Despite the cryptocurrency market slowing, Bitcoin price bulls have been buoyed by months of mostly positive perpetual funding rates. Despite strongly positive US fundamentals and the Fed’s hawkish monetary policy sentiments, Bitcoin has been consolidating in a narrow trading range of $19,000 to $20,500 for quite some time.

Positive perp futures funding rates are supporting bullish bias for the leading cryptocurrency and may keep it supported for a while.

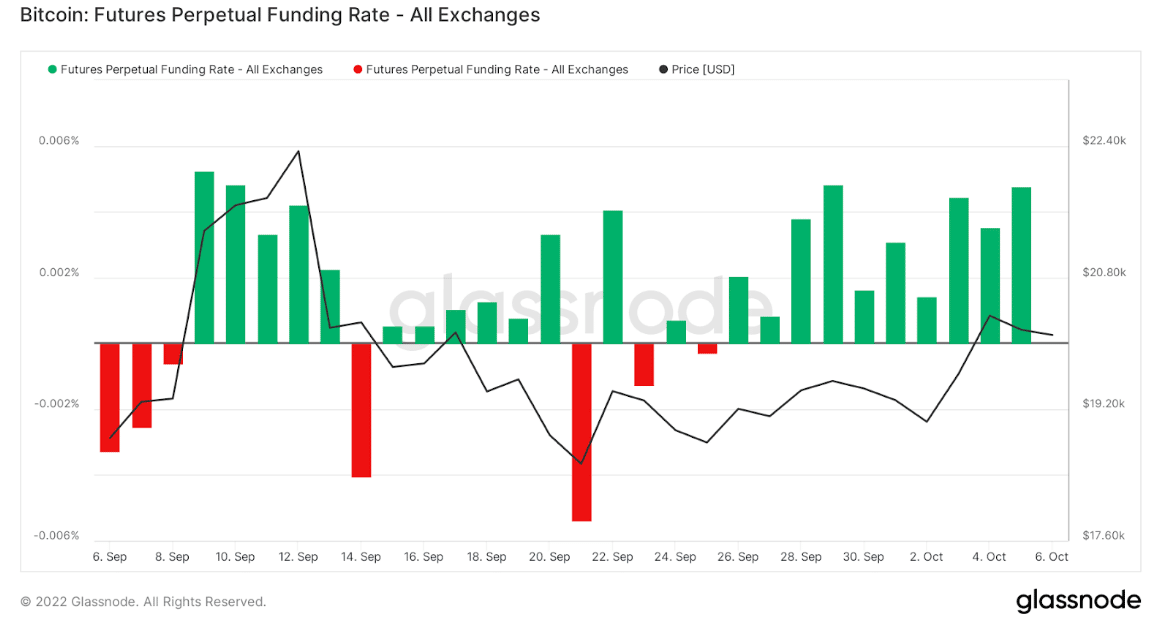

Bitcoin Futures Perpetual Funding Rates

Bitcoin’s perpetual funding rate remains positive, indicating that Bitcoin investors are still willing to hold a buying position in bitcoin even if they must pay a fee to do so. This reinforces the bullish outlook for Bitcoin’s future trend.

Future Funding Rate – Souce: Glassnode

What Exactly Is the Perpetual Funding Rate?

“Funding Fates” are periodic payments made to long or short traders based on the spread between markets for perpetual contracts and spot prices. As a result, traders will incur costs or obtain financing based on their current position.

Exchanges for perpetual futures contracts determine the average funding rate. Long positions will pay short positions at regular intervals in a positive rate environment. When the rate is negative, long positions are occasionally compensated by short positions.

Bitcoin Price Prediction

Given the futures market’s weeks-long positive perpetual funding rate, Bitcoin maintained a bullish bias. However, recent US nonfarm payroll and unemployment rate data put downward pressure on Bitcoin prices.

Bitcoin Price Chart – Source: Tradingview

Technically, the BTC/USD pair was rejected below the $20,400 level, and the formation of a hanging man candlestick pattern signaled the start of a downtrend. Bitcoin is now descending toward an immediate support level of $19,000.

Bitcoin’s 50-day moving average is also supporting a bearish trend. However, because the downtrend in Bitcoin can be fleeting, failure to break below $19,000 can signal a bullish reversal in BTC.

Related

- Bitcoin Price Prediction 2022 – 2030

- Best Future Crypto Coins to Buy in 2022

- Bitcoin Futures ETF Approved and This Time it May Presage Spot Approval

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption