Looking to invest in Bitcoin from Canada? The price of market-leading Bitcoin appears to be heading out of the doldrums right now. Is now the right time to buy, before the price shoots up again?

Below we review no less than 5 Bitcoin vendors who may assist your Bitcoin investment in Canada. From the brokers and exchanges we investigate, we are looking for a combination of safe investing, low fees and high convenience. There are many ways of gaining exposure to the crypto market and we hope to guide you towards a Bitcoin investment strategy that works for you.

How to Buy Bitcoin in Canada – Quick Steps

Thinking about buying cryptocurrency in Canada in 2023? Here’s how to buy Bitcoin with low fees in less than five minutes:

- ✅Step 1: Open an account with Coinbase – Sign up with your name and email. Get verified with proof of ID and proof of address.

- Step 2: Deposit – Deposit money into Coinbase.

- Step 3: Search for Bitcoin – Find Bitcoin by selecting ‘BTC’ in the search bar.

- Step 4: Buy – You can buy Bitcoin and Coinbase will hold it for you or allow you to transfer it to a crypto wallet.

Where to Buy Bitcoin in Canada

If you are trying to figure out the best way to invest in Bitcoin in Canada, allow us to present 5 options.

1. Coinbase – Popular Cryptocurrency Exchange with Huge Asset Portfolio

Based in San Francisco, USA, Coinbase does roughly $3bn worth of crypto business every day and boasts 73m verified users. This exchange — ranked 2nd exchange in the world by crypto analysts CoinMarketCap — is very friendly to beginners. You can earn crypto by completing learning modules, as well as browse one of the biggest crypto databases on the internet.

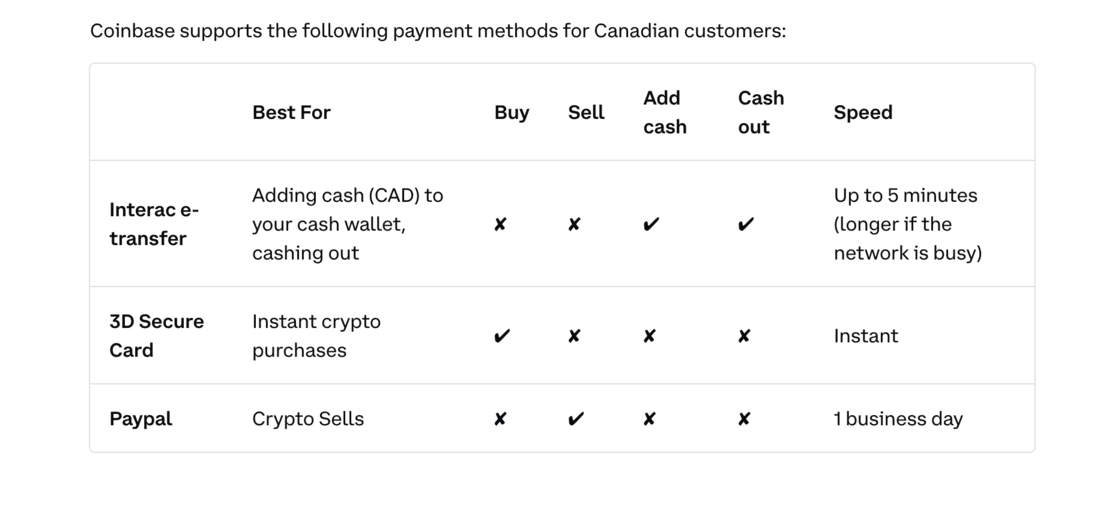

With Coinbase, you can buy Bitcoin direct from Canada using a debit card. You can then transfer your Bitcoin to your free Coinbase wallet, or sell it on the Coinbase exchange with the proceeds going to your Paypal account. You will get the fullest range of Bitcoin options as a Canadian investor will be available if you change up some Canadian Dollars into US Dollars first, and go from there.

One of the definite upsides of Coinbase is its commitment to security. It was one of the first crypto exchanges to store crypto in ‘cold’ storage (ie. mostly offline, where hackers cannot get to it). Coinbase was also the first exchange to go public on the stock markets with a 2021 IPO on the Nasdaq. You can actually trade Coinbase stock under the ticker ‘COIN’.

Fees on Coinbase cannot match BitBuy for simplicity or cheapness. The exchange uses a dual fee structure of flat fees and commissions. But Coinbase said in 2021 that a new fee structure is on its way.

The Coinbase smartphone app, which allows you to invest in Bitcoin and other crypto on the move, has been well-reviewed. It has received an average rating of 4.7/5 from 1.6m reviewers on the App Store and 4.3/5 from 600k+ reviewers on Google Play.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

2. Kraken – Secure Crypto Exchange With Excellent Margin Trading Features

But Kraken is also a perfect exchange for beginner crypto investors. Kraken offers over 200+ cryptos. While it does not insure user funds, it does deploy state-of-the-art security protocols including audited proof of reserves and a host of additional features for account security. 95% of all Kraken deposits are kept in cold storage, which is a great sign.

Kraken’s entry-level service – Instant Buy – charges a fee of 1.5% for Bitcoin and most other crypto. The price is lower (at 0.9%) for stablecoins. On top of this, a 0.5% processing fee applies when using ACH/online banking to purchase crypto with Instant Buy. These fees are moderate, when compared to Coinbase and other providers, but could be lower.

Kraken offers 5x leverage on its margin trading features. This means that a $2,000 investment could be leveraged to place trades worth $10,000. For the futures market, up to 50x leverage is available. The Kraken app has above-average ratings on both IoS and Android and it provides 24/7 customer support.

What we liked about Kraken is that it supports all three Bitcoin wallet address types – Legacy, SegWit, and Native SegWit. This can result in lower fees and faster confirmation speeds for certain BTC transfers.

It’s a great place to invest in Bitcoin with excellent support, moderate fees, and exceptional security features. Bitcoin can even be traded for as little as $2 with Kraken, which is an extremely low amount. The initial minimum deposit to open an account is $10.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

3. BitBuy – Excellent Broker to Buy Bitcoin in Canada

BitBuy stands out for having some of the lowest crypto transaction fees of any Canadian exchange. You’ll pay just 0.20% per buy and sell order when you use Express Trade. If you use the Pro Trade system, which was built for active traders, fees can drop to as low as 0.10%. Furthermore, you’ll also be able to invest in Bitcoin and other cryptocurrencies via the Bitbuy app which many consider to be one of the best crypto apps on the market.

You can buy and sell 15 popular cryptocurrencies on BitBuy, including coins like Ethereum, Litecoin, Dogecoin, and Ripple. You can deposit any cryptocurrency that BitBuy offers for trading and fees for withdrawing your coins to a third-party crypto wallet are very low.

For more details on the best place to store your crypto assets, you can read our guide on the best crypto wallets in Canada.

BitBuy’s Pro Trade module for active crypto traders is also noteworthy. It offers highly customizable technical charts, price alerts, and advanced stop and limit orders. You can also see the Bitcoin order book, making it easier to stay one step ahead of the market at all times.

The only notable drawback to BitBuy is that the exchange doesn’t accept credit or debit cards. You can fund your account with an Interac e-transfer for a 1.50% fee. BitBuy also accepts bank wires with just a 0.50% fee, but you must deposit at least $50,000. On the plus side, BitBuy doesn’t charge currency conversion fees when you deposit CAD.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

4. Binance – Giant Exchange to Invest in Bitcoin

Binance is the world’s biggest crypto exchange, with 90 million users. It offers super-low trading fees (0.1%) and a massive range of crypto trading and financing options. The good news for Canadian investors is that Binance’s 2021 issues with Canadian regulators have been resolved (outside Ontario). You can invest in Bitcoin outside Ontario using your Canadian credit/debit card with a fee of roughly 2% commission.

Regulatory issues aside, you won’t want to miss out on Binance’s elite crypto offering which includes multiple ways to get involved in crypto staking and crypto saving.

As well as 600+ crypto to trade, Binance offers a staggering array of power trading options. This can be a little overwhelming for crypto newbies. So beginners are advised to select the ‘Classic’ interface on the desktop app, and ‘Binance Lite’ on the smartphone app. Binance’s smartphone app received an average score of 4.7/5 from 96k reviews on the App Store and 4.3/5 from 570k reviews on Google Play.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

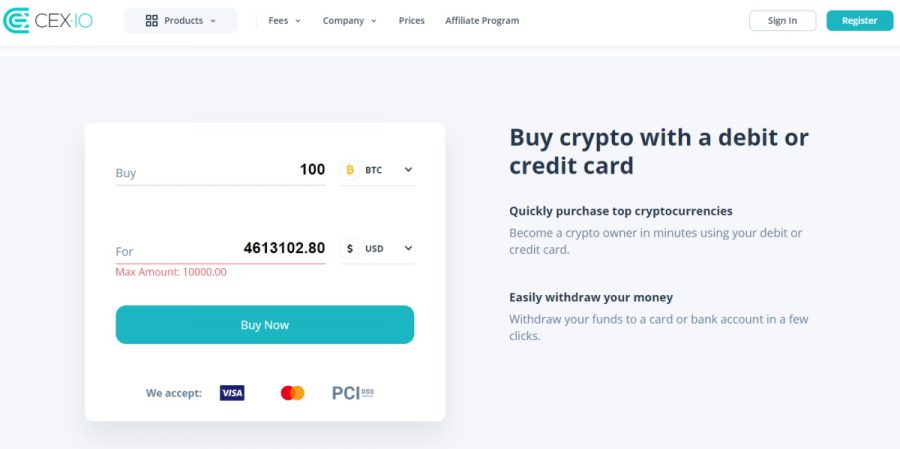

5. CEX – Leading UK Exchange with 70 Crypto

CEX is a UK crypto exchange that has stood the test of time. Launched back in 2013, CEX has attracted over 4m investors worldwide. Canadian investors will be pleased to hear that you can buy Bitcoin instantly with CEX using a Canadian credit/debit card (2.99% fee applies). Payments by SWIFT, SEPA, ACH, and e-wallet Skrill are available, depending on your country of residence.

CEX offers a decent range of 70+ crypto and a spread of regulation in the UK, USA, Gibraltar and Cyprus. A testament to CEX’s commitment to fair dealings is its involvement as a founding member of CryptoUK, an organisation which aims to streamline relations between the crypto world and stringent UK authorities.

As with fellow exchanges Coinbase and Binance, CEX offers crypto staking as well as the ability to get a crypto loan. As with Binance, margin trading is available — but this is only recommended for advanced traders. As freebies, CEX offers a smartphone app as well as a crypto wallet.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

What is the Best Way to Invest in Bitcoin?

How to invest in Bitcoin in Canada depends on your priorities. You can buy Bitcoin as an asset in its own right, or you can invest in what are known as ‘Bitcoin stocks’.

Buying Bitcoin

- Buy Bitcoin instantly with credit card at crypto exchanges like Coinbase, Binance and CEX. But watch out for high card commissions.

- Fund your account with a crypto broker like BitBuy. Then use those funds to buy Bitcoin.

- Use a Bitcoin robot service like Bitcoin Buyer or Bitcoin Evolution. These providers will use computer algorithms to spot trading opportunities for you. The emphasis here is on making money from Bitcoin trades, rather than amassing a store of Bitcoin.

- Check out some crypto signals providers. These teams of experts will send you details of upcoming crypto trading opportunities via Telegram. You can then take their advice (if you want) and execute the proposed trades yourself with a broker or exchange.

- Buy Bitcoin with PayPal – many options exist.

Investing in Bitcoin Stocks

You can explore what are known as ‘blockchain ETFs’. These are Exchange-Traded Funds which hold stocks in companies that do business in blockchain-related areas. An example of a blockchain ETF is the Amplify Transformational Data Sharing ETF (BLOK).

ETFs which simply hold Bitcoin (in the form of futures contracts) are just coming onto the market as regulators give them the green light. Currently available, for example, is the Pro Shares Bitcoin Strategy ETF (available with Capital.com).

Remember that you won’t find ETFs available with a dedicated crypto exchange.

Should I Invest in Bitcoin?

Investing in any crypto comes with considerable risk. The market is still young and price volatility is high. You should invest no more than 1%-5% of your total wealth in crypto. And it is a good idea to spread your crypto investment around. That being said, Bitcoin’s pole position in the crypto sector makes it perhaps one of the best long-term crypto investments. Here are five reasons why:

Take the Example of the Big Finance Players

Bitcoin is no longer new. Despite resistance from entrenched interests in the global finance world, Bitcoin is being taken on by PayPal, Mastercard and Visa. Apple and Amazon have said they will get involved too. And don’t forget El Salvador; for an entire country to make Bitcoin legal tender (which is what El Salvador did in 2021) represents a quantum leap forward in the evolution of the crypto sector as a whole.

Follow the Big Banks

The whole point of crypto is that, compared to conventional fiat currencies, it is decentralised. This means that there is no single central authority determining how much crypto there is, or who gains from transaction fees. Instead, transaction details are held on a distributed ledger, and transactions are authorised via a community rather than a big bank for example. At first, therefore, Bitcoin was greatly mistrusted by the big banks and sovereign regulators. But that has changed. 85% of institutional investors surveyed in 2021 said that they planned to begin investing in Bitcoin over the next two years, or to multiply their investments if they had begun investing.

Good Tokenomics

Just like gold, Bitcoin is a finite asset. This means there will only ever be so much Bitcoin in circulation. The total supply of 21 million coins will be reached in approximately 118 year’s time. This makes for a permanent support to its price; gold is so expensive, of course, for exactly the same reason of limited supply and worldwide demand. Bitcoin’s limited supply also means that it is unlikely to suffer the devaluation through inflation that has become the scourge of global fiat currencies right now: inflation in the US, for example, is at a 40 year high.

Market Leader Advantage

Is Bitcoin a good investment? That depends on the future, which nobody can predict accurately. What we can say with confidence, though, is that Bitcoin is the biggest and most popular crypto and is likely to stay that way. This gives Bitcoin a real advantage over other crypto. A virtuous circle of investment and awareness is in place: people know about Bitcoin, so they invest in it, so it gets a higher profile, and so on. Other less well-known coins among Metaverse coins, DeFi coins and meme coins may offer more dramatic short-term returns; but Bitcoin is out in front and likely to stay there.

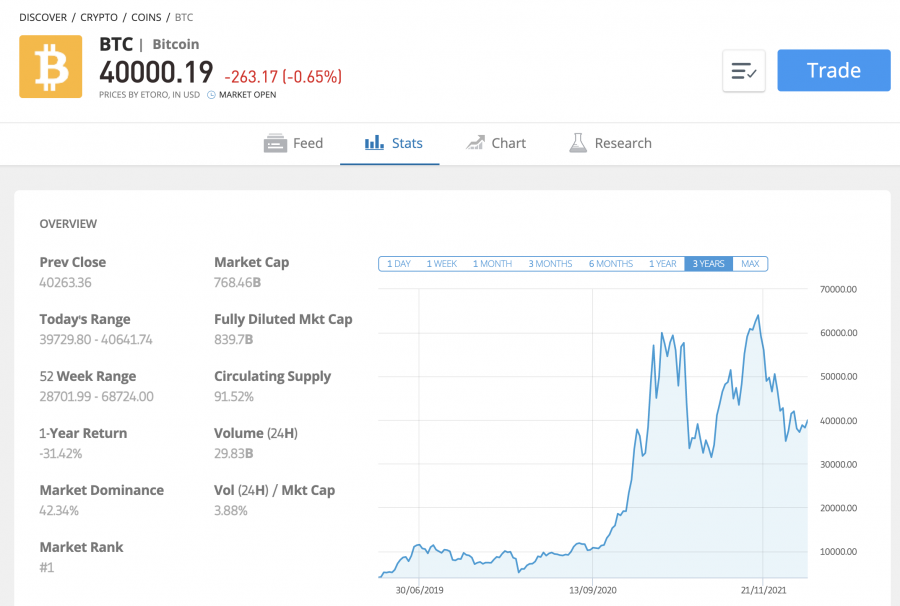

Buy Before Bitcoin Breaks Out

Since 23rd February 2022, Bitcoin has stopped falling. Its price has risen and fallen erratically between $35k and $45k with a general upwards trajectory. Some technical analysts say this behavior is a ‘continuation’ pattern, which means that shortly the price will either take off or fall dramatically. However, until this point, technical analysis of crypto in general has fallen short. Investor sentiment is such a key factor in crypto prices that a Bitcoin price prediction is always going to be unreliable. Bitcoin, now priced around $40k, has been in this price region six times since the new year. One strategy is to buy now and expect Bitcoin to break out of this pattern soon.

Alternatively, some crypto-enthusiasts invest in Bitcoin to gain access to the best Bitcoin casino sites in Canada.

Choosing a Bitcoin Wallet for Investing

Beginners should get one thing straight: you do not need to use a crypto wallet to buy and sell Bitcoin. The best crypto exchanges in Canada like BitBuy allow you to store your crypto inside your brokerage account. So, there’s very little difference between holding Bitcoin and holding more traditional assets like stocks.

So why do investors use crypto wallets? Crypto wallets allow you to hold crypto like Bitcoin on your own terms, as well as transfer it around the web to pay for items. You also receive a unique address on the blockchain which you can use to receive crypto payments. With some brokers like Binance, you can send crypto around using the in-house wallet. But generally a full-blown crypto wallet is required.

Crypto wallets are divided into those which are custodial and non-custodial:

- Custodial wallets mean the wallet is effectively in the ‘custody’ of the provider. This means that, if you lose your login details, you will be able to get back into your wallet. Binance offers two custodial wallets (the Binance Trust wallet and the Binance Chain Wallet). Coinbase and CEX offer custodial wallets too.

- Non-custodial wallets are wallets to which you alone have the private key. An example of a non-custodial wallet is the Metamask wallet, which allows you to buy any ERC-20 token but which does not allow you to withdraw fiat currency funds. If you lose your private key to your Metamask wallet as well as lose your ‘seed’ phrases, you are stuffed!

If you use BitBuy to buy Bitcoin, you can send your Bitcoin to any custodial or non-custodial wallet. Or, keep things simple by holding your Bitcoin in your BitBuy account.

Bitcoin Investment Strategies

How to invest in Bitcoin and make money depends on your own individual appetite for risk. This means how much money you are prepared to risk in return for potential gains. Your risk appetite may depend on your age; if you are younger, for example, you have more time to play with and can hold Bitcoin for decades in the hope that its value will rise. Older investors may favour dedicating a small amount of their portfolio to Bitcoin and pursuing a riskier strategy.

Low Risk Bitcoin Investment – Diversify

Invest only 1% of your total wealth in crypto, and make Bitcoin investment a small proportion of that. Diversification is the key to low risk investment. BitBuy offers trading on 15 different cryptocurrencies so that you can build a diversified portfolio.

Medium Risk Bitcoin Investment – HODL

‘HODL’ means ‘Hold On for Dear Life’. This is a popular phrase in the crypto world. It describes a long-term hold strategy. The idea is to buy Bitcoin right now, wherever the price is at, and … well … hold on for dear life! The Bitcoin price is likely to remain volatile. Crypto winters are the result of this sector-wide volatility, which mean that crypto prices slump for months at a time. The key to this strategy is to hold your Bitcoin stock throughout these crypto winters — and wait for the crypto Springs and Summers before you sell!

High Risk Bitcoin Investment – Margin and Leveraged Trading

Trading on margin (which means borrowing money to trade) is a classic high-risk way to trade Bitcoin. Using leveraged trades (available in some countries) is a way of doing margin trading. Leveraged trades are trades in which your gains or losses are amplified. Neither margin trading nor leveraged trading are remotely suitable for beginners — be in no doubt about that.

How To Invest in Bitcoin & Make Money – Example

If you had invested $1,000 in Bitcoin in 2011, your investment would now be worth roughly $40 million.

More recently, Bitcoin rose in value by 300% between November 2020 and November 2021. If you invested $1000 in Bitcoin now, and it experiences the same rate of price increase over the next year, your investment would be worth $4000 by March 2023.

When is the Best Time to Invest in Bitcoin?

In April 2021, the price of Bitcoin peaked at $64k. It became the best-performing asset of the decade with an annualised return over 200% since its launch. So, right now, is Bitcoin a good investment? The answer is yes if it continues to average an annual return of 200%.

Unfortunately there is no magic price level which Bitcoin can reach and then rise in a predictable fashion. The best time to invest in Bitcoin is always now, for the simple reason that, without a Bitcoin investment, an investor cannot possibly benefit from any gains in price. Just always be sure to invest money in crypto that you can afford to lose!

How to Invest in Bitcoin in Canada – Tutorial

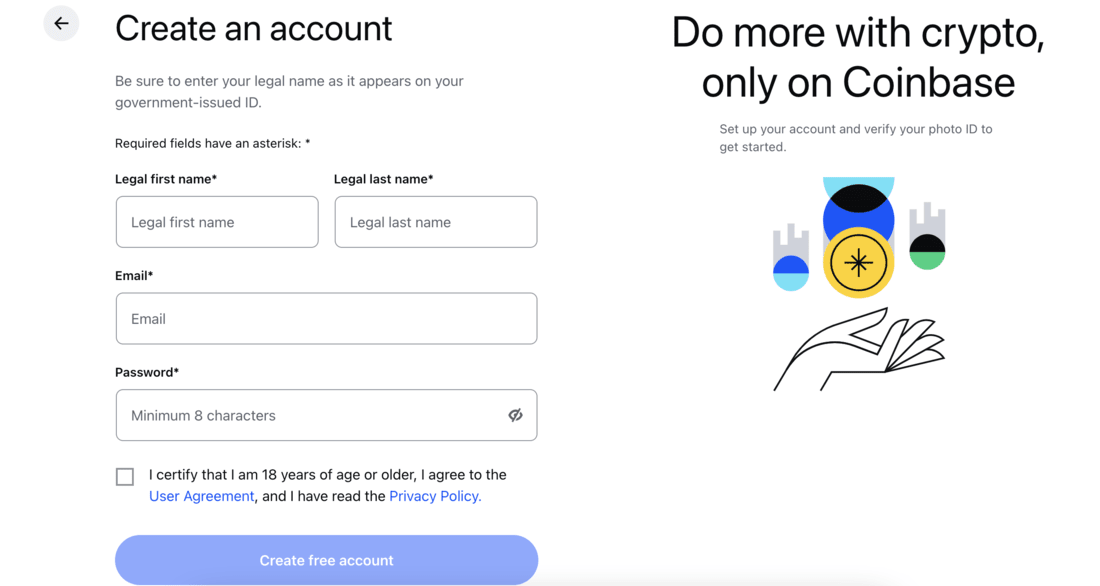

Step 1: Open an Account

To open an account, visit the Coinbase homepage and click on the ‘Get Started’ button to begin the process.

You will need to enter your details and tick the box to indicate you are over 18.

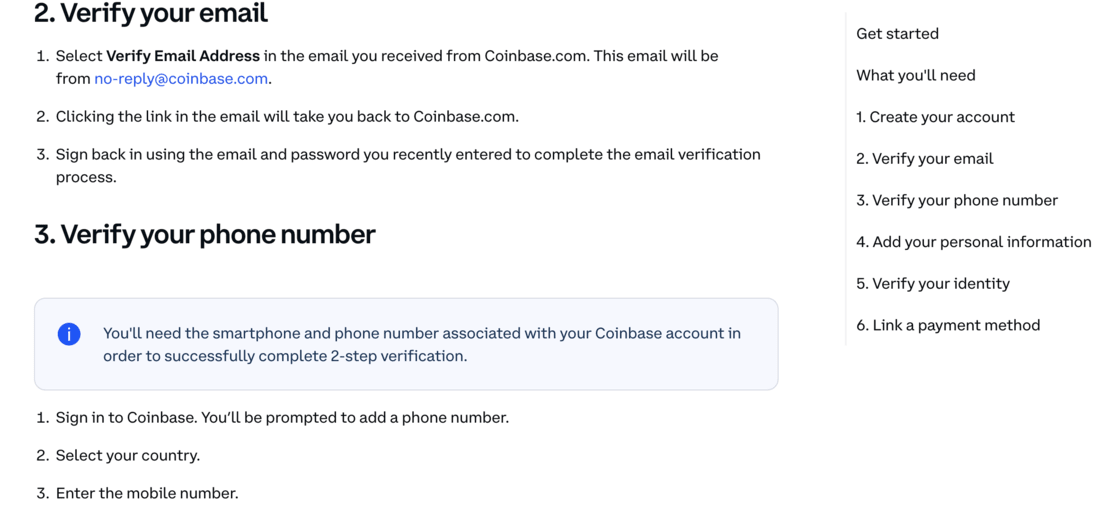

Step 2: Verify Email and Phone

You can verify your phone and email after you have signed up. When you have verified your email and signed into Coinbase, you can then verify your phone number.

Coinbase has rigorous security standards and users are auto-enrolled in 2FA.

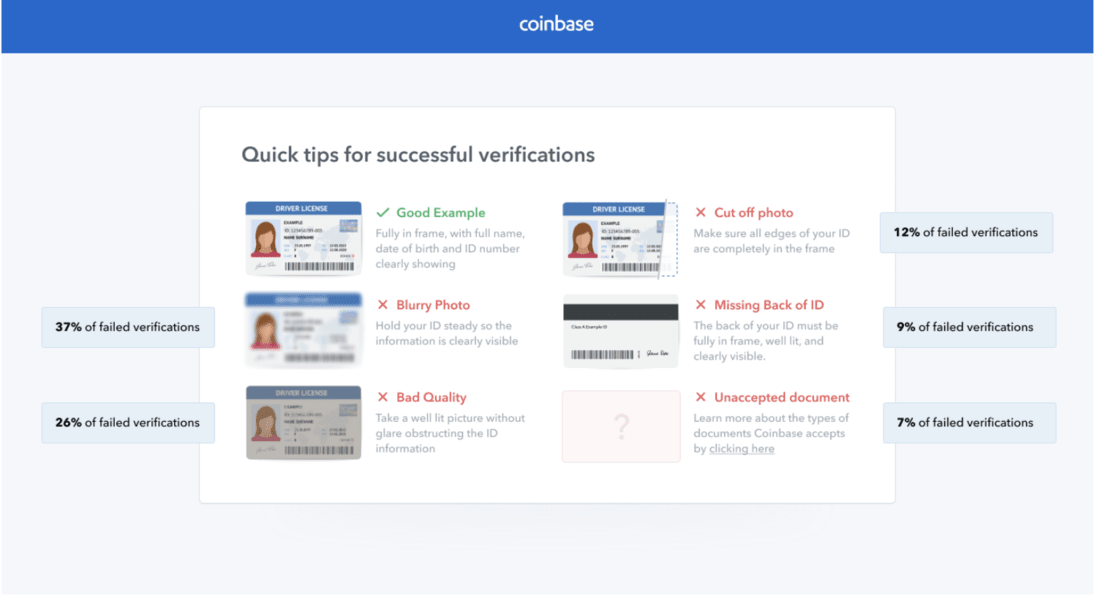

Step 3: Verify Identity

After your Coinbase account is verified, you will need to undergo KYC identity verification.

You’ll need to take a photo of your face as well as your government-issued identification document. You’ll also have to submit your tax information.

Step 4: Deposit and Trade

Your account is now set up. You can link a payment method and start to trade.

Cryptoassets are a highly volatile unregulated investment product.

Conclusion

Should I invest in Bitcoin? It’s a question investors asked over a decade ago; and the answer turned out to be ‘yes, definitely!’. Whether that remains the case is uncertain. And that’s why it is important to only invest a small proportion of your total wealth in crypto, and also to spread your crypto investment around. Crypto prices tend to follow the price of Bitcoin, but it is always best to diversify.

We have reviewed 5 Bitcoin vendors. We recommend Coinbase as it is highly regulated and the best place to purchase Bitcoin for beginners. It’s the most intuitive and easy-to-use exchange with good staking options for Canadian residents.

Security protocols are among the best in the world and it offers a huge range of products for individuals, businesses, institutions, and developers.