For B2B companies, understanding the customer journey is key to boosting profits, finding new opportunities, and increasing sales. We should focus on the best strategies offered by inbound marketing. This approach goes beyond just selling a product. The goal is to identify and keep the best customers while also finding new ones. This is where Customer Lifetime Value becomes important. It helps measure customer profitability and allows for better targeting.

What is meant by “Customer lifetime value”

Customer lifetime value (CLV) is a term in English that translates the value of a customer’s life. It is an indicator that represents the profits made by a company through its relationship with certain customers.

It is used to know the value of a customer, that is to say, how much this customer can generate, but also identify other strategies to attract new customers. It is also by calculating the CLV that the marketer can predict the lifetime of a customer.

The mechanism of the “Customer lifetime value”

The principle of the value of a customer’s life is essential when it comes to customer value and sound if customers are rather satisfied with the services offered. It validates the relevance and profitability of marketing campaigns, in particular by comparing the lifetime value and the cost of customer acquisition. The CLV involves all the monetary transactions a customer generates and all that he could bring back in the future.

Customer lifetime value is mostly used to determine the intersection between marketing and customer relationship management. When measures are calculated to improve the customer relationship, we get the value of each transaction or marketing action.

The value of a customer’s life is based on the average life of a customer and the price of consumption. It will also make it possible to calculate the acquisition cost of a customer, to value a company from the client portfolio.

As the concept of customer loyalty is essential for most B2B companies, it is essential to use modeling to begin its calculation.

Indeed, it is not uncommon for companies wishing to calculate the value of their client’s life face difficulties related to uncertainties caused by the lack of information and the instability of market conditions. Especially since some companies tend to overestimate the value of their customers by developing overly optimistic assumptions about consumption.

Several models also make it possible to obtain the CLV during the customer journey, in particular during the specific requests made by the customers. It is then necessary to take the duration of the customers into consideration according to the stages of the purchase. (First contact, relationship building, cross-selling, etc.)

It can, therefore, be said that the value of a customer is significant for a customer in terms of investment, and constitutes a calculation element of the CLV.

The main vocations of the “Customer lifetime experience”

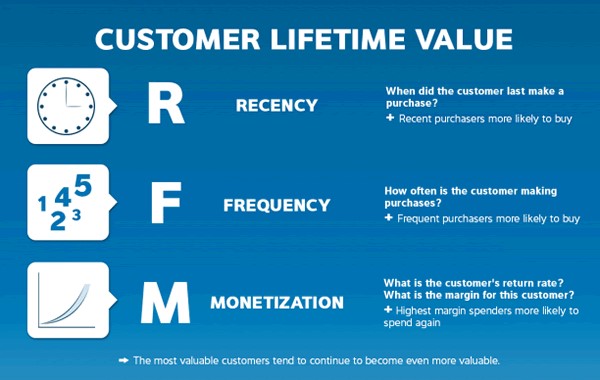

In practice, the CLV focuses on three kinds of variables, namely:

- The cost of acquiring a target that can be authorized, given the profitability of the latter over a given time.

- The retention by a segment that will be obtained from a survey of the customer base

- Customer capital valued at the time of an assignment within the company

Companies are interested in customer segmentation to develop clear and precise plans of action. They will observe their promotional campaigns from the attitude and behavior of customers. Thus, marketers and salespeople can characterize segments as advantageous or not for the company and determine the quality of their customers.

How to calculate the “Customer lifetime value”?

To calculate the value of a customer’s life, we apply the following formula:

Life Value = Total Customer Revenues – Total Costs for Customers

Let’s take an example where your customer has an income of 2,000$ in lifetime value or contribution. Knowingly, you would obviously not spend 2000$ for the acquisition of a new customer. However, you should expect about 10%, that is, 200$ for the cost of acquiring a new customer.

There are other ways to calculate the CLV from other variables such as termination rate, discount rate, profit margins, loyalty costs. The formula must be adapted to the various offers. But we also remember this formula:

Life value = (Average order value) x (Number of sales) x (Average duration of the relationship)

Also, remember that not all customers have the same economic situation. It is to this belief that the shoe pinches. It is possible that passive customers are more profitable, and that those who are active do not consume much and do not improve the products.

You will also meet customers who will give you more opportunities because they really appreciate what you do and what you offer them. For all these reasons, the segments all have different values. Hence the interest in having different strategies for each of them.

The important thing is to say that by improving the value of a customer’s life, you also improve his career.