Aave has had a strong week in the Cryptocurrency markets. Aave has finally broken back through the $100 psychological barrier. Currently we are seeing bullish-momentum and possibly the form of a new uptrend.

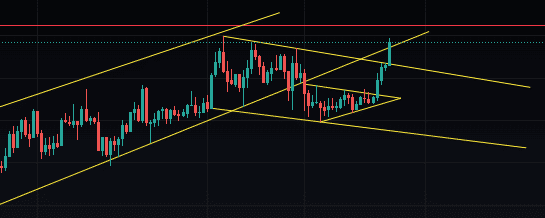

The image above displays the recent price action of Aave. We went from a bullish ascending channel into a bearish descending channel, which has a symmetrical triangle within it. We can see now Aave has broken out of the symmetrical triangle and is getting rejected at resistances such as the previous swing high of $110 on May 23rd 2022.

The Relative Strength Index is currently a little overheated on the 4 hour time frame and the next technical resistance is $112.40.

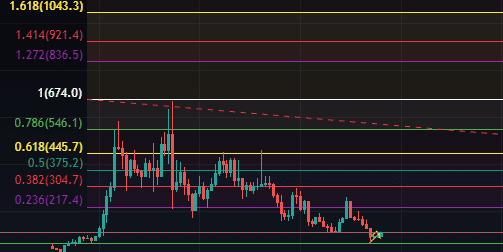

Did the 12th May 2022 reflect a market cycle bottom for Aave that allows us to forecast prices between 2025-2030?

Cryptoassets are a highly volatile unregulated investment product.

Aave Coin Price Prediction

Since the all-time high of $663 for Aave on the 20th May 2022 Aave has been in a constant downtrend. As the most powerful centralized finance protocol that allows lending and borrowing, I am very bullish on the future of Aave. These lower price levels offer potential undervaluation and opportunity for reaccumulation and could be ideal for a long-term investment portfolio using the hodl strategy (not selling for a long-period of time, regardless of market sentiment).

On Coinmarketcap Aave is currently trading at a modest $107.79 and ranked at #42. We have moved up one position on the ladder. The market cap has recently pumped back up to $1.5b today Aave has pumped 12.9% with a total transaction volume of $200m.

The previous all time high for Aave and it’s market capital was $8.06b which was set during the peak of the 2020-2021 Crypto Bull market on the 18th May 2021.

We currently have 87% of the capped supply in circulation for Aave. Even if Aave were to reach 100% of it’s circulation in supply, I still believe $835-$1,045 is a very pragmatic target for Aave in future bull markets.

Aave Descending Triangle Pattern – daily chart

Looking at the price action for Aave we came down to the lower support level of $64.1 This reminds me of the correction of 59.5% which bottomed in at $112.4 and shortly after resulted in an impulse to the upside of 108% resulting in rejection of the yellow trend line on our descending triangle (diagonal resistance).

Should history repeat and Aave have another impulse to the upside, I would expect Aave to come up to around $175 this June. This would result in roughly a 77% return on investment as each impulse wave diminishes over time.

With this in mind for June 2022 I think it could be realistic to look at a $140-180 Aave. This depends on whether we can break through the $112.4 resistance level. We would also want to see a high amount of volume across all time frames.

Ideally we are looking to break out to the upside of the descending triangle pattern which could result in prices of around $250, but with the extreme fear in the market it is wise to stay risk averse when looking to book short-term profits.

I think Aave is a great blue-chip project which should be included in most long-term portfolios. Especially as DeFi is one of the most lucrative and exciting sectors in the whole Cryptocurrency space.

Aave Price Prediction 2025-2030

If the market cycle bottom for Aave really is $64.1 we can start looking at realistic targets for 2025-2030. By using the previous all time high and the assumed market cycle bottom of $64.1 we can piece together a realistic future price prediction by at least 2025.

Aave Fibonacci Extension levels

- 1.272 Fib – $836.5.

- 1.414 Fib – $921.

- 1.618 Fib – $1,043.

As far as protocol upgrades go, Aave is still yet to deploy V3 on the Ethereum mainnet. This would be extremely bullish and most likely result in growth for the network and a highly anticipated rally for Aave. Currently Aave has been deployed across Fantom, Avalanche, Harmony networks, and Ethereum’s leading Layer 2 arbitrums known as Optimism and Polygon.

Once other projects also take on board the V3 iteration of Aave we will see even more explosive growth. In the future we could easily see mass adoption occur for Aave.

Another feat of Aave which makes me bullish is that during DeFi madness of Summer in 2020, Aave was one of the largest projects in terms of its total value locked within the protocol. This could easily repeat during the next bull market and it helps hold the floor level of Aave during bear markets.

Currently there are no major competitors to Aave and the borrowing and lending platform continues to grow. Now offering over 20 Cryptocurrencies to borrow and lend against Aave create a strong appetite for investors.

The unique selling points of Aave are the ‘flash loans’ and ease of switching between fixed and variable interest rates. This also makes the platform very appealing.

With enough long-term accumulation for Aave I would be confident that Aave reaches price levels of beyond $2,500 by 2030.

Related

- Where to Buy Aave – Beginner’s Guide

- Best Crypto Traders to Follow on Twitter – Trader Predicts AAVE pump

DeFi Coin (DEFC) - Undervalued Project

- Listed on Bitmart, Pancakeswap

- Native Token of New DEX - defiswap.io

- Up to 75% APY Staking

- Whitepaper and DeFi Tutorials - deficoins.io