Bitcoin price finally obliterated critical seller congestion at $24,000 last week and paved the way for gains slightly above $25,000. However, the largest cryptocurrency quickly ran out of steam after several rejections.

That said, support at $24,000 seems intact with BTC currently exchanging hands at $24,828. It would be prudent for bulls to push for a daily close above the decisive $25,000 level if they plan to close the gap to $28,000 this week.

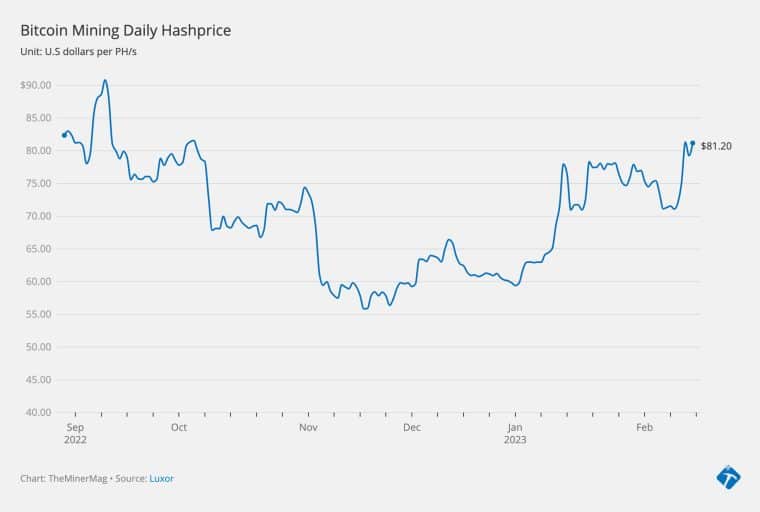

Bitcoin Price In Spring As Hashprice Hits 4-Month High

Following Bitcoin’s decent rally last week, the network’s hashprice has for the first time in four months returned to over $80 per PH/s, representing a 46% increase. This uptick in the hashprice suggests the older generation of equipment is once again profitable.

In other words, with the hashcost at $0.08/kWh energy rate, “miners with an efficiency of 40 J/TH could again generate profit.”

According to Alex Adelman, the CEO of Lolli, a cryptocurrency exchange, Bitcoin has had an impressive run since the beginning of the year, but warns it may be too early “to call any rally the start of a bull market.” Going forward, price action in the crypto market could mainly “be guided by regulation, inflation, and other crypto industry developments.”

It is evident the market was weakened by the implosion of FTX in November. Many companies are still reeling from the liquidity crunch witnessed in the wake of FTX’s bankruptcy filing not to mention the impact on individuals and other indirect casualties.

“The next bull market we see will be unlike any other. The most recent bull market brought crypto and bitcoin squarely into mainstream awareness – today, major financial institutions and retail companies have integrated crypto into their operations, effectively demystifying cryptocurrency for many in the mainstream,” Adelman said in a statement.

The CEO of Lolli believes the next bull market would be a game changer – unlike any other previous bull markets. Price stability, emerging projects focusing on solving existing issues, and features that bring financial resources closer to the people are some of the things that will characterize the incoming bull market.

Where Is Bitcoin Price Headed?

Bitcoin price is sitting on top of robust support, highlighted by the lower yellow band around $24,000. Another daily close above this price level would improve investor confidence in the uptrend aiming for $28,000.

The optimistic outlook for BTC price is bound to stay in place, especially if the Moving Average Convergence Divergence (MACD) indicator keeps donning a buy signal on the daily time frame chart.

Bitcoin price reconfirmed another call to investors to fill their bags as the MACD line in blue flipped above the signal line in red. The first attempt above $20,000 was weakened slightly above $24,000 in early February, culminating in a downswing in price to $21,422. Bolstering this buyer congestion zone was the 200-day Exponential Moving Average (EMA) (in purple).

In case of a pullback, support is anticipated at $24,000 but if push comes to shove and overhead pressure rises significantly, $22,000 would come in handy. However, investors should not worry about minor corrections, which are common even in bull markets.

The largest cryptocurrency by market capitalization has also flaunted a golden cross. This technical pattern appears when a shorter-term moving average crosses above a longer-term one. For instance, the 50-day EMA (in red) has moved above the 200-day EMA (in purple), as observed in the chart above.

Bitcoin price has in the past rallied by an average of 22% every time a golden cross appeared on daily time frame charts. Therefore, if history repeats itself, we are likely to see the leg stretching to $28,000 and above $30,000 in the next few days – maybe weeks.

Short-term Levels To Watch In Bitcoin Price

Traders should tread cautiously keeping in mind a sell signal being flaunted by the MACD on the four-hour time frame chart. As seen, the MACD line in blue is holding below the signal line in red. Besides, the momentum indicator is generally falling toward the mean line, implying profit booking is taking place among investors.

For traders looking forward to new long positions in BTC, they should consider waiting until the MACD sends another buy signal coupled with the histograms turning green from red. Support at $24,000 remains crucial even in shorter time frames and must be defended at all costs to avert possible losses to $22,000 and $21,000 respectively.

Conclusively, Bitcoin price is generally poised to keep up with the uptrend this week. Investors should keep an eye on support at $24,000 because if safeguarded, bulls can stage another upswing above $25,000 and gain momentum to $28,000. On the flip side, bears will dig holes in the moon-bound rocket and open the door to declines eyeing $22,000 and $21,000, respectively.

Bitcoin Alternatives To Buy Today

Before you start accumulating bitcoin, do you know about these new coins whose presales are selling out quickly in 2023? Investors are diversifying their portfolios with the best crypto presales, promising a better risk-reward ratio.

Fight Out (FGHT) is the first project on this list due to the revolutionary use of Web3 solutions to transform the fitness industry. Users wishing to become fighting fit with Fight Out do not have to deal with the various barriers to entry, as is the case with other Move-to-Earn ecosystems. Fight Out’s presale has raised $4.39 million so far with the price currently increasing in 12-hour intervals.

Similarly, C+Charge (CCHG) is the first project—off and on-chain to democratize the carbon credit industry. With the help of blockchain technology, the team at C+Charge will reward EV drivers with carbon credits.

C+Charge also brings convenience to the EV charging industry through a mobile app with features like charge station finder and charger wait times among others. The presale, now in stage 3, has raised $1.27 million.

Fight Out - Next Big Train-to-Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $5M Raised

- Real-World Community, Gym Chain