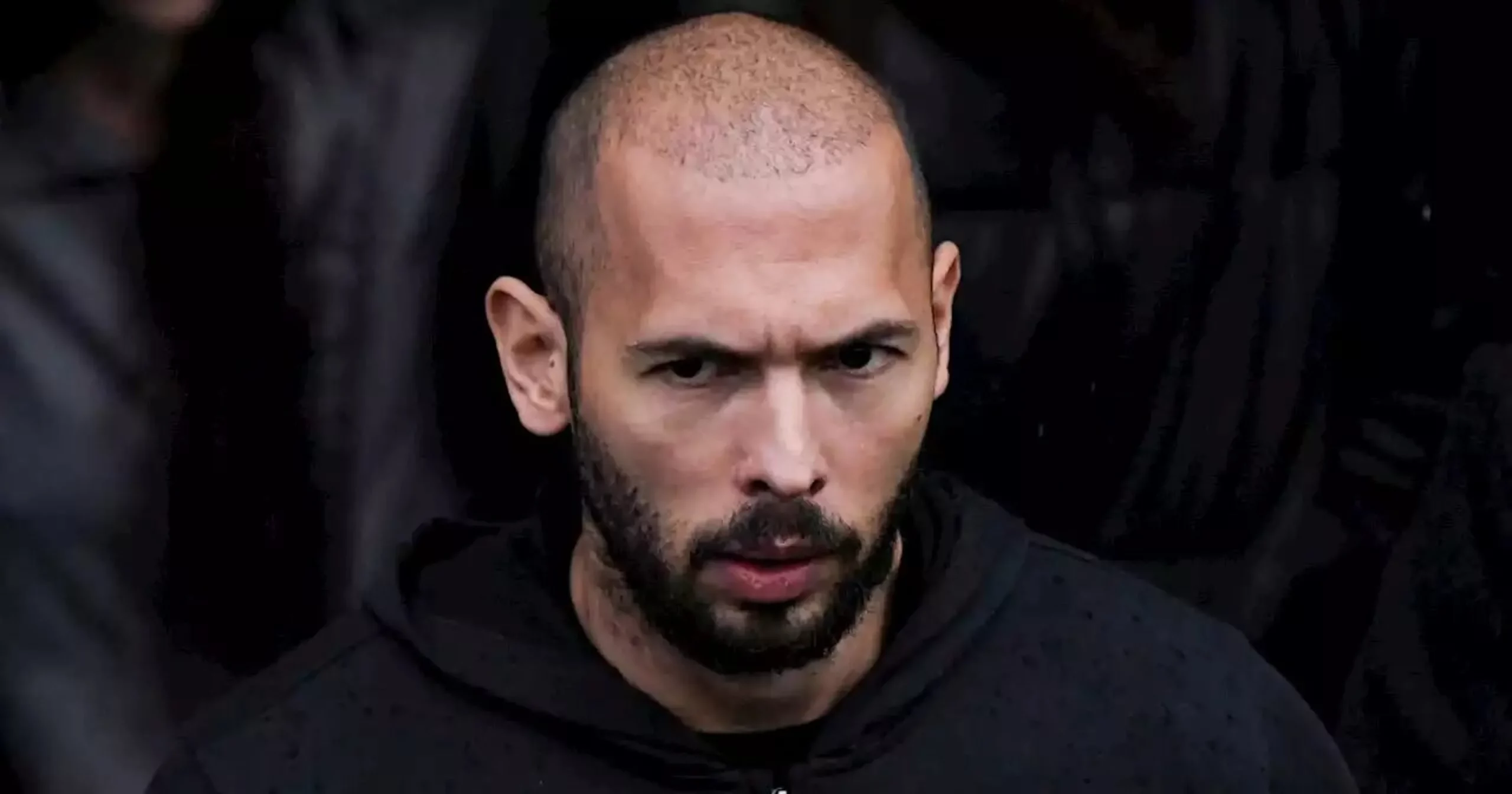

The controversial former kickboxer and internet personality Andrew Tate once again captured the attention of both the public and tabloids after he claimed he would be betting $1 million in Solana-based meme coins.

This new chapter in the exciting roller coaster ride that is the crypto coin space revolves ar0und Tate’s comments about his “diamond hands” – a term used to refer to one’s willingness to buy and hold an investment despite what the price does in the short term – and his intention to “crash the Solana network” by purchasing a significant number of tokens on the blockchain.

Tate went on to share a wallet address that users and crypto enthusiasts could use to send meme coins – possibly to trigger a significant spike in the network’s transaction volume. He reportedly burned a significant number of these tokens and claimed to have made “zero” money on these operations.

GUESS HOW MUCH MONEY IVE MADE TODAY?

ZERO.

IVE MADE OVER 100M TRADE THROUGH SOLANA, IVE TURNED PEOPLE INTO MILLIONAIRES.

IVE MADE ZERO. ZERO. I JUST BOUGHT COINS AND HELD THEM TO DUST.

I WILL MAKE ZERO MONEY BECAUSE I AM A REAL NIGGER.

— Andrew Tate (@Cobratate) June 7, 2024

“I’ve made over 100 million trading through Solana. I’ve turned people into millionaires. I’ve made zero. Zero. I just bought coins and held them to dust,” he posted on the social media platform X (formerly Twitter).

Throughout the day, Tate also promoted a token named Real N****r Tate (RNT), which ultimately reached a market cap of around $60 million as a result of his endorsement. Last night, the token surged to an all-time high of around $0.025 but has been steadily dropping since then to $0.014 while its market cap currently stands at just $13.7 million.

Meanwhile, another token called TOPG saw its market cap and price propelled by Tate’s action as the developer allocated as much as 58% of the token’s total supply to the celebrity’s crypto wallet. Tate ultimately burned the tokens and managed to pull a temporary supply crunch.

A handful of other tokens took advantage of Tate’s involvement with the Solana space yesterday including G, a meme coin inspired by Tate’s pet, GRETA (linked to his previous encounters with the climate change activist), and FTRISTAN, which makes reference to Tate’s conflicts with his brother, Tristan Tate.

Celebrity-Endorsed Pump-and-Dump Schemes Become the Latest Fad

Why Tate decided to pull off these stunts is unclear but his actions have surely raised eyebrows among regulators and even crypto enthusiasts who believe that this is just part of an elaborate pump-and-dump scheme.

When a celebrity endorses a certain cryptocurrency, their support causes their price to spike temporarily. The anonymity of the blockchain space may allow these individuals to benefit from the price surge without anyone knowing who is behind the curtain.

In traditional financial markets, this likely constitutes the crime known as insider trading. However, since the crypto space is largely unregulated in most countries, shady characters who have huge followings like Tate have managed to get away with these kinds of activities and have left a trail of thousands of investors who gamble their money and end up losing most of it in the majority of the cases.

Experts warn that the latest trend involving celebrities promoting meme coins associated with their persona is a dangerous precedent as these assets have no practical or real-world value and their price is often manipulated due to their low liquidity. These public figures can easily cash out at the peak and leave their followers holding a bunch of worthless tokens.

Tate Built His Following on Scandal

Tate’s motives are being scrutinized primarily amid his legal status and the sheer number of controverted situations he has been involved with lately. He and his brother, Tristan, are currently being charged with rape, human trafficking, and criminal activities involving the exploitation of women.

Moreover, authorities in the United Kingdom have issued arrest warrants to arrest the brothers on rape and sexual assault charges as well.

Andrew Tate’s online personality and following were primarily built through his career as a kickboxer and then as a participant in the show Big Brother in 2016, from which he was ousted due to allegations that he attacked a woman.

Meanwhile, his fame has been recently propelled mostly by his legal affairs. His latest involvement with the crypto space could be considered an attempt to cash in on a passing fad like chilling meme coins in the Solana space via protocols that facilitate minting this kind of token like Pump.fun. Tate currently has 9.4 million followers on X.

A $10M High-Profile Clash with Another Crypto Influencer

Tate has recently dared another crypto celebrity – Ansem – to engage in a live fight during the Dubai-based event called Crypto Fight Week, which will be taking place in December this year.

To make things interesting, Tate dared Ansem to bet $10 million on who would win the match. Ansem has been gaining popularity in the crypto niche of social media due to his success as an investor and influencer focusing on the meme coin market.

He first bought Solana (SOL) tokens when they were worth just $1.5 per coin and held on to them for a while until they reached $260. As a result, he pulled a 170x profit and was immediately followed by investors and crypto enthusiasts from all over the world for his accomplishment.

Ansem agreed to Tate’s invitation on social media. Although Tate’s legal situation, which prevents him from leaving Romania, makes it impossible for him to attend unless his legal charges are dismissed, this was surely a fun interaction to watch.

Iggy Azalea and Caitlyn Jenner Take Part in the Meme Coin Craze

Don’t disappoint your mother…

3S8qX1MsMqRbiwKg2cQyx7nis1oHMgaCuc9c4VfvVdPN pic.twitter.com/G8x2mms47P

— IGGY AZALEA (@IGGYAZALEA) May 29, 2024

Apart from Tate, other celebrities have taken advantage of the meme coin craze to launch their own tokens to possibly capitalize on the trend while it lasts.

One notable example is Caitlyn Jenner, the former Olympic athlete, who launched her meme coin $JENNER in late May with the help of a promoter named Sahil Arora who ultimately turned out to be a scammer.

Her token experienced a significant jump in trading volumes once it hit the market and managed to reach a market cap of $20 million at its peak.

However, the token’s value has progressively dropped and its market cap currently stands at just $6.15 million while its trading volume has diminished to $23.3 million in the past 24 hours according to data from CoinMarketCap.

Meanwhile, the popular Australian rapper Iggy Azalea also promoted her very own meme coin named Mother Iggy ($MOTHER) and attracted significant interest from investors initially. However, the whole offering was a bit shadowed by the fact that insiders were assigned 20% of the token’s total supply before it hit the market.

In the first few days after it was minted, the token rose from $0.02 to $0.09, delivering gains exceeding 350% to early buyers. This one has maintained some degree of acceptance among crypto enthusiasts as its market cap stands at $212.8 million. However, those who bought at the most recent peak likely lost their shirt on the trade as the token is nowhere near $0.09 at the time.

The significant volatility that meme coins often experience, their lack of practical utility, and the absence of a business model that generates cash flows to justify their worth is exactly what makes them such a dangerous asset to invest in, especially for novice investors who may ignore these caveats.

Experts recommend that investors should proceed with extreme caution when it comes to this segment of the crypto market. In addition, there have been various incidents where unscrupulous promoters exploit the image of public figures without authorization and manage to lure millions in assets from unwary investors who believe these tokens are being promoted by the celebrities they love and follow.