When you drive a personal vehicle for business purposes, every mile incurs a cost.

To claim reimbursement from an employer or calculate a tax deduction, you need to quantify that cost.

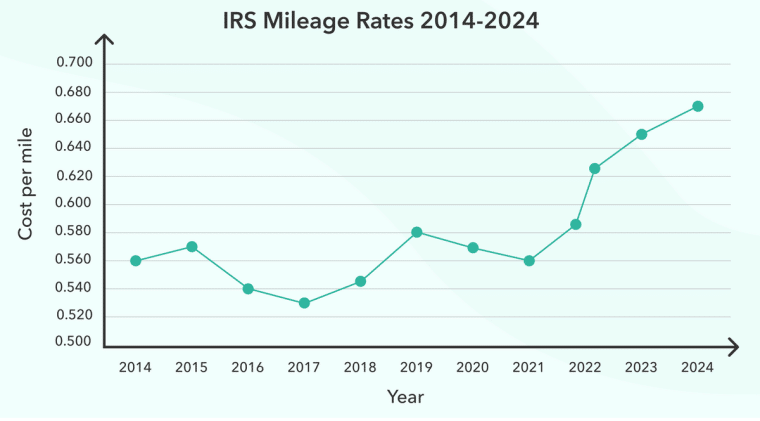

Federal mileage rates are released annually by the Internal Revenue Service (IRS) and act as the standard cost per mile of operating a vehicle. Here are the standard mileage rates for 2023 and how to use them.

IRS Standard Mileage Rates 2023

The standard mileage rates for the 2023 calendar year are:

- Business Rate: 65.5 cents per mile for business use.

- Charitable Rate: 14 cents per mile for charitable use.

- Medical/Moving Rate: 22 cents per mile for medical or moving purposes.

- Purpose: Rates are used to calculate reimbursements and tax deductions for vehicle use.

- Usage: Applicable to cars, vans, pickups, and panel trucks, regardless of fuel type.

What Is The IRS Mileage Rate?

The IRS mileage rate is the standard cost per mile of operating a vehicle. There are separate rates for vehicles used for different purposes.

The business rate is used by:

- employees who drive a personal vehicle for work to claim reimbursement from their employer

- self-employed individuals, to calculate tax-deductible expenses

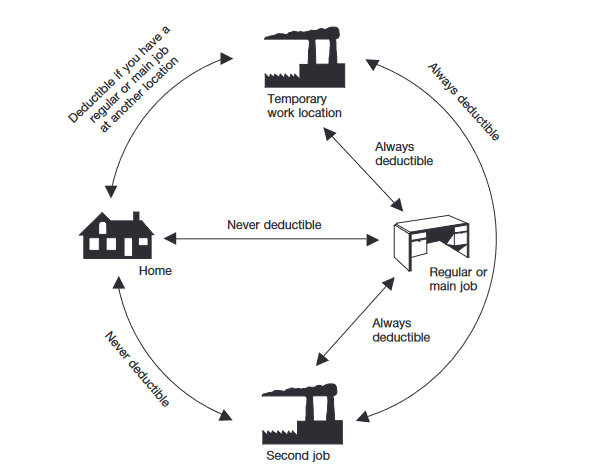

Business use includes visiting customers, buying supplies, making deliveries, attending meetings, and traveling from home to a temporary work venue e.g. project site.

The charitable rate applies to mileage accumulated when you use your personal vehicle to assist charitable organizations or travel somewhere to volunteer.

The medical rate applies to transportation expenses when you go to the doctor, dentist, or hospital in your own car. Medical expenses are tax deductible if they exceed 7.5% of your income.

The moving rate applies to qualified active-duty members of the Armed Forces who incur moving expenses while making a permanent change of station.

How Are The IRS Mileage Rates Determined?

Every year the Internal Revenue Service (IRS) calculates the standard mileage rates based on a study of the costs of operating a vehicle.

The business standard mileage rate includes fixed costs (e.g. insurance, registration fees) as well as variable costs (e.g. fuel, oil) but the rates for charitable, medical, and moving purposes are based only on variable costs.

Standard Rates Vs. Actual Rates

The actual costs of operating a vehicle fluctuate over time and depend on factors like vehicle age and driver habits. Drivers can use standard rates or opt to calculate the actual cost of operating their vehicle. You may choose to calculate both rates to see which provides a bigger deduction.

Actual expenses include:

- gas

- oil, repairs, and tires

- insurance, registration fees, and licenses

- depreciation or lease payments

- parking fees and tolls

For tax purposes, it is compulsory to use IRS rates for the vehicle’s first year of business use.

How To Use The IRS Mileage Rate

Calculating your mileage deduction can be a bit of a pain but it’s easier than you might think. There are 3 steps to calculating your mileage expense.

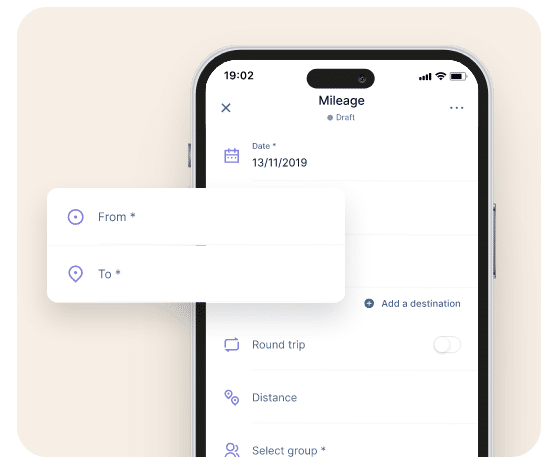

1. Track every mile.

Measure the mileage of every journey using your odometer or a mileage-tracking app. It is also important to check your odometer:

- at the start and end of every year

- when you first use a vehicle for business purposes

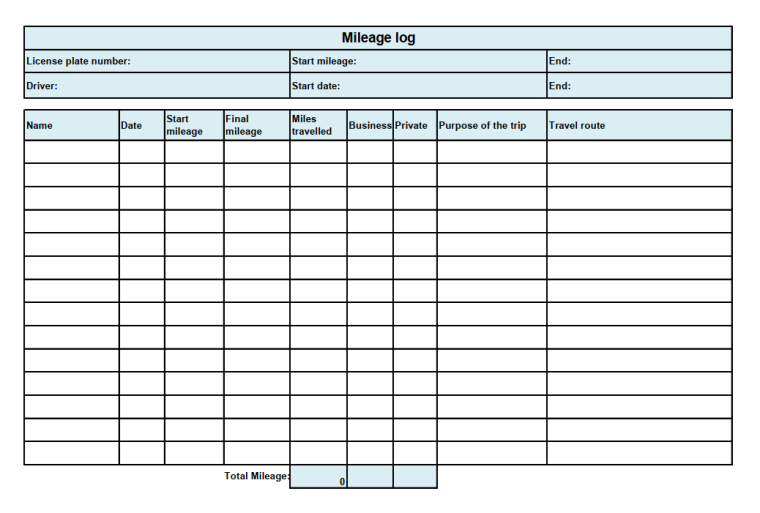

2. Keep a careful log

According to the IRS, “The law requires that you substantiate your expenses by adequate records“. Similarly, if you claim reimbursement, your employer will likely request evidence.

Log every trip, including personal journeys. Include the mileage, date, time, destination, and purpose of the trip, and categorize each journey as business or personal use.

3. Calculate Your Mileage Expense

Say you drove 800 miles in your car in 2023. Of that, 200 miles (25%) were for business purposes. The standard mileage rate for business is 65.6 cents per mile. Therefore:

Mileage deduction = 200 miles x 65.6 cents per mile= $131.20

You’ve worked out that it cost $700 to run your car in 2023 in actual costs. Therefore, based on actual costs:

Mileage deduction = 25% x $700 = $175

In this example, you can deduct more using your actual expenses than at the IRS mileage rate 2023.

IRS Mileage Rates for 2024

As of January 1st 2024, the standard mileage rates are:

- 67 cents per mile for business use

- 21 cents per mile for medical or moving purposes

- 14 cents per mile for charitable use

The Extra Mile

It’s worth noting that there is no federal law requiring employers to reimburse employees for business miles at all, never mind at the standard mileage rate. State law and company policy apply.

Tax regulation is complicated with plenty of exceptions and qualifications, so if you’re unsure about your tax return it’s best to speak to an accountant.