Anytime you check lists of the most wealthy people in the world you are sure to see Steve Cohen before too long. Impressively, Cohen was born to a middle-class family and managed to craft a staggering net worth from a very young age.

Today, Steve Cohen’s net worth is estimated at around $19.8 billion.

Back in 2006, The Wall Street Journal called Steve Cohen “the hedge fund king” for his accomplishments in the industry. Fast forward to 2023 and Cohen isn’t just a top-earning hedge fund manager – he’s also delved into entrepreneurship, owns a sports club, has a passion for collecting art, and engages in other ventures.

In this article, you’ll learn what he did to amass those billions.

How Much is Steve Cohen Worth in 2024?

- Net worth: Estimated at $19.8 billion in 2024.

- Major income sources: Hedge fund management, art collection, real estate.

- SAC Capital: Managed $14 billion in assets before closing.

- Point72 Asset Management: Manages $26.7 billion in assets.

- Art Collection: Valued at over $1 billion, includes works by Picasso and Pollock.

- Real Estate: Owns properties worth over $1.5 billion.

- Sports: Owner of the New York Mets, invested over $2.5 billion.

Steve Cohen’s Net Worth: Full Breakdown

Steve Cohen has accumulated billions in his net worth, primarily from his rapid trading strategy in hedge fund management, but he has made various other investments and ventures that have also contributed significantly.

It’s impossible to pinpoint Steve Cohen’s exact net worth but we were able to find enough reliable public sources to build a strong estimate of his wealth, income sources, and assets.

Let’s dive in.

| Asset | Contribution to Net Worth |

| Junior trader for Gruntal & Co. | At least $25 million |

| SAC Capital | $14 billion in AUM, 2013 |

| SAC Capital penalties and fines | $1.8 billion |

| Point72 Asset Management | $26.7 billion in AUM |

| Stake in the New York Mets | $2.5+ billion |

| Real estate | $1.5+ billion |

| Art collection | $1+ billion |

| Total Net Worth | $19.8 billion |

6 Fun Facts About Steve Cohen

- Early Life: Born on June 11, 1956, in Great Neck, New York.

- Education: Graduated from the University of Pennsylvania’s Wharton School.

- Art Lover: Owns one of the most valuable private art collections.

- Philanthropy: Donated millions to various causes, including healthcare and education.

- Family: Married twice, has seven children.

- Interests: Enjoys collecting art and owns several luxury properties.

Latest News about Steve Cohen

In July 2024, Steve Cohen’s hedge fund, Point72 Asset Management, made headlines by significantly increasing its stake in Palantir Technologies, acquiring millions of shares.

This acquisition has contributed to Palantir hitting a 52-week high, reflecting growing confidence in the company’s AI-driven business model. Investors have viewed Palantir as a key player in the AI sector, benefiting from continued product innovation and strong government contracts.

Cohen’s Point72 purchased nearly 30 million shares, bolstering Palantir’s momentum in the market(InvestorPlace). This is just one of Cohen’s recent investments, showcasing his ongoing involvement in high-growth technology sectors.

Additionally, Palantir’s stock surged as investors remained optimistic about its AI applications and lucrative contracts and it’s listing in the S&P500, positioning the company for further growth.

In March 2024, Steve Cohen’s philanthropy was highlighted when the Steven & Alexandra Cohen Foundation awarded a $116.2 million grant to LaGuardia Community College.

This grant, the largest ever in CUNY’s history, is being used to create the Cohen Career Collective, a state-of-the-art workforce training center focused on healthcare, technology, and other high-growth sectors. This is part of Cohen’s broader commitment to education and economic mobility, a continuation of his deep involvement in philanthropy and supporting underserved communities.

Steve Cohen’s Early Life

Steven Ira Cohen or, as we know him, Steve Cohen, was born in 1956 in Great Neck, New York, into a middle-class family of ten. After he completed high school, Cohen went to Pennsylvania to pursue a degree in Economics at the University of Pennsylvania’s Wharton School of Business, where he successfully graduated in 1987.

Once he obtained his college degree, Cohen entered the world of trading as a junior trader for Gruntal & Co., a boutique investment bank. He made successful trades while at the company and reportedly generated over $100,000 per day.

With the fortune he collected as a junior trader, he decided to launch his own hedge fund in 1992, called SAC Capital Advisors.

Steve Cohen Net Worth: Tracing the Steps to His Billionaire Success

Discovering your true calling at such an early age is a rare feat – but Cohen made it happen for himself. He started his journey by finding a dream job in which he excelled and from which he earned billions.

This, on its own, is a major success. But, little did we know, this would be only the start of an even more successful career.

Let’s delve into the specifics.

SAC Capital Advisors

SAC Capital Advisors wasn’t a small endeavor, especially since Steve Cohen invested $25 million of his hard-earned money to establish it. Soon enough, SAC Capital Advisors became one of the most successful hedge funds globally.

In the early stages of the hedge fund company, Cohen adopted an aggressive approach by engaging in high-volume investments and maintaining stock positions for periods ranging from only a few hours to a few days. In 1999, he decided to escalate this strategy and set a goal for SAC to trade 20 million shares per day consistently.

His strategy proved highly successful, relying on high-risk, high-reward trading.

The portfolio made 70% returns during the dotcom bubble, followed by 70% more when he shorted the stocks during the tech bursting of the tech bubble in 2000. SAC’s trading accounted for 2% of all the trading activity on the stock market by the year 2006.

In 2007, SAC Capital held a $76 million stock position in Equinix.

Between 1992 and 2013, Cohen’s business counted annual returns of 25% on average for its investors.

In 2009, SAC had a $49 million investment in Whole Foods, which increased to $78 million in 2010. In 2012, SAC Capital invested $26.7 billion in Ardea Biosciences so, when AstraZeneca bought the company a few weeks later, this boosted Cohen’s position in Ardea to approximately $40 billion.

Not all investments were positive for SAC. The hedge fund experienced massive losses in ImClone Systems and Human Genome Sciences, for example.

Criminal Charges

Today, SAC Capital Advisors is a defunct company after a major insider trading investigation was launched by the Securities and Exchange Commission (SEC) back in 2010.

Cohen wasn’t charged, but the company pled guilty to trafficking in non-public information and paid $1.8 billion in fines.

In 2016, Cohen was banned from managing investors’ money for a duration of two years, a ban that expired in January 2018. This is when SAC officially closed its doors to traders.

In 2008, SAC had a $700 million position in Elan and Wyeth, two pharmaceuticals that worked on a drug to treat Alzheimer’s.

This stock plummeted due to poor results of the clinical trials, but Cohen had liquidated his positions in the companies a week before, and also bet against the companies. The move would have saved the firm $276 million (if it wasn’t caught and fined for much more).

In November 2012, SAC was again charged for insider trading. The company pled guilty and agreed to pay a fine of $900 million and asset forfeitures of $900 million. The SEC indicted the company’s portfolio manager Mathew Martoma for insider training, claiming that he received information about the Elan and Wyeth clinical trials and used the information to sell out of the position and make profits.

Steve Cohen was never charged, but he was implicated in the scandal as Portfolio Manager A in the insider-trading case against Martoma. Martoma got nine years in prison and paid $9 million in wages, but the civil suit brought against Cohen was dropped in 2013.

In addition to Martoma, seven SAC employees were found guilty of insider trading. Michael Steinberg, the portfolio manager was also sentenced to prison for insider trading charges, but this was dismissed in an appellate court later on.

Point72 Asset Management

Once his ban for trading ended, Cohen decided to convert his operations to a new business called Point72 Asset Management. The new company was cleared to raise and manage capital in January 2018. This is a family business and Cohen remains its CEO to date.

Point72 Asset Management is a hedge fund with 16 offices scattered around the globe and assets under management of $26.7 billion. The most notable investment of the company is its stake in Tesla.

Steve Cohen and Point72’s Role in Palantir’s Growth

Steve Cohen’s Point72 Asset Management played a pivotal role in Palantir Technologies‘ recent stock surge by acquiring millions of shares. This significant investment underlines Cohen’s bullish stance on companies that leverage artificial intelligence for large-scale data analytics, aligning with Palantir’s core business model.

In July 2024, Point72’s acquisition helped push Palantir’s stock to a new 52-week high, amidst a broader market trend of AI stocks rising sharply.

Palantir has established itself as a dominant player in the AI sector, securing government contracts and expanding into commercial applications, which has attracted high-profile investors like Cohen. As of mid-2024, Palantir’s stock performance has been a reflection of its strong execution and continued innovation in AI-driven solutions for various industries, including defense, healthcare, and logistics.

Steve Cohen’s Investment Portfolio

When it comes to asset management and hedge funds, Cohen is a pro. He’s made billions from his two companies, but where does he invest his money?

In addition to businesses, stocks, and trading activities, Cohen also owns sports teams and invests in real estate. His art collection is impressive, too, and we’ll explore this in more detail shortly.

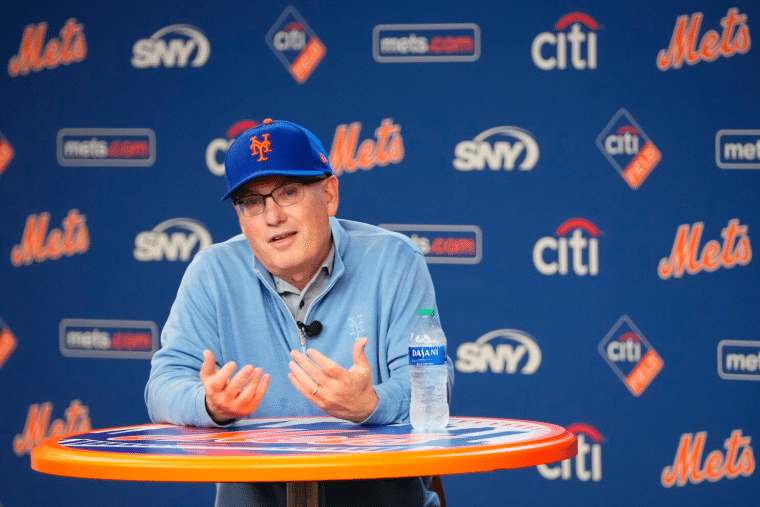

The New York Mets

In 2012, amid the challenges that SAC Capital Advisors faced, Cohen decided to acquire a small stake in MLB’s New York Mets. His stake was 8% in the beginning, which cost him $40 million.

On average, The New York Mets lost about $90 million a year before the coronavirus pandemic. When the pandemic struck, the losses were over $200 million in a single year.

Cohen was considering investing in a bigger stake at the time and while he postponed doubling down on his investment in 2019, the deal fell through in 2020.

In 2020, he bought a much higher stake and got a controlling interest in the New York Mets baseball team for $2.4 billion. Today, he is the owner of the New York Mets with over 95% stake in the team.

Since he became a major stakeholder, Cohen has spent a fortune to improve the New York Mets. For instance, he offered $315 million to Carlos Correa in an attempt to sign him for a 12-year contract.

His investment has certainly paid off. In 2017, Bloomberg valued his small stake at the time at $90 million, which was an increase of 350% in only five years.

He’s invested over $2.5 billion in the club so far, but the current value of his stake in it is unknown.

Real Estate

Back in 1998, Steve Cohen bought a $14.8 million estate in Greenwich, Connecticut, that he still owns to this day. The mansion has a golf course, private ice skating rink, pool, and indoor basketball court. That’s just one of several properties, though.

In addition to this estate, Cohen also owns:

- A Beverly Hills mansion bought for $34.5 million in 2015

- An East Hampton estate bought for $62.6 million in 2013

- Two Delray Beach mansions in Florida worth over $30 million, bought in 2005 and 2021

In addition to these, Cohen also owns several townhouses in Greenwich Village, New York City. The townhomes are all side-by-side and were recently torn down to build a 20,000-square-foot palace.

Art Collection

The hedge fund billionaire is an art aficionado. He started collecting art in 2000 and has a very versatile portfolio today.

His collection includes:

- Pollock drip painting, worth $52 million

- La Reve by Picasso, worth $150 million

- The Physical Impossibility of Death in the Mind of Someone Living by Damien Hirst, worth $8 million

- Jeff Koon’s Rabbit, worth $91.1 million

Cohen’s art collection is truly impressive, featuring masterpieces from artists like Edvard Munch, Willem de Kooning, Alberto Giacometti, Lucio Fontana, and Andy Warhol. The estimated value of his collection is $1 billion today.

Steve Cohen keeps most of his collection in Point72 Asset Management offices around the world, and his most expensive art is kept in the private museum in his Connecticut mansion. The most expensive art purchase to date was his Picasso painting.

He said to Fortune:

When it comes to buying art, I am purely from the gut. And I know right away. If it stays in my brain — let’s say I go see a picture, if I keep thinking about it, I know it’s something I like. If I forget about it, then I know, couldn’t care less.

Philanthropy

Steve Cohen, through the Steven & Alexandra Cohen Foundation, has committed over $1.2 billion to various charitable causes, focusing on healthcare, education, veterans, and children.

Key initiatives include:

- Healthcare: Cohen has made significant donations to combat Lyme disease, including a $60 million donation to establish the Cohen Lyme and Tick-Borne Disease Initiative.

- Veterans: The Cohen Veterans Network was founded with $275 million to provide mental health care for veterans and their families. This network has opened over 25 clinics nationwide, offering free or low-cost mental health services to veterans affected by post-traumatic stress disorder (PTSD) and other mental health challenges.

- Children and Education: In 2024, Cohen’s foundation provided a $116.2 million grant to LaGuardia Community College to establish the Cohen Career Collective, aimed at building a workforce training center. This is part of a broader commitment to improving access to higher education and promoting economic mobility in underserved communities.

- COVID-19 Relief: During the pandemic, the Cohen Foundation made donations to various organizations to support healthcare workers and provide critical supplies in New York, including ventilators and PPE.

- Environmental Conservation: Cohen has supported efforts in wildlife conservation and marine preservation, with donations to organizations like the Oceana Foundation.

What Can We Learn From Steve Cohen’s Success?

The life of Steve Cohen, ‘king of Wall Street’ and owner of the Mets, offers us highly valuable insights into the world of investments, finance, and business.

He’s one of the most successful hedge fund managers and a versatile investor.

His story underscores the importance of risk-taking, but not just for the sake of it. Over the years, he’s demonstrated tremendous strategy in risk-taking. He can navigate financial markets throughout difficult times and makes informed decisions when it comes to investing his money.

While he’s experienced some serious troubles over the years, including the insider trading charges and the outside capital trading ban, he persevered and reached even greater success.

This shows us that, with some talent, good business acumen, and courage, you can succeed even if it feels like everything is failing you.

But, it also teaches us a lesson that, in business, working fairly and lawfully is important because one decision can make or break a business – and even put you in jail like the case of some of SAC’s employees.