What Is the Gearing Ratio?

A gearing ratio is a financial measure that looks at a company’s financial leverage by comparing its debt to its equity. This ratio helps determine how much a company uses debt to fund its operations instead of equity, offering important insights into its financial setup and risk level.

Gearing ratios such as the debt-to-equity ratio and equity ratio are crucial for understanding how a business manages its finances and sustains its operations.

Organizations in both the business-to-consumer (B2C) and business-to-business (B2B) verticals have to assess financial risk and guide debt financing decisions.

While some financial metrics compare a business to its competitors, gearing ratios focus on assessing a company’s internal financial health.

An optimal gearing ratio—typically between 25% and 50%—indicates a healthy balance between using debt and equity to finance the company’s operations.

High gearing ratios, over 50%, suggest a heavy reliance on debt, increasing vulnerability to economic downturns and interest rate rises.

Conversely, a low gearing ratio, under 25%, may indicate an over-reliance on shareholder equity and could potentially deter investment due to perceived underutilization of financial leverage.

Thus, understanding and maintaining the right gearing ratio is critical for financial stability and strategic financial planning.

Fun Fact: Despite high gearing ratios indicating more debt, companies in capital-intensive industries like utilities or telecommunications often operate successfully with higher ratios due to stable cash flows and regulated environments.

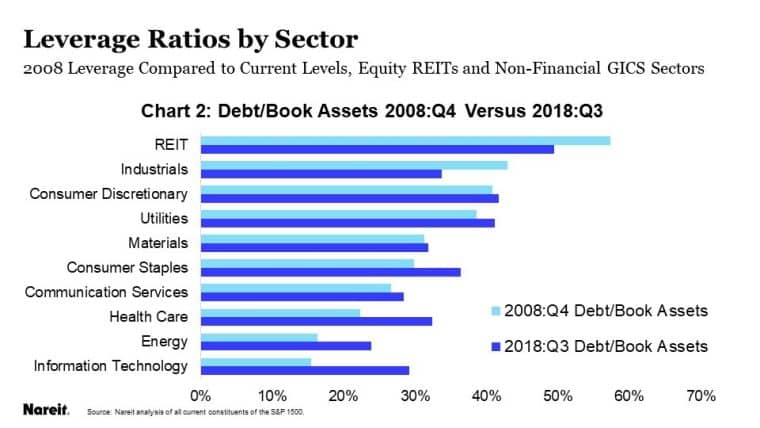

Important: Optimal and reasonable gearing ratios can differ significantly between industries and sectors.

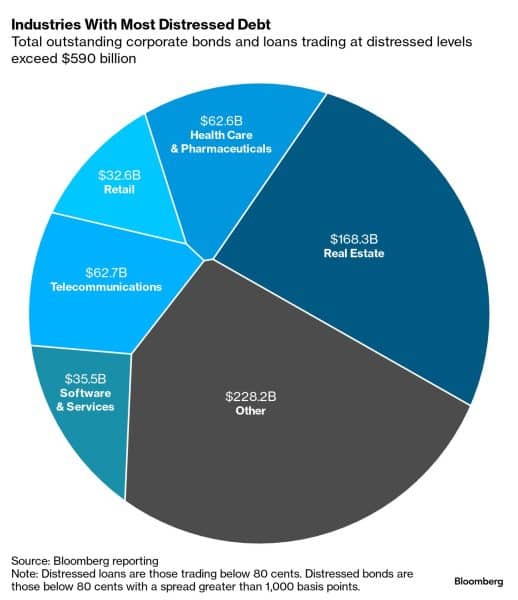

Recommendation: If you already have the data you need and want to start calculating, scroll down to find out gearing ratio calculators. The most common gearing ratio formula determines the debt-to-equity ratio by dividing the company’s debt by its shareholders’ equity. The formula appears as follows: The other approach involves calculating your simple equity ratio. To calculate the gearing ratio in this way, you’ll need to divide shareholder equity by company assets. The formula appears as follows: These formulas can be calculated manually or using various financial tools and resources, like spreadsheet software or a financial analysis platform. Finally, the third gearing ratio is the total-debt-to-total-assets-ratio. All you need to do for this ratio is to divide total debt by total assets. The formula appears as follows: If you already have the data you need, you can use the below gearing ratio calculators to skip all of the tedious math. All you need to do is plug in your data into the fields below and hit calculate. Once you are finished calculating, scroll down to the next section to see how to best interpret your results. Once you’ve calculated your gearing ratios, it’s time to make sense of the numbers. Typically, a high gearing ratio indicates a lot of leverage. However, it doesn’t necessarily mean that your company is in poor financial health. Instead, it indicates that you have a riskier financial structure, as you’ve financed many of your operations using debt. Generally speaking, two categories of businesses can operate with higher gearing ratios. If you operate in a tightly regulated vertical, you can usually operate with a bit more debt than a business that is in a loosely regulated industry. Additionally, some business models just rely on sustaining large debts, like in the real estate sector. Additionally, if your organization operates in a sector with little competition, it could be less susceptible to the risks of economic downturns and rising interest rates. If you aren’t in one of these sectors, then it’s always best to have a lower gearing ratio, right? Not necessarily. A low gearing ratio indicates that you are less dependent on debt and, therefore, more resilient during economic turbulence and rising interest rates. However, maintaining that low gearing ratio comes at a cost — usually missed growth opportunities. Taking on debt provides an injection of cash that you can use to support expansion efforts, hire more staff, upgrade equipment, or seize other emerging market opportunities. Remember: If you are relying primarily on stakeholder equity funding, you will likely enjoy less flexibility when these fleeting chances to grow emerge. There are numerous instances when you should use gearing ratios. They are crucial for investors to evaluate the risk and stability of potential investments. With that in mind, you can present positive gearing ratios to prospective investors in order to drive home your value proposition during a fundraising campaign. Gearing ratios are also important metrics to keep an eye on internally to ensure that your debt doesn’t get away from you. As you get ready for a new fiscal year, it’s important to calculate your gearing ratios and consider how they changed over the previous revenue cycle. If your numbers are outside of optimal ranges, you may need to proactively move them back toward the healthy center. While gearing ratios are just one piece of the financial puzzle, they provide essential context when compared to other financial metrics, like liquidity ratios, solvency ratios, or profitability margins. Keep in mind: Your company isn’t the only entity that will examine your gearing ratios. Financial institutions often use gearing ratios when evaluating your loanworthiness. Some loan agreements may require you to operate within specific guidelines regarding gearing ratio calculations. Businesses use gearing ratios to make informed decisions about capital structure and financing. For instance: A company considering expansion might use its gearing ratio to determine whether to finance the expansion through debt or equity. A lower gearing ratio might encourage taking on more debt, leveraging the opportunity to grow while keeping financial risks manageable. Most companies like to regularly calculate these ratios to keep an eye on the business’ fundamentals so you can bookmark this page and come back to use our gearing ratio calculators every quarter or year. Consider how an identical gearing ratio means different things for unique businesses. In this scenario, company A is in the manufacturing sector and has a gearing ratio of 60%. This might be normal for its industry, where heavy investment in machinery is required. In contrast, company B, a tech start-up with the same ratio, might be at higher risk due to its unpredictable revenue streams and the volatile nature of the industry. From an investor’s perspective, allocating funds to the manufacturing entity might not appear overly risky, as a 60% gearing ratio is “normal.” Conversely, investing in company B carries a high degree of risk. Different sectors exhibit typical gearing ratios reflective of their operational needs. In industries like manufacturing, utilities, real estate, or telecommunications, higher gearing ratios are common due to the significant capital expenditures required. Furthermore, companies in these verticals often have a monopolistic foothold on the market. For example: Consumers typically have a choice of only a few telecom providers based on where they live. Gearing ratios also have a strong correlation with cash flow. One study of 36 manufacturing firms discovered that a high capital gearing ratio has a negative effect on cash flow. Researchers also discovered a negative correlation between a high-income gearing ratio and cash flow and a positive correlation between a high-operating gearing ratio and cash flow. However, these two correlations were non-significant. Understanding how to apply and interpret gearing ratios can significantly impact financial strategy and investment decisions. For example: a company planning to expand might look at its low gearing ratio as an opportunity to safely borrow, leveraging debt to finance growth without overly increasing risk. If you are evaluating investment opportunities, it is vital to consider the gearing ratio during your due diligence period. While the 25 to 50% optimal gearing ratio threshold provides a good starting point for your evaluation process, you can’t examine these figures in a vacuum. Businesses that are monopolistic in nature or required to invest in costly fixed assets can be viable investment opportunities, even if they fall slightly above the normal range. Conversely, volatile start-ups may be less appealing investments despite staying under the 50% gearing ratio threshold. When examining the viability and financial risk associated with an investment opportunity, consider how the company’s ratio compares with industry standards. Pro Tip: Consider ratios across different verticals so you can obtain a holistic view of your risk profile. Like all financial metrics, gearing ratios provide only a fragment of the puzzle. They can also be misleading if you over-rely on them to the point that you ignore or partially disregard other metrics. One potential issue is ratio misinterpretation. For example, imagine a utility company with a 55% gearing ratio. Because this number is above the “ideal” level, you quickly decide the investment is too risky. But if you had looked closer, you would have found that the company’s gearing ratio is actually normal for its industry. Another shortcoming of gearing ratios is that the calculations are based on historical data. Therefore, they may not fully capture future uncertainties or the company’s current cash flow dynamics. Recent moves, such as new loans or debts, may not be reflected in ratios. Additionally, economic downturns can significantly impact gearing ratios. A company with a high ratio might struggle during a recession, as decreased revenue makes it challenging to service debt. The recession could impede your return or result in a loss of equity. Other factors that could make gearing ratios unreliable include: Balancing gearing ratios with other financial indicators, such as liquidity ratios, profitability margins, and cash flow statements, provides a more comprehensive view of a company’s financial health. This holistic approach enables better-informed decisions and a clearer understanding of the company’s financial position. Gearing ratios provide a valuable glimpse into a company’s financial leverage. While the debt-to-equity ratio is the most common, it is important to consider several variations when assessing financial risk. For example: Comparing debt and equity gearing ratios to the standard debt-to-equity ratio will provide more granular insights into a company’s financial performance. As an organizational decision-maker, tracking gearing ratio trends will help you understand how to approach new growth opportunities and cover operational expenses. If you are an investor, use these data points to balance your portfolio and stay within acceptable risk tolerances. Moving forward, apply these concepts to your financial analytics processes so you can obtain a more complete picture of risk and business performance. Remember: The power of financial analysis lies in its application. Always make sure to leverage the take advantage of the data at your disposal.Key Takeaways: The Gearing Ratio Calculator

How to Calculate Gearing Ratios: The Formulas You Need

Gearing Ratio Calculators

Debt-to-Equity Ratio Calculator

Equity Ratio Calculator

Total-Debt-to-Assets Ratio Calculator

Interpreting Gearing Ratios: Analyzing Your Results

When Should I Use Gearing Ratios?

Applying Gearing Ratios: Practical Examples

Practical Application: Analyzing Gearing Ratios

Gearing Ratios: A Quick Guide for Investors

Limitations of Gearing Ratios: What to Watch Out For

Understand Your Company’s Financial Leverage With Gearing Ratios