Bitcoin Runes captivated investors’ interest in late April following the widely expected occurrence of the BTC halving. The protocol, which is designed to make the network more scalable by reducing transaction fees and processing speeds, paved the way for the rise of meme coins and other similar tokens that can now be minted on the BTC network.

Although the protocol’s activity and network usage progressively dropped as the hype waned, certain tokens have experienced positive performance in the past few days as investors seem to be regaining interest in tokens like DOG•GO•TO•THE•MOON (DOG).

Are Bitcoin Runes still a thing or is this just another passing fad in the ever-evolving crypto space? Here’s a quick look at what has transpired in the past couple of weeks.

The Birth of Bitcoin Runes: A New Era in BTCFi

Bitcoin Runes is part of a broader movement known as Bitcoin decentralized finance (DeFi), or BTCFi, which aims to enhance the functionality of the Bitcoin network. Developed by Casey Rodarmor, the creator of the Ordinals protocol, Runes is designed to be an elegant and byte-efficient protocol that allows users to deploy (etch), mint, and launch assets similar to ERC-20 tokens on Ethereum.

Runes are part of a movement that seeks to bring decentralized finance (DeFi) to the Bitcoin network by enhancing its scalability. Rodarmor designed Runes to enable the creation of ERC-20-like tokens but within the Bitcoin network to allow developers to mint new types of assets and expand the BTC ecosystem.

Runes are much more efficient than their predecessor – BRC-20 tokens – as they use Unspent Transaction Outputs (UTXOs) to store messages that are used to record the Runes transaction on the BTC blockchain.

The launch of Runes coincided with the fourth Bitcoin halving, creating a perfect storm that saw transaction volume on the Bitcoin blockchain skyrocket. On April 23, transactions attributed to the Runes protocol accounted for a staggering 81.3% of all Bitcoin transactions, pushing daily mining revenue to an all-time high of $107.7 million.

After Runes were officially launched on 23 April, a date that coincided with the widely-awaited Bitcoin halving, transactions within the Bitcoin blockchain skyrocketed along with miners’ revenues, which posted a daily record of $107.7 million. Back then, a total of 81.3% of all transactions posted in the network were attributed to Runes.

DOG Reignites Runes Frenzy After Posting Triple-Digit Gains in Late May

One token in particular seems to be reigniting the hype surrounding Runes and their ability to revolutionize the BTC ecosystem. The name of the token is DOG•GO•TO•THE•MOON (DOG) and its performance lately has been shushing the rumors that Runes are dead.

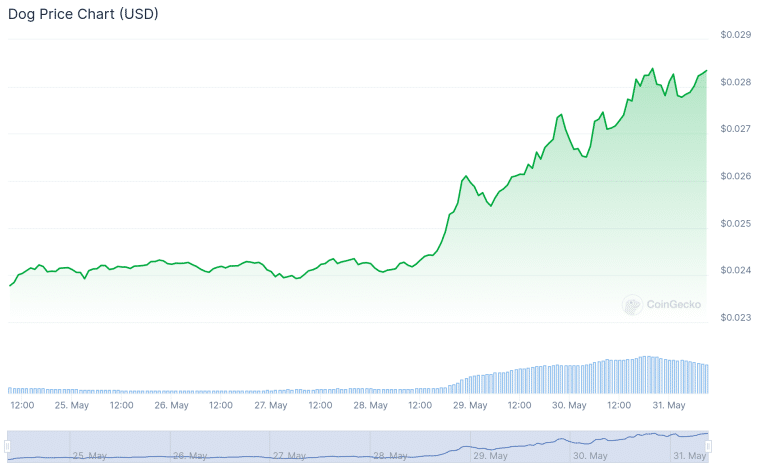

As of yesterday, the price of DOG had experienced a 24-hour surge of 13.7%, with its value standing at $0.00828 according to data from CoinGecko. Meanwhile, the token posted total gains of 117.4% in the past 7 days alone and has seen its market cap jump to nearly $825 million.

The DOG Rune was created by the Twitter influencer Leonidas. It is a dog-themed token that is considered one of the flagship meme coins of the BTC ecosystem.

DOG’s success is part of a larger trend in Bitcoin-based meme coins. Another notable performer is SATOSHI•NAKAMOTO, which has seen a 24.1% increase over the past 24 hours to $2.44. Meanwhile, in the past 7 days, this Rune has delivered remarkable gains of 47.9%. Its market cap is, however, much smaller compared to DOG as it stands at nearly $60 million at the time of writing.

Miners See Significant Drop in Network Fees as Runes Hype Fades

Despite this latest spike in the value of flagship Runes, the protocol is still struggling to attract significant trading volumes as indicated by the latest network statistics. Compared to April 24th, when Runes transactions accounted for nearly half of the total within the BTC network, their share dropped to just 11.1% as of May 2nd.

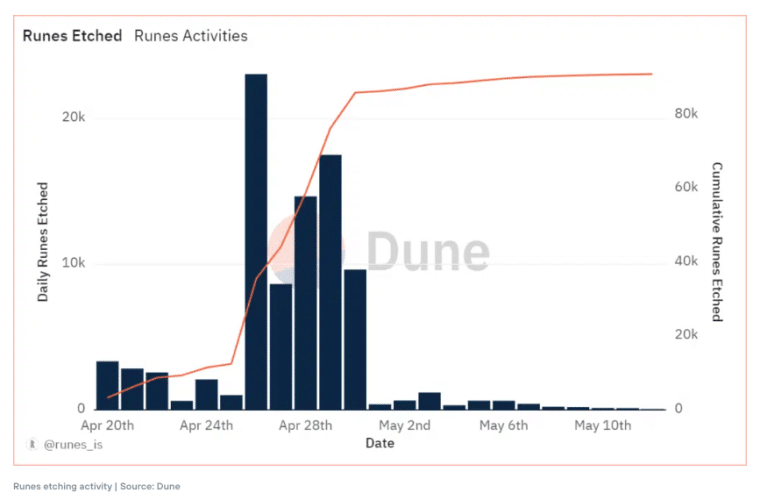

The number of Runes etched has also dropped dramatically in the past few days compared to late April. For example, on April 30th, a total of 86,047 etchings occurred while on May 12th the number stood at just 120.

This drop in activity has had a direct impact on miners’ revenues. While Bitcoin miners have earned a total of $4.56 million in fees from Runes, the majority was collected during the initial etching period between April 19 and April 30. Since then, fees have decreased substantially along with the activity.

The impact on miners’ revenues has been substantial. On 13 May, for example, transaction fees associated with Runes landed at $3,835. In total, since the protocol was launched, miners have collected $4.5 million in transaction fees as of 13 May. The majority of those fees were collected within the first few days after the protocol’s launch date.

Some Technical Challenges May Still Limit Adoption Rates for Runes

The fluctuating interest in Bitcoin Runes reflects a broader trend in the Bitcoin ecosystem. Charlie Spears, co-founder of Blockspace Media, notes that neither Runes nor BRC-20s have currently harnessed much momentum, partly due to technical limitations and user experience issues.

“Right now, especially with meme coins being the resurgent sector in crypto, […] people don’t really care how a Rune or BRC-20 works,” Spears told Decrypt. “They want to trade them as quickly and with as much liquidity as possible.”

The concept of Bitcoin Runes is still relatively new compared to similar assets minted on other networks like Ethereum and Solana, where meme coins have existed for years. Moreover, Runes can be traded primarily on centralized exchanges like OKX or marketplaces like Magic Eden. In contrast, Solana-based meme coins can be traded on decentralized exchanges as well – typically the preferred alternative for crypto investors.

Despite these hurdles, some see long-term potential in Runes. For example, Rennick Palley, founding Partner at Stratos, believes that by making the network busier and more versatile, Runes could help Bitcoin miners stay profitable despite the impact of the latest halving event. “It’s especially promising because it meshes well with Bitcoin’s existing UTXO model,” he said.

However, this increased activity comes with a cost. As Runes’ popularity grows, transaction fees may climb, making everyday Bitcoin transactions more expensive. This could push additional transaction volumes to layer-2 solutions, a development that many in the industry see as inevitable and even beneficial.

“Overall, I see the rise of layer-2 solutions as a major positive,” Palley emphasized. “These technologies will be the key to enabling hyperbitcoinization. Bitcoin would always need layer-2 solutions to scale — ordinals, BRC20s and Runes have just accelerated the timeframe, which is great.”

The BTC Ecosystem is Undergoing a Cultural Shift to Embrace New Trends

As Bitcoin hovers around the critical $60,000 level, the crypto community is closely watching both its price movements and the evolution of Bitcoin Runes. DOG’s performance in the past few days challenges the notion that “Runes are dead.”

However, transaction volumes are still quite low, pointing to stalled momentum and slow adoption rates among crypto investors.

Interestingly, this period of experimentation is also fostering a cultural shift within the Bitcoin community. Alexei Zamyatin, co-founder of the layer-2 Bitcoin and Ethereum protocol BOB, notes: “Bitcoin has become more welcoming of new developers and builders, with the toxic maximalist culture subsiding into irrelevance.”

This change in attitude, coupled with the learning opportunities provided by protocols like Ordinals and Runes could have a significant long-term impact on how the Bitcoin ecosystem grows. By providing people with cheaper and faster ways to start minting and trading Bitcoin-based assets, these innovations are helping the Bitcoin network be more accessible and competitive.