Jamie Dimon, the American billionaire banker, has been the CEO and chairman of JPMorgan Chase since 2006.

His career has been nothing short of impressive, which has helped him become not only a renowned name in the industry (and the world at large) but also a multibillionaire.

As of 2024, Jamie Dimon’s net worth is estimated at over $2 billion.

How did Jamie Dimon become the CEO of JPMorgan Chase and accumulate his billions? This article will answer these questions and many more by delving into his life and career, as well as the source of his incredible wealth.

How Much is Jamie Dimon Worth in 2024?

- Jamie Dimon’s net worth in 2024 is estimated at over $2 billion.

- He has been the CEO of JPMorgan Chase since 2006, significantly increasing the bank’s value.

- Dimon’s wealth comes from salary packages, JPMorgan shares, and real estate.

- He has been involved in politics, primarily supporting the Democratic Party.

- Dimon has won numerous awards for his contributions to finance and philanthropy.

Jamie Dimon’s Net Worth Breakdown:

Jamie Dimon is a relatively public person, mostly through his position at JPMorgan Chase and his political involvement.

Unlike most businesspeople who make it hard to pinpoint their earnings, Dimon’s salaries and pay packages have been publicly disclosed over the years, which has helped us make a detailed breakdown of his net worth.

While some details naturally remain private, here is what we know about Dimon’s fortune:

| Asset or Income Source | Contribution to Net Worth |

| Citigroup share sale | $110 million |

| Salary package in 2006 | $26 million |

| Salary package in 2011 | $23 million |

| Salary package in 2012 | $11.5 million |

| Salary package in 2013 | $20 million, incl. $18 million in restricted stock |

| Salary package 2022 | $34.5 million |

| JP Morgan Chase shares | $1.5 billion |

| Real estate | $100 million |

| Total Net Worth | $2 billion |

5 Fun Facts About Jamie Dimon

- Dimon’s grandfather changed their surname from Papademetriou to Dimon.

- He was fired from Citigroup by Sandy Weill in 1998.

- Dimon sold 2.3 million shares of Citigroup for $110 million.

- He was named CEO of Bank One in 2000, which merged with JPMorgan Chase in 2004.

- Dimon’s 2022 salary package was $34.5 million.

Latest News & Controversies

In October 2024, Jamie Dimon raised significant concerns about global economic stability.

He highlighted geopolitical tensions and U.S. fiscal challenges, including inflation risks and deficits, as critical issues potentially leading to a “treacherous” future. Dimon also criticized what he views as overreaching regulatory measures by the Biden administration, indicating a readiness to challenge regulations he believes could hamper banking efficiency and security.

Additionally, he left open the possibility of a government role if Kamala Harris wins the presidency in 2024.

These comments come as JPMorgan Chase remains robust with strong stock performance and expansion plans, including interests in Africa and a commitment to advancing AI in banking operations.

In September 2024, he strongly criticized recent U.S. banking regulations, particularly open banking rules he argues favor credit card companies.

He also warned about potential stagflation -high inflation paired with stagnant growth – that could impact the U.S. economy. Amid this, Dimon reportedly supports Kamala Harris’s presidential run and would consider a role in her administration.

His exit planning from JPMorgan is underway, raising questions about future leadership as the bank navigates these economic challenges.

Early Life, Education, and Personal Life

James Dimon was born on March 13, 1956, in New York City, as one of three sons of Themis and Theodore Dimon.

Theodore’s father, Jamie’s grandfather, was a Greek immigrant who worked as a banker in Athens, Greece, and Izmir, Turkey. His surname at birth was Papademetriou, which he decided to change to Dimon.

Jamie Dimon has a twin brother Ted, and an older brother Peter. Dimon’s father and grandfather worked as stockbrokers at Shearson, so he grew up surrounded by brokers and bankers.

As for his education, Dimon studied at Browning School, followed by his graduation from Tufts University, where he majored in psychology and economics. He graduated summa cum laude.

While at Tufts University, Jamie Dimon wrote an essay discussing Shearson’s mergers, which impressed his mother and prompted her to send the paper to Sandy Weill, who offered him a job at Shearson during his summer break.

He started working at the company doing budgets during his break, returning to university once the summer ended.

After his graduation, he had a two-year stint working in management consulting at Boston Consulting Group, before he decided to continue his education. He enrolled at Harvard Business School and got his MBA as a Baker Scholar in 1982.

Fast forward to 1983, and Dimon married Judith Kent, whom he met while they were both attending Harvard Business School. The couple has three daughters: Julia, Laura, and Kara Leigh.

Jamie Dimon Net Worth: Banking Is In His Veins

Dimon started working in the banking industry before he completed his education, which meant that at the point when he got his MBA, he already had experience and excellent work prospects.

This is where his career in banking started, and it would soon turn him into an award-winning banker with billions in his personal wealth.

Early Career

During summer vacation at Harvard Business School, Jamie Dimon worked at Goldman Sachs.

After he graduated, Sandy Weill advised him to turn down several job offers he received from Goldman Sachs, Lehman Brothers, and Morgan Stanley, and join him as an assistant at American Express.

Even though the salary was lower, Dimon decided to accept the offer to work at American Express. At the time, his father was an executive vice president at the company.

In 1985, Weill decided to leave American Express, and Dimon followed. The colleagues embarked on a new journey to take over Commercial Credit, a consumer finance firm.

Dimon was the chief financial officer at Commercial Credit and his work has helped the business tremendously. Via a series of acquisitions and mergers, he and his friend Weill formed a new conglomerate, which they named Citigroup.

At the time, he was also the chief operating officer of Travelers, the insurer firm, and Smith Barney, a brokerage firm. He retained these roles between 1990 and 1998 when he became the president of Citigroup.

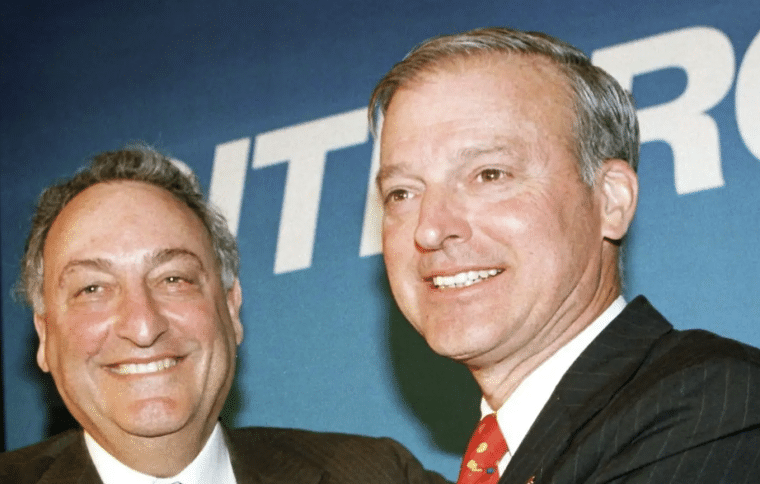

Citigroup

In 1998, Dimon and Weill formed a major financial services conglomerate, Citigroup, which added the first large chunk of profit to Dimon’s net worth.

However, after Weill asked him to resign during one of their weekend executive retreats, Dimon left Citigroup in November 1998.

Reportedly, the partners argued over Dimon’s leadership since he didn’t promote Weill’s daughter, and Dimon didn’t feel like he was being treated as an equal.

At one point, Weill shared with The New York Times that the real reason for this was that his partner wanted to be CEO, but Weill wasn’t ready for retirement.

The partners worked together for 15 years and Dimon was essentially fired from the role.

“When I was fired from Citi, I was totally surprised,” Dimon said on a podcast. “I shouldn’t have been. There were a lot of tell-tale signs, but I missed them at the time.”

You can listen to the full interview, here:

Forced out by the company, Dimon sold 2.3 million shares of Citigroup, which earned him $110 million, pre-taxation.

After he left this position, Dimon interviewed for positions at companies like Amazon and Home Depot, but he eventually landed a major role as CEO of a Chicago-based Bank One.

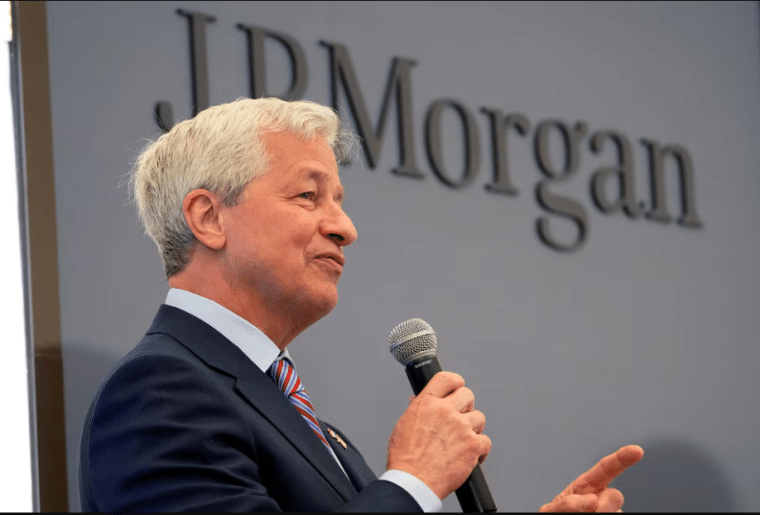

Bank One and JPMorgan Chase

In March 2000, Dimon became the CEO of Bank One, the fifth-largest bank in the nation. Four years later, JPMorgan Chase Co. merged with Bank One, so Dimon became the president and chief operating officer of the newly founded, combined business.

A year later, in 2005, he was named CEO of JPMorgan Chase. In 2006, he was named the company’s chairman and president.

By 2007, Dimon was also appointed class A board member of the Federal Reserve Bank of New York.

JP Morgan Chase thrived under his leadership, and soon became the leading US bank in domestic assets under management, publicly traded stock value, and market capitalization value.

When Dimon took on the role of chief executive officer at JP Morgan Chase in 2006, the JPMorgan stock was trading at around $40 a share. Fast forward to 2023, and the stock traded at $143, marking an increase of amazing 257%.

Earnings from JPMorgan Chase

CEO Jamie Dimon is one of the few bank chief executives in the world to have earned billionaire status, and this is mostly because of his stake at JPMorgan Chase.

In 2011 alone, Dimon earned $23 million in a pay package, which was more than any other CEO of a bank in the US.

In 2012, his compensation was reduced to $11.5 million following a series of controversial losses which amounted to $6 billion.

In 2014, the company announced that its CEO would receive $20 million for the previous year, which was a year of record profits and stock price under his reign. This award included over $18 million in restricted stock and a 74% raise.

In 2022, Dimon received $34.5 million in pay.

As of 2022, his base salary was $1.5 million, which is the highest among employees at large US banks by market capitalization and assets.

His salary in 2005 was $1, but he accumulated much more in incentive pay packages. For instance, in 2006, which was his first year as CEO, Jamie Dimon had a base salary of $1 million, but he got a bonus and stock valued at $26 million!

Keep in mind that this doesn’t even begin to cover his dividend earnings over the years.

According to a Form 8-K filing with the Securities and Exchange Commission from October 2023, Dimon and his family held 8.6 million shares in JPMorgan. Dimon also had unvested shares of over 2 million, worth around $1.5 billion.

This ownership of shares makes him one of the largest shareholders of the company.

In October 2023, Dimon and his family shared their intention to sell 1 million shares of JPMorgan in 2024 for tax planning and to diversify their finances. This marks the first time Dimon has decided to sell shares since he joined JPMorgan after the company merged with Bank One. When he made this announcement, the shares were valued at $141 million.

His first share sale happened in February 2024, when Jamie Dimon sold 882,00 shares for a pre-tax windfall of $150 million.

Assuming that he remains in good health, Dimon is expected to keep the CEO position into 2026, at the very least, when a chunk of his JPMorgan stock compensation package vests, but he could remain chairman past 2026, according to a proxy filing by the bank.

Involvement in Politics

Over the years, the financial expert has been actively involved in politics, primarily donating to the Democratic Party.

After the Obama administration won the 2008 presidential election, there was some speculation that Dimon would become Treasury Secretary, but the President named Timothy Geithner to the position instead.

When JPMorgan acquired Washington Mutual, Obama spoke of Dimon’s handling of the financial crisis, the real estate crash, and the banking collapse which affected major financial institutions, saying that Dimon did “a pretty good job managing an enormous portfolio”.

During this time, Dimon had close ties with several members of the Obama administration, such as the former chief of staff Rahm Emanuel.

However, despite his many years supporting the Democratic Party, Dimon publicly dissented on some of their policies. In 2012, he said he was “barely a Democrat”, for instance. He also said, “My heart is Democratic but my brain is kind of Republican”.

In December 2016, he joined a business forum which was assembled by Donald Trump to offer policy advice on various economic issues.

During the UK European Union membership referendum of the same year, JPMorgan, under Dimon’s leadership, donated to the Remain campaign. Dimon also campaigned with George Osborne, the then Chancellor of the Exchequer.

During Trump’s presidency, the banker didn’t support his administration’s immigration and trade policies but he was a proponent of the Tax Cuts and Jobs Act of 2017, to the surprise of absolutely no one.

He publicly shared his diverse views, such as his disappointment with the government’s response to the COVID-19 pandemic under Trump, despite supporting him on many points at the same time (especially tax cuts).

Dimon even has planned to run in the presidential election in the past.

Bill Ackman, the hedge fund manager and Twitter warrior, reportedly encouraged him to run in the 2024 presidential election. However, Dimon shared he had no plans to do this at the time since he plans to remain CEO and stay at JPMorgan Chase for at least a few more years.

Despite Ackman’s praise, Dimon would be an extremely unlikely candidate to win the presidency as he is seen as part of “the machine” and supports policies that most Democrats and many Republicans hate vehemently (like tax cuts for the rich).

Jamie Dimon is one of the world's most respected business leaders. Politically he is a centrist. He is pro-business and pro-free enterprise, but also supportive of well-designed social programs and rational tax policies that can help the less fortunate. He is extremely smart,…

— Bill Ackman (@BillAckman) May 31, 2023

Philanthropy and Awards

During his very successful career, Dimon has been involved in philanthropic activities and has won several awards for his contributions to society, as well as business success.

He and his wife founded the James and Judith Kent Dimon Foundation, which donates to various causes including healthcare, community development, and education.

He has also been actively involved with The Robin Hood Foundation, which provided food, job training, and shelter to fight poverty in New York City.

In 2017, Jamie Dimon was awarded the Carnegie Medal of Philanthropy for his substantial contributions.

He has won the following awards:

- 1994: Added to the Browning School Athletic Hall of Fame

- 2006: Won the Golden Plate Award by the American Academy of Achievement, presented by the Mayor of Chicago

- 2010: Named Chicago’s International Executive of the Year by the Executives’ Club

- 2011: Listed in the National Association of Corporate Directors Directorship 100

- 2006, 2008, 2009, 2011: Included in Time Magazine’s list of 100 Most Influential People in the World

- 2012: Won the Intrepid Salute Award

- 2016: Won the Americas Society Gold Medal

- 2022: Awarded the French Legion d’Honneur

Jamie Dimon Net Worth: Other Ventures and Investments

Jamie Dimon is serving on the board of directors of the Federal Reserve Bank in New York, but this is not his only board membership. Since then, he has secured a board seat with:

- Harvard Business School, his alma mater

- Bank Policy Institute

- Business Roundtable

Outside of stock investments, he also owns real estate worth around $100 million, which includes a 30-acre property in Bedford Corners in New York and a lavish Park Avenue apartment.

What Can We Learn from Jamie Dimon’s Story?

Jamie Dimon’s story offers insights into resilience, leadership, and the legacy of family influence.

As the CEO of JPMorgan, his journey teaches us the importance of strategic vision and adaptability in the finance industry.

Raised in a family rooted in banking, Dimon’s upbringing instilled in him a deep understanding of the industry from a young age, as well as a strong work ethic.

The influence of Dimon’s father and grandfather, both prominent figures in finance, shaped his approach to decision-making and leadership and laid a foundation for future success.

Dimon’s departure from Citigroup was definitely a disappointment, but he didn’t give up.

Not long after, the financial expert bounced back and was named CEO at a major bank. Soon after this appointment, he became the JPMorgan CEO and one of the highest-paid executives in the finance sector, not to mention one of the most influential men in the world.

This teaches us that failures are part of life, and you must embrace them and choose perseverance to find success.

Throughout his tenure at JPMorgan as the president and chief operating executive, Dimon has shown leadership characterized by this unique pursuit of excellence.

His bold decision-making has propelled the bank to new heights and solidified its position as a global powerhouse in the financial sector.

As Dimon’s legacy evolves, his story serves as a reminder of the transformative power of leadership and the inevitability of change in shaping the course of history.