The Bitcoin (BTC) price saw a strong rebound on Tuesday, with the world’s largest cryptocurrency by market capitalization last trading close to 4.0% up on the day in the upper $26,000s.

That means BTC has now all but erased the entirety of its Monday drop to the mid-$25,000s on Monday/Tuesday morning, which was at the time triggered by the US Securities and Exchange Commission (SEC) announcing lawsuits against two of the world’s largest cryptocurrency exchanges, Binance and Coinbase.

The SEC is accusing both of acting as unregistered security exchanges because they offered a number of cryptocurrencies to the general public that the SEC deems are actually securities.

The SEC is also charging Binance, its US subsidiary Binance.US and the exchange’s founder Changpeng Zhou (CZ) with a series of further serious charges relating to the mismanagement of customer funds.

Importantly for bitcoin (and Ether), the SEC didn’t label the cryptocurrency as a security as it did with other major blue-chip names like BNB, Binance USD (BUSD), Cardano (ADA), Solana (SOL) and Cosmos (ATOM).

Some analysts think that bitcoin’s strong Tuesday rebound thus reflects a possible safe-haven bid, as crypto investors shift their assets from those at risk of being regulated like securities in the US to those that do not face the same risk (like bitcoin).

Indeed, the current SEC Chair Gary Gensler has repeatedly said that he views BTC as a digital commodity rather than a security, but views most other cryptocurrencies as crypto securities.

Here’s What Option Markets Say About the Price Outlook

Despite the sharp rebound on Tuesday, options markets remain downbeat on the short-term outlook for bitcoin.

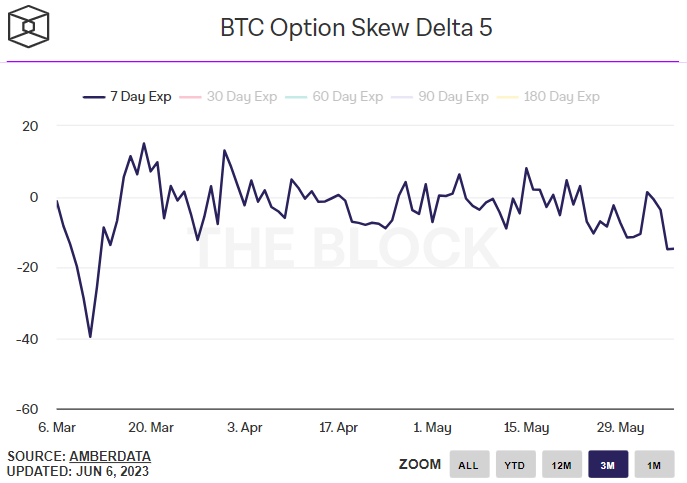

The 5% delta skew of bitcoin options expiring in seven days fell to around -15 on Monday, its lowest level since mid-March, and held around this level on Tuesday.

A 5% delta skew of below zero means that bearish bitcoin put options expiring in seven days are trading at a premium versus equivalent bullish call options, suggesting investors disproportionately demand the former.

That is consistent with the fact that bitcoin remains stuck in a downwards trend channel that has been in play since the yearly highs were hit in April above $31,000.

The low 5% delta skew of options expiring in 7-days suggests that investors expect bitcoin rallies to be sold into in the coming days, and that a retest of recent multi-month lows in the mid-$25,000s remains a strong likelihood.

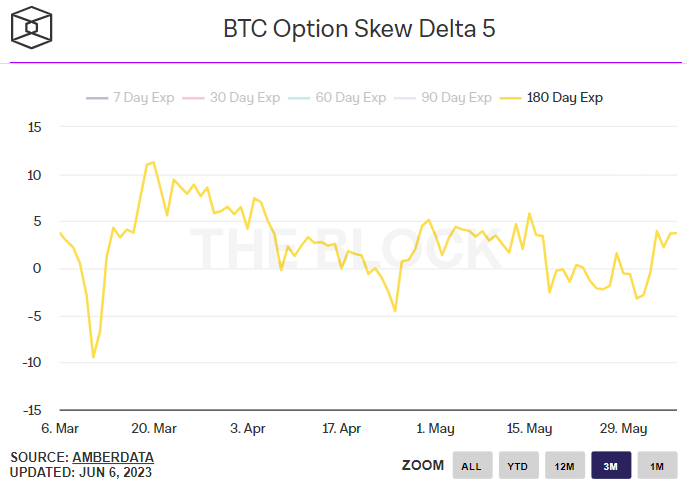

But while the 7-day 5% delta skew it at multi-month lows, the 180-day delta skew remains at relatively strong levels of close to 4.

That suggests that investors remain confident that, despite the risk of short-term downside, bitcoin is likely to remain in a longer-term uptrend for the remainder of 2023.

That is consistent with the idea that bitcoin is in the early stages of a new bull cycle, as strongly hinted by various on-chain bull/bear market indicators, as well as an expected near-term peak in interest rates in the US as inflation comes back under control and the economy cools.

From a technical standpoint, as long as bitcoin can hold above the mid-$20,000s, the 2023 bull market arguably remains structurally intact.

Related Articles

- Bitcoin (BTC) Price Prediction 2023 – 2040

- How to Buy Bitcoin in 2023 – Safely & With Low Fees

- 10+ Best Crypto To Buy Now

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards