The Dollar Index (DXY), a trade-weighted basket of major USD currency pairings, rallied 0.8% on Monday, putting it on course for its biggest one-day gain since late October. The rally saw the DXY rebound from the near-six-month lows it printed just above 104.00 earlier in the session to the mid-105.00s. The index was last changing hands in the 105.30s, only slightly below its 200-Day Moving Average at 105.60 which it broke below for the first time since June 2021 last week.

This Macro Update Drove The US Dollar’s Strength

The DXY’s rebound was driven by a significantly stronger-than-expected US ISM Services PMI survey for November, which showed the dominant US services sector still humming along nicely midway through the final quarter of 2023. While last week’s ISM Manufacturing PMI survey pointed to a weakening US manufacturing sector, Monday’s data, combined with last Friday’s robust labor market numbers for November, underscore the notion that the US economy is still faring well and doesn’t look likely to enter recession anytime soon.

That’s good news for most Americans. But it isn’t good news for risk assets. That’s the message the market has sent on Monday, anyway. US stocks have been selling off on Monday, with traders fearing that the robust service sector and jobs data will encourage the Fed to press ahead with aggressive rate hikes in the next few months, raising the risk that the bank misjudges the economy and causes an even deeper recession later in 2023/in 2024.

Cryptocurrency markets often move in tandem with US stocks and tend to also have a negative correlation to the US dollar and US bond yields (which, like the dollar, jumped on the strong economic data). Most altcoins have thus given back their early Monday gains, with traders ditching assets deemed as risky in favor of dollars, with the buck typically viewed as a safe-haven asset.

Altcoin Prices Reverse Lower

Major altcoins are mostly now lower on the day and over the last 24 hours, and nearly all have at least pulled back from highs. Ripple’s XRP, at one point up about 2.0%, is currently down just over 1.0% around $0.385 and is back under its 21 and 200DMAs.

Dogecoin’s DOGE, which at one point hit fresh highs since early November above $0.11, representing a more than 7.5% on-the-day rally at the time, is back to trading around the $0.10 level once again, where it is down around 3.0% on the day.

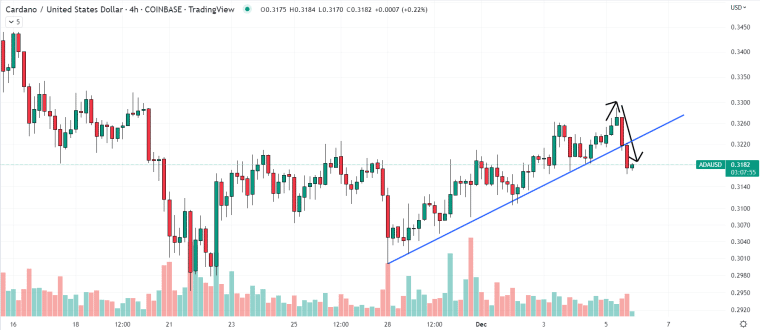

Cardano’s ADA, which hit multi-week highs near $0.33 earlier in the session where it was at the time up about 2.5%, has reversed back under $0.32 and is down about 1.3% on the day. The cryptocurrency is threatening a break back below its 21DMA.

Polygon, Polkadot and Uniswap were all last down about 1.7% in the last 24 hours, according to CoinMarketCap. Notable exceptions include Axie Infinity’s AXS token, which was last up around 26%, but also substantially below earlier session highs. Litecoin, meanwhile, was last up around 3.6%.

Dash 2 Trade (D2T)

Those interested in investing in a promising crypto trading platform start-up should look no further than Dash 2 Trade. The up-and-coming analytics and social trading platform hopes to take the crypto trading space by storm with its host of unique features.

These include trading signals, social sentiment and on-chain indicators, a pre-sale token scoring system, a token listing alert system and a strategy back-testing tool. Dash 2 Trade’s ecosystem will be powered by the D2T token, which users will need to buy and hold in order to access the platform’s features.

Dash 2 Trade is currently conducting a token pre-sale at highly discounted rates. D2T token sales recently surpassed $8.4 million. The sale is very close to entering its fourth phase, with over 96% of stage 3 tokens now sold. When the sale enters its next stage, prices per token will be lifted to $0.0533 from $0.0513.

Related Articles

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof Audited, CoinSniper KYC Verified

- Trading Community of 70,000+ Members