Reed Hastings, the co-founder and chairman of the streaming platform Netflix, has changed the entertainment industry at its core. When Netflix’s stock peaked, Hastings’ fortune reached $7 billion.

In 2024, though, Reed Hastings’ net worth is estimated at $5 billion.

The American businessman has earned most of his fortune through Netflix compensation and stock, but he also sits on several boards, which adds even more to his net worth.

How Much is the Netflix Owner Net Worth in 2024?

- Reed Hastings’ net worth in 2024 is estimated at $5 billion.

- Most of his wealth comes from his role at Netflix, including stock options and salary.

- He co-founded Netflix after selling his first company, Pure Atria.

- Hastings’ major philanthropic efforts include donations to historically black colleges.

- He remains a significant figure in the tech and entertainment industry through board memberships and investments.

Reed Hastings’ Net Worth Breakdown:

Reed Hastings has been accumulating millions yearly from his role as CEO and chairman of Netflix, the company he co-founded. He was also the co-founder of another profitable business, which he sold before forming Netflix.

As you would assume, most of his net worth comes from his stake and earnings from Netflix, but we also found that he has been earning money from board memberships and has a significant stake in at least one other business.

Here is a short breakdown of his wealth as it stands:

| Asset or Income Source | Contribution to Net Worth |

| Pure Atria sale | Unknown share of $623 million |

| Netflix investment | -$2.5 million |

| Netflix earnings as CEO and Chairman up to 2023 | $40-50 million per year |

| Netflix Chairman salary, 2023 | $500,000 plus stock options |

| Netflix stock | $1.8 billion |

| Meta stock | $23 million |

| Powder Mountain stake | $100 million |

| Total Net Worth | $5 billion |

Latest News & Controversies

As of 2024, Reed Hastings, the co-founder and former CEO of Netflix, has an estimated net worth of about $5 billion. His wealth mainly comes from his Netflix stock, which he still holds in large amounts even after resigning as CEO in 2023. In January 2024, Hastings gained attention for donating $1.1 billion in Netflix shares to the Silicon Valley Community Foundation, highlighting his dedication to giving back.

Hastings has also been involved in political commentary, recently advocating for U.S. President Joe Biden to step aside for the 2024 election. He expressed concern that Biden’s performance in debates might hinder the Democratic Party’s chances against Donald Trump.

5 Fun Facts About Reed Hastings, the Netflix Owner

- Hastings sold vacuum cleaners door-to-door to make extra cash in high school.

- He was inspired to start Netflix after paying a $40 late fee at Blockbuster.

- Hastings served in the Peace Corps, teaching math in Swaziland.

- He co-founded Netflix with $2.5 million from his earnings at Pure Atria.

- Reed Hastings’ middle name is Wilmot.

Early Life and Family

Wilmot Reed Hastings Jr. was born on October 8, 1960, in Boston, Massachusetts, to his father, Wilmot Sr., an attorney for the Department of Health, Education and Welfare in the Nixon administration, and mother, Joan Amory Loomis, a debutante.

Young Hastings attended Buckingham Browne & Nichols School in Cambridge. To make extra cash, he sold vacuum cleaners door-to-door.

After a gap year following high school, Reed Hastings enrolled at Bowdoin College to study Mathematics. He spent his summers training at the Marine Corps Platoon Leader School, planning to join the Marines after his graduation.

He spent some time at the Officer Candidate School boot camp at Marine Corps Base Quantico in Virginia in 1981 but didn’t complete the training and wasn’t commissioned into the Marine Corps.

When he graduated in 1983, Hastings joined the Peace Corps, where he taught math in Swaziland schools. He taught around 800 students between 1983 and 1985.

Hastings credits part of his success and entrepreneurial spirit to the years spent in the Peace Corps, having said:

I was a Peace Corps volunteer right out of college in rural Africa, in Swaziland. Either that developed my risk tolerance or it was symptomatic of it. But once you have hitchhiked across Africa with ten bucks in your pocket, starting a business doesn’t seem too intimidating.

During his teaching years, he decided that he wanted to pursue further education and was considering schools like M.I.T. for his Master’s degree. However, he was rejected by his first choice of school and decided on Stanford University. In 1988, Hastings got his Master’s degree in Computer Science.

These days, Hastings lives in Santa Cruz, California with his wife Patricia Ann Quillin. The couple has two children together.

Reed Hastings Net Worth: How a Peace Corps Teacher Became Netflix’s Founder

By the time he had his Master’s degree from Stanford University, Reed Hastings already had solid work experience behind him, which allowed him to find a new job almost instantly.

What’s even more impressive about his story is that Netflix wasn’t the first successful company he founded. Let’s see how he built up his fortune – as well as his fame.

Early Career

After Stanford, Reed Hastings started working for the oilfield services firm Schlumberger. He didn’t stay there for long before he found a job as a software developer for Adaptive Technology, where he created tools for debugging software.

At Adaptive Technology, Hastings met Audrey MacLean, the then-CEO of the company. He would later tell CNN: “From her, I learned the value of focus. I learned it is better to do one product well than two products in a mediocre way.”

In 1991, Hastings decided to leave his job and start his first business, Pure Software.

Pure Software

In 1991, Hastings teamed up with Raymond Peck and Mark Box and launched Pure Software.

Pure Software was a company that created products for software troubleshooting. At first, Hastings had a hard time running the business because he lacked management experience. His education did not equip him for the role of CEO, so he requested the board to replace him as he found it difficult to handle the growing workforce. However, the board declined his request, which made Hastings learn how to manage a business through tough experiences.

Despite his initial struggles, the company thrived in the following years. In 1995, the company was taken public by Morgan Stanley. A year later, Pure Software merged with Atria Software, a combination that mixed the company’s programs for detecting bugs with Atria’s tools for software management.

Sale of Pure Atria

The combined company was named Pure Atria and, in 1997, having struggled with the merger for a while, it was acquired by Rational Software.

The news about the acquisition triggered a major drop of 42% in the companies’ stocks, which reduced the agreed purchase sum to $623 million from the initial $902 million.

Even though he didn’t receive the initially agreed payout from Rational Software, Hastings still added millions to his net worth, though we don’t know exactly how much of the business he owned at this point.

Reed Hastings was the chief technical officer of the combined company but following the acquisition, he stepped down from this role.

Netflix

With an undisclosed number of millions in his net worth and much more experience compared to before, Reed Hastings almost immediately co-founded his next business following his resignation from Pure Atria.

In 1997, Hastings co-founded the DVD rental service Netflix with Marc Randolph, offering flat-rate movie rentals by mail to US customers. This was called the “red envelope revolution” since the partners sent DVDs via mail, allowing customers to order them online instead of printing out paper catalogs.

@netflix Long Live the Red Envelope! #netflix

He reportedly used $2.5 million to fund the business, taking it from some of the profits from the sale of his first company.

Hastings reportedly stumbled on the Netflix idea after he paid a $40 late fee at a Blockbuster rental store because he returned Apollo 13 six weeks late. He realized that his gym’s monthly fee model was much better than the traditional movie rental system, so he decided to create a service that allowed people to pay a flat rate to rent as many movies as they wanted.

“I had misplaced the cassette. It was all my fault. I didn’t want to tell my wife about it. And I said to myself, ‘I’m going to compromise the integrity of my marriage over a late fee?’ Later, on my way to the gym, I realized they had a much better business model. You could pay $30 or $40 a month and work out as little or as much as you wanted.” – he explained to the Super U podcast.

Fast forward to 2007, and Netflix launched a streaming service for movies and shows with Hastings as the only man at the helm. The other co-founder, Marc Randolph, left Netflix in 2002 after the company’s initial public offering.

The Growth of Netflix

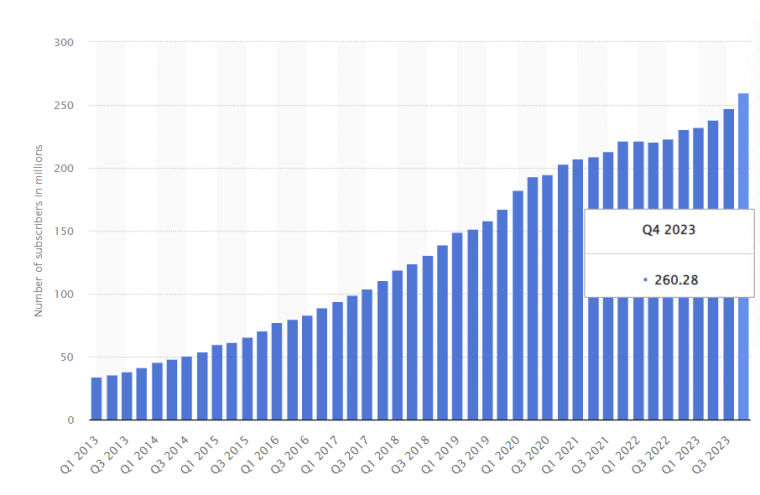

Netflix had raised $30 million in venture capital funding by 1999, only two months after it launched the monthly subscription concept. In 2000, the company had around 300,000 subscribers but it was actually losing money, which prompted Hastings to make Blockbuster an offer to buy Netflix.

Blockbuster initially showed some interest, but when Reed Hastings asked for $50 million, the CEO of Blockbuster John Antioco immediately rejected the offer, so the deal never happened. Short of a decade later, Netflix had become a streaming giant and Blockbuster was bankrupt.

In 2002, the partners took the company public at an initial offering price of $15 per share. Following its IPO, the company had a market cap of $300 million. In July of that same year, Netflix stock crossed $500 for the very first time.

In 2011, shares of the company reached a new high, right before Hastings made what critics at the time considered to be questionable changes. As the company’s chief executive officer, he divided the streaming business and the DVD subscription service into separate services, charging separate fees.

Customers didn’t like this, so Netflix’s stock dropped 75% by the end of the year.

This drop didn’t last long, though. The subscriber base of the video streaming service started recovering soon after, leading to the 260 million paid memberships it counts today.

As high-speed internet became increasingly available, the streaming model made infinitely more sense than rentals of any kind. Netflix’s first-mover advantage in the streaming business was absolutely massive but it didn’t last for long.

In 2013, Netflix started producing its own movies and TV shows, known as Netflix Originals.

As the original subscription service grew in revenue and subscribers, it prompted others to follow suit, so Netflix now has its set of formidable opponents such as Prime Video by Amazon, Disney+ by Disney, and HBO Max by HBO.

Stepping Down as Netflix Co-CEO

In 2020, the company promoted Ted Sarandos to co-CEO of the business, prepping him to take over the full role, which happened in 2023.

In 2023, Netflix’s founder resigned as CEO after having spent 25 years at the helm.

Ted & Greg are now co-CEOs. After 15 years together we have a great shorthand & I’m so confident in their leadership. Twice the heart, double the ability to please members & accelerate growth. Proud to serve as Executive Chairman for many years to come https://t.co/oYc0laqMXQ

— Reed Hastings (@reedhastings) January 19, 2023

Reed Hastings’ Earnings at Netflix

In the last year as a co-CEO of the company, Hastings earned $51.07 million in total compensation, which included $49.4 million in stock awards.

By stepping down in January 2023, Hastings took a pay cut. He remains executive chairman of the company, which comes with a $500,000 base salary and $2.5 million in stock options.

As a co-CEO, president, and chairperson of the board of the company, Hastings made $40 million to $50 million a year in total compensation. His official base salary was $650,000, but he received a lot more in the form of stock options, as well as bonuses.

In 2022, for instance, Hastings got $34 million in annual stock option allocation in addition to his $650,000 salary. A year before that, he received $40.8 million.

These days, he reportedly owns about 2,991,569 shares of Netflix Inc. worth over $1.8 billion, which equals around 2% of the company. In January 2024, he donated roughly $1.5 billion worth of shares to an undisclosed entity.

Philanthropy

Reed Hastings and his wife Patty Quillin are known for their massive donations to charitable causes.

In 2020, the couple donated $120 million to support historically black colleges and universities in the US, a donation that is the first to exceed $100 million from any billionaire or couple to date. This makes Hastings the first of the Silicon Valley business world to make such a donation to promote racial justice.

The $120 million donation was equally split between the United Negro College Fund, Spelman College, and Morehouse College. This was the second donation he made to the United Negro College Fund, having donated $1.5 million for college scholarships through the Hastings Fund.

In 2020, Hastings and his wife donated $30 million to support the COVAX COVID-19 vaccines initiative by GAVI.

One of the issues that Hastings advocates most strongly for is charter schools, including publicly and privately run elementary and secondary schools. In 2006, he donated $1 million to Beacon Education Network to open up new schools in Santa Cruz County.

In 2016, Hastings opened a donor-advised fund at the Silicon Valley Community Foundation, making a major contribution of $100 million.

In 2017, Hastings gifted Bowdoin College, his alma mater, a gift to create THRIVE, an initiative aimed to transform the educational experience for first-generation and low-income students.

Member of the Giving Pledge

Last but not least, Reed Hastings is one of the members of the Giving Pledge, a program started by Bill Gates and Warren Buffett in which rich people pledge to donate the majority of their wealth to charity during their lifetime. Some other members of the Giving Pledge are:

- Ray Dalio, founder of Bridgewater Associates

- Robert Smith, founder of Vista Equity Partners

- Larry Page, co-founder of Google

- Larry Ellison, founder of Oracle

- Dustin Moskovitz, co-founder of Facebook and Asana

- Brian Chesky, Airbnb founder

- Richard Branson, founder of Virgin Media

- Michael Bloomberg, founder of Bloomberg LP

- Tim Cook, Apple CEO

- Mackenzie Scott, Jeff Bezos’ ex-wife

- Melinda Gates, Bill Gates’ ex-wife

Reed Hastings Net Worth: Other Assets and Investments

As the co-founder and former co-CEO of Netflix, Hastings has accumulated the majority of his net worth from his compensation and stake at the company. However, these aren’t the only sources of his wealth.

Board Memberships and Stock in Other Companies

Between 2007 and 2012, Hastings held a seat on the board of Microsoft. Between 2011 and 2019, he was on the board of Facebook, Inc., and in September 2016, he reportedly owned 47,846 of Meta Inc. stock, worth over $23 million. Additionally, Hastings is a former member of the California State Board of Education and a fierce advocate for education reform.

More recently, Hastings became the majority owner of Powder Mountain, a ski resort based in Utah, in which he invested $100 million in 2023.

Authorship

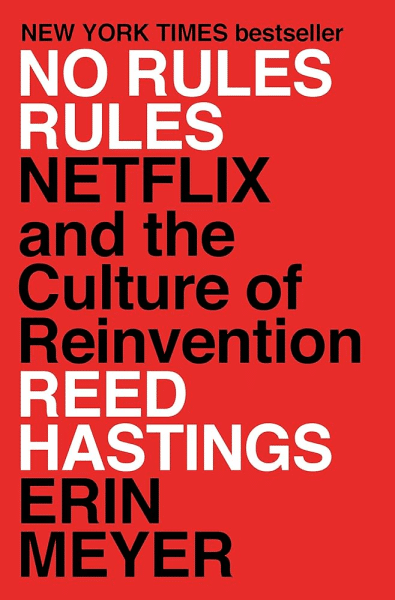

In September 2020, Reed Hastings and Erin Meyer co-authored a book speaking of Netflix’s culture, featuring interviews with the company’s employees. The book was titled No Rules Rules: Netflix and the Culture of Reinvention. The book swiftly became a New York Times bestseller and was featured on year-end lists for publications like The Economist and NPR.

Real Estate Investments

Hastings and his family live in Santa Cruz, California, though the value of their home is undisclosed.

Other Assets

Back in 1995, the businessman appeared in a front-page article in USA Today, posing with his Porsche. He sold his car since and now reportedly owns a Tesla.

What Can We Learn from Reed Hastings’ Story?

Examining Reed Hastings’ story offers valuable lessons about the entertainment industry, online streaming, and entrepreneurship in general. Hastings, who co-founded Netflix and owns a significant portion of it, is a fantastic example of achieving tremendous financial success in life.

He realized that the entertainment industry was dominated by outdated business models and late fees and saw the potential of online streaming before anyone else. Believing in his idea and himself, he invested his own money into Netflix and took a major risk that paid off.

Key takeaways from Hastings’ story include the importance of innovation and adaptability in navigating shifting customer preferences. He has embraced the digital frontier, which led him to transform Netflix into a media powerhouse.

He wasn’t afraid to step out of the traditional and challenged the old models to revolutionize how we consume media by producing original content.

Furthermore, Hastings’ commitment to diversity and inclusion, exemplified by his donations to two historically black colleges, highlights the broader societal impact of philanthropy in the world.

Finally, Hastings’ previous success with another venture shows the importance of courage, but also experience.

At one point, feeling insecure in his expertise, he asked to step down from the managerial role, showing humility and self-awareness. This shows that true leadership is not just about making bold decisions, but also about learning and acknowledging your errors.