Jim Simons, the famous mathematician turned billionaire, is the founder of an esteemed trading hedge fund that currently manages over $50 billion.

As of 2024, Jim Simons’ net worth is estimated at $30.7 billion.

The renowned investor, or as people call him, “the Quant King”, is famous for using quantitative analysis in his strategies. He’s the founder of Renaissance Technologies and its famous Medallion Fund, easily one of the most successful funds of all time.

Simon’s story is very inspiring, especially since he earned his first million after the age of 40. Let’s see how he became the billionaire he is today.

How Much is Jim Simons Worth in 2024?

- Net Worth: $30.7 billion

- Renaissance Technologies Stake: 25%

- Medallion Fund Returns (2021): $3.4 billion

- Simons Foundation Donation: -$2.7 billion

- Superyacht: $100 million

- Private Jet: $70 million

- Real Estate: $1.47 million+

Jim Simons’ Net Worth: Full Breakdown

Even though he’s been retired for over a decade, Simons keeps benefiting from Renaissance Technologies, as he still holds a significant stake in the business.

Throughout his career, he has made countless smart investments, both in business and in philanthropic causes.

In addition to his stake in the hedge fund, he also has billions invested in the firm’s Medallion Fund, which is reserved only for a small circle of inside traders, and has seen the biggest success of all hedge funds managed by Renaissance.

Such a significant net worth makes it difficult to pinpoint every source of the billionaire’s wealth. Even so, we found sufficient data to create an estimate for the biggest contributions to his wealth, such as:

| Asset or Income Source | Contribution to Net Worth |

| Medallion Fund assets | Unknown |

| Medallion Fund returns, 2021 | $3.4 billion |

| Renaissance Technologies stake | 25% |

| Simons Foundation donation | -$2.7 billion |

| Superyacht | $100 million |

| Private jet | $70 million |

| Real estate | $1.47+ million |

| Total Net Worth | $30.7 billion |

6 Fun Facts About Jim Simons

- Mathematical Genius: Holds a Ph.D. in mathematics from UC Berkeley.

- NSA Code Breaker: Worked as a code breaker during the Vietnam War.

- Founder of Renaissance Technologies: Created the hedge fund in 1978.

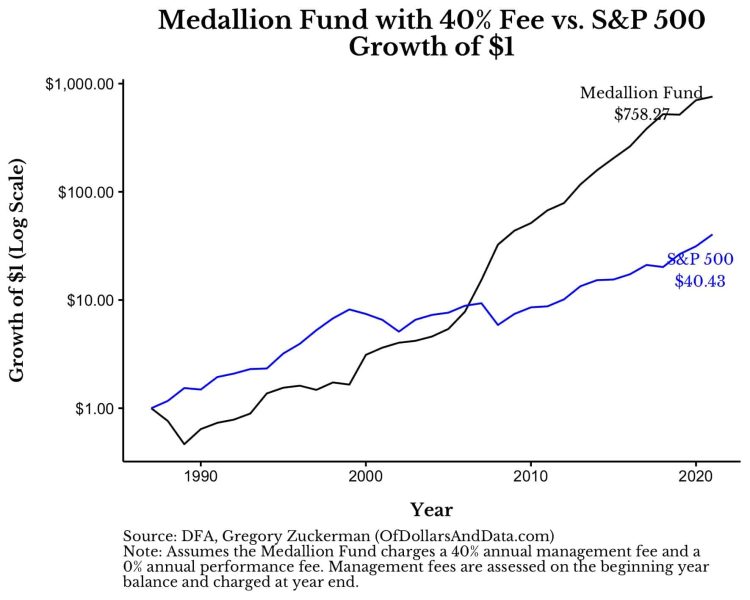

- Medallion Fund: Known for its phenomenal 66.1% average annual return.

- Philanthropy: Co-founded the Simons Foundation, supporting education and health.

- Personal Tragedies: Lost two sons in separate tragic incidents.

Latest News & Controversies

As of 2024, Jim Simons continues to make headlines for his unparalleled contributions to both the finance industry and philanthropic efforts. Simons passed away in May 2024 at the age of 86. Known for founding Renaissance Technologies and pioneering quantitative finance, his Medallion Fund remains one of the most successful in history, delivering annual returns of 66% since its inception.

Simons’ legacy includes his revolutionary use of mathematical models and data in trading, a technique that is now a gold standard in the financial industry. Despite his genius, Simons was also a controversial figure—especially for his opposition to the Vietnam War, which cost him a position at the Institute of Defense Analysis

Additionally, his vast charitable donations, especially through the Simons Foundation, have left a lasting impact on scientific research, with over $2.7 billion directed toward education and health. He has also faced scrutiny over his hedge fund’s Medallion Fund tax practices, which sparked debates over the use of complex financial strategies to minimize tax liabilities.

The Early Life & Origins of a Trading Genius

James Harris Simons, or as people call him, Jim, was born on April 25, 1938, in Brookline, Massachusetts. He was the only child of Marcia and Matthew Simons and was raised in his hometown.

He studied mathematics at the Massachusetts Institute of Technology, where he obtained his Bachelor’s degree. During the summer break after his MIT graduation, Simons traveled to Bogota, Colombia, on a motor scooter.

Following his graduation, Simons enrolled in the University of California, Berkeley, where he obtained his Ph.D. in mathematics in 1961.

Simon’s mathematical endeavors centered on the extremely complex topology and geometry of manifolds.

In his 1962 doctoral dissertation at Berkeley, he presented a novel proof of Berger’s classification concerning the holonomy groups of Riemannian manifolds. He also worked with Shing-Shen Chern to discover the Chern-Simons theory for secondary characteristic classes of 3-manifolds, a discovery that was later used in Albert Schwarz’s topological quantum field theory.

Thanks to these and several other contributions to mathematics, Simons was awarded the AMS Oswald Veblen Prize in Geometry in 1975.

Jim Simons Net Worth: Billionaire Mathematician & Hedge Fund Pioneer

James Simons didn’t immediately make his fortune or build his investment company after graduation. For many years, he worked as a code breaker for the NSA, worked for the Institute for Defense Analyses, and even did some teaching and managed an entire mathematics department.

The foundation of Renaissance Technologies is what made him a billionaire, but this is not where his story started. Let’s see how James Simons built his career and earned his billions.

Career Before Renaissance Technologies

During the Vietnam War, Jim Simons broke codes for the National Security Agency (NSA) and was also a researcher at the Institute for Defense Analyses, a position he left in 1968.

Due to his public opposition to the war, he was forced to leave his spot in the Communications Research Division at IDA, and he joined the faculty at Stony Brook University.

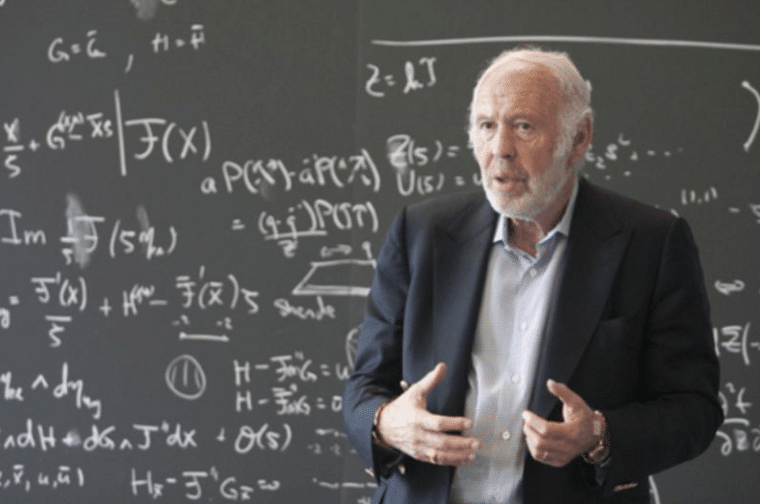

Before his breakthrough with Renaissance Technologies, Simons taught at different universities. He taught mathematics at Harvard University and MIT while working for the IDA. He was eventually appointed chairman of the math department at Stony Brook University.

Founding Renaissance Technologies

James Simons earned his first million in his early forties. In 1978, he founded Renaissance Technologies, a hedge fund management firm that was initially called Monemetrics.

Three years after he founded the company, Simons renamed it Renaissance Technologies and, that same year, he established the flagship Medallion fund.

In the beginning, the hedge fund was only moderately successful. It used mostly basic fundamental and technical approaches to making investments, but Simons soon decided to start using a systematic approach to avoid common trading biases.

He found that pattern recognition can be applied to trading and developed a system using complex quantitative models. He put the models to the test trading options, a kind of financial derivative used to gain leverage on investments like stocks. Before Simons’ innovations, the options market was rather small but once he essentially solved how to best price options with his mathematics, the industry exploded and is now a multi-trillion dollar arena.

The company worked with mathematicians, physicists, and statisticians, relying entirely on algorithmic investment strategies and quantitative analysis.

This unique and highly successful approach earned Simons the moniker of “Quant King” in only a few years.

If you’re interested in learning more about how he did it, the popular science YouTuber Veritasium made a brilliant mini-documentary on the development of the mathematical equations used to price options, featuring Jim Simons’ work heavily.

The Success of Renaissance Technologies

For over two decades, the New York-based hedge fund Renaissance Technologies has employed mathematical models to execute trades and often used automation to get a competitive edge. Renaissance uses computer-based complex mathematical models based on analysis of pools of data and looks for movements to make predictions about price changes in financial instruments.

The Medallion fund, which is the main fund open only to inside investors like James Simons himself, has earned over $100 billion in trading profits since it was established in 1988, which translates to the 66.1% average gross annual return between 1988 and 2018.

This is not the only fund managed by Renaissance Technologies, though. The company also manages other hedge funds including:

- Renaissance Institutional Equities Fund or REIF

- Renaissance Institutional Diversified Global Equity Fund

- Renaissance Institutional Diversified Alpha or RIDA

These three funds totaled $55 billion in combined assets as of 2019 and were open to outside investors.

Earnings and Stake of James Simons in the Hedge Funds

Simons announced that he was retiring from Renaissance Technologies on January 1, 2010, but remains as non-executive chairman of the company. He is also keeping his money in the funds, most of which are invested in the Medallion Fund.

“I have led the organization and its predecessor for thirty-one years, and it is time to pass the torch,” Simons said.

Today, James Simons owns around 25% of Renaissance Technologies.

Philanthropic Endeavors

Apart from his versatile investments through hedge funds, James Simmons is credited for his philanthropic work.

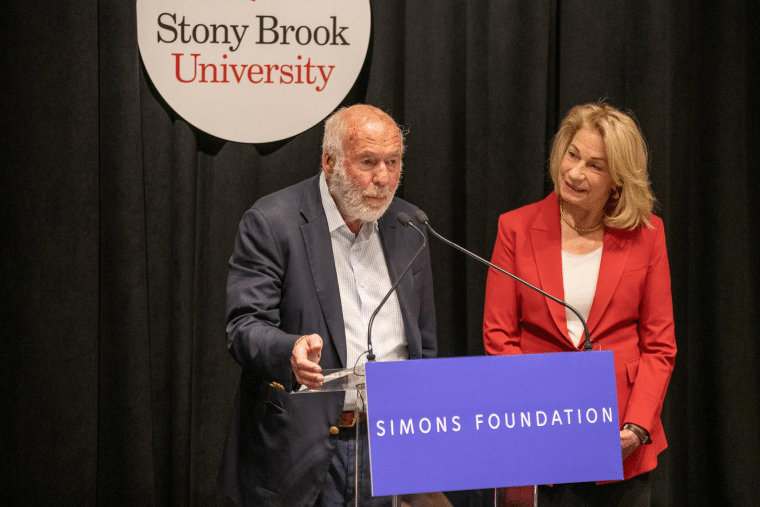

In 1994, Jim Simons and his wife Marilyn Hawrys Simons founded the Simons Foundation, contributing over $2.7 billion of their net worth to different causes ranging from health to education to scientific research.

Simons’ alma maters have been benefactors from his trading successes for years with major contributions made to the Massachusetts Institute of Technology, the University of California Berkley, and Stony Brook University.

Some of the biggest investments to date were the $25 million donation to Stony Brook University and the $60 million donation to the Simons Center for Geometry and Physics.

Simons has also funded the renovation of the building that houses the math department at MIT, which was named in his honor in 2016, and he endowed the Simons Center for the Social Brain.

In 2003, the couple established the Simons Foundation Autism Research Initiative. In 2016, they established the Flatiron Institute to house five groups of computational scientists who work on computational biology, astrophysics, quantum mechanics, neuroscience, and more.

A year later, Jim Simons founded Math for America, an organization that encourages mathematics and science educators to advance their teaching abilities.

James Simons is a member of several boards too:

- Stony Brook Foundation

- MIT Corporation

- Simons Laufer Mathematical Sciences Institute in Berkley

In addition to these positions, Simons is also chair of the boards of the Simons Foundation and Math for America.

Unfortunately, Simons’ life wasn’t all smooth sailing as 2 of his sons died unexpectedly within a few years of each other. In memory of Paul, the son he had with his first wife Barbara Simons, he established Avalon Park, a nature preserve in Stony Brook. His son was killed by a car while riding a bicycle in 1996.

Simons’ other son, Nick, drowned in Bali, Indonesia, in 2003 while on a trip. Nick worked in Nepal, so the Simons became major donors to Nepalese healthcare through their Nick Simons Institute.

James Simons has three other children: Nat, Audrey, and Liz Simons.

Awards and Honorable Mentions

James Simons’ success as a hedge fund manager and mathematician earned him several awards including:

- 1976: AMS Oswald Veblen Prize in Geometry

- 2006: Financial Engineer of the Year

- 2006: Named “the world’s smartest billionaire” by the Financial Times

- 2007: Elected to the American Philosophical Society

- 2008: Inducted into the Hedge Fund Manager Hall of Fame at the Institutional Investors Alpha

- 2011: Included in the 50 Most Influential list of Bloomberg Markets Magazine

- 2014: Election to the US National Academy of Sciences

- 2016: Alumni Award at Berkley Charter Gala by the Cal Alumni Association and UC Berkeley

- 2016: Asteroid 6618 or “JimSimons” was named after him by the International Astronomical Union in honor of his contributions to philanthropy and mathematics

- 2018: Honorary doctorate from the Trinity College Dublin

In 2019, Gregory Zuckerman wrote and published a book about Simon’s investing methods titled The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution. The book is a New York Times bestseller.

Jim Simons Net Worth: Other Businesses and Assets

As the famous quant investor who founded Renaissance Technologies and spawned a new era of trading, James Simons has made most of his money – and his investments – through the company’s funds.

He hasn’t publicly disclosed any information about other investments except for assets like the superyacht Archimedes and his private jet.

Superyacht

James Simons owns a 222-foot, multi-story superyacht that costs him $8 to $10 million per year in running expenses. The yacht itself is worth around $100 million and is named Archimedes after the famous mathematician. Simons has owned the luxurious boat since 2008.

Private Jet

In addition to his superyacht, the famous Wall Street billionaire also owns a $70 million private jet – the Gulfstream G650.

Real Estate

Jim and his wife Marilyn Hawrys Simons reportedly live in East Setauket, New York. The house is worth at least $1.47 million. Seeing how they live a very private life, there is little known about other real estate assets.

What Can We Learn from Jim Simons’ Story?

Few people have had such a tremendous impact on the world as Simons and we have much to learn from him and his life.

For starters, his background as an academic has played a crucial role in his success.

His deep understanding of mathematical models and quantitative analysis enabled him to develop his New York-based hedge fund and turn it into one of the most profitable companies on the financial market. His breakthrough trading strategies outperformed traditional approaches, showing us that stepping out of the traditional isn’t a bad move if you are sure of your skills and ideas.

Simons’ talent and knowledge made him a prominent academic straight out of school.

He has worked as a code breaker for the National Security Agency and was teaching at some of the most prestigious universities, creating a highly successful career before he jumped into entrepreneurship and finance.

When he was over forty years old, James Simons decided that he was ready to establish his own investment business. He assembled a team of talented scientists and mathematicians to collaborate on developing trading models at Renaissance Technologies. This ability to attract and retain top talent and teach them of his unique investment strategies made his business one of the best hedge funds on Wall Street.

Simons’ story also teaches us the importance of adaptability and flexibility.

His business constantly adapted its trading strategies in response to evolving technology and changing market conditions. His willingness to refine his approaches showcases the importance of flexibility and adaptability in entrepreneurship.

Finally, Simons knows how important it is to give back to the community. He has already dedicated a significant portion of his wealth to charitable causes. From forming his charitable organization to investing millions into diverse causes, he teaches us the commitment to making a positive impact on society.