Gina Rinehart, the Australian mining magnate and famed heiress of Lang Hancock, her father, is currently the direct owner and executive chairwoman of Hancock Prospecting, which makes her Australia’s richest woman. As of 2024, Gina Rinehart’s net worth is estimated at $50 billion.

When Lang Hancock, Gina’s father passed away in 1992, she succeeded him at the throne of the company, leading the family business to impressive success and turning it into the largest private company in Australia today.

If you want to learn how she leveraged her family fortune to become Australia’s richest person, her life story is described in detail below.

Gina Rinehart’s Net Worth Breakdown:

Rinehart is among the wealthiest individuals in the world, with her net worth varying significantly over the years. In 2019, Forbes estimated her wealth at $14.8 billion. By 2023, the Australian Financial Review reported her net worth to be over $24 billion. At that time, the Financial Review Rich List ranked Rinehart as the richest person in Australia.

Since most of her wealth comes from her stake and earnings in Hancock Prospecting, it makes sense that her fortune has varied so much over the years. Rinehart has been on the BRW Rich 200 list since 1992, after her father’s passing, but she became Australia’s richest woman in 2010, Australia’s richest person in 2011, and even the world’s richest woman in 2012, according to this magazine.

When someone owns such a profitable private business, it is difficult to pinpoint their net worth. For instance, Citigroup estimated that Rinehart was set to overtake Carlos Slim and Bill Gates since she owns the companies outright.

Of course, she didn’t hold the top position for all of these years, and her wealth rankings were impacted adversely by the fall of the wholesale iron ore price between 2013 and 2019. However, based on our findings, Rinehart is now richer than ever. Her wealth soared nearly 40% in the last year alone, largely due to the performance of the Roy Hill iron-ore mine, and she is now worth around $50 billion.

| Asset or Income Source | Contribution to Net Worth |

| Hancock Prospecting revenue | $16.6 billion |

| Ownership of Hancock Prospecting | 76.6% |

| Real estate portfolio | $200+ million |

| Total Net Worth | $50 billion |

Gina Rinehart Net Worth: Early Life and Education

Georgina Hope Rinehart (née Hancock) was born on February 9, 1954, in Perth, Western Australia. Until she was four years old, Rinehart lived at Nunyerry near Wittenoom, after which the family moved to Mulga Downs station in Pilbara. She spent her early childhood in Pilbara and studied at St. Hilda’s Anglican School for Girls.

After her graduation, Rinehart enrolled at the University of Sydney but soon decided to drop out to help her father manage the family business, Hancock Prospecting.

Personal Life

In 1973, when Gina Rinehart was 19 years old, she met Englishman Greg Milton (who later changed his last name to Hayward). She married him soon after and had two children with Hayward, John Langley and Bianca Hope, born in 1976 and 1977 respectively.

In 1979, Rinehart separated from her husband and got divorced in 1981. Two years later, she married Frank Rinehart, a corporate lawyer with whom she has two children, Hope and Ginia, born in 1986 and 1987 respectively. Frank Rinehart passed away in 1990.

Gina Rinehart has had a difficult relationship with her children from her first marriage. Her son John changed his surname by deed poll to Hancock at age 27, and his mother wasn’t present at his wedding to Gemma Ludgate. She also didn’t attend her daughter Bianca Hope Rinehart’s wedding to Sasha Serebryako in 2013 after Bianca was replaced in the position of director of Hancock Prospecting by her half-sister Ginia in 2011.

Starting in 1992, Rinehart was involved in a years-long legal fight against her stepmother Rose Porteous over Hancock’s death and his bankrupt estate. Fourteen years later, the lawsuit was settled with Hancock Prospecting retaining the mining tenements.

Gina Rinehart Net Worth: Becoming Australia’s Richest Woman

Georgina Rinehart was the only child of Lang Hancock and Hope Margaret Nicholas and as such, she inherited the business and succeeded her father as executive chairwoman at the company following his death in 1992. Fast forward to today, and she has successfully turned the business into the largest private company in all of Australia.

Rinehart rebuilt the company from scratch and, during the iron ore boom in the early 2000s, she expanded it greatly, becoming a nominal billionaire and paving her path toward becoming the richest woman in Australia.

Let’s see how she rebuilt the iron ore business from a relatively precarious situation to such great heights.

Propelling the Iron Ore Family Business to New Heights

When her father passed, Gina Rinehart became Executive Chairwoman of Hancock Prospecting Pty Limited or HPPL, as well as the HPPL Group of companies, all of which are privately owned. A year after she inherited her father’s ailing mining company, Rinehart achieved the Roy Hill tenements in 1993 and focused on developing undeveloped deposits and raising capital through partnerships with other businesses.

Today, Hancock Prospecting owns 50% of Hope Downs and gets 50% of the profits generated by the 4 Hope Downs mine, operated under a joint management committee by Rio Tinto. This joint venture alone produces 47 million tonnes of iron ore per year.

Another profitable joint venture of Rinehart is that with Mineral Resources at Nicholas Downs, which produces 500 million tonnes of ferruginous manganese. Also, The Roy Hill Iron ore project in the Pilbara, produces 60 million tonnes a year, with pending approvals to increase this number to 70 million tonnes annually.

In 2016, it was announced that Rinehart’s company signed a deal to invest in Sirius Minerals, an AIM-listed UK-based mining company to work on the North Yorkshire Polyhalite Project. This happened only a year after the mining magnate sent initial shipments of iron ore to China through the Roy Hill mine.

More recently, in 2024, Rinehart revealed that she acquired a 5.82% stake in Lynas Rare Earths, as well as a 5.3% stake in MP Materials, both of which produce earth materials. These latest purchases have strengthened Rinehart’s presence in the Chinese market even further.

The family company also announced that they plan to develop a 20 million tonnes per year iron ore mine on Mulga Downs, the cattle station where the heiress grew up.

Expanding Hancock Prospecting to New Industries

While Gina Rinehart is primarily a mining magnate and built her significant fortune through this industry, she has decided to expand the business to new industries, as well.

In 2010, Rinehart acquired a 10% stake in Ten Network Holdings, as well as an undisclosed stake in Fairfax Media, becoming a major player in the media world.

Two years later, she increased her stake in Fairfax to reach 12%, becoming the company’s largest shareholder. A few months later, she boosted her stake to 18.67%, but this was followed by several disagreements over Fairfax’s policy on editorial independence. Following the very public disagreements, chairman Roger Corbett announced that Gina Rinehart would not be getting a seat on the board of directors at Fairfax. Rinehart decided to sell her stake in the business in 2015.

Media isn’t the only industry Rinehart expanded the business to, though. In 2013, she acquired Fossil Downs Station, a 4,000-square-kilometre property with 15,000 head of cattle worth between A$25 and A$30 million. She also spent A$40 million on a 50% stake in Liveringa and Nerrima Stations in 2014.

Today, Gina Rinehart is Australia’s second-largest cattle producer. She has also made significant investments into the gas sector and rare earth minerals, including her joint $1.1 billion bid to buy Azure Minerals, the lithium outfit in Western Australia in partnership with SQM.

Gina Rinehart and Politics

Rinehart’s father founded the Westralian Secession Movement to work on the secession of Western Australia. Back in the 1970s, Gina Rinehart was an active supporter of this movement and was also involved with the Progress Party, which was a libertarian organization founded by Singleton.

Rinehart founded a lobby group called Australians for Northern Development and Economic Vision and lead a group of mining magnates that opposed the Mineral Resource Rent Tax and Carbon Pollution Reduction Scheme by the Rudd government.

Starting from 2010, Rinehart has been promoting the cause of the development of Australia’s north, writing articles and a book on the topic, stressing that the country must do more to welcome investments in the area.

The Hope Margaret Hancock Trust

Back in 1988, Lang Hancock established a trust in which his daughter was nominated as trustee, with the four grandchildren (Gina’s children) being the beneficiaries. Gina Rinehart was appointed to run the trust until the youngest child, Ginia, turned 25, which happened in 2011.

Today, the Hope Margaret Hancock Trust owns 23.6% of the Hancock Prospecting shares, worth around A$5 billion (around $3.3 billion). Gina Rinehart owns the remaining of the business.

After a lengthy and rather controversial battle between Gina Rinehart and three of her children, she lost the trustee role in May 2015 when the court appointed Bianca as the new trustee.

Controversies

In 2023, after having sponsored Netball Australia for years, Rinehart publicly withdrew her $15 million sponsorship after the player Donnell Wallam asked not to wear the company’s logo on her uniform, reportedly due to comments made by Lang Hancock in the 1980s.

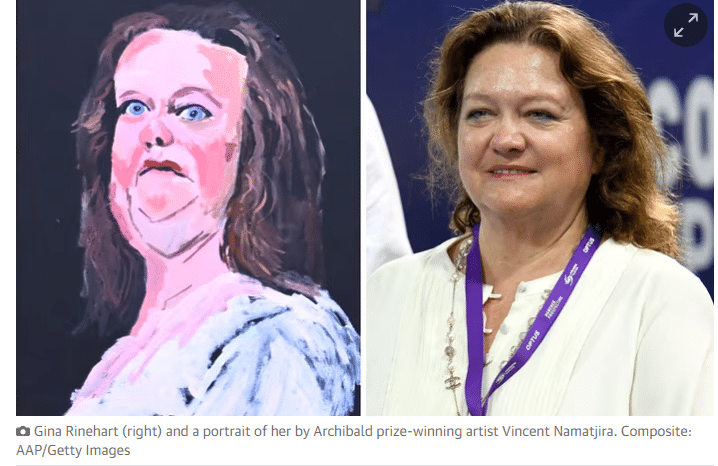

More recently, in May 2024, Rinehart demanded to have a portrait removed from display at the National Gallery of Australia. The portrait, painted by artist Vincent Namatjira, sits at the National Gallery, and it is far from flattering. It was unveiled as part of the artists’ career survey exhibition titled Vincent Namatjira: Australia in Colour. Rinehart spoke to the country’s national gallery director personally asking to have the portrait removed.

The National Gallery has since rebuffed the efforts to have this painting taken down, sharing in a statement that they welcome public dialogue on its displays. Namatjira’s distinctive distorted style is evident not only in Rinehart’s portrait but also in several others who take part in the exhibition.

That same month, the mining magnate gifted a painting of herself to the National Gallery. However, even though she has donated often to the gallery in the past, the NGA director Nick Mitzevich rejected Rinehart’s request to deinstall the Namatjira portrait, with the artist being a celebrated portraitist and the first nation’s artist to win the Archibald Prize. The unflattering painting is one of several similar depictions, including those of the late Queen Elizabeth II, the prime minister of Australia Julia Gillard, and the Australian monarch King Charles III (though Rinehart’s is especially unflattering).

Gina Rinehart Net Worth: Other Ventures & Investments

For the most part, Gina Rinehart’s investments fall under the Hancock Prospecting business portfolio. The business empire dabbles in different industries and manages several highly profitable businesses.

As one of the richest people in the world, Rinehart has invested billions into real estate and land, some part of her business projects and some part of her personal projects. Let’s take a look at how she spends her money.

Assets and Other Investments

In 2022, the Australian rich-lister spent over $76 million on four properties in a Qld suburb. She spent $9.75 million for a beach house in Park Crescent, Sunshine Beach, followed by $6.75 million on a property on the beach a few months later. She also acquired the Arakoon Cresent property in Sunshine Beach for $21.5 million, and the Park Crescent house for $11.2 million.

Rinehart is also the owner of the most expensive property ever sold in the state, the Webb House, which she bought for $34 million. She bought the lavish beach house in Noosa in 2021.

While she is investing heavily in personal real estate, the magnate recently showed a desire to sell the majority of her West Australian cattle portfolio. In March 2022, she made two million hectares of Hancock Prospecting available to buyers, which accounts for 20% of the 30-property cattle portfolio of the company.

In 2023, it was reported that Rinehart would be spending $240 million to buy an office tower in Brisbane. She purchased 175 Eagle Street in the city’s CBD after months of talks.

As for her other assets, the magnate reportedly owns at least one private jet that she got in 2021, a Gulfstream 600, though its value hasn’t been disclosed to the public.

Philanthropy

The mining magnate Gina Rinehart is known not only for her business acumen but also for her philanthropic activities, contributing millions to charitable causes. Even so, she prefers to keep a low profile for privacy and to avoid being ‘harassed by other charities’.

As for her publicly known philanthropic activities, she is frequently seen visiting girls’ orphanages in Cambodia and is a member of the expert advisory board of SISHA, a non-profit organization that campaigns against human trafficking.

In 2012, the Georgina Hope Foundation partnered with Hancock Prospecting to donate $10 million over 4 years to Swimming Australia, a deal that supports the Australian Swim Team through payments to targeted development swimmers. Rinehart then renewed this arrangement for two more years in 2015, being given naming rights to different events such as the Australian Swimming Championships.

Rinehart is also known to be a very generous boss, having given away millions to her staff. She has given over $7 million to her employees on a series of special occasions. At her 2023 Christmas party alone, she gave out $100,000 to 70 people individually to thank them for working across her companies.

Awards and Accolades

Being one of the most prominent Australian and international figures has made Rinehart worldwide acknowledged and brought her many awards throughout her career. In 2022, she was appointed as an Officer of the Order of Australia in the Australia Day Honours for her ‘distinguished service to the mining sector, to the community through philanthropic initiatives, and to sport as a patron’.

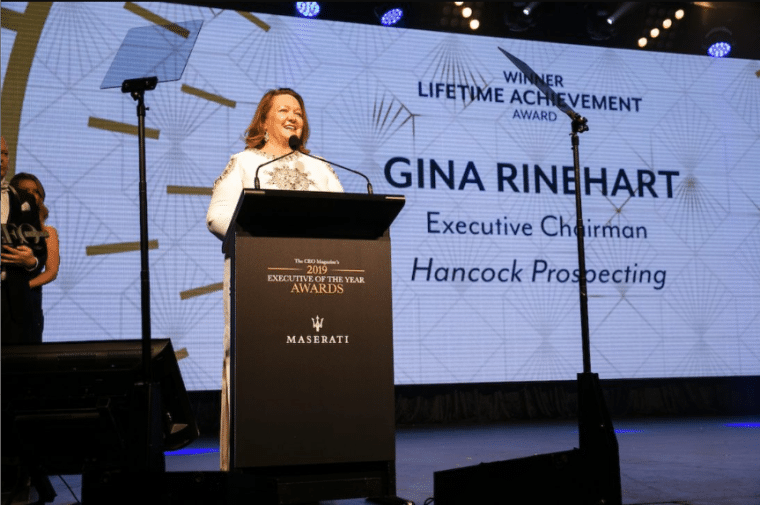

In addition to this prestigious award, Rinehart won the inaugural Lifetime Achievement Award from the CEO Magazine in 2019.

She has also won several ‘Business Person of the Year’ awards by Financial Review.

What Can We Learn from Gina Rinehart’s Story?

The story of the mining magnate Gina Rinehart is truly inspiring. She was raised in wealth but, despite inheriting a business worth billions, Rinehart didn’t merely rely on her inheritance, even though it would have made her wealthy for life. Instead, Rinehart rebuilt the family business and expanded Hancock Prospecting, demonstrating the importance of innovation and proactive management.

This helped Rinehart cement her reputation as one of the fiercest female entrepreneurs in the world, and one of the very few in the iron ore industry.

Rinehart faced numerous challenges during her career and personal life, including legal battles, fluctuating market conditions, and family disputes. Her ability to navigate these difficulties shows us the importance of resilience and adaptability, especially in growing a business.

Rinehart’s success was based on strategic partnerships and joint ventures, to begin with, which highlights the significance of forming alliances to leverage shared resources and expertise.

Furthermore, her diversified investments beyond mining into media, real estate, and agriculture show us that diversification can open new revenue streams and ensure long-term financial stability.

Finally, Rinehart’s generosity toward employees, as seen in the significant gifts, illustrates the importance of valuing one’s staff, which can boost morale and loyalty.