Gautam Adani, an Indian entrepreneur and multibillionaire, built his success as a college dropout and is now one of the richest people in the world.

The billionaire industrialist is the owner and chairman of Adani Group, a giant conglomerate of companies based in India. Despite some controversies and a significant drop in his net worth in the last few years, he is now back on his feet and as of 2024, Gautam Adani’s net worth is over $100 billion – and growing at a whirlwind pace.

Since his stock increased after a major legal battle, Adani once again became Asia’s richest person, beating the other Indian billionaire mogul Mukesh Ambani to the spot. However, Ambani recently seems to have flipped Adani once again though only by a few billion dollars.

oday, Adani’s fortune makes him one of the 20 richest people worldwide – and the 2nd richest person in Asia.

Let’s see how he built his fortune from scratch.

Latest Update:

Gautam Adani has regained his standing as one of Asia’s wealthiest individuals in 2024, with his net worth rebounding close to $100 billion. This follows the resolution of investigations into his business practices, which were triggered by the 2023 Hindenburg report. Despite these challenges, Adani’s companies saw a sharp uptick in stock value after India’s Supreme Court ruled in his favor. His flagship firm, Adani Enterprises, reported a 130% increase in profit, reflecting his resilience in navigating business crises.

Key Highlights: How Much is Gautam Adani Worth?

- As of September 2024, Gautam Adani’s net worth stands at $100 billion, a significant recovery following the sharp decline from the 2023 Hindenburg report allegations.

-

He has regained his position as Asia’s second-richest person, just behind Mukesh Ambani.

-

$13 billion of his wealth was recovered in just two days in early 2024 due to a rebound in Adani Group’s stock prices.

- The majority of Adani’s wealth is derived from his stakes in Adani Enterprises, Adani Power, Adani Total Gas, and other publicly traded companies(

- His business empire spans multiple industries, including energy, infrastructure, logistics, and ports, making Adani a key player in India’s economic growth.

- He is currently the 12th richest person in the world, having bounced back from a low point of $37.7 billion in 2023.

Gautam Adani’s Net Worth: Full Breakdown

Gautam Adani hasn’t always been one of the richest men in India and Asia.

He used to be a college dropout and a diamond sorter before he turned an idea into a business that went on to become a major conglomerate. We have quite a bit of information about his stakes in the major public companies but he doesn’t reveal much else about his assets or investments.

Here is what we know about his fortune.

| Asset or Income Source | Contribution to Net Worth |

| Adani Enterprises stake | 73% of $43.5 billion market cap |

| Adani Power stake | 70% of $25.6 billion market cap |

| Adani Total Gas stake | 37% of $13.2 billion market cap |

| Adani Energy Solutions stake | 73% of $13.7 billion market cap |

| Adani Green Energy stake | 53% of $31.83 billion market cap |

| Adani Ports stake | 66% of $32.8 billion market cap |

| Real estate | $50+ million |

| Private jets | $36 million |

| Car collection | $3-650,000 |

| Total Net Worth | $100 billion |

Fun Facts About Gautam Adani

- Self-Made Billionaire: Despite being a college dropout, Adani rose to become one of the world’s wealthiest individuals by expanding his business into critical sectors like ports, power, and renewable energy.

- Founder of the Adani Group: Starting with a commodity trading firm in 1988, Adani now controls one of the largest conglomerates in India.

- Loves Aviation: Adani owns private jets like the Bombardier Challenger 605 and the Embraer Legacy 650, showcasing his lavish lifestyle.

- Philanthropy Focus: Adani’s foundation has donated millions to educational and healthcare causes, including a recent pledge of $7.7 billion to mark his 60th birthday.

Adani’s Early Life and Education

Gautam Adani was born on June 24, 1962, in Ahmedabad, Gujarat, India. He was one of eight siblings born to father Shantilal and mother Shantaben Adani, both of whom worked in the textile industry and ran their own small business. His parents had migrated from Tharad in the northern part of Gujarat, and Gautam studied at the Sheth Chimanlan Nagindas Vidyalaya school in Ahmedabad.

As a child, Gautam Adani had little interest in academics. He enrolled in Gujarat University to study commerce but dropped out after his second year. While the Adani family already had a business, young Gautam was not interested in following in their footsteps in the textile industry.

Eventually, in 1978, Adani moved to Mumbai to work as a diamond sorter for Mahendra Brothers.

Gautam Adani Net Worth: Career Beginnings and the Success of Adani Enterprises

Gautam Adani jumped into the business world a few years after he dropped out of school. Let’s see how he transformed his diamond trader career into entrepreneurship and later on, into billions.

Early Career Days

When Adani worked in Mumbai as a diamond sorter, his brother Mansukhbhai invited him to manage the operations in his newly purchased plastics unit, so he moved back to Ahmedabad to help him. Through his new post, Adani learned about global trading and PVC imports, and in 1985, he started importing primary polymers for small-scale industries.

At this point, Gautam Adani had set up his textile unit and three years later, he decided to open his own business called Adani Group.

The Success of the Adani Group

Adani’s dream of a wide-reaching conglomerate became a reality in 1988 when he founded Adani Group. Since then, it has become one of India’s largest conglomerates with interests in real estate, agribusiness, logistics, ports, power generation, and more.

The company started as a trading business in partnership with Adani Enterprises, its flagship company. A few years after it was established, it built Mundra Port as the base of trading operations. During the Indian economic liberalization in 1991, Adani Group was quite favorably impacted and soon enough, it managed to expand into trading textiles, agricultural products, and metals.

A major turning point for the business came in 1994 when the government of Gujarat announced that it would begin managerial outsourcing and it gave Adani the contract. Just like in the US or Russia, government contracts in India turned out to be incredibly lucrative for the lucky few who were awarded them like Adani.

In 1995, he set up the first jetty that was originally operated by Mundra Port & Special Economic Zone and was later transferred to Adani Ports and SEZ. The group’s flagship company is Adani Ports and Special Economic Zone or APSESZ, which now operates India’s largest private port and brings billions into Adani’s fortune.

A year later, Gautam Adani founded the power business arm of the company, Adani Power, which holds thermal power plants and is the largest private thermal power producer in the country.

Fast forward to 1999, and Adani Group had already started coal trading, which marked the beginning of the Adani Enterprise as a company with large infrastructure assets like ports, ships, mines, and power plants.

Between 2009 and 2012, Gautam Adani acquired Abbot Point Port based in Australia, and the Carmichael coal mine based in Queensland.

The Adani Enterprises and Adani Group Today

As the holding company of Adani Group, Adani Enterprises has three main subsidiaries:

- Adani Airport Holdings for airport operations

- Adani Road Transport for road development

- Adani Wilmar for food processing

The remaining subsidiaries include Adani Cement, Adani Defense & Aerospace, AdaniConneX, Adani Mining, Adani Water, Adani Solar, and Adani Welspun Exploration.

Adani Group is now an industrial conglomerate consisting of 10 publicly traded companies. Adani’s empire focuses on everything from train lines and airports to data centers and coal mining. The businessman’s strategy is mostly centered on giving the Indian government what it needs to develop its economy, which can include anything from bringing more reliable electricity to upgrading data centers.

“Our vision is to become the world’s largest solar power company by 2025 and the largest renewable power company by 2030,” wrote Gautam Adani on his LinkedIn account in 2020.

Overall, Adani Group operates in 50 countries worldwide. Its revenue has fluctuated greatly, especially in the last couple of years. Due to a recent controversy and legal battle, which we’ll discuss below, the Ahmedabad-based company had a $27.4 million net income for the quarter through September 2023, representing a 41% slip compared to the previous year.

Adani Group’s stocks rallied since the controversy and the case was eventually resolved in Gautam Adani’s favor, which is why his net worth increased significantly in the last few months.

The bulk of Adani’s fortune comes from his stake in six publicly traded companies that are part of the Adani Group.

These include:

- Adani Enterprises – 73%

- Adani Power – 70%

- Adani Total Gas – 37%

- Adani Energy Solutions – 73%

- Adani Green Energy – 56%

- Adani Ports – 66%

Together, these companies are worth about $160 billion in terms of market capitalization, and his stakes in them make up a vast majority of his net worth.

Hindenburg Research Allegations and Controversy

In January 2023, an infamous US-based short seller that became famous after betting against cryptocurrency companies like Tether named Hindenburg Research accused Adani of “pulling the largest con in corporate history”. Reportedly, Hindenburg Research discovered that the Adani conglomerate engaged in stock manipulation and accounting fraud schemes over decades.

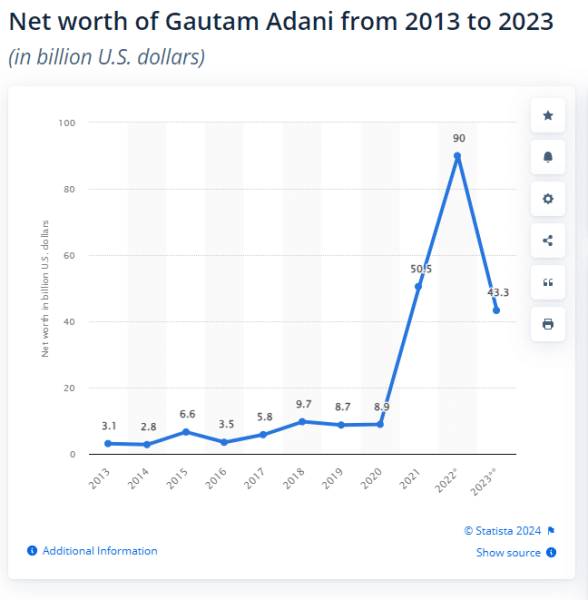

The event that started in January 2023 led to quite a devastating year for the Indian tycoon. The accusations led to a lot of scrutiny, so his fortune which was more than that of Jeff Bezos in 2022 saw a stunning fall, causing him to lose over $80 billion at one point.

Of course, Hindenburg research’s claims should be considered with a grain of salt because they stand to directly profit from a decline in stock prices of Adani’s companies.

Nevertheless, the Hindenburg report ruined the confidence of investors and wiped out billions in market value for Adani’s company with its claims of “brazen stock manipulation”.

In return, the Adani Group published a 413-page rebuttal claiming that the Hindenburg analysis was based on lies. While this didn’t prevent their stock market meltdown, India’s supreme court ordered the regulator the wrap up the investigation, saying that no further probes into the group were needed.

Adani welcomed this ruling stating that “truth has prevailed”. After the ruling, his stock started rising at a whirlwind pace, adding billions to his net worth in days.

Gautam Adani was the richest man in Asia for a long time until the Hindenburg Research report shook his companies to the bone. Soon after the report dropped, he was dethroned by the Chairman of Reliance Industries, Mukesh Ambani. Right after the most recent court ruling, Adani’s stocks rocketed up, making him the richest man in Asia yet again. But that didn’t last long as the 2 traded places yet again in recent weeks.

There’s no telling whether Ambani will hold the spot for long though as he is only worth a few more billion dollars than his rival.

The Adani Group stocks have been slowly inching higher since the end of the debacle. Adani’s wealth has already surged, reportedly by $13.3 billion since the beginning of 2024 as the Adani stocks are regaining strength. Adani’s boost in wealth occurred in only two days, making for the largest jump in wealth this year.

Philanthropy

In 1996, Gautam Adani founded the Adani Foundation through his company to foster sustainable growth and development in India through diverse projects. The Adani Foundation focuses on education, sustainable living, healthcare, and community infrastructure.

So far, it has established cost-free schools for underprivileged children in Bhadreshwar, Ahmedabad, Surguja, Navchetan Vidyalaya, and more. The foundation, in conjunction with the Gujarat government, also established the Gujarat Adani Institute of Medical Sciences.

Other notable initiatives launched by the foundation include:

- SuPoshan to reduce malnutrition in pregnant women and teenage girls

- Udaan to provide educational trips for students

- Saksham to offer skill cultivation and vocational training to female-led organization members

During the COVID-19 pandemic, the Adani Foundation donated $13 million to the PM CARES Fund and made a donation of an undisclosed sum to the Maharashtra CM Relief Fund.

The Adani Foundation is led by Gautam’s wife, Priti Adani. During her leadership, the Adani Foundation has pledged to donate $7.7 billion in honor of Gautam’s 60th birthday.

How Asia’s Richest Man Invests: Assets and Investments

Adani is a relatively private person, so details on his investments and assets are not publicly disclosed. He does, however, live quite a lavish lifestyle and owns several properties and luxury cars.

Real Estate

Adani’s most luxurious real estate asset is the Gurgaon, Delhi, property. The property is the city’s most expensive residence worth over $48 million.

Gautam Adani reportedly also owns a house in Ahmedabad, the headquarters of his company, but its value is unknown.

Car Collection

Gautam Adani is known for his passion for luxury cars, and he is rumored to have quite a collection of high-end vehicles. His collection includes a 2008 Ferrari California, a BMW 7 series, a Range Rover LWB, a Rolls-Royce Ghost, and a Toyota Alphard, among others. This combination of cars is worth between $300,000 and $650,000 in total.

Private Jets

Adani’s lifestyle is grand, so it should come as no surprise that he moves around in his business jets, a Bombardier Challenger 605 and an Embraer Legacy 650, both worth 10s of millions of dollars.

What Can We Learn from Gautam Adani’s Story?

Gautam Adani’s story is as educational as it is inspirational.

He started his entrepreneurial journey by creating a business from scratch, after dropping out of school and leaving his family’s business behind. His ability to envision – and create – a diversified business conglomerate clearly paid off, showing us the importance of having a clear vision, courage, and taking calculated risks.

Adani’s success also heavily hinged on his ability to diversify across diverse sectors including energy, infrastructure, resources, and logistics. This is yet another example of the power of diversification. Adani’s spread in varied industries showcases the benefits of managing a portfolio of businesses to mitigate risks and create growth opportunities.

Adani has been particularly focused on government contracts and infrastructure development including ports, logistics, and airports.

His emphasis on building critical infrastructure aligns with the broader economic development goals of his nation, which profits both him and his country’s people.

Furthermore, Adani’s success has contributed to wealth creation and job generation. His story teaches us the potential for entrepreneurs to play a role in driving economic growth and development.

A lot of his success is attributed to his ability to adapt to changing market conditions. Whether it is the shift in the energy sector or the evolving logistics trends, Adani has demonstrated a capacity to adapt his business to new realities, which is a valuable lesson in staying relevant.

Finally, Adani has proven the ability to handle a crisis. His life and career were turned upside down when his company was accused of financial fraud in a January 2023 report. However, he persevered, stood his ground, and fought the accusations and today, he is getting stronger than ever.