The Covid-19 outbreak caused the most dramatic shifts in consumer behaviour seen in our lifetime but now we have to turn our attention to the post-pandemic world.

Google has partnered with UK research consultants Trinity McQueen to test the attitudes and behaviours of 5,000 consumers across the country. As Google explains, “the results point to both opportunities for online retail and the value in-store experiences can add for an effective omnichannel strategy”.

Here, we summarise the five key findings from this research.

#1: The shift to online experiences is permanent

The Covid-19 pandemic accelerated the shift towards online shopping in the UK with store closures, lockdown measures and safety concerns all contributing to increased online spending.

The pandemic forced people who rarely or never shopped online before to make the big jump and encouraged everyone else to spend more of their money through online channels. And, according to the joint study published by Google and Trinity McQueen, these new shopping habits are here to stay.

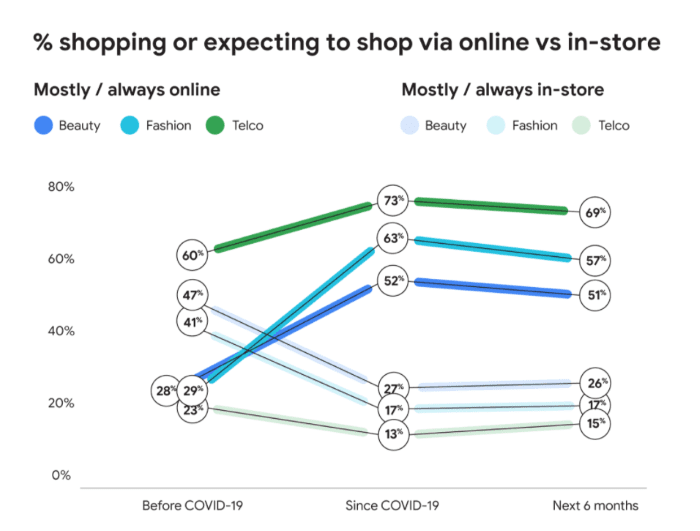

“Our research signals that this seismic shift to online is here to stay. In the fashion, beauty, and telecommunications categories, the percentage of consumers saying they will shop or expect to shop online versus in-store in the next six months remains significantly higher than pre-pandemic levels.” – The shift in shopping: The data that reveals the permanent changes to U.K. consumer behaviour, Think with Google

Even 18 months after the first lockdown was announced in the UK, the percentage of shoppers who expect to shop online vs in-store over the next 6 months remains significantly higher than pre-pandemic levels – a 28% increase in the fashion retail sector alone.

As a result, thousands of businesses in the UK have survived the most challenging economic event in living memory, thanks to having an online presence while some have even thrived by making the shift to online selling, in response to changing consumer behaviour.

The key takeaway here is that this trend isn’t temporary, meaning businesses need to make the permanent switch to online channels or increase investment in existing online channels to reach customers where they’re most active.

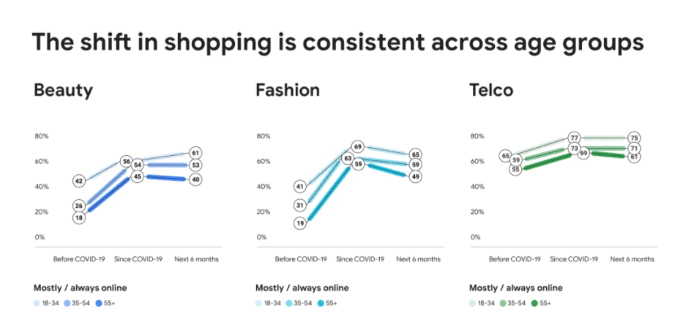

#2: Attitudes to online shopping has changed across age groups

The survey also reveals how the pandemic has affected attitudes towards online shopping across age groups. As expected, younger age groups were already shopping online at higher levels before the pandemic and, while this is still true across all three industries, the change in shopping behaviour is most extreme among older age brackets.

As the study suggests these changing attitudes are permanent, retailers need to reassess the balance between in-store and online shopping experiences – especially if the older age groups are important demographics.

In fact, Google says many retailers may need to rethink the entire role in-store experiences play and how they can complement, rather than compete with, the online experience.

#3: Pandemic not the only driver towards online shopping

Given the significance of the Covid-19 pandemic, it’s easy to attribute all recent changes in consumer behaviour to the outbreak. However, as Google points out: “while the pandemic has been a significant driver in these cross-generational changes in shopping behaviour, it is far from the only one.”

In the survey, each age group was asked to select the main reasons for shopping more online and the results among beauty shoppers are telling:

Among the youngest age group, Covid-19 scored lowest among the five reasons for shopping more online. For respondents aged between 35-54, not wanting to visit stores due to Covid-19 was the joint-top response but you can see how every other reason was also selected in much higher volumes.

Even among the 55+ age bracket, where Covid-19 was cited as the top reason, convenience and home deliveries were selected by more than 40% of respondents – benefits that will continue to exists long after the pandemic.

#4: New brand loyalties being formed online

In the past year, 1 in 4 clothing and home shoppers have bought from a new brand or retailer while 1 in 3 beauty shoppers have purchased from new brands over the same time period.

The survey reveals that consumers are forming new loyalties as they increase online spending with 75% of womenswear and 82% of menswear shoppers saying they will continue to buy from these same new retailers over the next six months.

As people do more of their shopping online, they increasingly evaluate their options and this often leads to buying from new retailers, starting fresh relationships that blossom into customer loyalty.

In Google’s words: “Consumers are less decided than ever when shopping online, presenting valuable opportunities for purchase choices to be disrupted”.

“Make sure you’re present and visible in the places where your customers are looking to explore and discover — namely, generic search and YouTube. With generic searches increasing faster than branded searches, challenger brands have an excellent opportunity to make their mark by investing in channels that were previously only associated with the end of the purchase journey.” – The shift in shopping: The data that reveals the permanent changes to U.K. consumer behaviour, Think with Google

Google refers to “generic searches” where consumers are evaluating purchase options and the search giant has seen a dramatic increase in the searches over the past year: “best electric car” (+80% year-on-year), “vegan meals” (+58% YoY), “best skincare” and “best paint”.

#5: Physical stores play a different role now

Any uptake in online shopping has an impact on physical stores and the findings from Google’s survey suggest that people newly converted to shopping online will seek a more omnichannel experience going forward.

Those who have always done most of their shopping online will continue to do so with little change to their attitudes and expectations. However, those who are newer to shopping online have different attitudes – not only in terms of what they expect from shopping online but also from physical stores in the future.

Younger audiences have simply adapted or gotten used to the common challenges of shopping online – such as not being able to try clothing items on – but these issues are more significant for newly converted online buyers.

Retailers need to adapt their online experiences to cater for these expectations as digitally converted shoppers continue to buy online and also use physical stores to enhance the buying experience – eg: click-and-collect, reservations and providing in-store buying advice.

You can read Google’s full summary of the study in this post, published on the Think with Google website. You may also want to take a look at our summary of how UK search habits changed throughout lockdown and our interview with Vertical Leap Managing Director, Chris Pitt, on using search data to inform key business decisions and navigate difficult times.