Staples announced their second quarter earnings estimates this week. The company did not fare well as it recovers from store closures and competition in the office technology market. Earnings from continuing operations came in at $0.16 per share, missing expectations for $0.18. The company reported income of $104 million for Q2 2013, which was significantly lower than Q2 2012 income of $125 million.

CEO Ron Sargent stated that although Staples had made progress by driving online sales and aggressively managed expenses, the company suffered from the 103 stores they closed in the 12 months prior to the second quarter and the weak performance of “retail stores and international businesses.” Staples also cited less foot traffic and lower average purchases internationally, which was evident from the decrease of international store sales by 8.3%.

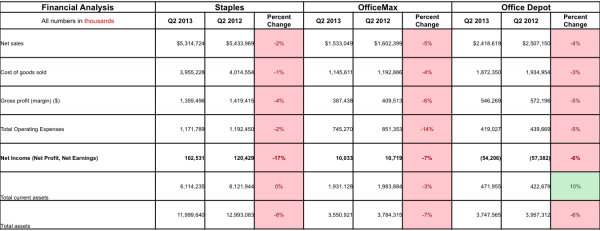

The table below highlights some key metrics gathered from Staples second quarter earnings report and also compares their performance with two of its competitors – OfficeMax and Office Depot.

Staples’ sales fell by 2% to $5.3 billion and can be attributed to lower store sales and international sales. However, OfficeMax and Office Depot had a similar drop in sales falling 5% and 4% respectively. The Staples Q2 earnings report claimed weakness in business machines and technology accessories as the main reason for drop in sales. The comparable store sales, which exclude sales in Staples.com, decreased 3%, and reflected a 2% decline in traffic as well as a 1% decline in order size versus last year.

Although total operating expenses were reduced by 2% the company still saw a decrease in net earnings, dropping almost 17%. OfficeMax and Office Depot also saw a decrease in operating expenses, and OfficeMax saw a decrease in net earnings whereas Office Depot saw an increase, but still faced a net loss nonetheless.

The loss in sales and drop in earnings per share could indicate an opportunity to revisit Staples strategy, especially considering the merger that was announced between Office Depot and OfficeMax. Office Depot revealed plans to buy OfficeMax in February, and is currently awaiting regulatory approval for the merger. As this Reuters article states, both companies currently have lower market shares than Staples, but the merger is an attempt to fix that by boosting profitability as well as shareholder value. The office supply sector has also faced some challenges including the drop in demand for their products, and increase in competition from online businesses such as Amazon and Wal-Mart. Regardless of their position in the market, all office-supply chains will be tested in the long-run especially since online interactions are growing and the need for office supplies is decreasing.

However, the merger will be a primary concern for the office supply sector since it may actually give Staples room to grow. Bloomberg reports that the merger between OfficeMax and Office Depot will result in nearly 600 stores closing. This cut in locations could help create a void that Staples is well suited to fill. Another deciding factor that will impact the companies is their commercial business units. Staples could benefit from the merger as companies, in response to the new and unknown future of OfficeMax-Office Depot, may switch their contracts to Staples. The merger is also sure to result in various positions being terminated that could benefit Staples with an influx of potential experienced employees who are looking for work.

Staples also has higher sales, and the combination of OfficeMax and Office Depot’s sales would still not be enough to overcome the industry leader. Although Staples does have to address future market concerns and improve sales during the subsequent quarters, there is a potential for growth in the office supply sector. Office supply retailers could leverage their existing market knowledge and target online marketing initiatives more, which could pose lucrative opportunities.