If you want to launch a small business (or grow a fledgling one), you’ll most likely need some capital. You could empty your piggy bank, borrow from family, or find an investor, but that’s not always possible or suitable, and without a record of steady revenue, a traditional business loan is out of the question. Fortunately, there is a solution designed for this problem: startup business loans.

Here’s our guide detailing how to get a startup business loan with no money, the risks and benefits of this type of credit, and the best alternative funding options, plus top tips for paying off debt.

What Is a Startup Business Loan?

A startup business loan is a financial product designed specifically for new businesses with no credit record or revenue history. It can help an entrepreneur cover startup costs like equipment, inventory, and rent so they can get their business off the ground.

Startup Loan Vs. Traditional Business Loan

| Traditional Business Loan | Startup Business Loan | |

| Business Stage | Established businesses with a history of steady profits | Pre-launch or recently-launched startups |

| Terms | Lower interest rates and longer repayment terms | Higher interest rates and shorter repayment terms |

| Eligibility Requirements | Revenue history | Business plan, expense sheet, financial projections |

| Credit Check? | Requires a good business credit history | May require a good personal credit score |

If you’re starting a small business with no money, you probably won’t be eligible for a traditional business loan. Banks and credit unions like to loan money to businesses that have:

- credit scores of 700+

- 2+ years of operational history

- $500k+ in annual revenue

Startups that don’t meet these criteria are a far riskier prospect. However, some lenders do offer specialist loans for businesses that are pre-launch or have only been operating for a short time.

To account for the high-risk nature of a startup loan, lenders will need to see additional documentation (such as a business plan) as part of your application. They might also offer less appealing terms such as a shorter loan repayment period or higher interest rates.

Be wary of anyone offering you a deal that seems too good to be true. It’s always smart to speak with a financial advisor before making major financial decisions.

Should I Get a Startup Business Loan?

A startup business loan can be a game-changing tool that provides the cash flow you need to get a startup business off the ground. For some small business owners, it may be the only source of capital available. It’s also an opportunity to build up a strong credit record for your business.

However, a startup business loan comes with an inherent cost: interest. There is also the risk that your business will be less successful than expected and you’ll be unable to make your loan payments.

Before you commit, consider all the funding options as well as the associated risks and advantages.

A small business loan may be right for you if:

- You are earning enough to pay the bills, but there are gaps in your cash flow while you wait to get paid.

- You have a strong plan to earn revenue, but you need equipment or other assets to get started.

- You have a successful small business and you need capital to scale.

A small business loan may be a bad idea if:

- You haven’t figured out how to generate revenue yet.

- It will take a number of years to start generating revenue – longer than the repayment term of most loans.

- You can run or grow the business without taking on debt.

Remember, everyone’s situation is unique so do your own research and speak to a financial advisor if possible.

How to Get a Startup Business Loan

Here’s how to get a startup business loan with no money in seven steps.

Step 1: Consider Your Options

Before you apply for a startup business loan, consider whether it is the right choice for your business. Ask yourself:

a) Will I be able to make the loan payments?

Entrepreneurs are by their nature optimistic but consider the worst-case scenario. Many businesses fail. Many make less revenue or take longer to turn a profit than expected. Will you have the cash flow to pay off a loan plus interest?

b) Is this the best capital source for my business?

There are various funding sources to explore including equity, grants, or loans from relatives. There are pros and cons to each of these options. For example, if you take on an investor, you won’t have to pay interest but you will lose full ownership and control of your business.

c) Can I afford to wait?

If you can survive without a loan, you’ll save yourself the cost of interest and avoid taking on debt. Some entrepreneurs start their business as a side hustle with just a few customers or a simple version of their product and only scale when they start earning revenue. If your business doesn’t rely on expensive assets, this strategy could be a good choice.

Step 2: Prepare Your Documents

Startup lenders need to see documents that show how you will pay back the loan. These may include:

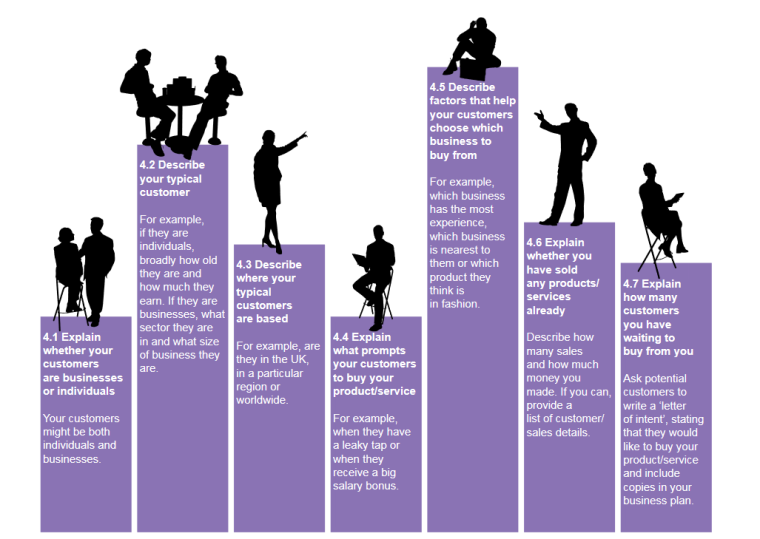

a) A business plan

A good business plan persuades lenders that your business model will fit the market and solve a problem for your customers in a way that will make you stand out from competitors and generate a profit.

Take a look at SBA’s guide to writing a business plan or download the Prince’s Trust business plan pack to get started.

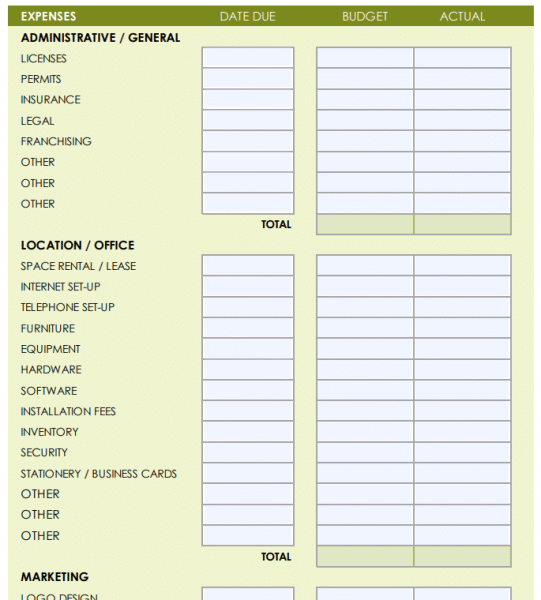

b) An expense sheet

Write a list of all your one-off expenses (e.g. buying equipment or designing a website) and all your monthly expenses (e.g. rent, payroll) and estimate their cost. You and your lender will use this to calculate how much money you need to borrow and whether or not you will earn enough to pay it back.

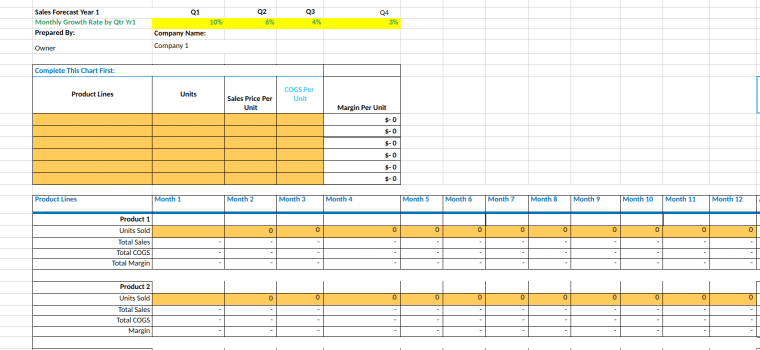

c) Financial projections

Financial projections estimate your business’s future income and expenses. Your projections should incorporate factors like the cost of goods sold (COGS), sales estimates, and your break even point.

Step 4: Research Lenders and Loan Types

Startup loans are available from traditional lenders (i.e. banks and credit unions), alternative lenders (i.e. online platforms) and government agencies. Research what’s available and take note of:

- eligibility criteria

- interest rates

- loan terms

Research the different credit products available such as microloans, equipment financing, business credit cards, and lines of credit.

Options to consider include:

- Small Business Administration (SBA) loans. The SBA offers microloans of up $50k for small startups via intermediary lenders. Terms and eligibility criteria vary by lender but interest rates are generally between 8% and 13%. Collateral and a personal guarantee are usually required and the maximum repayment term is 7 years. Generally best for: Small business owners with a good personal credit score.

- Fundbox approves small business loans via their online platform. You’ll need at least 3 months of business transaction history to apply but collateral is not required and there is no early repayment fee. Their fee starts at 4.66% and you can select a 12 or 24 week repayment schedule. Generally best for: Short term small business loans.

- Credibly is another online funder. They offer long term, equipment, and working capital loans, as well as lines of credit of between $5k and $600k. Most of their products require a credit score of 500+ (which is quite low), but you’ll need at least 6 months in business. Generally best for: Businesses with some revenue and operating history.

- National Business Capital is an online platform that offers small business loans from 75+ lenders. It has no minimum credit score requirement and does not require collateral or profitability. The only paperwork you’ll need is 3 months bank statements. Generally best for: New businesses.

Be aware that some lenders will check your eligibility for a loan by doing a hard credit pull which could impact your credit score.

Step 5: Do the Math

Once you’ve found a loan that you’d like to apply for, take a look at the repayment schedule and the interest rate. Check this against your financial projections to make sure you’ll be able to make those payments when they are due.

Step 6: Read the Small Print

Get into the details. Is the interest rate fixed or variable? Are there any penalties for early loan repayment? What are the penalties for late payment? What are the restrictions on how the loan can be used?

Step 7: Improve Your Chances

If you’re having trouble finding a loan, you can make yourself a more appealing borrower by:

- Putting up an asset as collateral

- Offering a personal guarantee

- Enlisting a cosigner with good credit

Each of these measures involves some kind of risk.

Pros of Getting a Startup Loan With No Money

- An early injection of cash can transform your business.

- You retain full ownership of the business – which is not the case if you take on an investor.

- As you pay it off, you’ll build a credit record which could be useful for borrowing later on.

- You don’t put strain on relationships by borrowing from a friend or relative.

Cons of Getting a Startup Loan With No Money

- Small business loans can have strict eligibility requirements.

- There’s a risk that you’ll default on the loan if your business is unsuccessful.

- You take on the cost of interest, probably at a high interest rate.

- A small business loan usually has less flexible repayment terms than a loan from friends or family.

Types of Business Credit Available

In additional to straightforward small business loans, lenders offer various difference credit products. Here are some of them.

Microloans

Microloans (up to $50k) are designed for startups and small businesses. and can be used for a variety of purposes, including equipment purchases and working capital. They often have more flexible repayment terms, more accessible eligibility criteria, and lower interest rates than traditional loans. The SBA has a microloan program with interest rates of 8-13%.

Lines of Credit

Unlike a loan, which is delivered as a lump sum, a line of credit provides access to a pool of funds that can be drawn on as needed. This is useful for ongoing expenses, like inventory or payroll, or for projects with unpredictable costs.

Equipment Loans

Equipment loans are designed to finance the purchase of business assets such as machinery and vehicles. Typically, the lender provides the cash for the purchase and the equipment acts as collateral. The SBA’s 504 loan program “provides long-term, fixed rate financing for major fixed assets that promote business growth and job creation” up to $5.5m for small businesses.

Business Credit Cards

Business credit cards help you cover short term expenses and build business credit. Eligibility is usually based on a good personal credit score (670+) to qualify so it’s possible to access a business credit card with no solid cash flow. However, these kinds of cards often require a personal guarantee, meaning you’re personally liable for the debt. If the business fails, you would still be responsible for paying it off with our personal assets. Credit cards also typically have a higher interest rate than small business loans.

Invoice Financing and Factoring

Invoice financing allows you to use outstanding invoices as collateral to secure a loan. A lender loans you most of the value of your outstanding invoices while you wait for your customers to pay, in return for a fee.

Invoice factoring is similar. In this case, you sell your unpaid invoices to a third party in order to access quick cash.

These financing options are best for B2B businesses with unpaid invoices. They can be a good option if you’re not eligible for other types of credit because eligibility is mainly based on the creditworthiness of your customers.

Merchant Cash Advances

A merchant cash advance (MCA) is when you sell a percentage of your future sales in exchange for an upfront sum of cash. Repayment is based on a percentage of daily credit card sales, plus fees. MCAs are more expensive than traditional business loans with high interest rates. They are best suited to startup businesses with steady sales and no alternatives.

Alternative Funding Options

Before applying for credit from a bank or online lender, consider alternative sources of capital, such as the following.

Equity Financing

Equity financing is when you raise capital by selling shares of your business to investors in exchange for ownership stakes. Investors could be friends, relatives, angel investors, venture capital firms, or private equity firms.

The advantage of equity financing is that there is no interest or repayment obligation – although investors will expect returns. Investors can also provide expertise and networking opportunities. However, equity dilutes ownership of your business and it can be difficult to find an investor if you are not an experienced business operator.

Crowdfunding

Crowdfunding platforms like Indiegogo or Kickstarter allow you to raise funding from individual investors who offer small amounts of money, often in exchange for early access to a product. It works best for products or services that can generate a lot of online attention from an engaged audience. Crowdfunding can also act as good brand PR, and it doesn’t require any kind of credit or operational history.

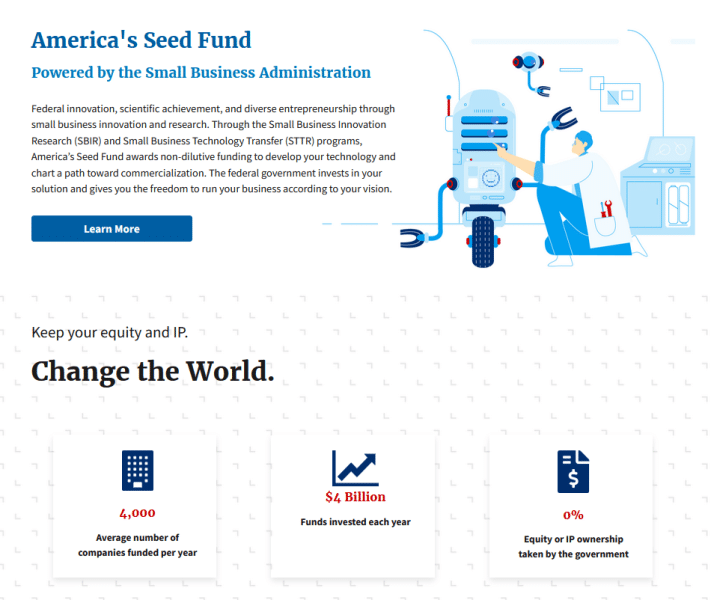

Business Grants

Business grants are lump sums offered by government agencies, non-profits, and corporations to support small business owners. Unlike a loan, a grant does not need to be repaid. Mentorship and other resources are sometimes included as part of a grant program. Grants are usually competitive so it’s important to spend time perfecting your application.

Many grants target specific groups, like The Amber Grant for female entrepreneurs and the Second Service Foundation for military entrepreneurs. Other grants to explore include the:

- Small Business Innovation Research (SBIR) grant

- Small Business Technology Transfer Program (STTR)

- Build to Scale (B2S) program

- FedEx Small Business Grants Program

Personal Loans

As a business owner, you can take out a personal loan and use it to fund your business. You’re more likely to be approved for a personal loan if you have a good credit score and income. Be aware that some loans will come with criteria that determine how they can be spent.

Loans From Friends or Family

Loans from personal connections can come with flexible terms and better interest rates than traditional business loans but make sure you put everything in writing to avoid disputes later on. Be aware that if your borrow money from a loved one, it can put pressure on your relationships.

Tips for Repaying a Startup Loan

- Keep a close eye on cash flow. Track everything going in and out of your accounts and ensure you are setting aside the money you need for loan payments. A good accounting system (even if it’s just a Google Sheet) is a good place to start.

- Be disciplined about payments. Make sure you have a good system in place (ideally an automated system) so you don’t miss a payment. Missed payments can harm your credit record and have other negative consequences.

- Talk to your lender. If you’re likely to miss a payment deadline, let your lender know as soon as possible. Business lenders often prefer to renegotiate the terms of a loan than to let a borrower default, but they’re more likely to be amenable if you’re upfront and proactive.

- Get professional help. An accountant or financial advisor costs money but they’re worth more than their weight in gold if they can help you avoid getting into financial trouble.

The Bottom Line

A startup business loan can be a game-changing opportunity for a business if you can secure one, but it is also a risky and potentially expensive financing option.

Before applying for a loan, consider all the financing options – from crowdfunding to equipment financing and venture capital – and do your research on the different lenders and products. Choose the funding option that best matches your lending needs, repayment capabilities, and eligibility profile.

A solid business plan, clear financial projections, and personal guarantee will improve your chances of being approved.