Staking crypto is one of the ways that investors can earn money, and it’s a process of locking up crypto holdings to get rewards or earn interest. Crypto staking in Canada also involves participating in transaction validation.

To get the best returns from staking, investors need a reliable cryptocurrency exchange. We scoured the market for the best crypto staking platform in Canada and found several great options.

Best Crypto Staking Platform in Canada List

Investors should use the best crypto staking platform in Canada, which entails receiving low fees and a large collection of staking coins. We found a few platforms offering those benefits and more.

- Sponge V2 – An upgraded version of Sponge Token that saw 100x growth, combining meme appeal with a Stake-to-Bridge model and an interactive P2E game.

- DeFi Swap – Offers some of the best annual percentage yields (APY).

- Crypto.com – Enables staking of more than 40 cryptocurrencies

- Coinbase – Provides up to 5.75% APY

- Binance – Provides more than 120 cryptocurrencies for staking

- Blockfi – Offers up to 11% APY

- Nexo – Platinum account holders earn up to 10% on stablecoins

- Kraken – Enables you to earn up to 23% annually

Best Crypto Staking Platforms in Canada Reviewed

We wanted to get under the hood of each exchange to see exactly what they offer and how they fare against each other. And we wanted to find the best crypto staking platform in Canada so that when investors buy cryptocurrency they can start staking their digital currencies.

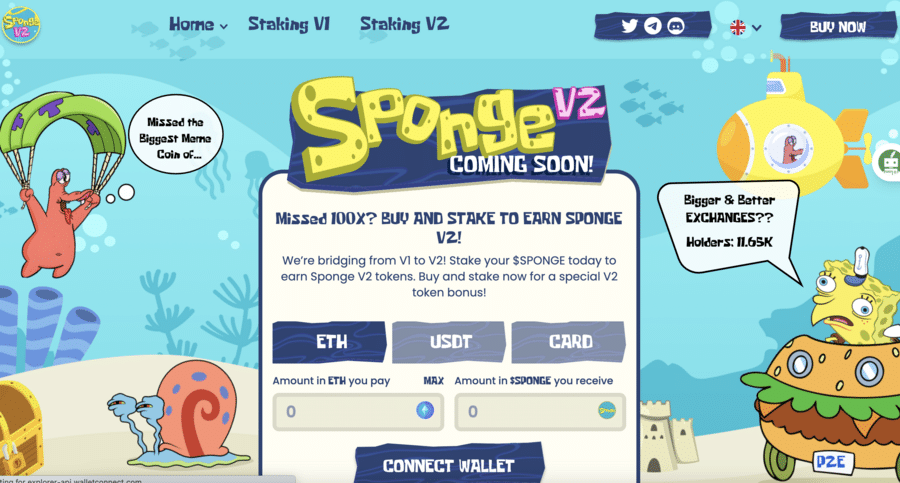

1. Sponge V2 – Evolved Version Of Sponge With Stake-to-Bridge model, a P2E game And A 40% APY

Sponge V2

Launched at the start of a potential phase of the bull market, Sponge V2 aims to expand beyond the impressive success of its predecessor, which achieved a market cap of nearly $100 million.

It aims to offer a seamless transition from V1 to V2 through staking while improving utility and community engagement.

Per the Sponge V2 whitepaper, the project introduces a new concept- the Stake-to-Bridge model. This mechanism allows users to stake their V1 tokens ($SPONGE) to earn V2 tokens ($SPONGEV2).

It’s important to note that staked V1 tokens will be permanently locked and phased out after the V2 launch. This strategy ensures a smooth transition while rewarding loyal community members with the new token. The approach offers a minimum APY of 40%, rewarding users for their commitment over 4 years.

A key feature of Sponge V2 is its P2E game, which provides both free and paid versions. Players can earn $SPONGEV2 tokens by participating in the game, adding an extra layer of utility and fun to the token.

The total supply of SPONGEV2 is 150 billion tokens. The allocation includes 26.93% for bridged $SPONGE, a significant 43.09% reserved for staking rewards, 10% for CEX liquidity, 7.5% for marketing, 8% for P2E rewards, and 4.47% for game development.

You can enter the Sponge Telegram channel and follow it on X (formerly Twitter) for the most recent project updates.

| Staking Rewards on Cryptocurrencies | 40% |

| Min & Max Staking Amounts | No minimum or maximum |

| Lock-In Period | Yes |

| Security & Regulation Features | – |

| Additional Rewards Offered | Variable |

| Payout Frequency |

Over 4 years |

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

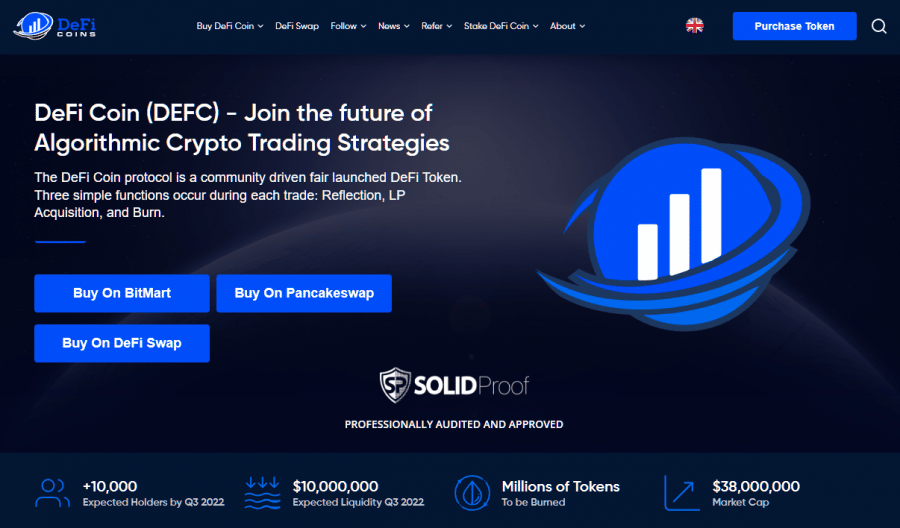

2. DeFi Swap - Promising Crypto Staking Platform in With High APYs

Taking advantage of this deal means that investors will stake DEFC on the DeFi Swap exchange and opt for a 365-day staking term. That’s an entire year the exchange will hold the coins, but investors are rewarded for their patience.

The 75% annual percentage yield means that investors will receive 750 DEFC for every 1,000 coins staked. The exchange offers another benefit to investors. Holders get a share of 10% tax.

That’s another income stream by holding tokens.

Each DEFC transaction contains a 10% tax. The exchange distributes that income proportionate to your investment. The best part of this benefit is that DEFC dividend payments happen every time a user buys or sells DEFC coins. DeFi Swap ensures that the DEFC coin remains highly liquid by using half of the 10% transaction tax to allocate it to the DEFC/BNB liquidity pool.

DeFi Swap offers four lock-up terms. The bronze term is for 30 days and offers a 30% APY. The silver term lasts 90 days and returns a 45% APY. Gold lasts 180 days and has a 60% APY, and the platinum is for a year and offers a 75% APY.

Many investors consider DeFi Swap to be the best crypto staking platform in Canada.

| Staking Rewards on Cryptocurrencies | DeFi Coin, 30-75% APY |

| Min & Max Staking Amounts | No minimum or maximum |

| Lock-In Period | 30, 90, 180, or 365 days |

| Security & Regulation Features | Decentralized exchange |

| Additional Rewards Offered | Transaction fees charged for trading DEFC are shared among stakers |

| Payout Frequency | Daily |

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

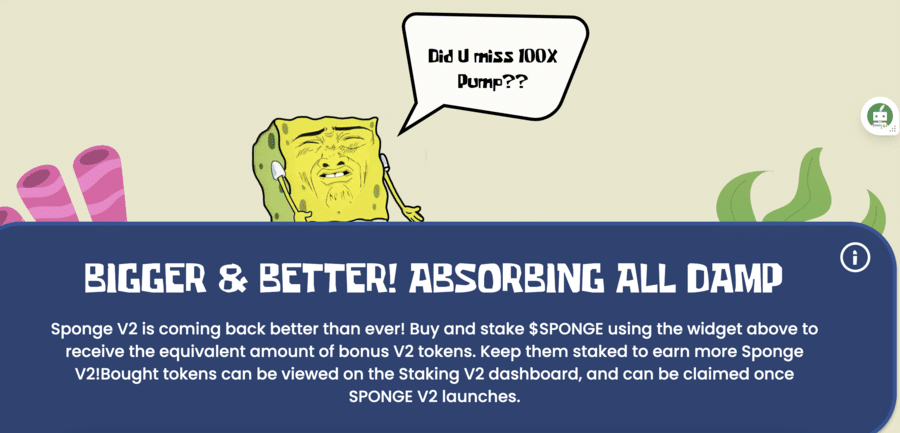

3. Crypto.com - Top-Rated Cryptocurrency Exchange in Canada

Popular coins such as Ethereum provide a 6% return per annum. Staking the coin Polygon will entitle you to earn a 14.5% APY. The exchange offers a handy tool that allows investors to determine returns by inputting the fiat amount invested, coin and term.

Investors looking for short-term staking periods will find a home at Crypto.com. The exchange offers 1-month and 3-month lock-in terms. An investor's stake return also depends on the amount of CRO staked. CRO is the exchange’s native token. To get the best return, investors need to stake at least $40,000 in CRO. Aside from the crypto staking features, Crypto.com also lets crypto enthusiasts buy Bitcoin with some of the lowest fees on the market.

For the returns, Crypto.com works on a 3-tier reward structure effective from 1 June 2022. Tier 1 entitles investors to the full rewards rate less than or equal to $3,000. After filling the Tier 1 quota, the exchange allocated the next $27,000 as 0.5 x Tier 1 rate. After filling your Tier 1 and Tier 2 quotas up to $30,000, the exchange will treat subsequent allocations as 0.3 x Tier 2.

| Staking Rewards on Cryptocurrencies | Stablecoins (USDT, USDC, DAI, etc) – Up to 14%

Non-Stablecoins (BTC, ETH, CRO, LTC, etc) – Up to 14.5% |

| Min & Max Staking Amounts | Minimum – Varies depending on coin (e.g. 0.005 BTC, 0.15 ETH) |

| Lock-In Period | Customizable – 15 days, one month, or flexible |

| Security & Regulation Features | Tier 4 assessment from NIST Cybersecurity

· Stress-tested by Kudelski Security |

| Additional Rewards Offered | APR increases as the amount of CRO staked increases. |

| Payout Frequency | Weekly |

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

4. Coinbase

The platform provides automatic rewards into an investor’s account periodically, depending on the asset. Investors can start with as little as $1 in crypto, but large accounts earn significant rewards. Coinbase offers various APYs. It depends on the staked asset, but the maximum APY investors can earn is 5.75%.

Only Coinbase customers that have a verified identity and a valid TIN on file are eligible to stake. The benefit of staking with Coinbase is that investors don’t need to purchase assets from the exchange. To earn staking rewards, investors can send assets from an external wallet to a Coinbase account for free.

Coinbase has no minimum value for crypto staking in Canada. But the exchange has placed a maximum limit on each coin that users can stake to manage network limits. The maximum amount changes over time and isn’t specific to an individual account. The lock-in period also varies for each asset.

| Staking Rewards on Cryptocurrencies | Up to 5.75% on non-stablecoins; up to 2% on stablecoins |

| Min & Max Staking Amounts | Varies on assets |

| Lock-In Period | Varies on asset |

| Security & Regulation Features | Regulated by the SEC, Listen on NASDAQ |

| Additional Rewards Offered | None |

| Payout Frequency | Daily, weekly, quarterly - depending on the asset |

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

5. Binance

Locked staking consists of 112 coins, and the DeFi staking pool has 13 coins. The feature that will appeal to investors the most is the potential APY earned. The APY varies per coin, some projects offer over 120% APY. The duration of the stake is another great feature.

Depending on the coin, investors can choose from 15, 30, 60, 90 and 120 days to stake. Investors interested in staking the Binance coin (BNB) can expect a 12.99% return in 90 days. Bitcoin stakers can expect an 8.19% return for 60 days. The benefit of opting for DeFi stakes is that some coins offer a flexible option for the term a coin is staked.

Unlocking the tokens takes one day and a day to redeem the funds. For investors, receiving their interest timely is important. It’s for that reason that Binance does an interest payout daily. Some of the locked staking coins offer impressive APYs. As an example, Santos offers a 169.95% APY for 15 days.

| Staking Rewards on Cryptocurrencies | Triple-digit interest rates for certain coins |

| Min & Max Staking Amounts | Varies amongst the coins |

| Lock-In Period | Flexible, 12 days, 15 days, 30 days, 60 days, 90 days and even 120 days |

| Security & Regulation Features | Paris-based market authority AMF |

| Additional Rewards Offered | None |

| Payout Frequency | Daily |

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

6. BlockFi

The interest earned from BlockFi is compounded, and the exchange uses a tiered interest structure. The three tiers that Blockfi offers determine the potential APY. As an example, staking Bitcoin (BTC) under tier 1 means depositing 0 to 0.10 BTC to earn 3% APY. A tier 2 stake is a deposit of 0.10-0.35 BTC to earn 1%.

The tier structure applies only to certain coins. BlockFi offers no limit for many of the staked coins offered. Cardano has no limit and can earn investors a 10% APY.

| Staking Rewards on Cryptocurrencies | Up to 15% APY |

| Min & Max Staking Amounts | Varies amongst the coins |

| Lock-In Period | Varies but usually at least 30 days |

| Security & Regulation Features | Its custodian, Gemini, is regulated by the New York State Department of Financial Services |

| Additional Rewards Offered | None |

| Payout Frequency | Monthly |

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

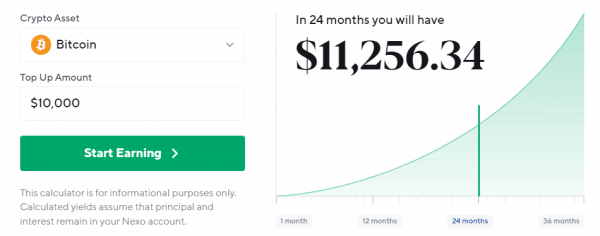

7. Nexo

Another benefit is that the investment has no fees. Moreover, Nexo offers flexible earnings. Nexo also offers interest on stablecoins. Investors who opt for Tether or USDC can earn up to 12% annual interest.

To get started with Nexo stake coins, investors follow a simple sign-up process. Nexo gives investors the option to transfer their coins from another wallet to stake them on Nexo. Buying it from the exchange isn’t compulsory. After the coins are in an investor’s Nexo account, the investor starts earning interest the next day.

Investors interested in earning 16% interest on coins need to become Platinum Loyalty tier clients. To do that, investors need to ensure that their portfolio consists of 10% or more NEXO tokens. The other criteria are that investors need to opt to earn interest on NEXO tokens for up to 2% additional interest. The last criterion is that investors need to create a 1-month fixed term for an extra 1% interest.

| Staking Rewards on Cryptocurrencies | Up to 16% |

| Min & Max Staking Amounts | Minimum 1% of NEXO to be in the investor’s portfolio and maximum 10% |

| Lock-In Period | Varies per coin |

| Security & Regulation Features | Assets secured by BitGo trust |

| Additional Rewards Offered | None |

| Payout Frequency | Daily |

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

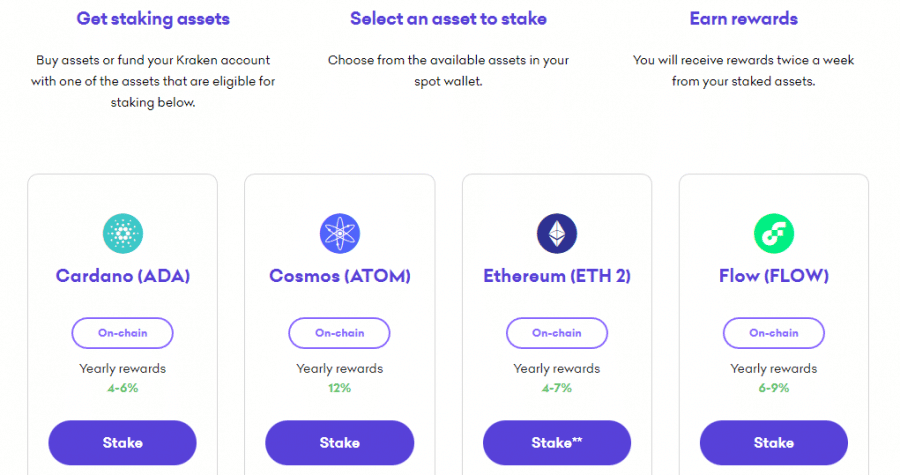

8. Kraken

Some staking coins on Kraken require a bonding period. For certain coins, investors earn rewards only after the coin selected finishes bonding. After the bonding, the coin earns rewards bi-weekly from the proof-of-stake process.

Investors can earn up to 23% annual interest by staking on Kraken.

| Staking Rewards on Cryptocurrencies | Up to 23% |

| Min & Max Staking Amounts | No minimum |

| Lock-In Period | Bonding period applies on certain coins before staking begins, but no lock-up periods exist |

| Security & Regulation Features | FinCEN |

| Additional Rewards Offered | None |

| Payout Frequency | Bi-weekly |

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

What is Staking Crypto?

Crypto staking in Canada involves locking up crypto assets for a designated period on an exchange to earn interest or obtain rewards. To stake safely, make sure to choose the best staking platform in Canada.

How Does Crypto Staking in Canada Work?

Investors have two options to stake coins. They can do it themselves or invest with an exchange. The first option requires investors to run a node on personal hardware, sync it to the blockchain and fund the node with sufficient cryptocurrencies to meet the minimum threshold.

The easier way is to use a crypto exchange offering staking. Some exchanges require investors to purchase the native token or other staked coins on the platform to earn interest. Several exchanges let investors transfer coins from a wallet into the exchange’s account. The exchange does all the work after the investor has staked coins in the account. Interest begins accumulating the day after the investor deposits funds.

Mining vs Staking

Mining involves solving a complex puzzle to secure the network and stop hackers from hijacking it. Miners use power in bids to mine a block. It’s used to generate new coins and verify transactions. Mining occurs via a decentralized global network of computers that document cryptocurrency transactions. Miners are rewarded for their contributions with new coins.

Staking also involves verifying transactions and achieving consensus. It varies from mining because staking requires investors to stake their coins. That means being unable to withdraw their coins for a specified period, and the network chooses validators for each block. Staking consumes less energy than mining.

On-Chain vs Off-Chain Staking

Every step of on-chain staking happens on the blockchain and is considered valid when the blockchain is modified to reflect the transaction on the public ledger. Miners ensure the validity of transactions.

Off-chain staking happens outside of the blockchain. The parties involved in off-chain staking can choose several methods to complete a transaction. One option is to use a third party who’s to honour the agreement, or the transacting parties can draw up a transfer agreement.

Benefits of Staking Crypto in Canada

The main benefit of staking cryptos is to earn more crypto. Some exchanges also offer stake investors rewards. But most investors stake coins because they want to earn interest on them, thereby earning more of the staked coins. To get the most benefits, it’s important to choose the best crypto staking platform in Canada.

By staking coins, investors also contribute to the security and efficiency of blockchain projects. When investors stake funds, they support the blockchain to be more resistant to attacks. The other benefit that staking provides to blockchain is strengthening its ability to process transactions.

The 5 Best Crypto Staking Coins in Canada

Crypto exchanges offer numerous stake coins, yielding various returns. Some projects proved to have stake coins offering better benefits for investors, so we explored the best crypto staking coins.

1. DeFi Coin

The biggest benefit of investing in DEFC is the return. Investors staking DEFC can earn up to 75% APY annually. That is much higher than what most exchanges offer for Bitcoin—around 8%. If investors consider the high APY that DeFi offers and decide to stake 1,000 DEFCs, the annual return is 750 DEFCs.

Another benefit is getting a share of the 10% transaction fee that DeFi charges. The exchange distributes a portion of the transaction fees collected to investors staking DEFC. The amount distributed to each investor is proportionate to the investment.

DeFi Swap enables investors four staking terms: 30 days, 90 days, 180 days and 365 days. Not only is the DeFi coin attractive due to the high APY, but it has experienced massive price pumps. The coin surged 435% within 24 hours on 6 May 2022. You can buy the DeFi token.

Cryptoassets are a highly volatile unregulated investment product.

2. Lucky Block - LBLOCK

LBLOCK may not be regarded as a staking coin, but it enables investors to earn interest. The project serves as a competition platform built on the Binance Smart Chain to provide transparency of all the aspects of the competition process. The main advantage of Lucky Block is that it enables global users to participate in crypto jackpots.

Lucky Block recently launched a $1 million prize draw. The draw resulted in two winners, each winning prizes to the value of $1 million. One winner won $1 million worth of LBLOCK coins and the other prize was also worth $1 million, selected from owners of the Lucky Block Platinum Rollers Club NFT.

Earning rewards with Lucky Block is simple. All investors need to do is buy LBLOCK to receive a token distribution from the jackpot. An investor’s distribution is in proportion to the number of coins held.

Apart from the rewards that LBLOCK offers, it had a massive rally at the beginning of 2022 when it launched. Investors who bought the coin in February 2022 watched it surge just over 1,100% to reach its all-time high of $0.009.

Cryptoassets are a highly volatile unregulated investment product.

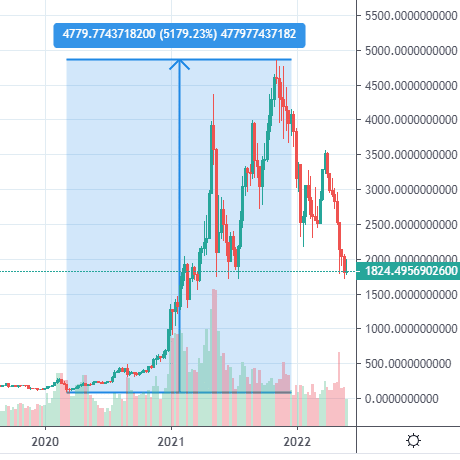

3. Ethereum

Ethereum (ETH) has cemented its place as the second-biggest coin by market capitalization. One of the reasons Ethereum has grown significantly is because of its use case. Many crypto investors use Ethereum’s project for decentralized finance to make peer-to-peer transactions without relying on a third party such as an exchange. Other Ethereum platform uses are for decentralized autonomous organizations (DAOs) and non-fungible tokens (NFTs). NFTs are secured on the Ethereum blockchain, and its market is expected to grow by $147 billion by 2026.

Users wishing to stake Ethereum can use any amount of ETH to secure the network and earn rewards. Ethereum allows staking in various forms.

Investors can opt for solo home staking, staking as a service, pooled staking and cryptocurrency exchanges. Each of the options has risks and rewards. As an example, solo staking provides maximum rewards, but it contains penalties, costing ETH, for going offline.

Staking ETH through exchanges is the simplest method. Crypto.com provides investors staking ETH with a 6% APY. Investing in Ethereum means that investors may experience massive bull runs, such as the one Ethereum had in 2021.

Investors who bought ETH during March 2020 earned just more than 5,000% profit by November 2021, when ETH reached an ATH of $4,880. Interested investors can still buy ETH.

Cryptoassets are a highly volatile unregulated investment product.

4. Cardano

Cardano’s proof-of-stake platform is one of the biggest in the world, combining technologies to provide security and sustainability to decentralized applications, systems and societies. The developers designed the platform to redistribute power from unaccountable structures to individuals.

The platform has strived to make its use more environmentally friendly, but investors can also earn interest on ADA, Cardano’s native token. Binance is one of the major exchanges offering ADA staking. Staking ADA on Binance means that investors can earn up to 10.12% for 120 days. Binance also offers a flexible lock option, but the estimated APY for that duration is only 1.5%

ADA investors have witnessed the coin experience massive pumps. The coin surged just over 3,000% from November 2020 to August 2021 to reach an ATH of $3.09. Investors who think the coin still has upside potential can buy Cardano.

Cryptoassets are a highly volatile unregulated investment product.

5. Uniswap

Uniswap (UNI) is the native token of Uniswap, a decentralized exchange. The exchange is a liquidity provider for trading tokens on the Ethereum network and enables users to swap and earn coins. The platform also consists of a growing network of DeFi Apps.

Uniswap is constantly looking for ways to improve its platform and did so with Uniswap V3, the protocol reducing transaction costs. Staking UNI is easiest done with a major exchange such as Crypto.com. Investors staking UNI with Crypto.com can earn up to 3% per annum.

Besides its use case and benefits offered to investors, UNI’s price has gone on massive bull runs. The coin pumped just over 2,400% from November 2020 to May 2021, when it reaches an ATH of $44.97. If you believe the coin will pump again, you can buy Uniswap.

Cryptoassets are a highly volatile unregulated investment product.

How to Stake Crypto in Canada

Investors interested in staking crypto in Canada on the Sponge V2 will find out step-by-step tutorial of the best crypto staking platform in Canada useful.

Step 1 - Connect Wallet

To buy $SPONGE tokens, first link your MetaMask or Trust Wallet using the provided interface. $SPONGE is available on Uniswap, and its contract address is 0x25722Cd432d02895d9BE45f5dEB60fc479c8781E.

Step 2 - Upgrading from Version 1 to Version 2 Tokens

Holders of Version 1 ($SPONGE V1) tokens can upgrade to Version 2 ($SPONGEV2) through the Staking Dashboard. This process involves staking V1 tokens, which are then exchanged for V2 tokens.

Step 3 - Purchasing $SPONGE

If you don't own $SPONGE, you can buy it using ETH, USDT, or a card through the specified widget.

Purchasing V1 tokens leads to their automatic staking, and you'll also receive a bonus in V2 tokens. The bonus amount in V2 tokens is based on the value of your transaction.

Step 4 - Claiming Sponge V2 Tokens

V2 tokens are obtainable only by staking V1 tokens before the official release of V2. The number of V2 tokens you can earn correlates with the number of V1 tokens staked and the staking duration.

Is Crypto Staking Taxed in Canada?

Under Canadian tax laws, crypto staking resembles an investment. The reason is that earning staking rewards requires an investor to hold a sufficient interest in the cryptocurrency platform’s native token. That means a cryptocurrency staker acquires a property.

So when a staker receives rewards, the receipts constitute investment income. In some cases, a staker could be viewed as providing a service. But a taxpayer using cryptocurrency to generate an income constitutes tax characterizations of acquiring an income.

Receiving reward tokens from cryptocurrency staking is fully taxable.

Is Crypto Staking in Canada Safe?

Any type of investment carries a risk. Staking crypto is considered investing and should be approached with caution. Crypto staking in Canada appears safe because investors are required to lock in their coins with an exchange for a specific period.

Just because a coin is locked-in, it doesn’t mean it’s safe. Staking cryptos usually prevents investors from withdrawing the coins for a specific period, so that makes the investment riskier. Investors can reduce the risks associated with staking cryptos by opting for a regulated crypto exchange. Some exchanges offer additional security and insurance for stake investors.

Conclusion

Staking cryptos offers several benefits to investors and blockchain. By getting involved in crypto staking in Canada, investors can earn significant interest and rewards. Some cryptocurrency exchanges offer coins with triple-digit APYs. That is much more interest than most local banks can offer on any type of account or investment. Staking crypto benefits the blockchain network by securing it and validating transactions.

One of the coins that yield high interest is $SPONGE. Investors staking $SPONGEV2 can earn a 40% APY. This upgraded version of Sponge Token combines meme appeal with a Stake-to-Bridge model and an interactive P2E game, offering a strategic transition from V1 and focusing on long-term user rewards.

Cryptoassets are a highly volatile unregulated investment product.