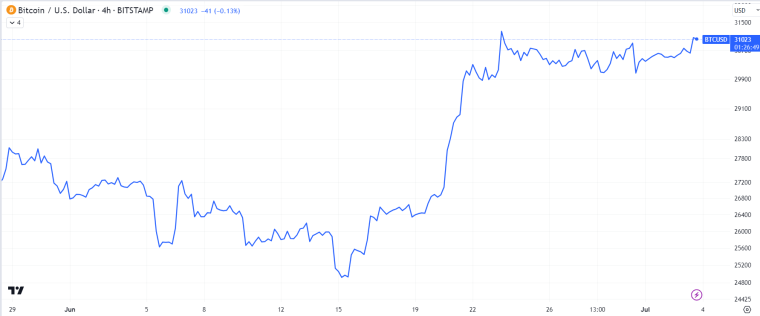

Bitcoin (BTC) has broken back above the $31,000 level on Monday amid positive macro developments.

Firstly, BlackRock just refiled its application to form a spot bitcoin exchange-traded fund (ETF) with the SEC, this time naming Coinbase as its market surveillance partner.

The SEC had last week told BlackRock and a number of other institutions that had filed for an ETF that their applications had been “inadequate”.

BlackRock’s filing of its first spot bitcoin ETF in mid-June was the catalyst for a big run up in the bitcoin price, with numerous other financial institutions following suit with their own bitcoin ETF applications.

Some also cited Monday’s much weaker-than-expected US ISM Manufacturing PMI survey as also supporting the price, given that it feeds into expectations for a weaker US economy ahead and, by virtue, a less aggressive Fed tightening cycle.

But amid relatively low trading volumes given that tomorrow is a US holiday (independence day), the bitcoin bulls haven’t had enough impetus to push the cryptocurrency back to yearly highs.

Those were hit around one and a half weeks ago around the $31,500 mark.

Where Next for the Bitcoin (BTC) Price?

While tomorrow is set to be uneventful for bitcoin amid US market closures, things will pick up for the remainder of the week.

The minutes from the US Federal Reserves last meeting are scheduled for release on Wednesday and should highlight that most policymakers back the idea of a further two interest rate hikes given sticky inflation and a resilient jobs market.

The US ISM Services PMI survey is then due on Thursday alongside the JOLTs job openings report, ahead of the official jobs report for June on Friday.

The information this data reveals about the health of the leading US service sector and the (so far strong) US labor market could greatly influence Fed tightening expectations—specifically, whether the economy has enough strength for the Fed to proceed with its planned two additional rate hikes.

And this could impact crypto prices.

But bitcoin has been fairly resilient to rising US yields in recent weeks (a reflection of rising Fed tightening bets).

Indeed, despite the 2-year close to yearly highs near 5.0%, bitcoin has nonetheless reclaimed $30,000.

Narratives surrounding institutional adoption and crypto being in a new bull market could continue to support the price and bitcoin is looking primed for a push to new yearly highs.

Bullish technicians have marked up key resistance levels at $32,500, $33,000 and $34,500 as the next areas that BTC will test.

Related Articles

- Bitcoin (BTC) Price Prediction 2023 – 2040

- Ethereum Price Prediction: Massive Whale Gets Liquidated Shorting ETH – Is ETH Finally Ready to Blow Past $2000?

- Bitcoin Price Prediction: Institutional Interest Started the Rally But Retail Traders Will Drive the Real Bull Market

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards