Figuring out how to invest in cryptocurrency in Canada? With crypto investment legal in Canada, you too can get in on the crypto action. Below we show you how to do so safely without getting hacked or ripped off.

We review four top crypto exchanges which you can access from Canada. As well as detailing exactly how to invest in cryptocurrency in Canada, we also look at how crypto investing works in general. We pick out ten top crypto invest in, as well as three penny crypto you may never have heard of. But, first off, here’s how easy it is to get started:

How to Invest in Cryptocurrency in Canada – Quick Steps

- ✅Step 1: Open an account with Coinbase – This is one of the safest and most well-regarded exchanges in the world.

- Step 2: Verify – Have some ID handy and be prepared to take a selfie.

- Step 3: Deposit – Transfer CAD from your bank account or use credit/debit card to buy your crypto.

- Step 4: Search for Cryptocurrency – Choose from 150+ crypto.

- Step 4: Buy – Just choose how much you want to spend, and Coinbase will hold your crypto till you want to sell.

Crypto assets are a highly volatile unregulated investment product.

Where to Invest in Cryptocurrency in Canada

How to invest in cryptocurrency in Canada to suit your individual investor needs boils down to where you shop for your crypto.

You can buy and sell cryptocurrencies with online crypto exchanges. These are like stock market exchanges, but they deal only in cryptocurrency.

Most of these 500+ crypto exchanges provide a free smartphone app to access their services. Otherwise, you can access their online platform via your web browser.

Of the best crypto exchanges Canada, here are 5 you should try out with good regulation, low fees and easy account opening.

1. Coinbase – Big Exchange With Top Cryptocurrency to Invest in

Coinbase is well worth checking out as a veteran crypto provider with plenty to offer the newcomer in the way of learning modules.

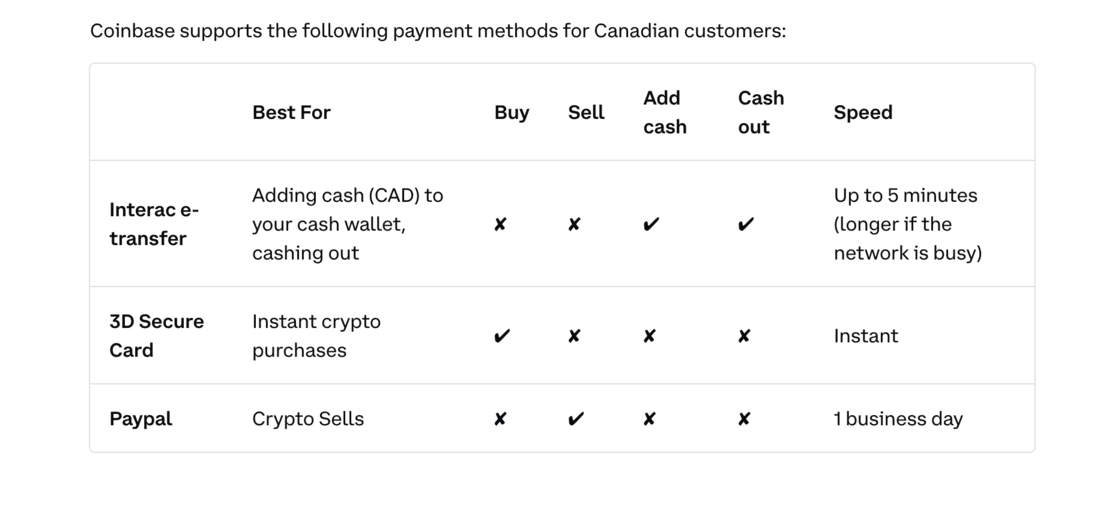

When it comes to how to invest in cryptocurrency Canada, however, purchasing options are currently limited to debit card. If you buy crypto with Coinbase as a Canadian investor, you can sell it with the proceeds going to your PayPal account. But, otherwise, you will need to use a crypto wallet to move your crypto out of the exchange to cash up.

Pros

- Buy some of the best crypto assets to invest in with Canadian debit card

- Upgrade to Coinbase Pro for lower fees

- Free Coinbase crypto wallet

- Crypto staking options: earn 3.675% APY on Ethereum

- Range of 174+ crypto to trade

- Free crypto learning incentives

Cons

- Dual fee structure: flat rate and commissions

- No Canadian credit cards accepted

Crypto assets are a highly volatile unregulated investment product.

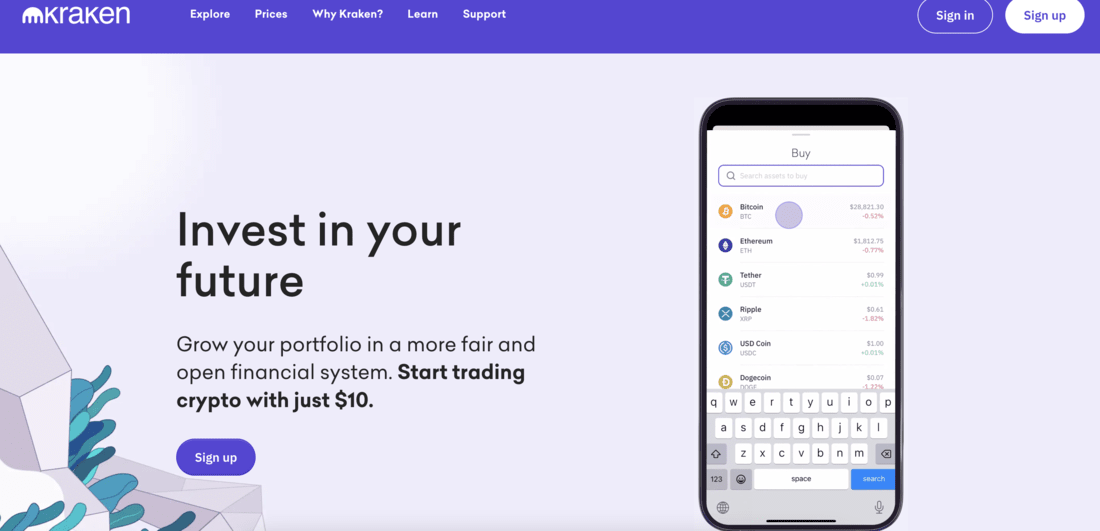

2. Kraken – Secure and Regulated Exchange For Crypto Newcomers

Kraken is an extremely secure platform with a huge range of security features. This includes 2FA (Google Authenticator/ Yubikey), email confirmations for crypto withdrawals, and encryption for at-rest and in-transit information. 95% of client funds are kept offline, in cold storage. And it works with a third party for audited proof of reserves.

Over 200 cryptos are available to trade on Kraken, which is a large figure by exchange standards. So aside from the more niche altcoins, users should be able to purchase the crypto they need on Kraken. Staking is also available on Kraken, though not for US customers. It’s easy to stake with Kraken, with rewards that accrue instantaneously and no lockup period. APY up to 24% is available, which is again higher than Coinbase, which offers up to 10%.

Kraken also offers 24/7 support and offers a 5x margin trading feature. Its IoS and Android applications are highly rated and the Kraken Pro Trading fees are among the lowest on the market. It’s an excellent place to start investing in crypto.

The main downsides are that it is perhaps not the most intuitive of the exchanges, and it does not offer any non-custodial wallet options for clients. Purchasing fees are moderate, but not high. Many of its offerings are geared towards intermediate to advanced traders, though it does cater reasonably well to beginners.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

3. Crypto.com – How to Invest in Cryptocurrency in Canada and Earn Interest

Crypto.com is a US-based exchange that provides a great app. Below we use the Crypto.com app as an example of how easy it is to get started with cryptocurrency investing.

Crypto.com offers 250 of the best crypto to invest in. This range features the top names like Bitcoin (BTC) and Ethereum (ETH), DeFi coins, Metaverse coins and exciting newcomers you may not have heard of.

Three factors make this app stand out for Canadian investors: good regulation, Canadian-friendly and strong crypto financing options.

Regulated

The safest way to invest in crypto is to use a vendor that is regulated (ie. overseen) by a sovereign financial authority. Crypto.com is registered with FINTRAC (Financial Transactions and Reports Analysis Center of Canada) as a Money Services Business. This means it is authorised to be dealing in virtual currency.

Canadian-Friendly

This platform accepts deposits of Canadian dollars (CAD). Many exchanges do not.

Great Crypto Staking Options

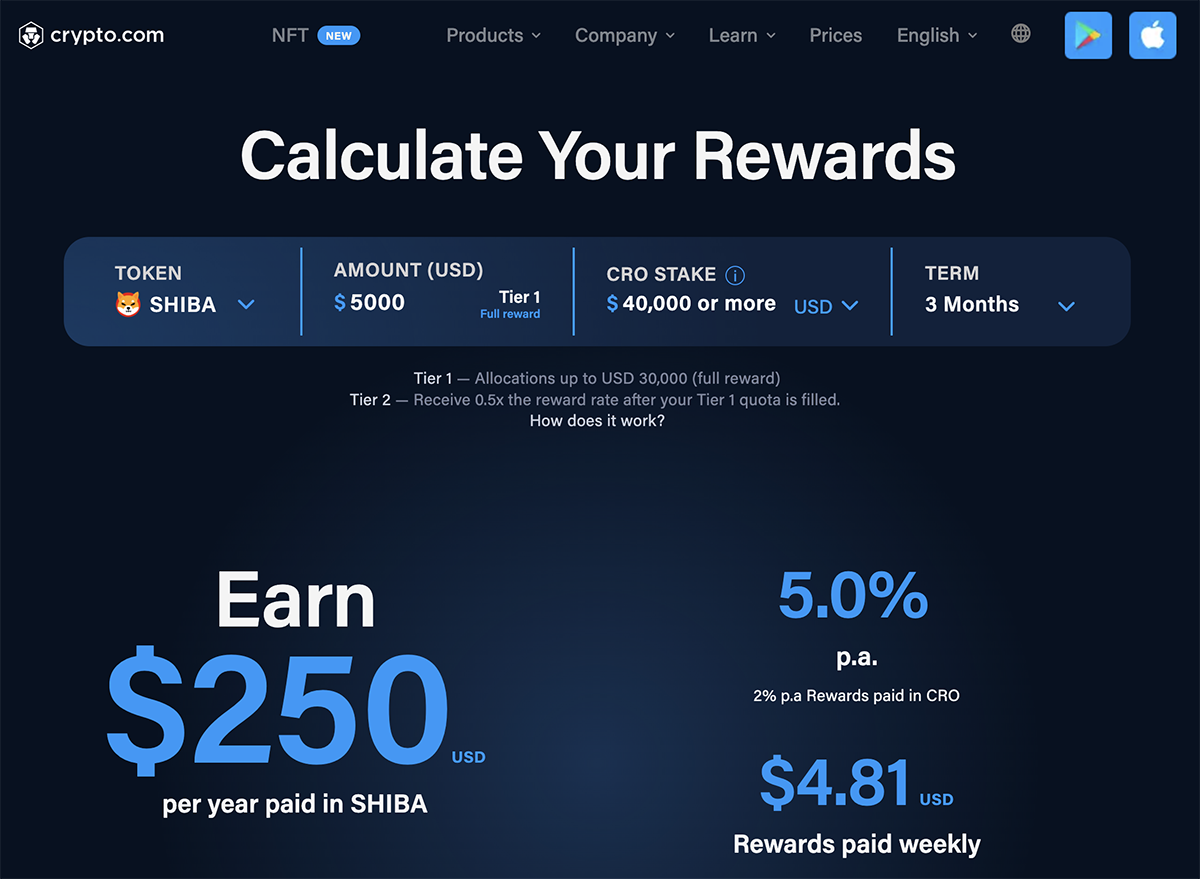

Crypto staking means earning interest on the crypto you earn. With Crypto.com you can earn up to 14.5% APY (Annual Percentage Yield) by staking some of the best crypto assets to invest in. If you buy some in-house crypto CRO, you can access the very best rates.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

4. Bitbuy – Exclusive Canadian Exchange with Low Fees

When it comes to how to invest in cryptocurrency in Canada, no-frills Bitbuy offers an ideal solution to newcomers. Offering a streamlined service to 400,000 existing Canadian customers, Bitbuy is dedicated to the Canadian market.

Bitbuy offers even better Canadian regulation than Crypto.com. Not only is Bitbuy registered with Canada’s own FINTRAC. But it is also fully regulated by the Ontario Securities Commission. Security is state-of-the-art, with two-factor-authentication for logging in as well as SSL technology reinforcing the platform. Like Crypto.com, most client crypto is held in ‘cold’ storage where hackers cannot get to it, and Bitbuy too is fully insured.

With Bitbuy’s Express Trade desk, you can buy 15 of the top cryptocurrencies to invest in 2025 and pay a commission of just 0.2%. Canadian investors get two deposit options: Interac e-Transfer (1.5% fee) or bank wire (minimum deposit: $20k, fee: 0.5%).

Like all of the best crypto exchanges Canada, Bitbuy will buy your crypto from you when you decide to sell. Some users also invest in cryptocurrency to access the best Bitcoin casinos in Canada.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

5. Binance – How to Invest in Cryptocurrency in Canada with Advanced Options

Binance is the world’s biggest crypto exchange. It does over $20bn in crypto business every day, and boasts 90m customers from around the world.

As you would expect from such a giant enterprise, the range of cryptos to invest in is massive (600+) and the exchange trading fees (0.1% commission) are the lowest in the business. What’s more, the suite of trading and financing tools available with Binance is easily the most comprehensive available.

You can buy crypto instantly with Binance using Canadian credit/debit card. Currently, direct transfer of CAD into your account is not possible. You can still import crypto from elsewhere, though, and use that to trade on the Binance exchange.

Pros

- Low trading fees (0.1% commission)

- Buy crypto instantly with Canadian credit/debit card

- Binance insurance fund

- Free crypto wallets

- Massive range of trading and financing power tools

Cons

- Binance not currently available in Ontario

- Cannot deposit CAD direct from bank

Cryptoassets are a highly volatile unregulated investment product.

Cryptocurrency Investment Explained

Investing in crypto works like investing in stocks:

- You sign up online with a provider. With stocks, this provider would be a broker; with crypto, you use an online exchange.

- You get your account verified using ID. This process is computerised, and can be a pain. But account verification plays a key role in keeping everybody’s money safe. And the KYC (Know Your Customer) technology is getting better all the time.

- You deposit money with your provider. This usually involves setting up a bank transfer.

- You search through the crypto available, and buy some. The exchange will then hold your crypto for you until you want to sell. Unlike with stocks, with crypto you can transfer your crypto out of your exchange account using a crypto wallet. You can then use it to pay for things online, send to other people, or exchange for other crypto at another crypto exchange.

What is the Minimum Crypto Investment?

This is a key question. Some investors are put off because they see the price of Bitcoin, for example, (which stands at $38k) and think ‘I cannot possibly afford that.’

But, with crypto, you do not have to buy an entire coin. You can buy fractions of coins.

In many instances, the minimum deposit is just $10, such as with Kraken.

What are Spread Fees?

All exchanges charge spread fees. The spread is the difference between the price you can buy at and the price you can sell at. Whenever you see the price of a crypto quoted, you will generally be able to buy it for slightly more, and sell it for slightly less. Generally, you will be charged a commission on top of spread fees too.

Is Cryptocurrency a Good Investment?

Before you decide best how to invest in cryptocurrency in Canada, you need to understand two key factors that influence crypto pricing:

Investor Sentiment

The price of a crypto is largely influenced by what investors feel about it. With a conventional stock, on the other hand, decisions are generally made on the basis of how much money a company is making, and how much it can make in the future.

Although many crypto are linked to revenues in the real-world, many are part of the crypto ecosystem only, and many are not linked to revenue at all. This makes them largely speculative purchases. This is why volatility is so high with crypto: prices go up and down sharply because a lot of emotion is at play in the market. This makes crypto risky.

Price of Bitcoin

The price of an individual crypto is independent. It goes up and down based on investor sentiment about it as well as news and other factors. But a key influence on all 19,200+ crypto prices is what direction the Bitcoin price is going. Crypto prices tend to follow Bitcoin’s direction of travel. Many are more influenced by Ethereum’s direction of travel. But no crypto is an island when it comes to price.

Benefits of Investing Cryptocurrency in Canada

Some analysts say that crypto could well be the biggest thing to ever happen in the history of finance.

With crypto investing legal in Canada and top exchanges (like Crypto.com and Bitbuy) available to Canadian investors, there is every opportunity to invest. And there are many compelling reasons to do so.

High Risk/High Reward Asset

Let’s look at crypto in the context of other investment assets.

Investors generally tend to spread their funds around assets with different risk profiles. Most investors are not prepared to risk everything they have in pursuit of high gains, so they spread their funds around.

Conventional stocks and shares are considered, for example, to be medium-risk investments. Exchange-Traded Funds (ETFs), which invest in many stocks at once on your behalf, are considered to be lower risk investments (but the rewards are lower too).

Against this backdrop, crypto is a high-risk/high-reward asset. A sensible investor would want their portfolio to centre on assets that offer low and medium risk, with only a small proportion (1-5%) dedicated to a high-risk asset. This is where crypto fits into the bigger picture; despite its risky volatility, no other asset can beat crypto in its sensible role as the small but powerful powerhouse of dynamic gains in your portfolio.

Crypto Growth Potential

Since the pandemic brought the benchmark US S&P 500 exchange to its knees in March 2020, its total value has doubled. 100% growth is pretty good going. But in the same time period, the value of all digital currencies has soared by 1,250%.

Standing out from the crowd during 2021, top meme crypto Shiba Inu (SHIB) delivered

Stake Crypto for Rewards

One of the key strengths of crypto as an investment asset is that you can put it to work. You may hold a particular coin in the hope that its value rises. But, in the meantime, you can earn rewards by simply lending it out. This is called ‘crypto staking’. There are two types:

On-Chain Staking

When you have gained some experience, you can stake your crypto direct onto blockchains and earn rewards by acting as a ‘validator’ for transactions. This requires both expertise and a lot of coins, and is not suitable for beginners.

Off-Chain Staking

What is suitable for beginners, on the other hand, is crypto staking via a third-party. This means lending your crypto out for a fixed period, and earning rewards payable in the crypto in question. So, for example, you can stake SHIB with Crypto.com for 3 months and earn up to 5% APY (Annual Percentage Yield). Stake SHIB with Binance and you can get rates of over 12%. All sorts of staking deals are available, so shop around.

Top staking providers like Crypto.com offer online calculators. These allow you to work out precisely what gains you will receive.

Anybody figuring out how to invest in cryptocurrency in Canada should consider staking. Staking your crypto is similar to putting money into a conventional limited access savings account with a bank. But staking offers far better rates.

Invest in DeFi

There are many types of crypto coins. Although some crypto coins in particular are called ‘DeFi’ coins, all crypto is general is part of what is known as ‘DeFi’ — Decentralised Finance.

Whereas ‘TradFi’ (Traditional Finance) works along the lines of centralised networks, DeFi is decentralised. Thanks to cryptocurrency blockchains, DeFi transactions are verified without any single body being in charge. This means that no business or government can get a monopoly on the market and cream off fees as they please. Thus crypto is considered by many to represent a fairer as well as more efficient future for financial transactions.

Unsurprisingly, traditional banks and governments have been suspicious of DeFi. But they are coming around:

- 80% of central banks worldwide, for example, are exploring setting up digital currencies.

- The possibility of a fully-digitized US dollar is being looked into by the US Federal Reserve.

- 85% of wealth managers polled across Europe in 2021 said that they planned to invest in crypto for the first time, or increase their holdings.

- Recently, the US state of Colorado declared that it would be accepting crypto for tax payments.

- And we already have an entire country, El Salvador, in which Bitcoin is accepted as legal tender.

Having learnt how to invest in cryptocurrency in Canada, many investors are now looking to HODL their crypto over the long term and see if the $100bn DeFi sector in particular fulfils its promise as the future of all finance.

Get a Crypto Wallet and Use it

With crypto having such exciting growth potential as an asset, it is easy to forget that you can actually use it too to get stuff done.

Get yourself a crypto wallet and you can use crypto to buy things online as well as to send money internationally. Depending on which blockchain you use, you can send money far quicker and cheaper than you can using the traditional banking network.

Wallets tend to be free. For top security, pick a ‘cold’ wallet. Cold wallets are rarely connected to the internet. This makes them less vulnerable to hacking, but less convenient than a ‘hot’ wallet’. Hot wallets are always connected to the internet. Smart crypto enthusiasts use a cold wallet to stash their crypto, and a hot wallet to handle sending and receiving it.

Check out some of the best crypto wallets Canada here.

The Best Cryptocurrency to Invest in

Ever wondered what crypto to invest in? If you are going to figure out how to invest in cryptocurrency in Canada, you need to get some idea of the territory. Below we give you a whistle-stop tour of the crypto landscape.

There are over 19,000 crypto to trade, so don’t expect to get a grasp of it all in one go! More crypto minted are every day.

We have assembled a short-list of ten of the best crypto to invest in. Each crypto profile below features a brief data table. Here is what it means:

| Ticker label: | The acronym that identifies the crypto — use this to find crypto on exchanges |

|---|---|

| Market Capitalisation: | The total value of all the coins in circulation |

| Price (USD): | How much you will have to pay for one coin |

| Daily Trading Volume (USD): | The total volume of trade in this coin over 24hrs according to leading analysts CoinMarketCap.com |

| Max Supply: | The total number of coins that can ever be minted |

| Circulating Supply: | The number of coins that have been minted and are available for trading |

1: Bitcoin — Best Cryptocurrency to Invest in 2025 for Long Term

If you are interested in crypto at all, then a Bitcoin (BTC) investment is a must. Since its launch in 2009, Bitcoin has been the dominant crypto. Today its market capitalisation of $723bn makes up over 40% of the entire crypto sector. And all 19,000 crypto tend to follow the Bitcoin price.

If the crypto sector emerges in 5 years time as the new way to do finance, the Bitcoin price will be the first to register this popularity. In the meantime, you can buy Bitcoin Canada with Crypto.com and earn up to 6% APY by staking it.

| Ticker label: | BTC |

|---|---|

| Market Capitalisation: | $723bn |

| Price (USD): | $38,008 |

| Daily Trading Volume: | $26bn |

| Max Supply: | 21m |

| Circulating Supply: | 19.03m |

Cryptoassets are a highly volatile unregulated investment product.

2: Ethereum — Best Cryptocurrency to Invest in For Future-Proofing

Ethereum (ETC), the second-biggest crypto by market capitalisation, is another one like BTC that investors HODL.

Whereas Bitcoin is a store-of-value crypto, designed to act as simple money, the Ethereum blockchain is designed to support programmable money. This means that literally thousands of crypto-related DApps (Decentralised Applications) run using the Ethereum blockchain. And most NFTs are minted and bought and sold using Ethereum.

You can buy Ethereum Canada with Crypto.com and earn up to 6.0% APY.

| Ticker label: | ETH |

|---|---|

| Market Capitalisation: | $334bn |

| Price (USD): | $2,771 |

| Daily Trading Volume: | $15bn |

| Max Supply: | NA |

| Circulating Supply: | 120.6m |

Cryptoassets are a highly volatile unregulated investment product.

3: Binance Coin — Top Cryptocurrency to Invest in For Trading Perks

Binance Coin is the utility coin for Binance, the world’s biggest crypto exchange. Given Binance’s primacy in the crypto market, the price prospects of BNB are therefore good. What’s more, if you own some BNB, you automatically receive a 25% discount on Binance exchange fees (which are already low at 0.1% per transaction). Other perks are available too. And you can earn rewards on BNB by staking it.

| Ticker label: | BNB |

|---|---|

| Market Capitalisation: | $62bn |

| Price (USD): | $383.34 |

| Daily Trading Volume: | $1.6bn |

| Max Supply: | 165.1m |

| Circulating Supply: | 163.2m |

Cryptoassets are a highly volatile unregulated investment product.

4: Enjin Coin — Best Cryptocurrency to Invest in For Metaverse Exposure

Unlike BTC, ETH or BNB, Enjin Coin is an ERC-20 token. That means it is one of the thousands of tokens that piggyback the Ethereum blockchain. What makes ENJ stand out as an investment prospect is its centrality to the Enjin Network. This is a popular social gaming platform. Every single NFT asset used on Enjin contains an amount of ENJ — and there are a billion of such assets and counting.

To get in on the metaverse craze, consider Decentraland (MANA) and Sandbox (SAND) too.

| Ticker label: | ENJ |

|---|---|

| Market Capitalisation: | $958m |

| Price (USD): | $1.09 |

| Daily Trading Volume: | $172m |

| Max Supply: | 1bn |

| Circulating Supply: | 882m |

Cryptoassets are a highly volatile unregulated investment product.

5: Terra — Best Cryptocurrency Investment for a Stake in Stablecoins

Terra is a promising system of stablecoins like UST, which is pegged to the value of the US dollar. Terra uses a clever system to keep the value of its stablecoins pegged to their fiat counterpart, and the governance token LUNA plays a critical role in that balancing act. The price of LUNA soared by $14 in February 2022 on news that a new UST exchange would be founded with $1bn of third-party investment.

| Ticker label: | LUNA |

|---|---|

| Market Capitalisation: | $27.8bn |

| Price (USD): | $80.87 |

| Daily Trading Volume: | $2bn |

| Max Supply: | 728m |

| Circulating Supply: | 345m |

Cryptoassets are a highly volatile unregulated investment product.

6: Bitcoin Cash — Veteran Store-of-Value Cryptocurrency

Bitcoin Cash is Bitcoin’s little brother. Formed from a fork of Bitcoin in 2017, Bitcoin Cash (BCH) was designed to outdo Bitcoin in the critical area of network fees and speed of transactions.

Both Bitcoin and Bitcoin Cash are what are known as ‘store-of-value’ crypto: this means they are designed to act as highly-efficient money. Bitcoin Cash offers a cheaper and faster way to send money around the internet than Bitcoin. Backed up with real utility, it therefore is likely to remain a sound investment prospect.

| Ticker label: | BCH |

|---|---|

| Market Capitalisation: | $5.3bn |

| Price (USD): | $277.99 |

| Daily Trading Volume: | $4.25bn |

| Max Supply: | 21m |

| Circulating Supply: | 19.05m |

Cryptoassets are a highly volatile unregulated investment product.

7: ApeCoin — Best Cryptocurrency to Invest in 2025 for Short Term

ApeCoin is one of the first NFT utility tokens to hit the market. APE is the governance token for Bored Ape Yacht Club NFTs. The price of APE reflects the fact that Bored Ape’s collection of 9,999 NFTs is in pole position in the NFT sector. Currently, each Bored APE NFT attracts a price, on average, of almost $450k, with almost $90m of business done in the last week.

APE is perhaps the best cryptocurrency to invest in 2022 for the short term.

| Ticker label: | APE |

|---|---|

| Market Capitalisation: | $5.05bn |

| Price (USD): | $17.71 |

| Daily Trading Volume: | $4.8bn |

| Max Supply: | 1bn |

| Circulating Supply: | 284m |

Cryptoassets are a highly volatile unregulated investment product.

8: Curve — Top DeFi Cryptocurrency

Curve is the governance token for the biggest Ethereum-based Decentralised Exchange (DEX). As such it is a key player of the $120bn DeFi sector, which makes it a strong investment prospect.

Investors hold CRV to buy into the success of the Curve DEX, which uses a unique algorithm to allow Curve users to swap stablecoins efficiently without falling foul of slippage. (Slippage is when the price of a transaction changes between setting the order and the order completing). $20bn of business is locked into the Curve DEX.

| Ticker label: | CRV |

|---|---|

| Market Capitalisation: | $943m |

| Price (USD): | $2.04 |

| Daily Trading Volume: | 175m |

| Max Supply: | 3.3bn |

| Circulating Supply: | 1.7bn |

Cryptoassets are a highly volatile unregulated investment product.

9: PancakeSwap — Popular DEX Governance Crypto

PancakeSwap is often to be found at the forefront of new and exciting crypto offerings. Both PancakeSwap and its token CAKE have something of a cult following.

| Ticker label: | CAKE |

|---|---|

| Market Capitalisation: | $2.1bn |

| Price (USD): | $7.45 |

| Daily Trading Volume: | 190m |

| Max Supply: | 730.9m |

| Circulating Supply: | 290m |

Cryptoassets are a highly volatile unregulated investment product.

10: Polygon — Exciting Layer 2 DeFi Cryptocurrency

Backed by the top two-biggest exchanges, Binance and Coinbase, the Polygon network is a system bolted onto the Ethereum network that makes transactions radically faster. Polygon boasts a speed of 65,000 Transactions Per Second (TPS) — compared to standard Ethereum’s TPS of 12-15.

MATIC is the token used to pay providers of services on the Polygon network. Investors, on the other hand, buy MATIC to invest in the future of Polygon, which can also — like Ethereum — support DApps.

| Ticker label: | MATIC |

|---|---|

| Market Capitalisation: | $8.5bn |

| Price (USD): | $1.09 |

| Daily Trading Volume: | 826m |

| Max Supply: | 10bn |

| Circulating Supply: | 7.85bn |

Cryptoassets are a highly volatile unregulated investment product.

Best Penny Cryptocurrency to Invest in

How to invest in cryptocurrency in Canada involves a lot of decisions. Do you invest in a titan crypto like Bitcoin, for example, which is worth $38,000 a coin? Or do you opt for a penny crypto? Penny crypto are coins that are priced at around/less than one US dollar.

Is a Penny Crypto a Good Investment?

A low price can mean one of three things:

- The crypto is not thought to be worth investing in.

Note that this status can change unexpectedly: we can never write off any asset completely! - The coin in question has a very large supply, which dilutes the price.

Cardano (ADA), for example, is a reputable blockchain which could feasibly knock Ethereum off its perch as the top programmable blockchain. But ADA’s price is just $0.77. That is not because it is a rubbish investment, but because there is no less than $34bn ADA in circulation. - The crypto is virtually undiscovered and could increase in value by many hundreds of times.

The penny crypto to track down are the ones at the beginning of their journey. In this instance, a low price means that the crypto has yet to be spotted fully by investors. And so its price could well rocket. For example, just 15 months ago, the price of meme coin Dogecoin was under 1 US cent. Just four months later, in May 2021, it peaked at 68 times that figure $0.6848 on 7th May 2021. You can buy Dogecoin Canada with the top 4 exchanges we review above.

Our Top Three Penny Crypto Picks

Lucky Block (LBLOCK)

Cryptoassets are a highly volatile unregulated investment product.

Chiliz CHZ)

CHZ is the utility token for sports fan token p

Cryptoassets are a highly volatile unregulated investment product.

Cronos (CRO)

CRO is the utility token for top crypto platform Crypto.com. CRO allows users on the platform to access top rewards for staking crypto, and is an investment asset in its own right.

Cryptoassets are a highly volatile unregulated investment product.

Investing in Cryptocurrency vs. Trading Cryptocurrency

How to invest in cryptocurrency in Canada sensibly will involve you deciding whether you want to trade or invest:

- Trading means buying crypto for the short-term and selling it a profit. Traders use technical charting and specialist knowledge to get in and out of crypto markets fast. Trading is not recommended for beginners, but most investors have a go anyway!

- Investing means you will HODL: Hold on for Dear Life. Investing centres on the understanding that the crypto sector goes through cycles of boom and bust, but that ultimately the exciting potential of Decentralised Finance (DeFi) means that the price of crypto assets is likely to keep rising over the long term.

How to Invest in Cryptocurrency Safely

No investment is 100% safe. Even government bonds, considered to be the safest of all assets, can default.

Crypto is risky because prices are influenced heavily by sentiment. This means the market is volatile, with prices shooting up and down frequently.

But crypto’s entirely digital basis makes it uniquely vulnerable to the risk of computer hacking. With blockchain technology advancing so fast, there will inevitably be hacks in the future.

When considering how to buy cryptocurrency in Canada, it is therefore highly sensible to focus on vendors which are fully-insured. But the best protection you can get overall is to go with a regulated broker. Government regulation is not a silver bullet that cancels all risks; but it does mean that you are dealing with a business that does things by the book.

Crypto.com, for example, is registered in Canada with FINTRAC as a Money Services Business. This means that it is fully authorised to carry out currency business. Fellow exchange Bitbuy is also registered with FINTRAC, but goes one further with regulation by the Ontario Securities Commission.

How to Invest in Cryptocurrency in Canada – Tutorial

To buy cryptocurrency Canada, you will need to:

- ✅Sign up with an exchange

- Verify your ID

- Deposit funds

- Buy crypto

We use the top Coinbase app as an example of how this simple process works.

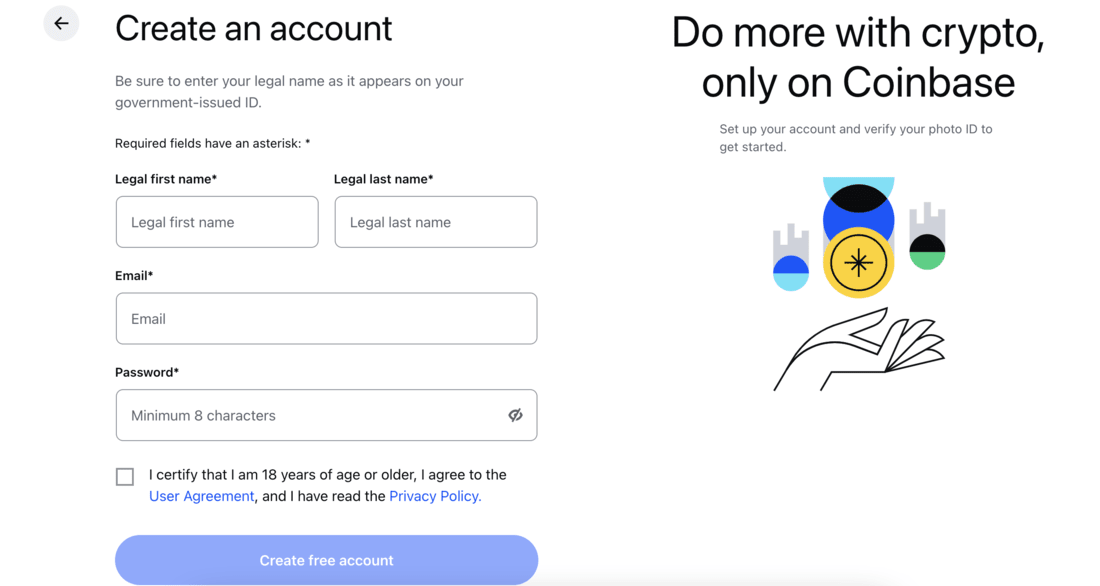

Step 1: Open an Account

To open an account, visit the Coinbase homepage and click on the ‘Get Started’ button to begin the process.

You will need to enter your name, email, and password.

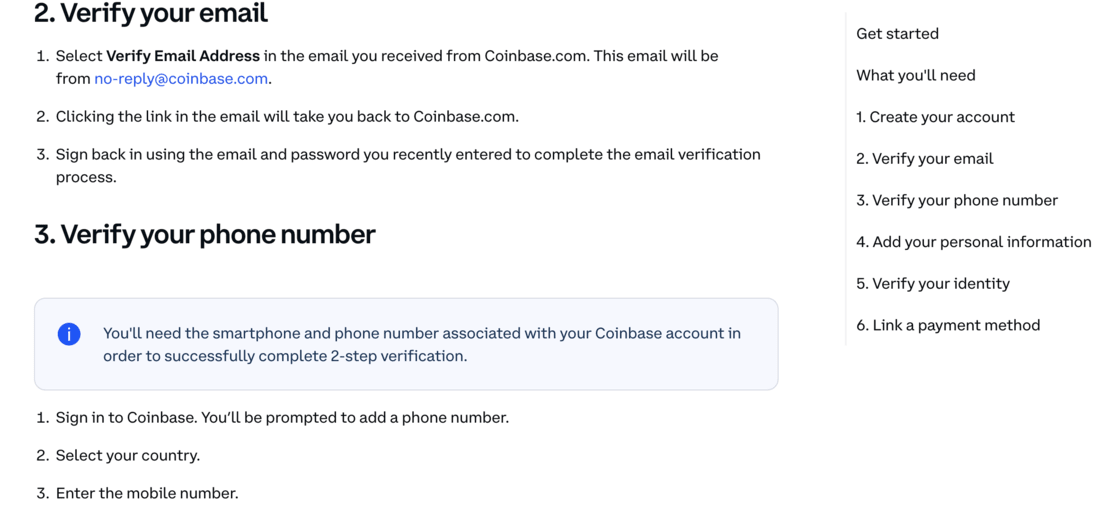

Step 2: Verify Email and Phone

You can verify your phone and email after you have signed up. When you have verified your email and signed into Coinbase, you can then verify your phone number.

Coinbase has rigorous security standards and users are auto-enrolled in 2FA.

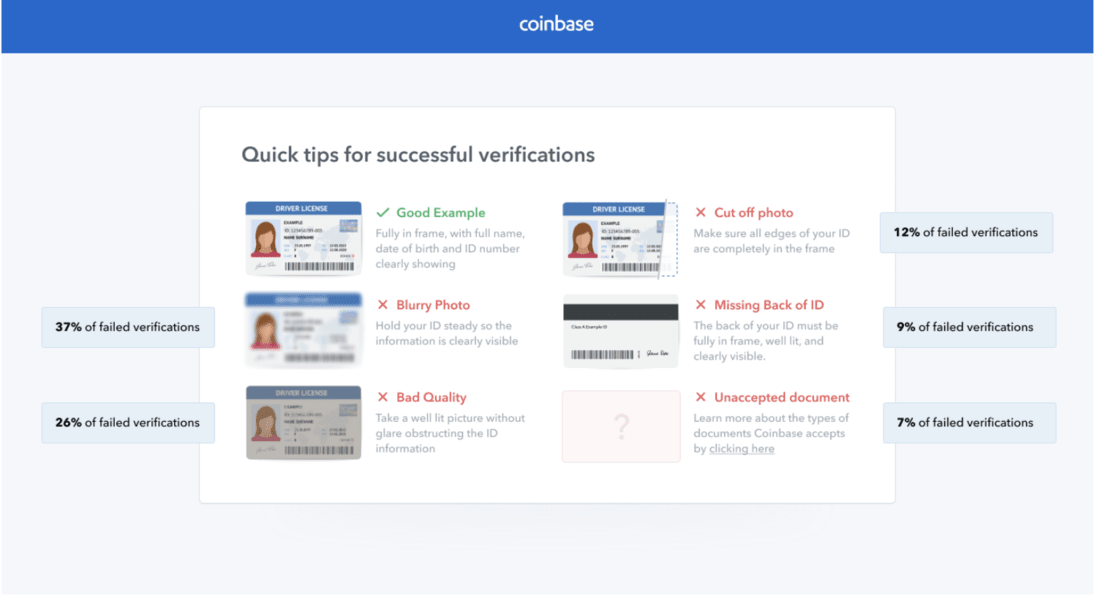

Step 3: Verify Identity

After your Coinbase account is verified, you will need to undergo KYC identity verification.

You’ll need to take a photo of your face as well as your government-issued identification document. You’ll also have to submit your tax information.

Step 4: Deposit and Trade

Your account is now set up. You can link a payment method and start to trade.

Once linked, it’s easy to make a payment.

Cryptoassets are a highly volatile unregulated investment product.

Conclusion

In tackling how to invest in cryptocurrency in Canada, our conclusion is that market-leading provider Coinbase is the best bet for beginners and more experienced traders alike.

It offers a huge variety of services and is a secure and regulated exchange. It also provides a Coinbase Wallet decentralized solution along with a Coinbase Earn program for staking APY. It could be one of the most secure exchanges on the market today.

Cryptoassets are a highly volatile unregulated investment product.

FAQs

What is the best cryptocurrency to invest in?

Is investing in crypto legal in Canada?

How can a beginner invest in cryptocurrency in Canada?

Where can I invest in cryptocurrency in Canada?