When we talk about self-help and financial coaching, one of the most prominent names that comes to mind is Robert Kiyosaki. He is an entrepreneur, educator, and the author of a bestselling inspirational finance book titled ‘Rich Dad, Poor Dad’.

As of now, Robert Kiyosaki’s net worth is estimated to be around $100 million.

Kiyosaki’s journey to financial success was marked by several failed businesses and multiple bankruptcy filings. He finally found his place in financial education and today, millions of people have read his book and many pay him hundreds of thousands to have him speak at major events.

Kiyosaki is recognized as an investor with valuable insights for individuals and entrepreneurs. In this post, we’ll delve into the details of how he built his net worth and the investments that contributed to his financial success.

Key Highlights: How Much is Robert Kiyosaki Worth in 2024? No one but Robert Kiyosaki (and perhaps his accountant) knows his exact net worth. Essentially all of his income sources are private companies that aren’t required to post financial statements publicly. Nevertheless, we were able to find enough information to put together a strong estimate of his net worth. Note that losses from lawsuits, bankruptcies, etc. are not included in the table. Here’s how it breaks down: Robert Kiyosaki is a Japanese American, born to Ralph and Marjorie Kiyosaki on 8 April 1947. He was born and raised in Hilo, Hawaii, and completed his high school education in 1965. After high school, Kiyosaki attended the US Merchant Marine Academy in New York State. He joined the US Marine Corps quickly after as a helicopter gunship pilot and served in Vietnam between 1972 and 1973. After his Vietnam tour, Kiyosaki continued his college education at the University of Hawaii at Hilo. He earned an MBA and started working as a sales associate for Xerox, where he remained until 1968. Robert Kiyosaki’s journey had its fair share of ups and downs. The early days were especially rough for the American entrepreneur. Below we’ll delve into his journey to becoming one of the most respected financial writers to ever live, all while amassing a small fortune. As soon as he obtained his MBA from the University of Hawaii, Kiyosaki moved to New York City and worked at Xerox before he started his first business. Before he succeeded as an entrepreneur, Kiyosaki made two failed attempts at entrepreneurship. He started a business that sold velcro/nylon wallets when these were hard to find on the market. The business experienced little success and eventually went bankrupt. After this failure, Robert Kiyosaki invested in his own retail business that sold t-shirts. At first, the company had moderate success and Kiyosaki licensed the rights to make clothes such as hats and bags for several Rock bands. However, this company also went bankrupt after a few years. The third attempt at entrepreneurship turned out to be a roaring success, proving the value of persistence. After two failed businesses, Kiyosaki decided to dabble in the world of education and started his company called Excellerated Learning Institute in 1985. The company’s focus was on teaching young people about self-responsibility. After the business took off, he sold it and started investing in real estate. In 1991, Robert Kiyosaki published his first book ‘If You Want to Be Rich and Happy, Don’t Go to School’. The book criticized college education and especially Doctorate programs. It encouraged readers to jump into the business world as soon as possible and praised investing in real estate. At this point in Kiyosaki’s life, he was heavily involved in such investments. Things started looking bright for Robert in 1997 when he founded a company called Cashflow Technology. This is the financial education company behind his famous brand Rich Dad, among a few others. This same year, the entrepreneur published his best-selling book ‘Rich Dad Poor Dad’ under the same brand. In 1996, Robert Kiyosaki started a financially focused company called ‘Rich Dad’. The company offers educational courses, publications, games, and financial classes. The company today has over one million followers on Twitter, 13 patents, and 62,000 referring domains. This was just the beginning of a very successful brand. The company’s educational arm, Rich Dad Education was founded in 2006. It now counts over 20,000 students in Canada, the UK, and of course, the US. It’s worth over $20 million and offers a range of educational services and products including: It all started with a board game named ‘Cash Flow’ that Kiyosaki created, which aimed to teach children about finances and financial freedom. Since the game was an instant success, Kiyosaki decided to release his book ‘Rich Dad, Poor Dad’. The book shares comparative stories of his two ‘dads’ – one poor and the other rich. The book is somewhat of an autobiography that aims to derive lessons from Kiyosaki’s life and the people in it. The poor dad is the author’s father, an educated professor with a PhD, but little money in his bank account. Kiyosaki explained in an interview with DJ Vlad that the rich dad is the father of his best friend growing up.

Robert Kiyosaki’s Net Worth: Full Breakdown

Asset

Contribution to Net Worth

Social media earnings

~$146k per sponsored post

Book profits

$270+ million

Real estate

$1+ million

Seminars and speaking events

$75k-$100k per appearance

Total Net Worth

$100+ million

5 Fun Facts about Robert Kiyosaki

Robert Kiyosaki’s Early Life

Robert Kiyosaki Net Worth: How He Became a Multi-Millionaire

Kiyosaki’s First Steps in the Business World

The Publishing of Kiyosaki’s First Book

Robert’s True Claim to Fame and Riches

The Story Behind the Rich Dad Brand

The Story Behind ‘Rich Dad, Poor Dad’

Some fans of the book speculate that the rich dad is actually a fictional character that Kiyosaki created to effectively inspire his readers to become financially literate and give his ideas more legitimacy.

The book is a fantastic resource for absolutely everyone who isn’t very familiar with finances. It is often regarded as one of the best books to read to help you make better financial decisions.

It was self-published but was soon picked up by Warner Books. It became a bestseller and remained on the New York Times bestseller list for over 6 years. The book sold over 32 million copies.

Other Books by Robert Kiyosaki

Kiyosaki went on to write more than 26 books, two of which are in collaboration with Donald Trump:

- Midas Touch

- Why We Want You To Be Rich

When Kiyosaki appeared on the Oprah Winfrey show in 2020, his appearance boosted the book’s sales even further.

The two published books were just the beginning of Robert’s career as an author. Here is a short list of his most popular books:

- Rich Dad’s Guide to Investing

This book is a guide to understanding real estate investing. It also talks about entrepreneurship and stocks, encouraging readers to enrich their financial literacy and make smart investment decisions.

- Why the Rich are Getting Richer

In 2017, Kiyosaki released another bestseller where he presents the educational system as the reason for the gap between the ‘rich and everyone else’.

- The Cashflow Quadrant

‘The Cashflow Quadrant’ shares a rather unique perspective on financial freedom and the ways to earn money.

- Why ‘A’ Students Work for ‘C’ Students and ‘B’ Students Work for the Government

In this book, Kiyosaki once again promotes the idea that higher education is irrelevant and shares that, in many cases, A students work for those who studied less. The idea behind this is to prioritize entrepreneurial thinking and skills over traditional education.

- Who Took My Money?

Kiyosaki speaks about factors that erode people’s finances such as mismanagement and taxes, as well as inflation. It’s a book that shares advice on how to protect your finances.

In all of his literature, Kiyosaki shares his belief that the secret to being rich is not high education but financial literacy. On his company’s TikTok channel, he’s shared six basic words of financial literacy: income, expense, asset, liability, and cash flow.

Kiyosaki’s Most Controversial Bankruptcy Claim

Robert Kiyosaki has filed for bankruptcy for several companies he owned over the years. The most notable bankruptcy claim happened in 2012 after he lost a legal case for his Rich Global brand.

On August 20, 2012, the entrepreneur filed for corporate bankruptcy through Rich Global LLC. His business has been weighed down by multiple lawsuits. The most devastating case was filed by one of the company’s former backers Learning Annex.

Bill Zanker, the founder of Learning Annex, sued Kiyosaki claiming that he failed to pay a percentage of profits from the speaking engagements the company arranged and organized for him.

The case ended when a district judge in New York ruled against Kiyosaki, asking him to pay $23.7 million to the Learning Annex.

According to Mike Sullivan, the CEO of the Rich Dad Co., the most profitable of Kiyosaki’s corporations, Rich Global didn’t have the funds to pay such an extravagant sum. According to the bankruptcy filing, the company has assets of only $1.8 million. Here’s what he told the Post:

“Robert and [wife] Kim are not paying out of personal assets. We have a few million dollars in this company, but not 16 or 20. I can’t do anything about a $20 million judgment . . . We got hit for what we think is a completely outlandish figure.”

While several of his companies have gone bankrupt over the years, this is separate from his personal finances, so Kiyosaki is not bankrupt in a personal capacity. Ergo, his net worth of $100 million!

Seminars and Speaking Fees

Robert Kiyosaki’s net worth is now mostly sourced from the sale of his books and his public appearances. His business model currently focuses on seminars conducted by different experts. Some of them are free, but the majority of his seminars cost hundreds – or tens of thousands of dollars.

If you are interested in having this entrepreneur speak at an event you better start saving now. He charges around $75,000 – $100,000 for an appearance.

Robert Kiyosaki’s Critics

Robert Kiyosaki has come under fire from many critics who question his methods and philosophies, especially for his bankruptcy claims. He’s been accused of running fraudulent courses and some critics have gone so far as to name him ‘a scam artist’.

In 2010, for instance, CBC Marketplace released their segment on his brand and seminars, criticizing his workshops as deceptive. However, Kiyosaki remains strong in the financial education market with an enormous fan base. His book ‘Rich Dad, Poor Dad’ has over 260,000 5-star reviews on Goodreads and a rating of 4.12/5.

Where Does Robert Kiyosaki Invest His Money?

Kiyosaki prioritizes investments that don’t tumble down during inflation. He invests in precious metals like silver and gold, but also real estate and cryptocurrencies.

Real Estate

At the age of 26, Kiyosaki bought his first apartment in Hawaii. This was the first of many properties he’s invested in over the years. During his career, his portfolio increased to accommodate commercial and residential properties in Nevada, Colorado, Georgia, Scottsdale, Arizona, Virginia, and other locations.

His initial investment was for a $65,000 property. When the market’s rates went up, he sold it for $95,000 and used the money to invest in a 12-unit apartment complex worth $300,000.

When the price went up two years later, he sold this complex for $495,000 and reinvested the money into a building with 30 units that earned him $5,000 monthly.

He then sold that building for $1.2 million.

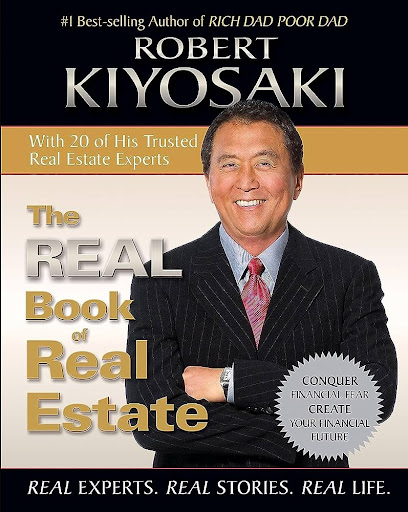

Kiyosaki invests in real estate for long-term wealth. He doesn’t exactly focus on flipping properties but evaluates the value of each asset over time, and sells when it’s most profitable. He’s also published a book on how to invest in real estate.

One of his smartest real estate investments is his former oceanfront home in Oahu which he bought for $2.75 million and sold at a 267% ROI – for $7.35 million in 2022.

Precious Metals

According to Kiyosaki’s tweets, silver is the lowest-risk, highest-potential investment over time. He also invests in gold and uses the two as a hedge against inflation. His recommendations are to invest up to 10% of your portfolio in these metals.

In one of his tweets, Kiyosaki said: “I do not touch paper gold or silver ETFs. I only want real gold or silver coins.”

Q: What is BEST investment VAUE TODAY? A: silver. Gold over $1700 and silver falls to $20. I do not touch paper gold or silver ETFs. I only want real gold or silver coins. Silver is an industrial precious metal. Gold is not. Do not take my word for it. Study precious metals

— Robert Kiyosaki (@theRealKiyosaki) July 29, 2022

Here are a few of his known investments.

In 2017, the investor bought a gold-backed token called KaratCoin. The following year, he prepared for an economic recession by buying gold and silver bullion. In 2019, he invested in platinum and palladium coins.

Crypto

Robert Kiyosaki is a known crypto investor. He once tweeted: “I love Bitcoin because I do not trust [the] Fed, Treasury, or Wall Street.” He advises investors not to put more than 5% of their money in cryptocurrencies, and to spread out the risk by investing in versatile coins.

That being said, Kiyosaki has known investments in Bitcoin, Ethereum, Solana, and a few other coins.

Giant crash coming. Depression possible. Fed forced to print billions in fake money. By 2025 gold at $5,000 silver at $500 and Bitcoin at $500,000. Why? Because faith in US dollar, fake money, will be destroyed. Gold & Silver Gods money. Bitcoin people’s $. Take care.

— Robert Kiyosaki (@theRealKiyosaki) February 13, 2023

Public Perception and Media Critiques

Robert Kiyosaki’s methods and financial advice have polarized public opinion.

Critics often challenge the validity of his “Rich Dad” inspiration and have scrutinized his bankruptcy filings, suggesting they contradict his financial advice. Media critiques also focus on the high cost of seminars and their aggressive marketing tactics, which some attendees have labeled as misleading.

However, his supporters admire his straightforward approach to financial education and his advocacy for financial independence through investing and entrepreneurship.

Business Investments and Ventures

Beyond his books and seminars, Robert Kiyosaki has diversified his business ventures into areas including real estate and technology.

His real estate investments have been particularly lucrative, often used as case studies in his teachings on how to build wealth.

Kiyosaki also invests in precious metals and cryptocurrencies, advocating these as viable strategies for protecting wealth against economic uncertainties.

His company, Rich Global LLC, while having faced financial challenges, underscores his commitment to spreading financial knowledge through various mediums.

What Can We Learn From Robert Kiyosaki’s Success?

Investing and finance topics are bewildering and complex to many people. A shocking number of people lack the basic financial skills it takes to stay afloat in today’s difficult economic situation.

There is much to learn from Kiyosaki, both from his books and from his career.

His books (especially ‘Rich Dad, Poor Dad’) can teach you about financial literacy and give you strong guidelines for becoming financially stable. Even those who think they are already familiar enough with finances and investing could get a lot out of his books.

Kiyosaki’s career also exemplifies the value of perseverance and shows that you can make it by teaching others how to be successful. Wealth isn’t a zero-sum game and there is always room for you to be successful if you persevere. If Kiyosaki gave up after his 2nd failed business, he wouldn’t be a world-renowned figure with a fortune to his name.