Don Robert Hankey, the American billionaire entrepreneur, oversees an automotive empire worth over $23 billion. You may recognize his name from media buzz over his company underwriting the appeal bond for Donald Trump, which saved the former president from having his assets seized.

As of 2024, Don Hankey’s net worth is estimated at $7 billion.

Hankey’s rise to fame is truly impressive, starting with the modest upbringing of a child who grew up washing and polishing cars, to becoming the founder of a company that revolutionized the auto loan industry.

To learn more about the life and wealth of Don Robert Hankey, keep reading.

How Much Is Don Hankey Worth in 2024?

- Estimated net worth: $7 billion.

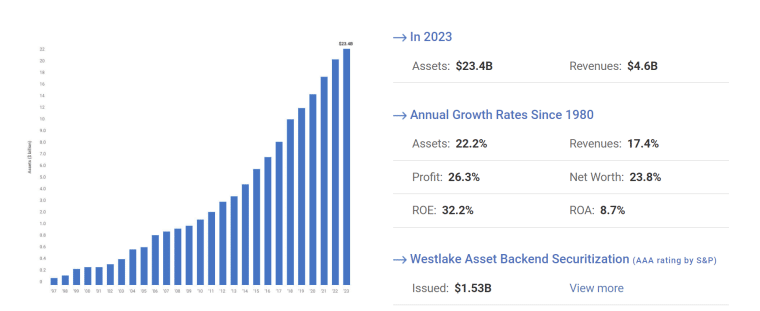

- Wealth derived from ownership of Hankey Group, a $23.4 billion financial and automotive services empire.

- Additional assets include stakes in Axos Bank ($180 million) and real estate ($50+ million).

Don Hankey’s Net Worth Breakdown:

For the most part, Hankey’s net worth is based on his ownership of the Hankey Group. This is a privately owned venture, meaning the exact stake Don Hankey has in the business isn’t clear. At one point, he sold 20% of the company to the Japanese company Marubeni for a $250 million investment.

After thorough research of the businessman’s assets and public records, we were able to create a comprehensive net worth breakdown, which will show you what exactly contributes to his wealth:

| Asset or Income Source | Contribution to Net Worth |

| Hankey Group Stake | Undisclosed |

| Hankey Group assets | $23.4 billion |

| Axos Bank stake | $180 million |

| Real estate | $50+ million |

| Other assets | $100,000+ |

| Total Net Worth | $7 billion |

6 Fun Facts about Don Hankey

- Started working in his father’s Ford dealership and later took over the business.

- Known as the “King of Subprime Car Loans” due to his success in high-interest auto loans.

- Founded Westlake Financial Services in 1978, a leading subprime auto lender in the U.S.

- Hankey’s businesses have expanded to include real estate, software, and insurance.

- Recently financed a $100 million loan for Trump Tower through Axos Bank.

- He has invested in high-profile real estate, including a vineyard in Malibu and multiple properties.

Latest News & Updates:

- Trump Appeal Bond: Don Hankey made headlines for underwriting the appeal bond for Donald Trump in 2023, preventing asset seizure as Trump appeals a civil fraud ruling.

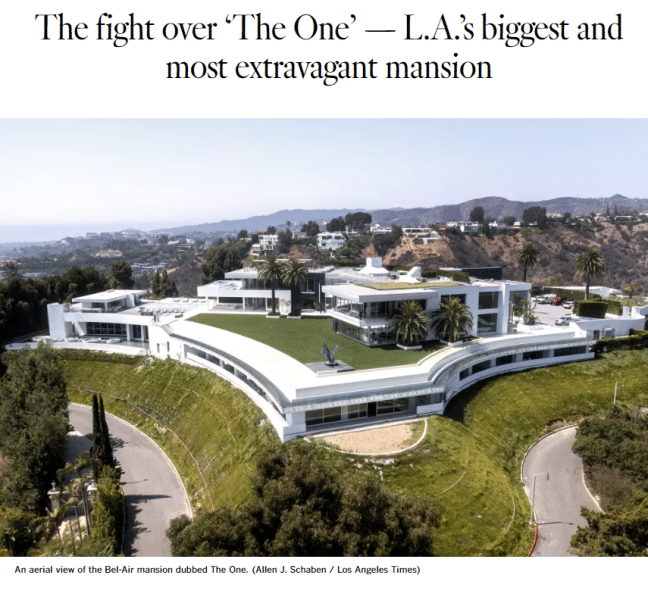

- Real Estate Investments: Involved in The One Bel Air mega-mansion financing, which saw financial troubles but allowed Hankey to recoup his investment when the mansion sold for less than expected.

- Company Expansion: Hankey’s Hankey Group continues to thrive, with assets projected to reach $23.4 billion in 2024, securing its place as a leader in the auto loan and financial services industry.

Early Life and Education

Don Robert Hankey was born on June 13, 1943, in Los Angeles, California. His father was a car dealer who owned a Ford dealership where young Hankey helped out as a child.

Following his college graduation from the University of Southern California, where he studied Finance, Hankey tried his luck on Wall Street, working as a stockbroker.

Eventually, Don Hankey took over his father’s Ford dealership in 1972. His father owned 25% of Midway Ford, but Hankey acquired full ownership of the franchise dealership after he took over.

Today, Don Hankey is married to Debbie Bowles and has four children with her. His son Rufus is managing the family software business Nowcom.

Don Hankey Net Worth: The “King of the Subprime Car Loans”

Hankey presides over the Hankey Group, a multi-billion dollar business that specializes in high-interest loans to car buyers with low credit scores, as well as real estate investments, insurance, financial services, and more. This often isn’t exactly considered the most moral business model (especially when it gets to repossessing vehicles) but it fills a need in the economy and Hankey has greatly benefitted from it.

Let’s see how he came to manage such a successful venture.

Founding Westlake Financial Services

In 1972, Don Hankey took over his father’s business at a point when the company was losing money. This is when he got the idea to lend money to people with bad credit instead of simply selling cars, offering higher interest rates than other dealerships.

“The big banks were worried about deals like these, and they were also leery of working with used car dealerships,” said Don Hankey about his idea.

The originating company of the business was the Midway Ford dealership, which soon expanded to include Midway Car Rental and Westlake Financial.

In 1978, Don Hankey decided to found his own business, a company that specialized in subprime car loans. He named this company Westlake Financial Services. Next he decided to pursue a role as a real estate investor, founding the Hankey Investment Company in 1982. In the years that followed, he expanded his business portfolio to include everything from a Toyota dealership to a software company and an investment business.

In 2011, Marubeni, a Japanese company, invested $250 million for a 20% stake in Westlake Financial Services, valuing the company at $1 billion for the very first time.

By 2015, Westlake Financial Services was repossessing about 250 cars every day. Not long after, the company became one of the largest subprime auto lenders in the US.

The Hankey Group

As the business expanded, Don Hankey created a holding company that gathered all the subsidiaries of his auto business, as well as his real estate company, and called it the Hankey Group.

Today, The Hankey Group is one of the largest financial companies in the world, operating eight companies including:

- Westlake Financial Services, the main business, is a privately held finance company, with up to $16.8 billion in assets.

- Midway Auto Group, an exotic car rental company established in 1986, counting over 4,345 vehicles and offices in Downtown Los Angeles, El Segundo, Beverly Hills, Santa Monica, and more.

- Knight Insurance Co., the Knight specialty insurance company with $1.77 billion in assets.

- Nowcom, a car lending software developer with a 97% ROE.

- Hankey Investment Company, a real estate investment firm.

- Hankey Capital, a private direct lender in bridge financing in the $2-100+ million range, secured by real estate in California (totals $200 million in recent structured finance solution deals and has over $1.46 billion in loans on its balance sheet).

- North Hollywood Toyota, one of San Fernando Valley’s leading dealerships for new and certified Toyota vehicles.

- HFC Acceptance, LLC., a fleet finance provider for independent car rental companies and franchise rental companies.

The Hankey Group’s total assets are projected to reach $23.4 billion in 2024.

At the time of writing, the businesses employ over 3,435 employees worldwide and have an average annual return on equity of 33% and an annual growth rate of 20%. The auto services and auto loans empire located in Los Angeles, California, works with over 30,000 car dealerships across all 50 states.

Connection to Donald Trump

In 2022, Axos Bank, the business in which Don Hankey holds a significant stake, refinanced Trump Tower for $100 million. In addition to this, Hankey has donated to Trump’s 2016 campaign.

However, the action that has put him under most scrutiny is his recent move. Don Hankey helped Donald Trump pay his civil fraud bond. On April 1, the former president posted a $175 million bond in a civil fraud case, which prevented the state of New York from seizing his assets. Trump is appealing a ruling that top executives at The Trump Organization, including himself, inflated the value of the assets to get more favorable terms from insurers and lenders.

Trump secured the bond through Knight Specialty Insurance Company, owned by The Hankey Group and managed by Don Hankey.

Awards and Accolades

Over the years, Hankey has received awards and accolades for his success.

In 2006, he was named the Ernst & Young Entrepreneur of the Year.

In 2019, he was inducted into the Automotive Hall of Fame.

Don Hankey Net Worth: Other Investments and Assets

Aside from the numerous businesses under Hankey’s company, the businessman hasn’t disclosed details on many other investments. However, we did manage to find some data about his major real estate investments, as well as details on what car he drives.

Real Estate Investor

Don Hankey generated quite a buzz when he spent $82.5 million in financing into The One, a Bel Air mega-mansion with 21 bedrooms and 42 bathrooms. He borrowed this money from Hankey Capital.

However, the property didn’t yield as much interest as expected, which led to financial challenges for Nial Niami’s Crestlloyd, the developer, forcing them to file for bankruptcy protection. The mansion ended up being auctioned for less than half of its expected worth, which was supposed to be $500 million.

Even though he didn’t make a profit, he got all his capital commitments back after the sale.

Personal Assets

As for his personal assets, Don Hankey and his wife Debbie own at least three Malibu properties. In May 2021, they spent $21 million on a property on Carbon Beach in Malibu. Their primary residence is a large mansion near Paradise Cove, which they acquired from Olivia Newton-John in 2005 for an undisclosed sum.

In addition to this, the family owns a vineyard in the Zuma Beach area of Malibu and a mansion in Beverly Park, which they bought from John Fogerty in 2014 for $18.5 million. The property is now most likely worth over $25 million.

The businessman is seen driving a 2013 Mercedes SL to work, worth over $100,000.

What Can We Learn from Don Hankey’s Story?

Don Hankey’s journey from a humble background to building a multibillion-dollar empire in the automotive and financial services industries offers invaluable lessons in entrepreneurship, innovation, and strategic decision-making.

His success story underscores the importance of recognizing the opportunities in niche markets. Hankey began by taking over his father’s struggling dealership but noticed the potential in offering unique loans to car buyers with low credit scores, a segment that was largely overlooked by other lenders.

This foresight led to the creation of his empire, which became the largest subprime auto lender in the US and revolutionized the auto loan industry.

Furthermore, Hankey’s expansion into different businesses such as rental car services and real estate teaches us the benefits of vertical integration and diversification of income sources. By establishing different companies through his Los Angeles business, Hankey created a synergistic network of brands that complemented each other’s operations.

This has been a recipe for success for his business.

Finally, Hankey’s involvement in financing high-profile projects such as the refinancing of Trump Tower or underwriting the appeal bonds for Trump, highlights the importance of seizing opportunities and making strategic partnerships.

These bold moves helped him find a place in the spotlight and solidified his reputation as a savvy businessman.