As public cloud computing becomes more popular among businesses, spending on infrastructure services like Infrastructure-as-a-Service (IaaS) is rising. Companies are focusing on how to connect cloud platforms with older systems to utilize the vast amounts of data they have gathered over the years. The integration of legacy systems, such as Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) systems, with cloud-based platforms is expected to speed up through 2016. I’ve noticed this trend in discussions with resellers and enterprise clients, and it is also shown in Gartner’s recent report on public cloud computing adoption, Forecast Overview: Public Cloud Services, Worldwide, 2011-2016, 4Q12 Update Published: 8 February 2013. Here are the main points from the report:

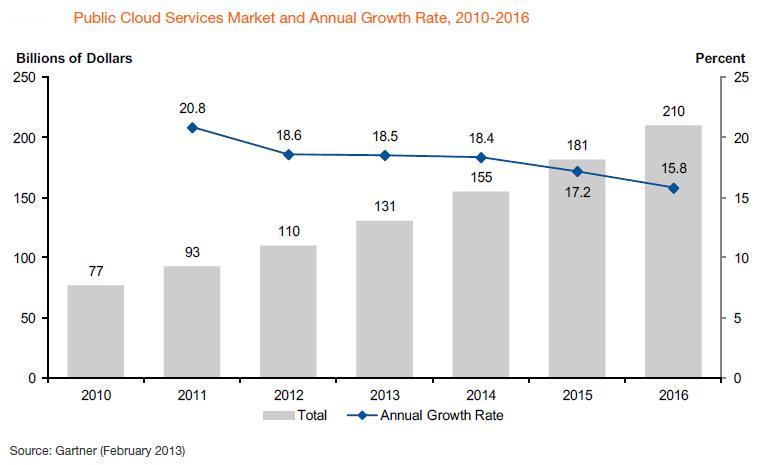

- Global spending on public cloud services is expected to grow 18.6% in 2012 to $110.3B, achieving a CAGR of 17.7% from 2011 through 2016. The total market is expected to grow from $76.9B in 2010 to $210B in 2016. The following is an analysis of the public cloud services market size and annual growth rates:

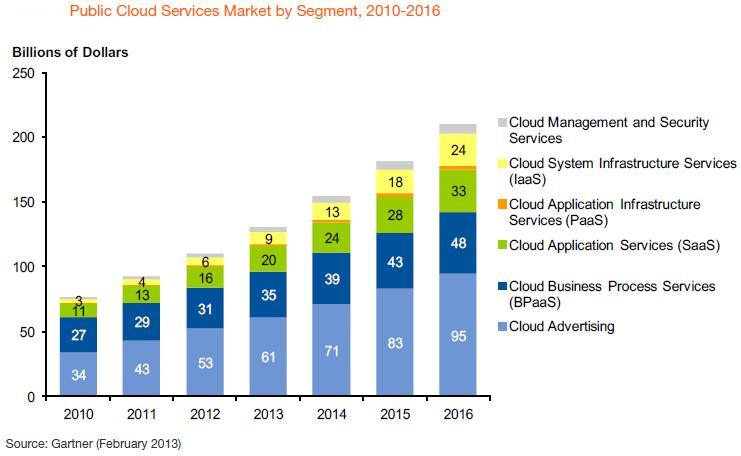

- Gartner predicts that Infrastructure-as-a-Service (IaaS) will achieve a compound annual growth rate (CAGR) of 41.3% through 2016, the fastest growing area of public cloud computing the research firm tracks. The following graphic provides insights into relative market size by each public cloud services market segment:

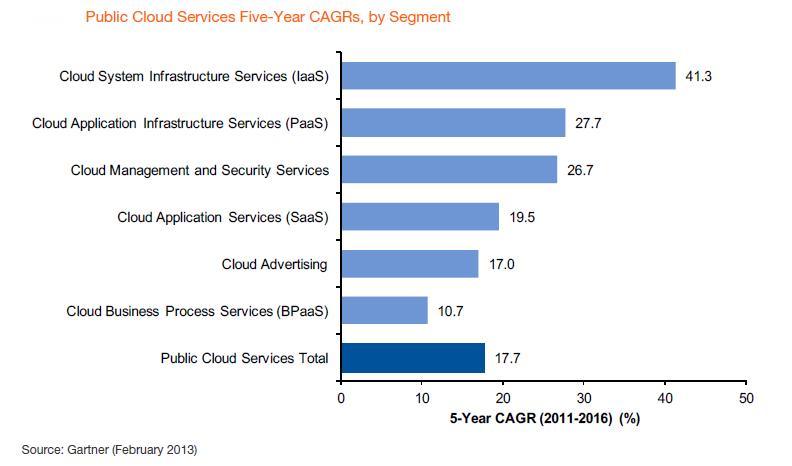

- Platform-as-a-Service (PaaS) will achieve a 27.7% CAGR through 2016, with Cloud Management and Security Services attaining 26.7% in the same forecast period. Software-as-a-Service’s CAGR through 2016 is projected to be 19.5%. The following graphic illustrates the differences in CAGR in the forecast period of 2011 – 2016:

- Gartner is projecting the SaaS market will grow at a steady CAGR of 19.5% through 2016, having increased the forecast slightly (.4%) since its latest published report. Global SaaS spending is projected to grow from $13.5B in 2011 to $32.8B in 2016.

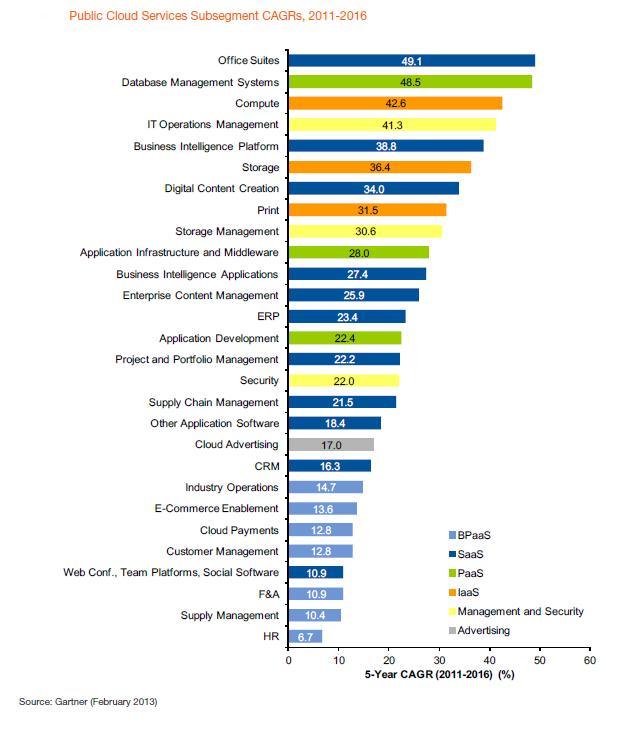

- CRM will continue to be the largest global market within SaaS, forecast to grow beyond $5B in 2012 to $9B in 2016, achieving a 16.3% CAGR through 2016. The highest growth segments of the SaaS market continue to be office suites (49.1%), followed by digital content creation (34.0%). The following graphic rank orders CAGRs across all public cloud services segments from the forecast period:

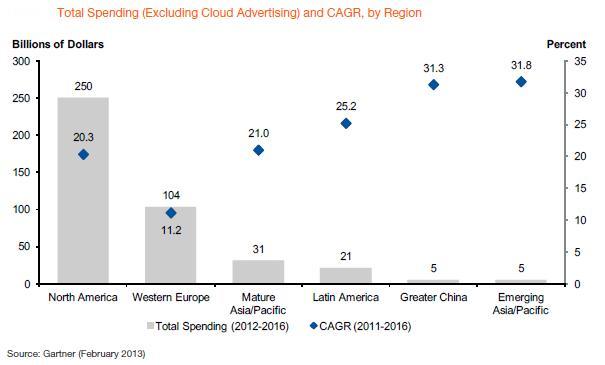

- 59% of all new spending on cloud computing services originates from North American enterprises, a trend projected to accelerate through 2016. Western Europe is projected to be 24% of all spending. A graphic comparing total spending by geography and corresponding growth rates is provided below:

- The following tables provide insights into each category of public cloud computing spending throughout the forecast period. Please click on the tables to expand them for easier reading.