Jim Cramer has taken many roles in his career: hedge fund manager, TV host, best-selling author, and founder of several highly successful businesses.

He’s an American television personality most known for his appearances on his own investing show: Jim Cramer’s Mad Money. Thanks to all these ventures and investments, he’s accumulated millions in net worth.

In 2025, Jim Cramer’s net worth amounts is estimated at about $150 million.

Let’s find out more!

Key Highlights: Jim Cramer Net Worth 2024

- Total Net Worth: Estimated at $150 million as of 2024.

- CNBC Salary: Approx $5 million annually for hosting “Mad Money.”

- TheStreet.com Sale: Earned $16.5 million from selling the financial news website.

- Book Royalties: Generates over $3 million annually from book sales.

- Real Estate: Owns properties worth over $5 million, including a restaurant in Brooklyn.

- Stock Investments: Holds various stocks, though specific details are private.

Jim Cramer’s Net Worth: Full Breakdown

Jim Cramer is generally hush-hush with his own financials and doesn’t reveal many specifics about investments or salaries but we were able to build a comprehensive break down of his net worth and form an informed estimate.

Here is what we know:

| Asset | Contribution |

| Cramer Co. income | 24% average annual return |

| CNBC annual salary | Approx $5 million |

| Thestreet.com sale | $16.5 million |

| Smart Money magazine income | At least $2 million stock investment |

| Book royalties | $3+ million annually |

| Real estate portfolio | $5+ million |

| Stocks in other companies | N/A |

| Total Net Worth | $150 million |

After his graduation, Cramer worked at the Tallahassee Democrat, followed by the Los Angeles Herald Examiner.

He worked as an entry-level reporter and started building on his journalism skills.

Soon enough, he became one of the first who covered the Ted Bundy murders, and he even worked for Jerry Brown, the Governor of California at the time.

6 Fun Facts about Jim Cramer

- “Mad Money” Host: Known for his energetic and informative investment advice on CNBC’s “Mad Money.”

- Harvard Graduate: Holds a BA from Harvard College and a JD from Harvard Law School.

- Early Investments: Made early stock market investments to cover his university expenses.

- Hedge Fund Manager: Produced a 24% average annual return during his 14-year tenure at Cramer & Co.

- Author: Written seven books, many of which are bestsellers.

- Real Estate: Owns multiple properties, including a restaurant in Brooklyn.

Latest Updates and Controversies

Jim Cramer has sparked a political controversy with his remarks on the 2024 U.S. election.

During his CNBC show, he advised viewers who “care about their paycheck” to vote for Donald Trump, which led to significant backlash. Many on social media criticized his statement, with some mocking his track record of inaccurate predictions. Several users suggested that Cramer’s endorsement might actually hurt Trump’s chances, with one user commenting that Cramer’s support is a “jinx.”

This sentiment stems from a long-standing joke that Cramer’s advice often leads to the opposite outcome.

In recent market commentary, Cramer has been discussing the potential impact of tech stocks like NVIDIA and Palantir, identifying these as strong buys despite ongoing market fluctuations. His predictions continue to stir debate in financial circles, given his history of bold but sometimes inaccurate market calls.

Cramer also criticized Trump’s proposed tariff policies, calling them “inflationary” and warning about their impact on the economy.

Jim Cramer’s Early Life

James Joseph Cramer or, as we know him Jim Cramer, was born on February 10, 1955, in Wyndmoor to mother Louise and father Ken. Cramer wasn’t exactly raised poor – his father owned a successful packaging company and his mother was an artist.

Jim Cramer studied at Springfield Township High School, followed by his time at Harvard College. He graduated magna cum laude from Harvard Business School in 1977, where he worked as the editor-in-chief of the Harvard Crimson newspaper. He has a Bachelor of Arts degree.

After his graduation, Cramer worked at the Tallahassee Democrat, followed by the Los Angeles Herald Examiner.

He worked as an entry-level reporter and started building on his journalism skills. Soon enough, he became one of the first who covered the Ted Bundy murders, and he even worked for Jerry Brown, the Governor of California at the time.

Later on, Jim Cramer would return to Harvard to study Law. Even at a very young age, he was interested in the stock market. He made early investments in the market to cover his university expenses.

Jim Cramer Net Worth: The Beginnings and Success of the Former Hedge Fund Manager

Jim Cramer has dabbled in many ventures over the years. From journalism to stock market investments to hedge funds to TV appearances – he’s done it all.

Let’s jump into his story to learn how he accumulated those millions.

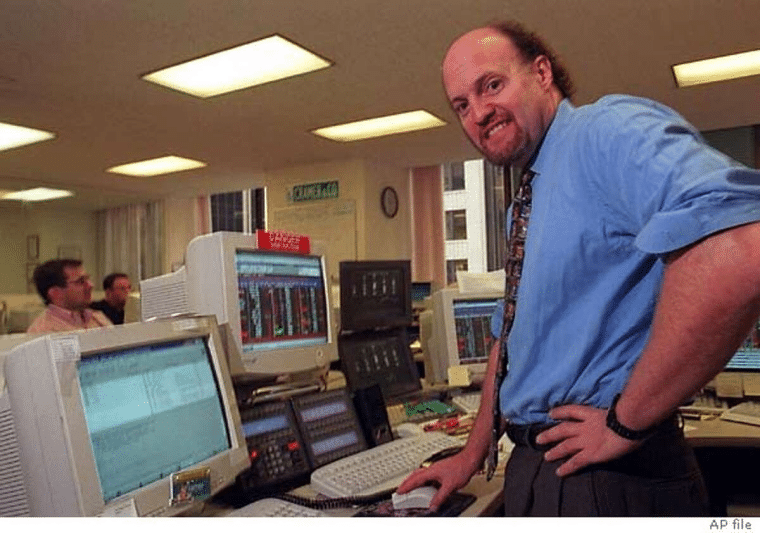

Cramer as a Hedge Fund Manager

Cramer started accumulating money early and was a millionaire before the age of 30!

But, how did it all begin?

Cramer & Co.

In 1985, a year after his graduation, Cramer was admitted to the New York State Bar Association.

But, he decided to pursue another path. In fact, he was so disinterested in this career path, that he lost his license to practice law in 2009 due to unpaid registration fees.

Following his graduation from Harvard Law School, Cramer started working as a stockbroker at Goldman Sachs.

He left Goldman Sachs in 1987 to start Cramer & Co., his own hedge fund. This company would later be renamed Cramer, Berkowitz & Co. Some of the early investors in this venture were Eliot Spitzer, Martin Peretz, and Steve Brills.

Cramer & Co. was a very profitable venture. Jim Cramer managed to raise $450 million in $5 million increments during his tenure. He received 20% of the profits, so the hedge fund company certainly helped grow his fortune.

He produced a 24% average annual return over 14 years working as a hedge fund manager at the company from 1987 to 2001.

Even so, in 2001, Cramer retired from the position of a hedge fund manager. Jeff Berkowitz, his partner, took over the hedge fund Cramer Berkowitz.

TheStreet.com

In 1987, Jim Cramer co-founded Thestreet.com, a website that would bring him mad money later on (pun intended). The website was a financial news and services website that went public in 1999.

Jim Cramer’s net worth became significantly larger thanks to his 15% stake at TheStreet.com. In 1999, the website’s market cap was $1.7 billion, setting its stake at $255 million.

So, why does he have less now?

Well, the dotcom crash did its damage, so Jim Cramer’s stake was worth $15 million after the peak of the dotcom bubble.

Eventually, Jim Cramer sold TheStreet.com for $16.5 million to The Maven in 2019.

SmartMoney Magazine

The former hedge fund manager also worked for SmartMoney Magazine. He was their Editor-at-Large, but this venture didn’t exactly pan out – at least not for his reputation.

During his time at Smart Magazine, Cramer was accused of unethical practices. He made a fortune of $2 million when he bought stock before his article with recommendations was published.

This might have built up Jim Cramer’s net worth, but it put a bit of a dent in his reputation.

Jim Cramer as a TV Personality

When Cramer retired from hedge fund management, he turned to TV appearances. In the late 1990s, he was often featured on CNBC as a guest commentator.

Eventually, he would be given his own show called “Kudlow & Cramer”, which he co-hosted with Larry Kudlow between 2002 and 2005.

When this show ended, he aired in an even more successful program.

In 2005, he started hosting the show Mad Money with Jim Cramer, one where he discloses his positions in regard to various stocks publicly with the audience and gives out investment advice. CNBC’s Mad Money is still an active show – and a very popular one, too.

At about the same time, and until 2006, he also hosted a one-hour radio show called Jim Cramer’s Real Money. The syndicated radio show was a big success.

In 2005, CNBC also produced a show called Squawk on the Street and made Jim Cramer its co-anchor. The show had initially one hour of airtime, now extended to two hours.

In addition to his CNBC show hosting, Cramer has also appeared on other shows including:

- NBC Nightly News

- The Tonight Show with Jay Leno

- The Daily Show with Jon Stewart

Jim Cramer as an Author

Jim Cramer’s wealth also comes from his book writing. He’s written and published 7 books, some of which found their spot in the bestseller lists. These are:

- “You Got Screwed! Why Wall Street Tanked and How You Can Prosper” in 2002

- “Confessions of a Street Addict” in 2002

- “Jim Cramer’s Real Money: Sane Investing in an Insane World” in 2005

- “Jim Cramer’s Mad Money: Watch TV, Get Rich” in 2006

- “Jim Cramer’s Stay Mad for Life: Get Rich, Stay Rich” in 2007

- “Jim Cramer’s Getting Back to Even” in 2009

- “Jim Cramer’s Get Rich Carefully” in 2013

Jim Cramer earns money from his books, though it’s not exactly known how much (the estimate is over $3 million so far). This also includes his speaking engagements, for which he charges between $30,000 and $50,000 per speech.

What Else Does Jim Cramer Invest In?

The host of Mad Money has quite a diversified investment portfolio.

He has major real estate holdings, not to mention many investments in stocks he’s accumulated over the years. While he publicly shares his investment finance opinions on the show Mad Money, his stake in companies is not public information.

Here is what we know about the investments of Jim Cramer.

Real Estate Portfolio

Notably, Jim Cramer has properties in New Jersey, Summit, and Carroll Gardens.

He has owned the DeBary Inn in Summit, New Jersey since 2009. This home was worth over $2 million, but he sold the property to his ex-wife Karen Backfisch as part of the divorce settlement for $1 million.

In 2008, Jim Cramer purchased another property in Summit for $4.7 million. He owns another home in Quogue, New York, and a smaller estate in New Jersey’s countryside.

Another part of his real estate portfolio, and a rather interesting one, is his Mexican restaurant. Jim Cramer owns Bar San Miguel in Brooklyn.

Stock Market Investments

Some of the stocks Jim Cramer has promoted over the years, in his books and on TV, and possibly the ones he’s invested in, too, include:

- Netflix

- McKesson Corporation

- Meta

- Starbucks

- Walt Disney

- Microsoft

- Salesforce

- Wells Fargo

Impact of Jim Cramer’s Political Statements

Jim Cramer has often focused on market trends and stock advice, but his recent political commentary has placed him in the spotlight for different reasons.

By suggesting that voting for Donald Trump would be financially beneficial, he has drawn criticism from both sides of the political spectrum.

His comments about the 2024 election led to widespread mockery, with many pointing out his history of controversial predictions. While Cramer defended his stance as a practical viewpoint on taxes and paychecks, the backlash demonstrates how his forays into politics can influence both his reputation and the public’s reaction.

What Can We Learn From Jim Cramer’s Success?

Jim Cramer is relentlessly dedicated to finance. He obtained a law degree but tossed that idea aside to follow his passion for the stock market and investments.

This teaches us that stepping out of your comfort zone, even when it’s the more difficult path, can be a fantastic idea if you are talented and persistent enough.

A lot of the time success depends on passion, and that’s exactly what Jim Cramer has followed throughout his life and career.

He also shows us that, in life, you can have more than one passion. His varied portfolio and quite diverse career choices demonstrate that one can be good at many things, and use their strengths to amass a tremendous net worth.

Today, Jim Cramer is one of the most trusted investment advisors in the world, not only because of his knowledge of finance but also his ability to turn intricate information into easily understandable insights for a broad audience.