Tyler and Cameron Winklevoss, often known as the Winklevoss twins, are world-famous venture capitalists, entrepreneurs, crypto enthusiasts, and rowing Olympians.

They gained widespread recognition for their major Bitcoin investments, as well as the high-profile legal battle with Mark Zuckerberg.

As of 2024, the combined Winklevoss Twins’ net worth stands at over $6 billion, with both brothers holding roughly the same amount based on their mutual investments.

To learn the story of the two men who claimed to have come up with the idea behind Facebook and made billions of dollars through smart investments, keep reading.

Key Highlights from Winklevoss Twins’ Net Worth

- Crypto Pioneers: The Winklevoss twins are notable for their early and substantial investments in Bitcoin, contributing significantly to their $6 billion net worth.

- Gemini Success: Their cryptocurrency exchange, Gemini, is a major success, processing around $200 million in daily trades and offering over 90 cryptocurrencies.

- Diverse Investments: They have stakes in 50+ crypto and blockchain startups and significant real estate holdings, illustrating a well-rounded investment strategy.

- Resilience and Innovation: Despite challenges like legal battles with Facebook’s Mark Zuckerberg, they have remained influential figures in the tech and finance sectors.

Fun Facts about the Winklevoss Twins

- The Winklevoss twins competed in the 2008 Beijing Olympics in rowing.

- They were portrayed by Armie Hammer in the movie “The Social Network.”

- The twins founded HarvardConnection, later rebranded as ConnectU, a precursor to Facebook.

- They taught themselves HTML and started a web-page company in high school.

- Their Bitcoin investment of $11 million in 2013 is now worth billions.

- They co-founded the Nifty Gateway NFT marketplace, later acquired by Gemini.

Winklevoss Twins’ Net Worth Breakdown:

As prominent figures in the crypto community, the Winklevoss twins have amassed a considerable net worth through their involvement in the crypto industry.

They are renowned for their early investments in Bitcoin and subsequent ventures in the crypto market, namely the crypto exchange Gemini.

In general, people with such significant wealth rarely disclose information about their assets. However, considering the twins’ notable involvement in the crypto industry, there is plenty of public information to build a strong estimate of their net worth. Here’s how it breaks down.

| Asset or Income Source | Contribution to Net Worth |

| Settlement money | $20 million |

| Facebook stock | $45 million |

| Bitcoin investment | $11 million in 2013 |

| Bitcoin fortune today | $4.6+ billion (70,000-180,000 Bitcoin) |

| Stake in Gemini | Majority stake of unknown value |

| Other crypto/blockchain investments | Investments in 50+ startups of unknown value |

| Real estate | $18+ million |

| Total Net Worth | $6+ billion |

Winklevoss Twins Net Worth: Early Life and Education

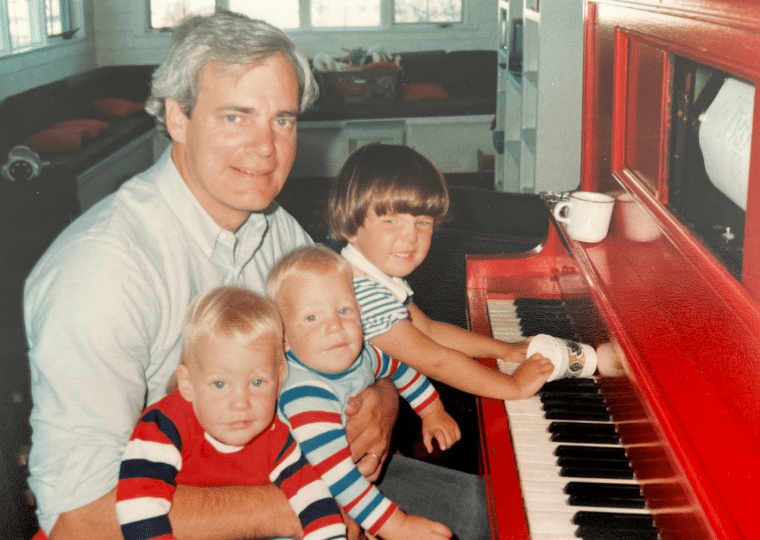

Tyler and Cameron Winklevoss were born on August 21, 1981, in Southampton, New York, to Carol and Howard Winklevoss.

Their father was a professor of actuarial science at the Wharton School, University of Pennsylvania, as well as an author.

The Winklevoss twins weren’t the only children of the family. In 2002, the twins’ older sister Amanda died from cardiac arrest due to a drug overdose. Tyler Winklevoss later wrote a letter to celebrate his sister’s memory, telling the story of her life.

Tyler and Cameron Winklevoss were raised in Greenwich, Connecticut, where they attended Greenwich Country Day School, followed by their graduation from Brunswick School.

The brothers had a virtually identical childhood and academic journey.

They built Lego together, played classical piano for over a decade, and studied Latin and Ancient Greek while in high school. The twins were also natural rowers who frequently participated in duo events like coxless pair.

During their junior year, they taught themselves HTML and used their newly acquired skill to start a web-page company, which provided websites to businesses.

In 2000, Tyler and Cameron both enrolled in Harvard College and studied Economics, graduating in 2004. At Harvard, they were members of the Porcelain Club and the Hasty Pudding Club.

Following this educational success, the twins both enrolled in the Said Business School at the University of Oxford, where they obtained their MBA education in 2010.

Over the years, Cameron and Tyler Winklevoss have lived very similar lives, working and investing together, which is how they have the same estimated fortune in their combined net worth.

Winklevoss Twins Net Worth: The Rise to Billionaire Status

The twins have a large combined net worth that comes from their investments, business projects, and the money they received from the legal fight we talked about earlier. Through their investment firm, Winklevoss Capital, and their Gemini Cryptocurrency Exchange, the brothers have created a fortune by using their talents and strong brotherly bond. Let’s explore how they achieved their wealth.

HarvardConnect (Rebranded as ConnectU)

In 2002, while they studied at Harvard, the Winklevoss twins partnered with their fellow classmate, Divya Narendra, and conceived a social network for other students at the school to use, initially called Harvard Connection.

Not long after, their concept expanded to other schools. The idea was to create a separate social network for each school so that students could exclusively connect and communicate with their peers.

In 2003, the partners enlisted the help of Sanjay Mavinkurve, a programmer and another Harvard student, to start working on their idea. Mavinkurve started the project but left it when he graduated a few months later and went to work for Google.

When Mavinkurve left, the Winklevoss twins and Narendra approached Victor Gao, a senior of Mather House.

He didn’t want to become a partner in the project and decided to work with them for a salary. He coded the website during the summer and the fall of 2003 and was reportedly paid $400 for his work.

However, Gao also left the project because of personal commitments. Following his suggestion, the three partners finally reached out to Mark Zuckerberg and invited him to join their HarvardConnection team. Within days, they met to discuss his programming role, and in November 2003, the Winklevosses and Narendra met with Zuckerberg at Harvard’s dining hall, where they shared the idea and project details.

Later, during the legal trial, the partners stated that Mark Zuckerberg entered into an oral contract with them and became their partner.

Apparently, he was even given the password for the finished code and website so that he could work on the remaining programming tasks.

The Legal Battle with Mark Zuckerberg

After a lot of back-and-forth communication between them, Zuckerberg decided to create TheFacebook (the “The” was axed before long) and registered thefacebook.com.

He co-founded the site with an entirely different team of people, including Eduardo Saverin, Dustin Moskovitz, Andrew McCollum, and Chris Hughes.

The Winklevoss twins and Narendra first learned of thefacebook.com on February 6, 2004, when they read a press release in the Harvard Crimson. Four days later, they sent him a cease and desist letter and reached out to the Harvard administration to act on what they viewed as a violation of the honor code of the school. However, this matter was outside the university’s jurisdiction, so they decided to take the matter to court, claiming that Zuckerberg stole their idea to build Facebook.

Narendra, Cameron, and Tyler had collected tons of evidence in the form of text messages and emails with Zuckerberg. However, by the time they took this to court, Facebook was already taking the world by storm, and they were basically left in the dust.

In the beginning, it seemed that their case would be dismissed. The owners claimed that Zuckerberg stole their idea, business plan, design, and technology, but Facebook launched in February 2004, and ConnectU launched three months later.

The Winklevoss twins eventually succeeded in winning a lawsuit against Zuckerberg in 2008. They won $65 million, including just $20 in cash, and the rest was paid in Facebook stock.

This was far from enough in the Winklevoss’ eyes, so the partners kept suing, but they eventually agreed to walk away with the settlement money and stock.

Bitcoin Investments: A Golden Decision

Following the long legal battle, the Winklevoss twins closed the chapter with Facebook and decided to start investing the settlement money. In 2013, they started investing in Bitcoin which was only a few years old at the time.

Initially, Tyler and Cameron Winklevoss invested $11 million to buy about 110,000 Bitcoin, constituting about 1% of the entire supply. They acquired BTC at $10 per coin, an investment that would be worth over $11 billion today if they hadn’t sold any of it. However, some sources say that the brothers sold a big portion of these digital assets and now own around 70,000 Bitcoin, which would be worth around $4.4 billion.

“So, we bought our first Bitcoin under $10. At that time, it was a combination of using over-the-counter brokers and also buying on Mt Gox, which was the largest exchange.” – said Cameron Winklevoss about the investment.

Winklevoss Capital Management

The brothers also opened their own investment firm, Winklevoss Capital Management. The family company’s investments are spread across multiple asset classes, and the business is headquartered in the Flatiron District in New York.

In 2013, Digital Assets Services, LLC, a company wholly owned by Winklevoss Capital, filed a Form S-1 with the US Securities and Exchange Commission to form the Winklevoss Bitcoin Trust. This was similar to an ETF for Bitcoin, and it changed the game in the crypto world.

Around the same time, the Winklevoss twins were busy working on BitInstant, a promising Bitcoin exchange startup based in NYC. They spearheaded a funding round that got $1.5 million in seed funding, which helped BitInstant expand its team and boost its offerings.

Since these ventures, Winklevoss Capital has been actively fueling innovation in cryptocurrency. Fast forward to 2014, and the firm made another smart move by investing in Protocol Labs. In 2017, they joined the fundraising efforts for Filecoin.

The Birth of Gemini

The brothers’ early investment in Bitcoin was just the beginning of their journey in the world of digital assets. Soon after they bought into Bitcoin, they founded a cryptocurrency exchange called Gemini Trust Company in 2014. Fast forward to today, and Gemini is one of the largest crypto exchanges in the world. It processes around $200 million daily in trades. Cameron Winklevoss is the company’s president, while his brother, Tyler Howard Winklevoss, is the company’s CEO.

Gemini has grown to offer over 90 cryptocurrencies, derivatives, a credit card, custodial and staking services, and more.

In 2016, the Winklevoss twins introduced a digital auction platform for Bitcoin to facilitate larger trades at lower costs and price discovery.

At one point, Gemini bought the Nifty Gateway NFT marketplace from Duncan and Griffin Cock Foster, but after its founding in 2018, this venture experienced painful security issues. Therefore, the Winklevoss twins decided to focus on other Gemini services in the crypto market, adding more features like Gemini Earn and the Gemini dollar, the latter being its US dollar-backed stablecoin.

Consequently, Nifty Gateway shut down its website and moved many of its digital assets to the Polygon blockchain.

Gemini’s Earn Platform and the Company’s Financial Struggles

Like most companies in the crypto world, Gemini also struggled with the impact of the crypto bear market between 2021 and 2022, so much so that it had to lay off 10% of its workforce and stop issuing redemptions for funds through the sister company Genesis Global Capital.

Before the crisis in the crypto industry, Gemini promised users 8% low-risk returns on their investments, but it funneled the money to Genesis Global Capital, a cryptocurrency lending firm that collapsed during the FTX debacle. It turns out that the returns are high-risk, proven by the situation with Genesis.

By the end of 2022, investors sued the Winklevoss brothers for not returning interest on their deposits, alleging that the company sloppily funneled user funds through Gemini Earn. Eventually, the Winklevoss twins reached a settlement with the State Department of Financial Services to give back $1.1 billion to Gemini customers. Consequently, Gemini terminated the Gemini Earn feature in January that same year, and the brothers used $100 million of their personal net worth to pay the users.

Media Appearances

The Winklevoss twins gained a lot of fame after the 2010 film “The Social Network”, where they are played by Armie Hammer. The movie tells the story of how Facebook was founded, depicting the twins’ trials.

The twins were also depicted on The Simpsons in the show’s eleventh episode of season 23, called “The D’oh-social Network”, which aired in 2012. in the show, they are seen rowing in the Olympic Games, and there is also a reference made to their settlement.

Finally, the brothers are the main protagonists in the book “Bitcoin Billionaires: A True Story of Genius, Betrayal, and Redemption”, published in 2019.

Rowing Career

The Winklevoss began rowing when they were only 15 years old. They started at the Saugatuck Rowing Club in 1997, but since their high school didn’t have a crew, in their junior year, the brothers co-founded a crew program.

In the summer of 2004, Winklevosses and their crew, known as the God Squad, headed to Lucerne, Switzerland, for the Lucerne Rowing World Cup. Their journey was marked by fierce competition, including notable victories over the British and French Olympic eight boats in the semi-final. This earned them a well-deserved spot in the grand final, where they ultimately secured a respectable 6th-place finish.

In 2007, the Winklevoss brothers represented the United States at the 2007 Pan American Games in Rio de Janeiro, Brazil. They won a silver medal in the men’s coxless four event and a gold medal in the men’s eight event on the Lagoa Rodrigo de Freitas.

The following year, in 2008, they competed at the 2008 Olympic Games in Beijing, China, in the men’s coxless pair event. Despite facing initial challenges, they secured a spot in the Semifinals after winning the Repechage. They eventually finished sixth in the Final among the fourteen countries.

In 2009, the Winklevoss brothers won a bronze medal at the Rowing World Cup in Lucerne, Switzerland, competing in the men’s coxless four event.

Other Businesses and Investments of the Twins

The majority of the brothers’ investments today are in the crypto industry.

They have made significant investments, most of which are through their firms. They invest millions in blockchain and crypto startups from Slingshot (trading platform) to Taxbit (tax facilitator) to Praxis.

Between their family company’s investments and the investments through Gemini, they have stakes in about 50 crypto or blockchain early-stage startups today.

Since most of the investments are made through the family company, there isn’t much information about where the brothers invested or how much they invested out of their personal net worth. However, we do know about some real estate investments they made over the years.

Real Estate

The twins own a luxury Los Angeles modern mansion worth $18 million. They also reportedly have apartments in Manhattan of undisclosed value, and they are renting their LA mansion. They seem to not care as much about fancy cars, however.

“While they both have apartments in downtown Manhattan, they say they live relatively spartan lives with few luxuries,” – reported Nathaniel Popper from The Times. “Cameron drives an old S.U.V.; Tyler doesn’t have a car at all.”

What Can We Learn from the Winklevoss Twins’ Story?

The Winklevoss Twins, famously known for their role in the early days of Facebook and the crypto community, have built a fascinating story filled with valuable insights for investors and entrepreneurs alike.

One key takeaway from their journey is the importance of weighing diversification and concentration in investment strategies.

Despite their initial financial gain from their early investment in Facebook, the twins recognized the potential of blockchain technology and the cryptocurrency market, which led them to diversify their portfolio by investing in crypto.

However, they didn’t invest in a huge range of investments outside of crypto because they had extremely high conviction that blockchain tech would explode in popularity and value.

The Winklevoss twins’ own crypto exchange and stablecoin are plenty of proof that the brothers have had innovative ideas and haven’t been afraid to push the limits on the market. By creating a coin tied to the US dollar, they provided investors with a good option for navigating the changes in the cryptocurrency market.

Furthermore, the strategic investments in blockchain through their family company, Gemini, demonstrate their forward-thinking approach to the financial future.

The brothers’ foray into the market wasn’t without its challenges, though, particularly when it came to Gemini Earn. Despite their success in other ventures, Earn came across serious problems along the way, including trouble with regulatory compliance and technological challenges.

Despite these road bumps, Gemini persevered and is evidently leveraging its experience to address issues with the platform. Despite facing a lot of skepticism along the way, the twins remained committed to their vision and ultimately emerged as influential figures in the crypto space, not to mention built a tremendous net worth in the process.