It has been over three years since the former Zappos CEO Tony Hsieh died from injuries he sustained in a fire. To this day, the entrepreneur’s family members, friends, and colleagues are feuding over the billionaire’s assets and estate.

At the time of his death in 2020, Tony Hsieh’s net worth was over $1 billion.

If he kept the Amazon shares he earned in the sale of Zappos, this number would be over $10 billion!

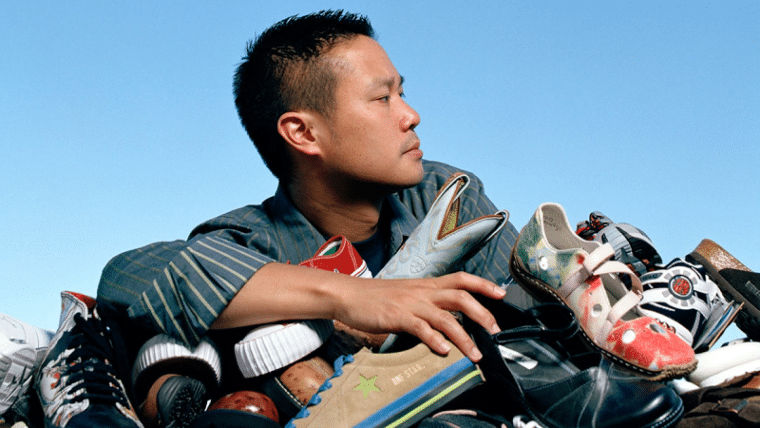

Hsieh was known for his friendly management style and fun-loving approach to making money, as well as for his highly successful shoe business that he sold a few years before his death.

In this article, we’ll tell you the story of how Tony Hsieh made his incredible wealth.

How Much Was Tony Hsieh Worth at the Time of His Death?

- Tony Hsieh’s net worth was estimated at over $1 billion in 2020.

- He sold Zappos to Amazon for $1.2 billion in 2009, reportedly receiving 10 million Amazon shares.

- Hsieh founded LinkExchange, which he sold to Microsoft for $265 million in 1998.

- His entrepreneurial ventures included investments in real estate, with over $56 million worth of properties in Park City, Utah.

- Hsieh was known for his philanthropic efforts, particularly his $350 million Downtown Project in Las Vegas.

Tony Hsieh’s Net Worth Breakdown:

Hsieh’s net worth is a true mystery these days.

He made two major sales during his life, one of LinkExchange and another one of Zappos.

As part of the latter, he reportedly received Amazon stock.

Seeing how he never publicly stated that he sold this stock, we can assume that he still had it at the time of his death, which would place his net worth at over $10 billion!

However, if he sold his stake at Amazon, his net worth could potentially be as low as $1 billion, which makes a big difference for his heirs.

We have been digging deep into the data and, despite all the controversies and legal proceeds following his untimely death, we’ve confirmed some details and can give you a breakdown of Hsieh’s wealth throughout the years:

| Asset or Income Source | Contribution to Net Worth |

| Salary at Oracle | $40,000 |

| LinkExchange sale to Microsoft | $40 million |

| Zappos investment | -$2 million |

| Zappos sale | $214 million, or 3 million Amazon shares |

| Zappos stake via Venture Frogs | $100+ million |

| JetSuite investment | -$7 million |

| Real estate | $56+ million |

| Total Net Worth | $1 billion |

5 Fun Facts about Tony Hsieh

- Tony Hsieh started his career selling pizza in his Harvard dorm.

- He once lived in a trailer park despite his massive wealth.

- His book, “Delivering Happiness,” became a New York Times bestseller.

- Hsieh was renowned for his unique leadership style, promoting a fun and innovative company culture.

- He did not leave a will, leading to significant legal battles over his estate.

Early Life and Untimely Passing

Anthony Hsieh was born on December 12, 1973, in Urbana, Illinois, to his father, Richard, and mother, Judy, Taiwanese immigrants who met while studying at the University of Illinois. Tony Hsieh had two younger siblings, his brothers Andy and Dave.

When Tony Hsieh was only five years old, his family moved to Lucas Valley in Marin County, California, where his father worked as a chemical engineer at Chevron Corp, and his mother was a social worker.

Tony Hsieh studied at the Branson School, after which he enrolled to study computer science at Harvard University. While at Harvard, he sold pizza to other students from his dorm, managing the Quincy House Grille venture. One of his customers, Alfred Lin, would later became the chief financial officer and chief operating officer at Zappos, Hsieh’s most successful business.

Hsieh graduated from Harvard in 1995. For most of his adulthood, he lived in downtown Las Vegas and also owned a home in Southern Highlands in Nevada.

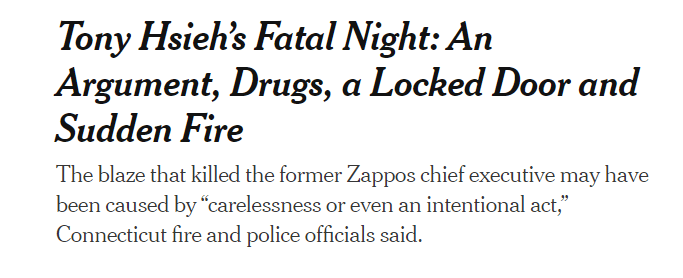

On the morning of November 18, 2020, Hsieh was seriously injured in a fire in New London, Connecticut, and died soon after. Initially, his identity wasn’t revealed, but it was later disclosed that he was the victim of the fire. His untimely death was major news in the media, especially because there were rumors that negligence or potentially even murder caused his death.

Some believed that he was trapped in a pool shed when the fire started. Others believed that he barricaded himself in and wouldn’t open the door. Eventually, the official report from the medical examiner’s office shared that Hsieh passed away from complications of smoke inhalation, and his death was ruled an accident.

Hsieh was initially rescued by firefighters and spent a few days in the Connecticut Burn Center at Bridgeport Hospital, but he succumbed to his injuries on November 27, aged 46.

According to The Wall Street Journal, he was staying at a house that belonged to Rachael Brown, a former employee at Zappos.

Following his death, his friends and family started fighting over his empire because he didn’t have a will.

Hsieh reportedly jotted down specifics of business deals on sticky notes, many of which were strewn across the walls of his home in Park City, Utah. Some people filed claims in court based on those notes, including Mark Evensvold, who has asked for $30 million based on one of Hsieh’s notes, claiming that he also agreed to give him a 20% share in a restaurant business.

Hsieh’s family, on the other hand, claimed that the deceased was swindled out of money by his assistant Mimi Pham, who preyed on his drug-addled state and attempted to exploit him. Through her company Baby Monster, Pham reportedly made a series of contracts that earned her millions of dollars.

Tony Hsieh Net Worth: How the Computer Science Graduate Made Millions Selling Shoes Online

Tony Hsieh’s story started long before he founded Zappos, his most popular business.

Let’s see how he built up his wealth starting from college.

Internet Market Solutions

Hsieh’s first job after Harvard was at Larry Ellison‘s Oracle, but he didn’t enjoy this role, so he started working on side projects with his college classmate Sanjay Mandan while working their 9-to-5 jobs. At the time, he was earning about $40,000 for his work at Oracle

While keeping themselves busy, Tony Hsieh and Sanjay Mandan eventually settled on designing websites. Mandan focused on the technical aspects while Hsieh took on the sales role. Their venture, which was initially called Internet Market Solutions, thrived in no time. They started with a free project for the local chamber of commerce and attracted more small businesses soon after.

They earned $2,000 from a mall project early on in the business. With increasing demand, Tony’s lunch breaks were reduced and Sanjay worked coding late into the night. After five months, they realized they couldn’t build the company while working at Oracle and needed a change.

Realizing they weren’t passionate about web design, the pair brainstormed again, which led to the conception of LinkExchange on a March weekend in 1996.

LinkExchange

Drawing inspiration from Tony’s past success in crowdsourcing study materials, LinkExchange offered small businesses free banner ad swaps on their websites, pioneering a new approach to online advertising.

Soon after the company was founded, the two partners were joined by a third member, Ali Partovi, the brother of Hadi Partovi, their friend from their Harvard days.

Since they didn’t have money to pay their employees at first, Hsieh turned to the same investor who had lost $2,000 in his pizza business at Harvard, the mother of his friend Alex Hsu. Despite the initial loss, she agreed to give them a $200,000 seed investment.

Within just three months of its establishment, LinkExchange boasted over 20,000 participating websites, and its banner ads were displayed over 10 million times.

Fast forward two years and Link Exchange had over 400,000 members. Every day, the platform rotated 5 million ads.

Eventually, the founders decided to sell Link Exchange to Microsoft, who spent $265 million on the purchase. This reportedly added $40 million to Hsieh’s net worth.

Venture Frogs

After the sale of Link Exchange to Microsoft, Hsieh worked with Alfred Lin to co-found another business, an incubator and investment firm named Venture Frogs. The idea behind the business came from a dare when one of their friends said they would invest everything if Hsieh named the business Venture Frogs.

The California-based venture capital firm was established in 1998 and focused on investing in early-stage ventures within the ecommerce, internet, information, and telecommunications technology sectors.

The company exists to this day and is headquartered in the San Francisco Bay Area. Its portfolio includes successful companies like Zappos, OpenTable, STSN, and more. On January 20, 2000, for instance, Venture Frogs made a $1.1 million investment in Zappos.

Zappos

By the end of the 90s Hsieh was already a successful entrepreneur but he wasn’t done just yet. In 1999, the two partners at Venture Frogs – Lin, and Hsieh – were approached by Nick Swinmurn with an idea to sell shoes online. Impressed by the idea, the partners decided to invest $2 million in this new business, originally named ShoeSite, through Venture Frogs. Two months later, Hsieh became the CEO of Zappos, a business that would soon turn into a major success.

In 2001, the company had $1.6 million in sales. Nine years later, it reached $1 billion in revenue.

Zappos was considered one of the best companies to work for, mostly because of Tony’s leadership. As Zappos’ CEO, Tony Hsieh was very popular with employees and customers. He offered free returns and free shipping and turned the business into a Holacracy without job titles, allowing employees to self-organize.

During his tenure, Tony Hsieh moved Zappos’ headquarters several times between the Bay Area, Henderson, and eventually downtown Las Vegas.

On July 22, 2009, Amazon announced that it would be acquiring Zappos.com for $1.2 billion, paying in cash and reportedly, 10 million Amazon shares. Hsieh made at least $214 million from this sale, and that doesn’t include the money he made through his ownership of Venture Frogs.

Hsieh’s Earnings from the Zappos Sale

“Now, in July 2009, as CEO of Zappos.com, I had just announced that Amazon was acquiring Zappos right after we had celebrated our 10-year anniversary. (The acquisition would officially close a few months later in a stock and cash transaction, with the shares valued at $1.2 billion on the day of closing).” – wrote Hsieh in his book Delivering Happiness.

Today, 10 million shares of Amazon stock would be worth over $32 billion, and presuming that he got around 3 million shares through the acquisition, his stake would be worth $9.6 billion. However, we don’t know if he sold his stake in the business or not. If we assume that he kept his stake, his net worth would be drastically higher at the time of his death, counting over $10 billion!

An S4 filing uncovered that Hsieh owned 29.4% of the common shares of Zappos, while Venture Frogs owned 39.9% of the shares, and his partner Lin owned another 2.7% excluding his stake through Venture Frogs. Since he and Lin owned and managed Venture Frogs, they also owned most of Zappos. This would mean that Hsieh made at least $100 million on top of the $214 million from his stake in the business in the all-stock deal with Amazon.

Even though the company was sold to Amazon, Tony Hsieh retained his position as CEO of Zappos for nearly a decade. In August 2020, Hsieh retired as the CEO of Zappos after 21 years of managing the business.

Awards

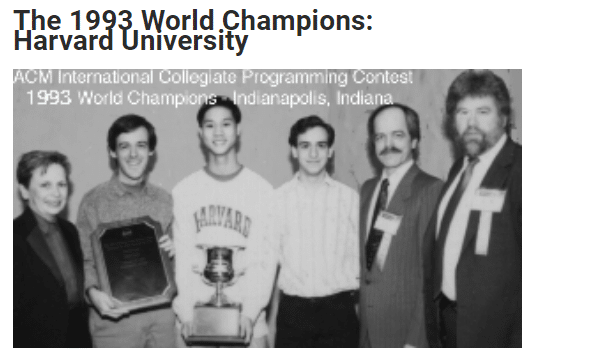

As a renowned CEO and entrepreneur, Hsieh was very popular in business circles. In 1993, he won the ACM International Collegiate Programming Contest in Indianapolis as a member of the Harvard University team, before his rise in the business world.

In 2007, Hsieh received the Ernst & Young Entrepreneur of the Year award.

Philanthropy

Hsieh was known for his leadership style, but also his good heart. Most of his philanthropic activities were associated with downtown Las Vegas.

He founded the Downtown Project worth $350 million, which still aims to revitalize the area by bringing in businesses and schools and turning Las Vegas into a more modern place. The project’s funding was divided between several initiatives: $200 million to be invested in Las Vegas real estate, $50 million for culture, health, and education initiatives, $50 million for small businesses, and $50 million for tech startups.

The businessman originally planned the Downtown Project for Las Vegas to be a place for Zappos.com employees to live and work, but the project became much bigger.

Tony Hsieh Net Worth: Other Ventures, Assets, and Investments

In addition to his major success with Zappos and LinkExchange, the famous venture capitalist made major investments in other businesses, published a bestseller, and invested a fortune in real estate

JetSuite

In 2011, Hsieh joined the board of JetSuite and led a $7 million round of investment in the very light private jet field with the company. This particular investment allowed JetSuite to offer two new Embraer Phenom 100 jets with two engines, two pilots, and safety features.

Authorship

In 2010, Hsieh published his first book titled Delivering Happiness, which became a New York Times bestseller, remaining on the list for over six months.

Real Estate

After he stepped down as CEO of Zappos in 2020, Hsieh bought several properties worth $56 million in Park City, Utah.

Before this, he famously lived in a trailer park, but he did own a home out in the Vegas suburbs.

What Can We Learn from Tony Hsieh’s Story?

Tony Hsieh’s story offers profound insights into leadership and entrepreneurship, teaching us several key lessons.

His entrepreneurial journey, from co-founding the internet advertising network LinkExchange to his transformative leadership at Zappos, exemplifies the power of innovation, vision, and hard work.

His pursuit of customer-centric values and commitment to company culture has been relentless, and as such has set a benchmark for success.

His legacy extends beyond his business achievements to his impact on urban revitalization and community development. His initiatives, such as the Downtown Project, show how transformative it can be to leverage business success for social good.

Hsieh’s passing also highlights the importance of careful estate planning, and understanding the implications of intestate succession laws and federal estate tax.

Business owners, and especially high-net-worth people, need to create an estate plan and proactively address these legal considerations to ensure a smooth transition of assets and minimize the challenges for loved ones.

For many years, his family has been struggling to access his assets, and this part of his story is unfortunetly still far from over.

Finally, while his story is one of remarkable success, it also carries a sobering lesson about the dangers of substance abuse. He struggled with drug use, particularly during his later years, which serves as a stark reminder of the toll that addiction can take on people, regardless of their societal status or achievements.