Data showing a larger-than-expected drop in inflation in the US in May failed to give the Bitcoin (BTC) price a lasting boost on Tuesday, despite bolstering hopes that the US central bank’s tightening cycle is now over.

According to the latest US inflation data release, the Consumer Price Index (CPI) only rose at a rate of 0.1% MoM in May, below the expected 0.2% rise.

The YoY rate, meanwhile, came in at 4.0%, a big drop from last month’s 4.9% reading and its lowest in exactly two years.

The data briefly helped BTC hit session highs in the $26,400s, but the rally was short-lived.

Bitcoin quickly dropped back under the $26,000 level, where it then spent the majority of the US session trading.

At current levels in the $25,800s, bitcoin is roughly flat on the week, but is close to 17% down from this year’s highs in the $31,000s.

Nearly 5% of those losses have come since the start of last week, with crypto sentiment taking a significant dent after the US Securities and Exchange Commission (SEC) went after Coinbase and Binance with lawsuits and, in doing so, labeled dozens of cryptocurrencies as securities.

While bitcoin was not among those named by the regulatory agency as a security – past and present leaders at the SEC having stated openly that they don’t believe BTC to be a security – heightened regulatory uncertainty in the US is weighing on the bitcoin price.

Fed Tightening Bets Ease, But This Key Technical Metrics Sends Ominous Sell Signal

In wake of Tuesday’s downside inflation surprise, traders moderated their Fed tightening bets.

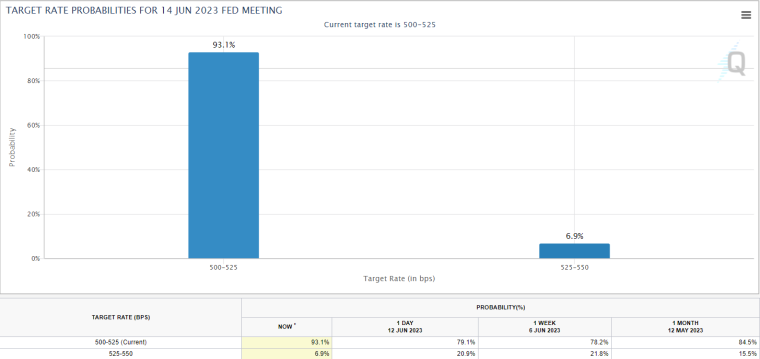

According to the CME’s Fed Watch Tool, the money market implied likelihood that the Fed leaves interest rates unchanged at Wednesday’s policy announcement is now around 93%, up from under 80% one day ago.

Indeed, the downside inflation surprise removes pressure on the Fed to continue hiking interest rates in wake of the 500 bps worth of hikes it has already implemented since March 2022.

But the market’s base case remains that the Fed will hike rates at least one more time.

Money markets implying a roughly 65% likelihood that the Fed will have lifted interest rates by at least another 25 bps by the end of July’s meeting, though this probability was higher at around 75% one day ago.

Bitcoin’s failure to rally despite Fed tightening bets easing is telling of the shaky state of confidence in the crypto market in wake of recent SEC enforcement actions, and in wake of the already sizeable pullback from earlier yearly highs.

While bitcoin is still holding above key resistance-turned-support in the $25,200-400 area, a key technical metric just sent an ominous sell signal that could be weighing on sentiment.

The Moving Average Convergence Divergence (MACD) indicator that tracks the 12 and 26 weekly moving averages just fell negative for the first time since last August.

The last time it turned negative after a prolonged spell in the green was in November 2021, shortly after bitcoin began its long pullback from 2021’s record highs of $69,000.

Prior to that, the MACD also sent a great sell signal when it turned negative in April 2021, with the BTC price going on to fall as much as 40% in the subsequent months.

If bitcoin does ultimately fall under $25,200-400 support, which would also see it snap its uptrend for the year, then a retest of the 200-Day Moving Average in the $23,600s would be on the cards, as would a possible collapse all the way to the low $20,000s.

Related Articles

- Bitcoin (BTC) Price Prediction 2023 – 2040

- Best Crypto Presales In June 2023

- 10+ Best Crypto To Buy Now 2023

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards