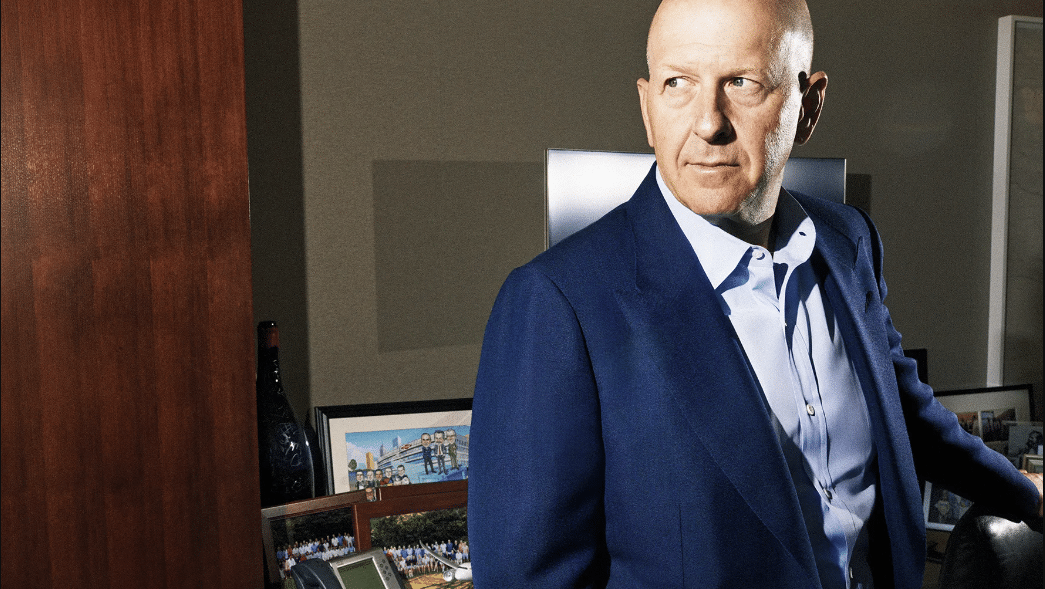

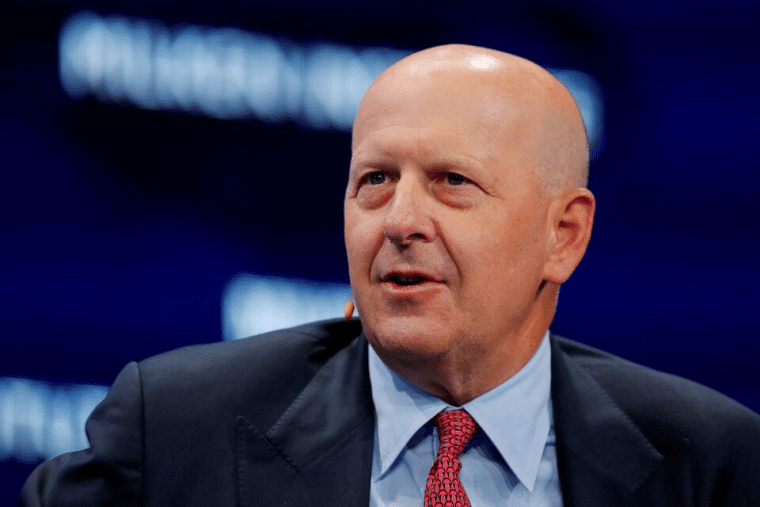

Being the CEO and chairman of Goldman Sachs, one of the biggest investment banks in the world, isn’t enough for David Solomon. While most of his wealth is derived from his leadership of the company, he also works as a DJ and record producer.

With an estimated net worth of around $150 million, Solomon has built up an impressive fortune over the years.

On LinkedIn, Solomon has over 1.2 million followers and is one of the major thought leaders on the platform. Here, we take a deep look into his career, net worth, and life story to see what other insights we can learn from Solomon.

How Much Is David Solomon Worth in 2024?

- Net Worth: Estimated at $150 million in 2024.

- Goldman Sachs Shares: Holds 124,782 shares worth $51 million.

- 2023 Share Sales: Sold roughly $5 million of shares.

- Goldman Sachs Salary: Earned $31 million in 2023, including $29 million in variable pay.

- Real Estate Investments: Properties valued at approximately $40 million.

David Solomon Net Worth Breakdown:

David Solomon is a successful CEO with interests in both privately held assets and publicly traded companies, primarily GS stock.

This makes it impossible to arrive at his exact net worth. However, we have been able to collect plenty of public information surrounding his various sources of income, investments, assets, and business ventures to build a solid estimate, which we break down here for you.

Despite having gradually sold GS stock as reflected in publicly available transactions over the years, Solomon holds 124,782 shares of Goldman Sachs.

He sold roughly $5 million of shares in 2023 and he could be eligible for more shares.

His total compensation in 2023 was $31 million which included $2 million in base salary and $29 million in variable pay of which $20.3 million was in restricted stock units.

| Asset or Income Source | Contribution to Net Worth |

| Goldman Sachs shares | $51 million |

| Goldman Sachs share sales, 2023 | $5 million |

| Goldman Sachs salary | $31 million |

| Real estate | $40 million |

| Other investments | $50 million |

| Total Net Worth | $150 million |

5 Fun Facts about David Solomon

- Double Rejection: David Solomon was rejected twice by Goldman Sachs before finally securing a position.

- DJ D-Sol: Beyond banking, Solomon moonlights as DJ D-Sol, performing at events and festivals.

- Record Producer: He’s also ventured into record production, blending his passion for music with his professional career.

- Lavish Parties: Known for throwing extravagant parties at his Manhattan penthouse in the trendy SoHo neighborhood.

- Avid Wine Collector: Solomon once had 500 rare wine bottles stolen by his personal assistant, including a $1.2 million collection.

Latest News & Controversies

Solomon faced controversies during his tenure, especially regarding Goldman Sachs’ troubled consumer banking expansion with Marcus, the bank’s foray into retail banking. The project has struggled with significant losses, prompting internal reviews and a pivot away from the strategy.

There have also been internal tensions regarding his leadership style, as some within Goldman Sachs have questioned his focus and decision-making amid these challenges.

In addition to these corporate issues, Solomon’s side gig as DJ D-Sol has drawn attention.

While he initially performed at high-profile events like Lollapalooza, Solomon pulled back from public DJ performances after concerns were raised about his dual career possibly distracting from his responsibilities at Goldman Sachs.

Despite these challenges, Solomon has remained a significant figure in the financial industry.

His philanthropic efforts, including his work with The Robin Hood Foundation and Hamilton College, and his advocacy for blockchain technology, have maintained his prominence outside the controversies. Solomon’s leadership continues to be scrutinized as Goldman Sachs navigates an evolving financial landscape, but his influence remains strong.

Early Life

David Solomon was born David Michael Solomon on January 22, 1962, in Hartsdale, New York. His mother, Sandra Solomon, worked as an audiology supervisor while his father Alan Solomon, was an executive vice president at a small publishing company.

David Solomon attended Edgemont Junior-Senior High School and graduated with a B.A. in political science and government from Hamilton College, Clinton in 1984.

Before running Goldman Sachs & DJing, David Solomon was an absolute frat GAWD at Hamilton College pic.twitter.com/rH7xDcbmXV

— litquidity (@litcapital) October 13, 2022

Solomon applied for the position of a two-year analyst at Goldman Sachs after his graduation but was rejected twice.

I like to remind people that I was rejected by Goldman Sachs not once, but twice

During his second attempt, he made it to the final round but was ridiculed by a partner who said, “David, let’s face it, you’re really not Goldman Sachs material.”

David Solomon Net Worth: From Rejection to Top Dog at GS

After getting rejected by Goldman Sachs, Solomon worked at Irving Trust. In 1986, he joined Drexel Burnham where he was a commercial paper (a kind of unsecured debt) salesman to begin with, but subsequently joined the junk bonds team.

In 1991, Solomon joined Bear Stearns as managing director of the bankruptcy and high-yield-bond group. By 1995 he had become a joint head of the investment banking division after steadily rising through the ranks at the now-defunct company which was later sold to JPMorgan Chase.

Rising Through the Ranks at Goldman Sachs Group

In September 1999, Solomon joined Goldman Sachs Group and for the next almost seven years held various roles including that of the Global Head of the Financing Group. In June 2006, he became the co-head of the Investment Banking Division – a role he held until December 2016.

Between January 2017 and September 2018, Solomon was President and chief or co-chief operating officer at Goldman Sachs. In October 2018, he became the CEO and in January 2019 he also became the chairman succeeding Lloyd Blankfein.

Solomon’s career at Goldman Sachs has been marred by some controversies including the ill-fated expansion in consumer banking. In 2016, the company launched Marcus which was named after the first name of its founder. However, the business failed to gain traction despite having garnered $50 billion worth of deposits in three years.

Goldman Sachs consumer unit fails to live up to expectations: https://t.co/nLJrDBSpDn – Plans to scale up online platform Marcus did not deliver the sort kind of valuation lift brash young firms were achieving

Tweeted by @BDliveSA https://t.co/osGhlfDvU2 https://t.co/1wkakRryPi pic.twitter.com/bwjESnbLGq— Rick Telberg (@CPA_Trendlines) October 10, 2022

According to a Wall Street Journal report, despite the troubles, Solomon has in recent months made it clear to senior executives that he would hold on to his position as the CEO and has been getting more actively involved with the investment bank.

David Solomon Net Worth: Keeping Busy Outside of Goldman Sachs

Along with heading Goldman Sachs Group Inc., Solomon is associated with multiple other ventures.

Even before he became the CEO of Goldman Sachs, Solomon was pursuing his passion for music under the stage name DJ D-Sol. As DJ D-Sol, he has performed around Manhattan and at the Lollapalooza festival.

However, 2022’s Lollapalooza turned out to be his last public performance – he left behind public DJing amid concern that his gig was distracting him from Goldman Sachs.

A Goldman Sachs spokesperson told the Financial Times, “Music was not a distraction from David’s work. The media attention became a distraction.” He still lists his DJing on his LinkedIn profile, though.

FINRA filings also reveal that Solomon is the part owner of Sherwood Forest Inc., Sherwood Forest, LLC, and Sherwood Robin, LLC, being involved since April 2012.

The companies are involved in business advising and consulting. In the company’s filings, it says that he spends only about 2 hours a year on the venture which is “comprised of responding to ideas/questions arising from the management of the organization”.

Solomon is also a Passive Advisory Board Observer for Discovery Land Co. LLC.

The firm is a real estate development organization that Solomon has been associated with since September 2021 though his involvement is limited to eight hours every year.

In addition, Solomon serves on the board of The Robin Hood Foundation which is New York City’s largest poverty-fighting organization. Solomon is also the Chairman of the Board of Trustees of Hamilton College, his alma mater. He also serves on the Board of Trustees of New York-Presbyterian Hospital.

David Solomon Net Worth: Real Estate Investments

David Solomon has made some enormously successful real estate investments in the past.

In 2020, he sold his property in Aspen for $26.5 million, masterfully splitting it into two to rake in more cash. He sold the 13,000 sq ft house on 45.6 acres for $19.5 million while the vacant 38-acre lot in the property secured him an estimated $7 million.

While the property was sold at $10 million lower than what Solomon was initially seeking, it was nonetheless a massively profitable investment for him considering he paid just about $5 million for the asset in 2005.

In 2017, Solomon also sold his Manhattan apartment in the prestigious San Remo on the Upper West Side of Manhattan in New York City for $21.5 million. He now stays in Manhattan’s trendy SoHo neighborhood, in a penthouse on the famed Wooster Street, and is known to throw lavish parties at the place.

Solomon also owns a home in the Bahamas and takes a Goldman Sachs corporate jet for his trips. Amid concerns over Solomon using the company jet for private use, Goldman Sachs clarified that he reimburses the company for the use.

David Solomon on Cryptocurrency and Blockchain

Solomon is a proponent of blockchain and in an opinion piece in Wall Street Journal in 2022 titled Blockchain Is Much More Than Crypto he wrote ”

As a longtime participant in financial markets, I still see blockchain as a promising technology if allowed to innovate under the right conditions. Under the guidance of a regulated financial institution like ours, blockchain innovations can flourish.”

Goldman Sachs Group Inc is also bullish on decentralized finance as its report in 2023 showed. Blockchain and cryptocurrencies have seen an increase in adoption in recent years and many investors see digital assets like bitcoin as a diversification tool.

Solomon hasn’t revealed whether he owns any cryptocurrencies but it seems likely judging by his favorable opinion on the asset class.

David Solomon’s Philanthropy

Goldman’s CEO has also made important efforts for social causes and in 2021 he donated the proceeds from his song Learn to Love Me to charity. In addition, Solomon has attended lunch events to raise funds for charitable causes.

David Solomon’s Life Outside of Work

Solomon married Ogilvy & Mather executive Mary Elizabeth in 1989 but the couple divorced in 2018.

He has an affection for good wine and in an infamous case, his personal assistant Nicolas DeMeyer was accused of stealing 500 wine bottles from him including the rare wine collection worth an impressive $1.2 million.

DeMeyer sold the wine under an assumed name to a broker and later tried escaping by traveling to different countries for 14 months. DeMeyer however jumped to his death from the Carlyle Hotel in 2018 just when he was set to plead guilty in court.

What Can We Learn From David Solomon’s Life?

David Solomon’s life and career contain a multitude of important lessons for those aiming to make it big in the corporate world, especially in the banking sector.

In his keynote speech at NYU Stern’s 2023 graduation ceremony, Solomon talked about what he called “foundational values” which are

- Resilience: This is one quality that most if not all successful people have. According to Solomon, “Life is a marathon, not a sprint.” He added that “one of the big mistakes people can make is, when a job starts getting tough, they give up and go someplace else.”

- Excellence: According to Solomon, one should strive for excellence and refuse “to settle for good”. In a world that’s getting increasingly competitive, mediocracy is unlikely to help whether you’re a startup, a mega-cap company, or even a corporate employee.

- Empathy: The third “foundation stone” that Solomon talked about was empathy. According to him, “connecting as a human” is a good strategy. This holds especially true with teams working remotely and human-to-human interaction reducing amid the digital transformation.

In a podcast for the Commencement Class of 2020 series, Solomon stressed the importance of time management. He said, “Even a banker will tell you the most precious commodity of all is time. No matter how smart or creative you may be, you cannot create more time, and once you’ve spent it, there’s no way to get it back.”

He also stressed that the corporate journey is not a linear path that many might believe it to be. He advised, “Listen to others tell you of their own journey, and most will tell you that their path has been one of crooked lines, u-turns, detours, and even the f-word: failure.”

As somebody who went on to head one of the biggest investment banks after having previously failed to even land a junior position at the company twice, Solomon’s career has been far from linear and has a lot of learnings for others.