looking ugly for alts in the mid term tbh. Not interested in longing much rn. #Bitcoin dominance could go much higher (alts take a beating if this is the case).

That said, if we see this happening, it means we’re closer to the bottom IMO. https://t.co/VJiLxUaMEt pic.twitter.com/9ZvNkZkCI1

— Altcoin Sherpa (@AltcoinSherpa) December 19, 2022

Whales Throw Their Weight Behind Bitcoin Price

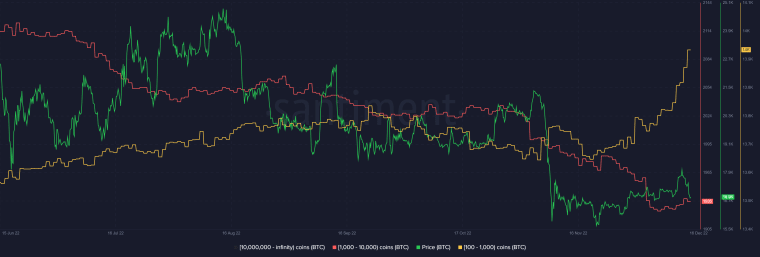

The recent drop in Bitcoin price has seen increased buying activities from large-volume holders, known as whales. On-chain insight from Santiment shows addresses with between 100 and 1,000 coins spiking to 14,000 from 13,685 on November 20.

Although whales with between 1,000 and 10,000 coins have exerted pressure on Bitcoin price since June, the chart shows that they could be positively flipping their sentiment toward BTC. Therefore, if they increase their Bitcoin uptake, a bullish momentum will start brewing ahead of a rebound not only above $17,000 but beyond $20,000.

Looks like $BTC is inside a descending channel pattern, price is bouncing off the lower support area.

After price broke down below the mid-area price has still not tested it, Expecting a relief rally & a re-test of mid area soon..#crypto #btc pic.twitter.com/vDwiAwZmXH

— Mags (@thescalpingpro) December 20, 2022

Altcoins Promising Quicker Returns

Although there is a high chance Bitcoin price will reward patient investors with a relief Christmas rally, crypto markets are dynamic, which makes price prediction difficult. Meanwhile, investors may be interested in checking out selected altcoin presales with strong fundamentals. Some tokens, like Dash 2 Trade, are ahead of schedule, with listings expected as early as January 2023.

Dash 2 Trade (D2T)

The team behind this crypto project believes that investing in the cryptocurrency market should be something other than a preserve of a few experts. For that reason, they are launching a world-class crypto analytics and social trading platform to simplify the investment process for all investors.

Dash 2 Trade boasts features such as trading signals, social sentiment and on-chain analysis on spot trending coins. A strategy builder has been created to help traders test their ideas and share them with others.

PRESALE ENDING SOON

⌛16 Days remaining until our presale ends⌛

The first CEX launch will go live on Wednesday 11th Jan 2023!!

Buy $D2T now before the exchange listingshttps://t.co/PMdwCfAHt1 pic.twitter.com/jIvJCN69Lb

— Dash 2 Trade (@dash2_trade) December 20, 2022

A bespoke scoring system allows access to crypto presales. Investors can also benefit from exchange listing alerts to capitalize on market movements like the “Coinbase effect.” Dash 2 Trade presale is ending soon, with the first CEX listing expected on January 11.

FightOut (FGHT)

The fitness industry continues to evolve beyond traditional machines and weights. According to FightOut, more than this growth is needed to solve issues ailing fitness enthusiasts, including the high cost of equipment and fitness instructor fees.

Move-to-Earn (M2E) stands out as the future of the fitness industry, and platforms incorporating Web3 solutions like FightOut offer users monetary value from the same activities they do to stay fit.

FightOut believes everyone should have access to its M2E fitness and gym chain that gamifies the fitness lifestyle. Users on the platform earn by completing workouts in addition to receiving badges.

It’s official #FightOutCrew!

We reached another milestone – over $2M raised!

Buy now and get up to a 50% bonus with $FGHT!

Don’t miss out! ⬇️https://t.co/xwthuHJbBG pic.twitter.com/1lXXlwWG8l

— FightOut (@FightOut_) December 16, 2022

Investors are currently buying FGHT in the early presale stages. The team has raised $2.8 million, selling 60 FGHT tokens for 1 USDT.

C Charge (CCHG) – Is Revolutionizing the Carbon Credit Industry

C+Charge is a peer-to-peer cryptocurrency payment system opening up carbon credits to the drivers of electric vehicles (EVs). The blockchain platform will also spearhead the rollout of charging stations while creating an acceptable industry standard.

With C+Charge, users can participate in a mission to open up the carbon credit industry from large corporations to individual drivers.

How to use your $CCHG?

♻️ Use it to charge your #EV with our partner charging stations

♻️ Receive carbon credits and earn from the marketGrab your $CCHG before it’s gone ⬇️https://t.co/ixe18bPqzI pic.twitter.com/HLqr9icw6Q

— C+Charge (@C_Charge_Token) December 21, 2022

CCHG token will power the ecosystem, allowing drivers to earn as they charge their EVs. Each token sells for $0.013, but the price is expected to rise through four stages, ending at $0.0235.

Related news:

Best Altcoins to Buy Today 20th December – IMX, FGHT, XDC, D2T, CCHG, LTC, RIA