The world’s largest cryptocurrency exchange by trading volume Binance will convert the remaining $1 billion in BUSD that it was holding in its Industry Recovery Initiative fund to native cryptocurrencies such as BTC, ETH and BNB, Changpeng Zhou announced via Twitter on Monday.

Given the changes in stable coins and banks, #Binance will convert the remaining of the $1 billion Industry Recovery Initiative funds from BUSD to native crypto, including #BTC, #BNB and ETH. Some fund movements will occur on-chain. Transparency.

— CZ Binance (@cz_binance) March 13, 2023

The crypto billionaire, who is the founder and CEO of Binance, said the decision was taken due to recent changes in stablecoins and banks. This is a reference to the recent collapse of a string of regional US banks with close ties to the crypto sector.

Concerns that deposits had been lost resulted in stablecoins holding reserves at these banks like USDC, and DAI, another stablecoin backed to an extent by USDC reserves, temporarily losing their 1:1 peg to the US dollar.

But a joint announcement from the likes of the Fed and the US Treasury over the weekend that all depositors will be made whole has eased fears that the bank run will worsen. It has also been interpreted as a sign that US authorities will once again start injecting liquidity back into the system and the Fed may now pause its rate-hiking cycle, thus sending the prices of major cryptocurrencies like Bitcoin and Ether surging.

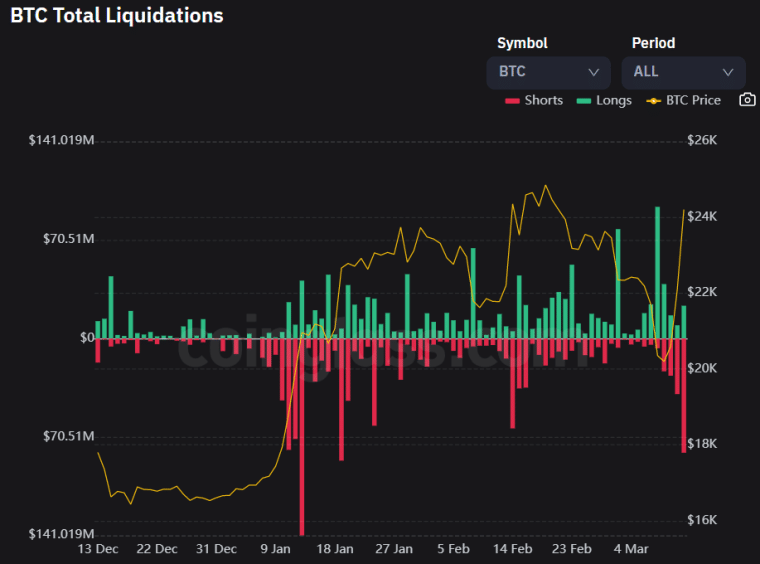

Bitcoin was last trading above $24,000 and Ether in the upper-$1,600s, both having enjoyed double-digit gains in the past 24 hours and eyeing a test of annual highs. The knowledge that Binance will be pouring $1 billion into these cryptocurrencies has helped, as has what traders have referred to as a short squeeze.

Bitcoin short-liquidations hit their highest level since mid-January of more than $80 million since the start of Monday’s Asia Pacific session.

Binance Moves $980 Million for Just $1.29

Changpeng Zhou, often called CZ, announced that some fund movements would occur on-chain. Indeed, he later shared the Etherscan.io URL to a $980 million transaction between Binance wallets, bragging that the transaction took only 15 seconds and cost $1.29 before facetiously telling his followers to “imagine moving $980 million through a bank before banking hours on a Monday”.

The transfer txid. Took 15 seconds and costs $1.29. Imagine moving $980 million through a bank before banking hours on a Monday. https://t.co/ViCppASVFK

— CZ Binance (@cz_binance) March 13, 2023

One of the key touted advantages of crypto over transferring funds through the traditional banking system is the lack of red tape created by middlemen (i.e. the bank), given that crypto involves direct peer-to-peer payments.

Related Articles

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards