In the retail industry, where accelerated disruption is the norm, keeping in step with emerging retail trends is the key to gaining a competitive edge and meeting ever-changing consumer expectations.

As all of the latest and most useful retail trends are scattered across a wide range of sources, at Business2Community we’ve used our expertise to pull them together into a curated list.

Let’s explore 10 key trends in the retail industry for 2025.

Key Retail Trends for 2025

- 80% of US consumers are trading down to lower-priced options in 2023.

- Purpose-driven consumers now represent 44% of consumers across all product categories.

- In 2023, 80% of all shopping still happens in stores.

- 80% of retailers in the US are incorporating, or planning to incorporate, returns processing technology.

- By 2024, 40% of the top 500 retailers will use AI to support improvements in omnichannel retail, customer loyalty, productivity, and profitability.

What are 2025’s Retail Trends?

In 2022, the global retail industry generated over $27 trillion, with projections that it could generate over $30 trillion by 2024. Nearly 20% of retailers have reported negative profits since 2015.

While the retail sector has created significant value during this period, the gap between top and low performers continues to widen, with the top 10% of publicly traded retailers now accounting for 70% of the sector’s economic profit. Post-pandemic, the sector faces growing complexity due to mounting economic pressure and changing customer expectations.

1. Spending Habits Shift

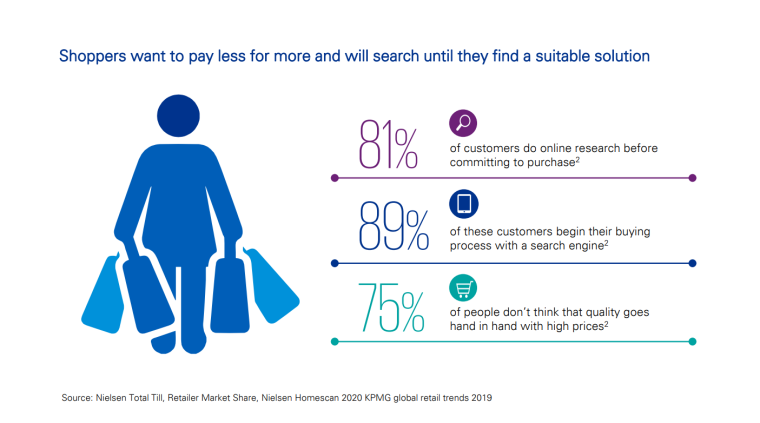

As of April 2023, 80% of US consumers are trading down to lower-priced options. According to a 2023 PwC survey, 46% of respondents expected to increase their spending on groceries, up from 42%. Meanwhile, 36% of respondents said they were spending more on clothing and health/beauty products, a year-over-year increase from 28% and 27%, respectively.

By 2023, IDC predicted that 80% of the top 2,000 retailers will implement Buy Now, Pay Later (BNPL) to improve conversion rates and increase basket size by an average of 25%.

As consumers continue to rein in their spending, deals and discounts will remain a key strategy for driving consumer spending in 2024. Businesses that extend their personalization efforts to offer the right products to the right consumers at the right price, will boost their sales.

2. Sustainability Shopping Surges

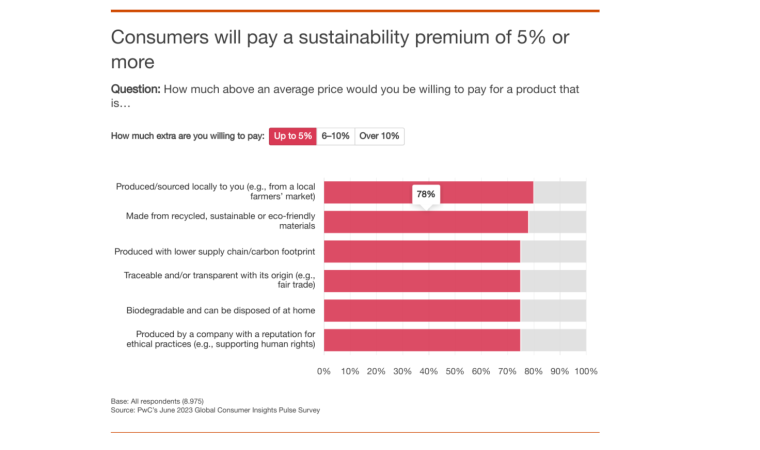

Purpose-driven consumers or those who choose products and brands based on how well they align with their values, now represent the largest consumer segment (44%) across all product categories according to IBM.

Consumers’ growing convictions about sustainability and social responsibility are reflected in their spending habits. 80% of consumers are now willing to pay up to 5% more for sustainable products stated a PWC survey.

Products making sustainability-related claims on their packaging have averaged 28% cumulative growth over the past five years, versus 20% for products that haven’t.

By 2025, the IDC predicts that 75% of retailers will update their supply chains to improve carbon emissions and environmental factors, resulting in a 45% increase in customer loyalty.

3. Last-Mile Delivery Concerns Soar

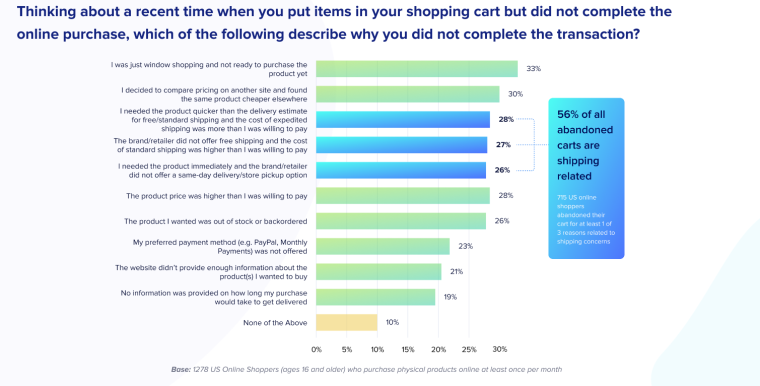

83% of US online shoppers say free shipping is important to them, with over 90% expecting free two to three-day shipping. Over 50% of shoppers report that three-day shipping is the slowest they’ll tolerate before looking to other retailers. And a whopping 56% of all abandoned carts are due to shipping-related concerns during checkout.

Delivery speed and accuracy remain a key concern, with more than 40% of consumers saying they’re willing to pay more for a product if they can get it quickly and conveniently.

According to PwC’s 2023 retail monitor report, 79% of retailers are making delivery speed and accuracy a priority. However, given the high costs of omnichannel order fulfillment, retailers face major challenges as they work towards improving delivery speeds profitably.

Additionally, even as consumer attitudes shift towards sustainability, only 25% of retailers offer sustainable delivery, showing that there is an opportunity for retailers to grow in this area.

By 2025, 75% of retailers will fully integrate order and inventory data to optimize fulfillment, improving conversion by 10%, customer satisfaction by 50% ,and reducing cost to serve by 25%.

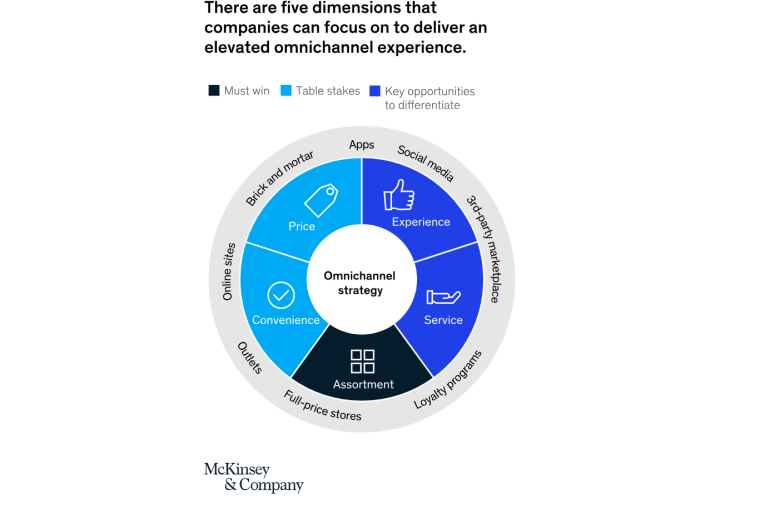

4. Omnichannel Retail Trends Up

Omnichannel continues to trend up, with more retailers using integrated strategies to provide a seamless shopping experience across online and offline platforms. Creating an integrated omnichannel strategy enhances customer experience and has a direct impact on spending; 64% of shoppers are willing to spend more when their concerns are addressed on their preferred channel.

As of 2023, 80% of all shopping still happens in stores. However, post-pandemic, consumers view digital tools as crucial for shopping and desire a seamless blend of physical and digital channels from retailers.

Even grocery, which was once a predominately store-based category, has become omnichannel, with nearly 40% of US shoppers saying they do at least some of their grocery shopping online.

In response to the growing need for a hybrid shopping experience, 50% of retailers currently offer, or plan to offer, ship-from-store capabilities and almost two-thirds of retailers currently offer or plan to offer buy online, pick up in-store.

5. Buyer Journeys Become More Fragmented

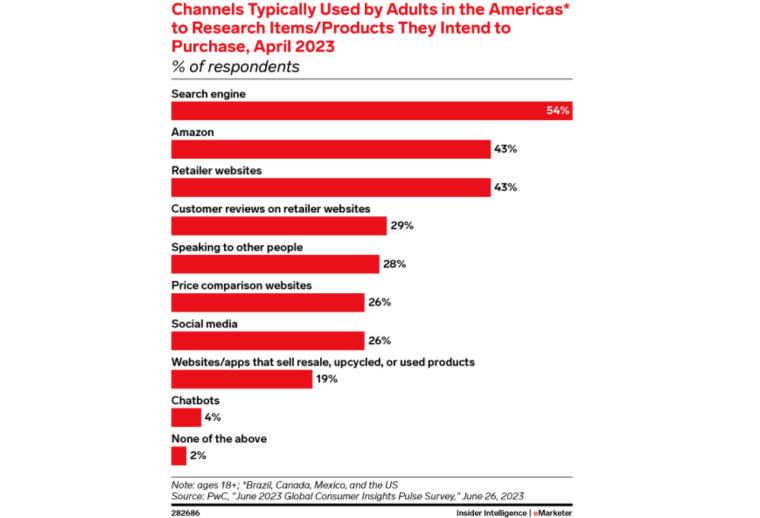

Around 50% of consumers and around 70% of Millennials and Gen Zers say they rely on social media, celebrities, articles, or blogs to make buying decisions. In a 2023 PwC survey:

- 54% of respondents rank search engines as their primary source for pre-purchase information.

- Amazon is the second most popular source, at 35%.

- Individual retailers’ websites follow closely at 33%.

- 31% of respondents also use retailers’ websites to read customer reviews.

In 2025 and beyond, retailers need to understand how consumers find, research, and purchase their products. Whether it’s through single or multiple channels, retailers must ensure each touchpoint offers a frictionless and consistent experience.

6. Reverse Logistics is Redefined

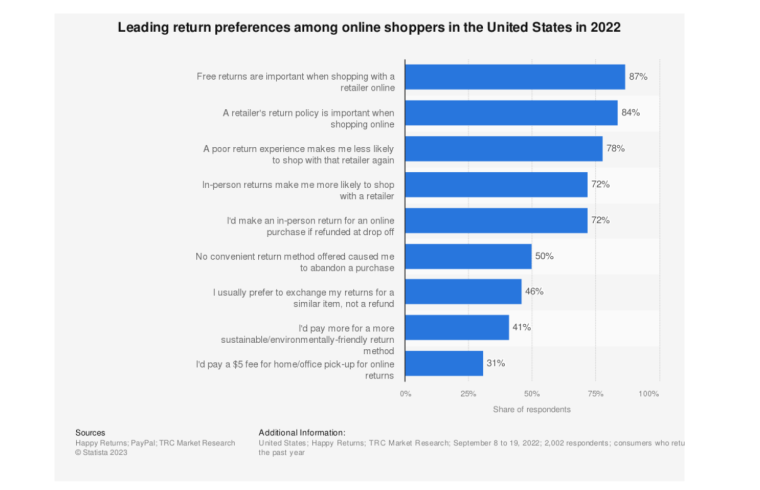

Returns accounted for $816 billion in lost sales across the US in 2022 and are set to surpass $620 billion, or 8.5% of total retail sales, in 2023. Savvy retailers are reimagining reverse logistics and turning potential losses into opportunities to improve customer satisfaction, advance sustainability efforts, and reduce fraudulent returns.

Reducing return rates has become a priority, with almost 80% of retailers in the US incorporating, or planning to incorporate, returns processing technology. Major retailers have also turned to return bars (stores that pack and ship returns for partnering retailers). Deloitte suggests that these return bars can save retailers over 20% in processing costs.

In 2023, retailers are curbing e-commerce returns through:

- Encouraging no-return behavior by offering rewards for consumers with low return rates or repurchasing behavior.

- Displaying the carbon footprint of a return so that sustainability-focused consumers are less likely to return products.

When asked about factors that would reduce return rates:

- 45% of consumers cited providing more accurate sizing information.

- 44% of consumers said greater accuracy in product descriptions.

- 40% said reading other customers’ reviews.

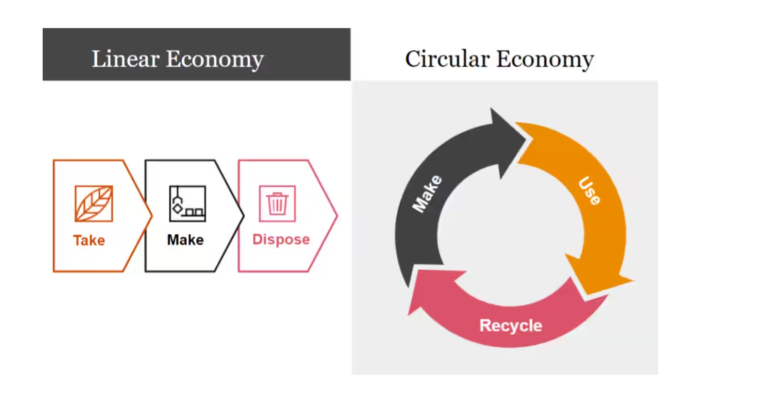

7. Interest in the Circular Economy Grows

Product resale is an emerging retail trend that is part of the broader circular economy. By redefining retail returns, retailers can offer consumers lower prices, while increasing their profits and attracting new consumers. The resale market is expected to grow 16 times faster than the broader retail market by 2026, representing an untapped area of potential for many retailers.

Building on the trend of conscious consumerism, a growing number of retailers are offering repair services for damaged products to help consumers maximize the utility of their items. According to Deloitte, 24% of consumers plan to increase spending on repair services in 2023, indicating a change in consumer behavior aligned with the principles of a circular economy.

8. Social Commerce Explodes

Social commerce is set to grow three times as fast as traditional ecommerce, driving global sales amounting to $1.2 trillion by 2025. In the US, social commerce will more than double, exceeding $99 billion by 2025, with the largest opportunities in apparel, consumer electronics, and home decor. Growth will be driven by Gen Z and Millennial social media users, who will account for 62% of global spending by 2025.

Social commerce levels the playing field, creating opportunities for medium-sized and small businesses. For example, 59% of social buyers say they are more likely to buy from a small business when shopping through social commerce versus online. 44% are also more likely to buy from an unfamiliar brand.

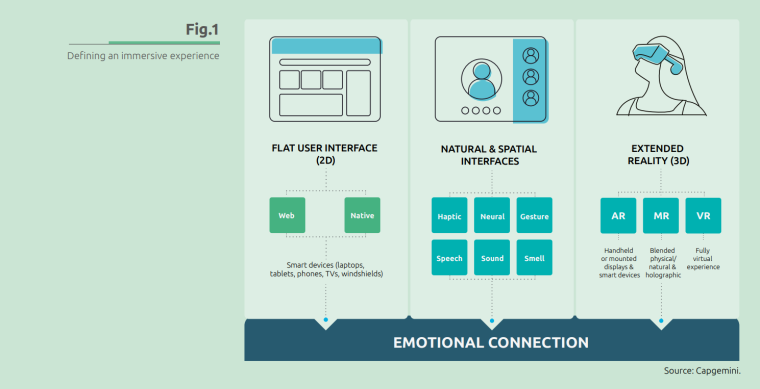

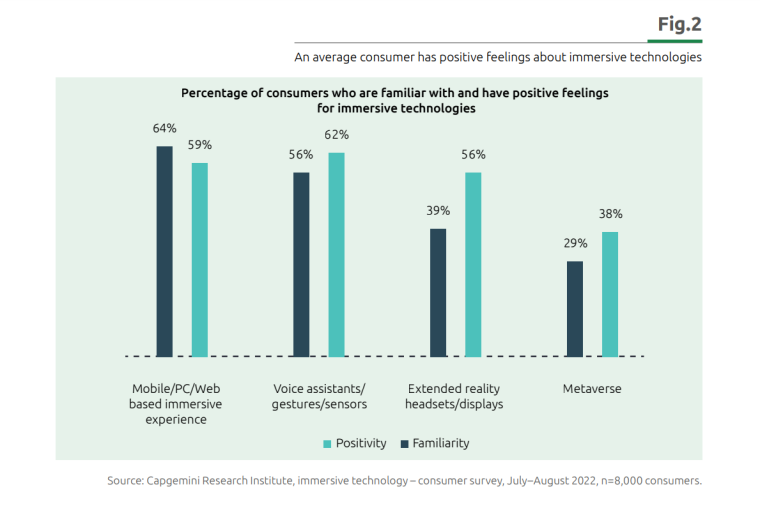

9. Immersive Technologies Gain Traction

AR, VR, and the metaverse are among the top retail technology trends to watch beyond 2023. McKinsey estimates that the metaverse alone will generate up to $5 trillion in impact by 2030, with $2 trillion to $2.6 trillion set to impact ecommerce. Retailers are harnessing AR/VR and other mobile/web-based applications including the metaverse to create a more immersive experience, such as allowing customers to:

- Walk around a virtual store

- Interact with avatar staff

- Browse products in 3D

- Engage in virtual-try ons

- Personalize items before placing an order

According to a 2022 Capgemini study, 70% of companies consider immersive technologies and the metaverse as a way to differentiate themselves, particularly in terms of the customer journey.

- 66% of companies have charted a roadmap for immersive experiences over the next 1-2 years.

- 15% aim to debut in the metaverse within a year.

- 45% predict the metaverse will become mainstream in three years.

In a 2023 PwC survey, metaverse adoption stood at 10%. 32% of respondents were now familiar with the metaverse and planned to use it. According to a 2022 Statista survey, consumer experiences for products were the most attractive use case for the metaverse in the retail industry.

- 35% of respondents would explore the metaverse for product purchases.

- 28% would explore it for services.

- 16% were interested in retailers adopting the metaverse for enterprise purposes.

32% of VR users have shopped with the technology in 2023 and VR is expected to keep growing, with 35% of users expected to increase their spending on the platform in at least six categories. Notably, luxury goods are a hit in the virtual world, with nearly 20% of VR users buying them.

10. AI in Retail Expands

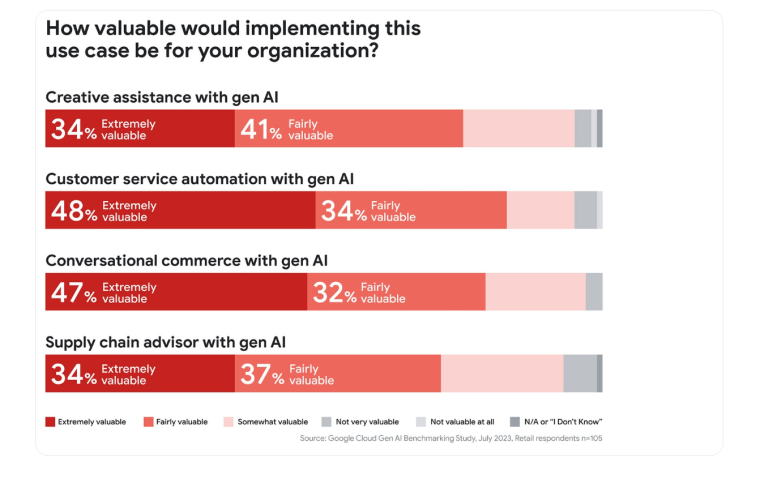

Digital retail leaders have invested in a range of artificial intelligence (AI) use cases, from customer-facing to back-end processes. The result? Over 2.5x higher returns than their peers. By 2024, 40% of the top 500 retailers will use AI to support improvements in omnichannel retail, customer loyalty, productivity, and profitability.

Given the meteoric rise of generative AI, its adoption is anticipated to be one of the most impactful retail technology trends. 75% of generative AI’s value will be realized across key functions such as customer operations, marketing and sales, and R&D. For retail businesses, it is another opportunity to offer a personalized and frictionless shopping experience for customers through:

- Greater personalization: With 73% of retail customers expecting brands to know their preferences, retail businesses can deliver highly engaging and personalized content more efficiently and cost-effectively than ever.

- Curbing search abandonment: Only 10% of shoppers report finding exactly what they’re looking for when using a retail website’s search function, resulting in losses of over $2 trillion each year. By addressing search queries, providing personalized product recommendations, and engaging customers in real-time, generative AI can drive major improvements in this area.

- Smarter product catalog management: Leveraging AI, retailers can optimize how they build and maintain their product catalogs. Considering that 92% of customers are more likely to buy a product when they can easily find it, ensuring products are easily searchable is crucial.

- Customer service automation: Over 75% of customers use multiple channels throughout their shopping experience, and AI helps extend customer service across these touch points.

When asked about the potential impact of AI on their shopping habits, 44% of shoppers expressed interest in using chatbots for pre-purchase product research. However, fewer consumers would turn to chatbots for tasks such as:

- Customer support – 35%

- Delivery schedules and product availability notifications – 34%

- Personalized communications – 31%

Sustainable Retail Practices and Green Supply Chains

Sustainability has transitioned from a niche concern to a central tenet of modern retail operations. Consumers increasingly demand that brands adopt environmentally responsible practices, influencing purchasing decisions and brand loyalty.

- Consumer Expectations: A significant portion of consumers are willing to pay a premium for products from brands that demonstrate a commitment to sustainability. This shift underscores the importance of integrating eco-friendly practices into the retail supply chain.

- Green Supply Chains: Implementing green supply chain strategies involves sourcing sustainable materials, optimizing logistics to reduce carbon footprints, and ensuring ethical labor practices. Retailers are increasingly adopting technologies and methodologies that minimize environmental impact, such as utilizing renewable energy sources and reducing waste through circular economy models.

- Case Study – Li & Fung: As a founding member of the Sustainable Apparel Coalition, Li & Fung has been instrumental in developing the Higg Index, a tool that standardizes the measurement of environmental performance across the apparel supply chain. Their initiatives include training programs for female factory workers and partnerships aimed at protecting forests through sustainable packaging solutions.

Consumer Trust and Brand Transparency

In an era where information is readily accessible, transparency has become a cornerstone of consumer trust. Brands that openly share information about their operations, sourcing, and business practices are more likely to build and maintain strong customer relationships.

- Building Trust: Transparency fosters authenticity, leading to increased brand loyalty. Studies indicate that a significant majority of consumers remain loyal to brands that are transparent about their practices.

- Strategies for Transparency: Brands can enhance transparency by providing detailed product information, openly communicating about sourcing and manufacturing processes, and engaging with customers through honest marketing. Embracing transparency not only builds trust but also differentiates brands in a competitive market.

- Case Study – Patagonia: Patagonia exemplifies brand transparency by openly sharing information about its supply chain and environmental practices. This commitment has strengthened consumer confidence and loyalty, demonstrating the positive impact of transparency on brand perception.

Flexible Payment Options and the Future of Buy Now, Pay Later (BNPL)

The financial flexibility offered by BNPL services has transformed consumer purchasing behaviors, particularly among younger demographics seeking alternatives to traditional credit.

- Consumer Adoption: The convenience of BNPL options has led to widespread adoption, with many consumers preferring this method for its simplicity and lack of interest charges when payments are made on time. This trend is reshaping retail payment landscapes, prompting retailers to integrate BNPL solutions to meet consumer demand.

- Retailer Integration: Retailers incorporating BNPL options have observed increased conversion rates and higher average order values. However, it’s crucial to manage the associated risks, such as potential increases in consumer debt and the need for robust fraud prevention measures.

- Future Outlook: The BNPL market is expected to continue its growth trajectory, with advancements in technology enhancing user experience and expanding accessibility. Retailers must stay informed about regulatory developments and evolving consumer preferences to effectively leverage BNPL solutions.

Automation and Robotics in Retail Operations

The integration of automation and robotics is revolutionizing retail operations, enhancing efficiency, accuracy, and customer satisfaction.

- Warehouse Automation: Robotic systems are streamlining warehouse operations by automating tasks such as sorting, packing, and inventory management. This automation reduces labor costs and minimizes errors, leading to faster fulfillment times.

- In-Store Robotics: Retailers are deploying robots for tasks like shelf scanning, cleaning, and customer assistance. These innovations improve operational efficiency and enhance the in-store experience by allowing staff to focus on customer engagement.

- Challenges and Considerations: While automation offers numerous benefits, retailers must address challenges such as the initial investment costs, integration with existing systems, and potential workforce displacement. Developing strategies for workforce reskilling and maintaining a balance between automation and human touchpoints are essential for successful implementation.

The Future of Retail Trends

The future of retail trends points to increased customer focus, a greater emphasis on technology, and more efficient resource deployment. Success in turbulent times is within reach for retailers who prioritize frictionless online shopping, immersive in-person experiences, and top-notch customer service.