After a serious fortune plunge of nearly $2 billion in 2023, Charles Schwab seems to be getting back on his feet and holding onto his position as one of the richest people worldwide. The American investor and founder of the Charles Schwab Corporation is still counting his billions.

In 2024, Charles Schwab’s net worth is estimated at over $11 billion.

Schwab semi-retired in 2008 by stepping down as the company’s CEO but remains its largest stakeholder and chairman today. The American businessman owes most of his wealth to his stake in the corporation but has also invested in politics and assets such as real estate.

Let’s see what exactly contributes to his estimated net worth today.

How Much is Charles Schwab Worth in 2024?

- Net worth: Over $11 billion in 2024.

- Major income sources: Founder and largest stakeholder of Charles Schwab Corporation, real estate, and other investments.

- Charles Schwab Corporation: Stake worth 6% of the company.

- Dividend and share sales: Over $3.5 billion.

- Real estate: Properties worth over $20 million.

- Salary: $6+ million as chairman.

6 Fun Facts About Charles Schwab

- Early Life: Born on July 29, 1937, in Sacramento, California.

- Career Start: Launched his investment newsletter in 1963, leading to the founding of Charles Schwab Corporation.

- Business Success: Took the company public, then private, and public again, growing it into a financial services giant.

- Real Estate: Owns significant properties, including a $20 million estate in Atherton, California.

- Philanthropy: Donated millions through the Charles and Helen Schwab Foundation.

- Political Involvement: Active Republican donor, opposed to wealth tax.

Charles Schwab’s Net Worth: Full Breakdown

Despite his wealth and popularity, Charles Schwab lives a rather private life.

As can be expected, high net-worth individuals don’t disclose information such as their salary or investments publicly. However, considering his extensive career in the financial services industry, we can glean insights into his net worth.

| Asset or Income Source | Contribution to Net Worth |

| Charles Schwab & Co. sale to Bank of America, 1983 | $55 million |

| Charles Schwab Corp re-purchase | -$280 million |

| Charles Schwab Corp. stake | 6% |

| Dividend and share sales | $3.5+ billion |

| Charles Schwab Corp, chairman salary | $6+ million |

| Real estate | $20 million |

| Total Net Worth | $11 billion |

Early Life and Education

Charles Robert Schwab, Jr. was born on July 29, 1937, in Sacramento, California, to mother Terrie, a housewife, and father Lloyd, a lawyer and Yolo County’s district attorney. After they had spent some time in Woodland, California, the family relocated to Santa Barbara, where young Charles studied at Santa Barbara High School and captained the golf team.

While he was still young, Charles R. Schwab worked several jobs including as a caddie, a railroad switchman, and a roustabout in an oil field.

Following his high school graduation, he attended pre-college school at Holy Rosary Academy and later enrolled in Stanford University to study economics.

In 1959, Schwab graduated from Stanford University and proceeded to study at the Stanford Graduate School, where he obtained his Master of Business Administration degree in 1961.

Schwab has been married two times and has three children from his first marriage to Susan Cotter: Charles Jr., Carrie, and Virginia. He then married Helen Schwab and has two children from this marriage: Michael and Helen.

Charles Schwab Net Worth: Masterminding the Brokerage Industry

Charles R. Schwab achieved major success almost straight out of university. Two years after his MBA graduation, he launched what would turn into a multi-billion-dollar business and changed his life to its core. Let’s see how he built his brokerage firm from scratch.

The Launch of Investment Indicator

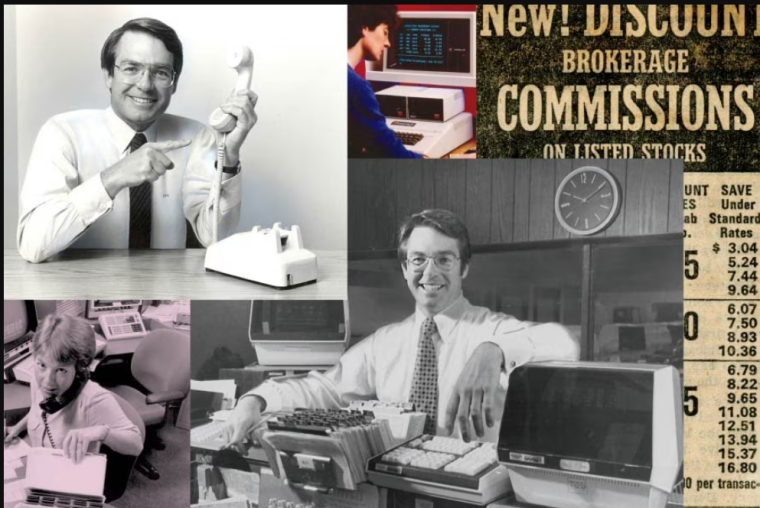

In 1963, Charles R. Schwab launched an investment newsletter called Investment Indicator.

At one point, the newsletter counted 3,000 subscribers and cost a whopping $84 a year (about $850 when accounting for inflation). He co-launched this business with two other partners, and eight years later, the firm was incorporated as First Commander Corporation in California, a wholly owned subsidiary of Commander Industries.

The reason why the business became First Commander Corporation was to enable it to conduct broker-dealer securities business in addition to publishing the newsletter.

That same year, he and four other people purchased the stock from Commander Industries. Just a year later, Schwab bought out all of the partners and got full ownership of the corporation.

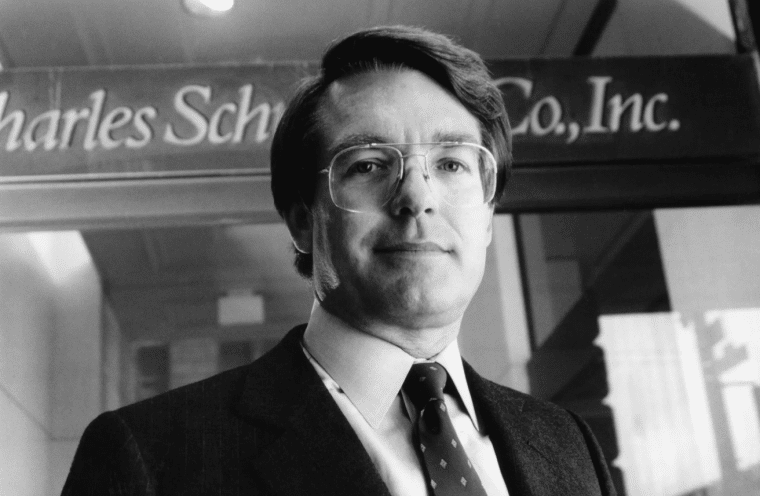

In 1973, he changed the name of the company to Charles Schwab & Co., Inc.

The Rise of Charles Schwab & Co.

In 1975, two years after the change of the business’ name, the US Securities and Exchange Commission (SEC) deregulated the industry through the 1975 Securities Act Amendments. This change allowed companies like Charles Schwab & Co. to charge any fees they wanted. At the time, securities weren’t bought by consumers but were sold through salesmen who charged major commissions and sold riskier policies.

With the amendments, the charges to consumers almost instantly split in half. Salesmen had to settle for hourly salaries and stopped charging commissions on sale prices. Finally, regular people could use the phone to make orders from anywhere using a toll-free number.

Companies that made major profits from the traditional, commission-based model were outraged and tried to stop Schwab from expanding, but in September 1975, he successfully opened the company’s first branch in Sacramento, California.

In only five years, the business cut its expenses, automated many of its processes, and expanded across the state. In 1977, he opened an office outside of California, in Seattle, and started offering seminars for his customers.

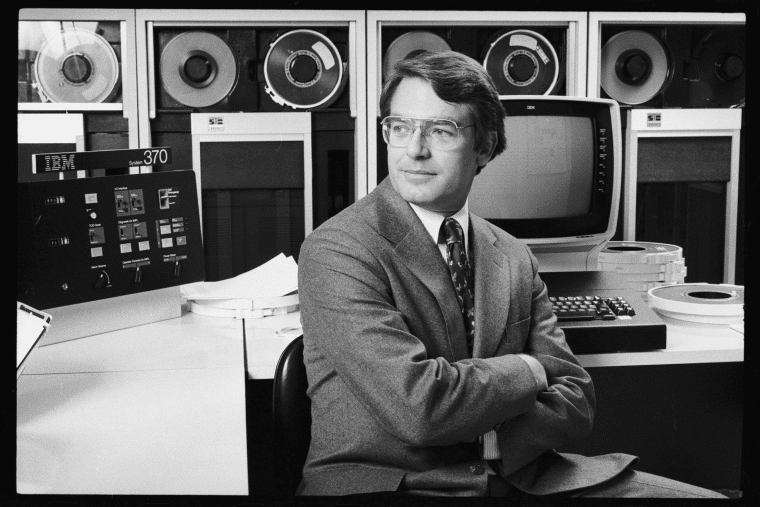

By 1980, Charles Schwab & Co. was the largest discounter in the country and had the industry’s first 24-hour quotation service. At this point, it counted over 147,000 clients across the country.

As a result, Bank of America reached out to Charles R. Schwab in 1981 and offered him $55 million in stock for a 37% ownership. He accepted the deal but remained as president of a semi-autonomous unit. That same year, Schwab became a member of the New York Stock Exchange and opened the firm’s first location in Manhattan.

A year after the deal, Charles Schwab & Co. became the first with a 24/7 order entry and quote service and opened its first international office in Hong Kong. By this time, the number of client accounts reached 374,000.

Fast forward to 1985, and the firm had 90 branches and 1.2 million customers – and was generating a whopping $202 million in revenue annually!

The Founding of The Charles Schwab Corporation

Bank of America was struggling at the time, which made the stock plunge.

The SEC investigated Charles R. Schwab on the possibility that he used insider information to sell stock, but no charges were filed since he denied it, and there wasn’t any proof of this. This, however, caused tensions between the Bank of America and the Schwab unit, which prompted Charles R. Schwab to stop the deal with the bank and buy back the brokerage company, paying $280 million for it.

In September 1987, an IPO created a new holding company named the Charles Schwab Corp., with Charles Schwab & Co., Inc. as the principal operating subsidiary. Schwab took the firm public.

In 1991, the company acquired Mayer & Schweitzer, which allowed Schwab to execute customer orders without sending them to an exchange. Two years later, it opened a new office in London.

In 1995, Charles Schwab Corp. acquired The Hampton Company, and Walter W. Bettinger, its owner, became the chief executive officer of the firm.

A year later, trading went live, allowing customers to trade listed and OTC stocks, and check order status on the official schwab.com website.

At this point, the business was by far the largest discount brokerage and counted $200 billion in assets under management. The revenue of the business was $1.4 billion, and there were 3.6 million active accounts.

Things were going pretty well for the business, and the number of customers kept growing. However, since it failed to arrange the best trades, the company was fined $200,000 in 1997.

In 2000, Schwab spent $2.73 billion to buy US Trust. A year after this acquisition, the subsidiary was fined $10 million in a bank secrecy law case and was ordered to pay this sum to the New York State Banking Department and the Federal Reserve Board.

In 2006, the company announced an agreement to sell US Trust to Bank of America for $3.3 billion, a deal that closed in 2007.

Fast forward to today, and the company has accumulated $8.5 trillion in client assets, 1.8 million banking accounts, and 34.8 million active brokerage accounts. The brokerage firm offers a multitude of investment options, but it also serves as a bank (named Charles Schwab Bank), offering with both checking and savings accounts.

Schwab’s Role in Charles Schwab Corp.

In 1998, David Pottruck started sharing the CEO title with no other than Charles R. Schwab. Schwab remained the company’s co-chief executive officer between 1998 and 2003. In 2003, Schwab announced that he was stepping down as CEO and leaving Pottruck as the sole chief executive officer of the business.

David Pottruck, who spent almost 20 years at the brokerage as the co-chief executive officer, was fired a year after he was given full rein of the business. In July 2004, the company’s board once again put Charles Schwab on the throne of the discount brokerage, as the chief executive officer.

The firm previously announced that its profits dropped by 10%, driven by a decline in revenue, which prompted the board to fire the CEO.

After Mr. Schwab came back into control, he shared that the company had “lost touch with its heritage”, and refocused the company to provide general counsel and financial advice to individual investors, as well as reduce the fees.

The company almost instantly rebounded and its earnings and stock started growing in 2005, marking a share price higher by 151% since Pottruck’s removal.

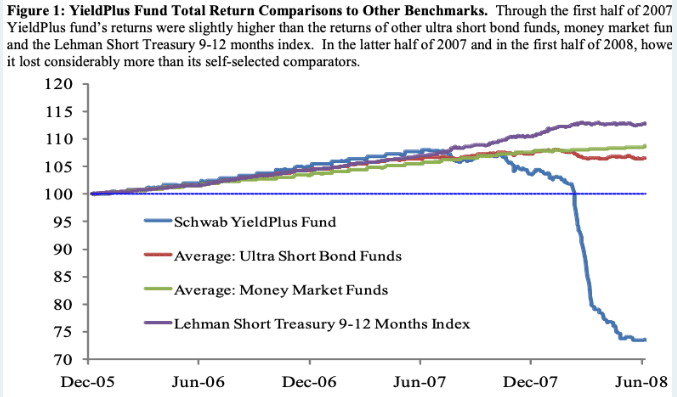

Between 2004 and 2008, the company’s net transfer assets quadrupled, but not every venture was successful for the CEO. During the financial crisis of 2007, the Schwab YieldPlus fund had a -31.7 % return, and investors in it, including Charles R. Schwab himself, lost $1.1 billion, forcing the firm to close the funds in 2011.

In 2008, Charles R. Schwab stepped down from the position of CEO once again – this time permanently. However, he didn’t fully retire since he remained executive chairman of the company. On July 22, 2008, Walter Bettinger, the previous CEO, was once again named chief executive.

Even though he no longer holds the position of CEO, Schwab remains the company’s largest shareholder with a 6% stake.

Due to the collapse of Silicon Valley Bank and worries of liquidity contagion spreading, Schwab shares dropped almost 12% in 2023, erasing $2.9 billion from his estimated net worth. Even so, Schwab’s net worth is still mostly derived from his stake in the company.

In addition to his worthy stake in the business, he has received at least $3.5 billion from dividends and share sales over the years.

While details of his salary in the investment business are not publicly disclosed, the overall remuneration is set at over $6 million in his capacity as Chairman of the Board.

Involvement in Politics

Charles Schwab is an active Republican. Over the years, he has donated heavily to the Republican Party and is strongly opposed to a wealth tax.

In 2017, for instance, he donated the maximum legal individual amount of $101,700 to the legal defense fund of the Republican National Committee, which partially paid for the defense of President Donald Trump in the Special Counsel investigation of coordination between his campaign and Russia.

He has also donated $12.5 million to general conservative political activities, out of which $2 million has gone to Donald Trump. This was mentioned in a 2019 Washington Post article discussing the largest PAC contributors in the US.

Reportedly, Schwab donated nearly $9 million to Americans for Job Security, a dark money group that opposed Barack Obama in the election of 2012.

After so many years of donating to politics and following the United States Capitol attack on January 6, 2021, Schwab’s company stopped making political donations, and the PAC donated the remaining funds to historically black colleges and universities and the Boys and Girls Clubs of America.

Awards and Accolades

As a co-chairman and founder of a major brand in the investment world, Charles Schwab has won many awards and honorable mentions over the years, and so has his business.

His company has been ranked #1 in Investor Satisfaction with Full Service Brokerage Firms by J.D. Power, as well as ranked the most trusted bank by Investor’s Business Daily in the same year.

The co-chairman Schwab himself has won several awards, too, including:

- 1989: Golden Plate Award from the American Academy of Achievement

- 1997: Named “King of Online Brokers” by Forbes

- 2016: Financial Innovation Award by the Museum of American Finance

Authorship

Charles Schwab authored a book titled Invested: Changing Forever the Way Americans Invest, which was published in 2019.

Charles Schwab Net Worth: Changing the World With Philanthropy

Charles Schwab stands behind more than one foundation. The company opened its Schwab Charitable Foundation, which granted over $6 billion to charity in 2023 alone.

He and his wife also created the Charles and Helen Schwab Foundation, which funds diverse projects in education, employment, and housing. In March 2003, the Foundation’s board of trustees decided to focus on public education on a national level and housing in the Bay Area. This foundation is independent of the Charles Schwab Corporation and the Charles Schwab Corporate Foundation.

Schwab sits on the Board of Trustees of the San Francisco Museum of Modern Art and is their Chair Emeritus. Since he and one of his sons are dyslexic, Schwab donated a fortune to support research and programs related to learning disabilities, among other health programs.

To date, Schwab is one of the most generous donors of his alma mater, the Stanford University and the Stanford Graduate School.

He is a trustee on the board, among other positions. Back in 1997, he donated $28.3 million to open the Schwab Residential Center, a dorm building at the university.

Charles Schwab Net Worth: Other Assets and Investments

Since he has an investment business, almost all of Schwab’s investments go through his company. He has, however, made notable investments in real estate.

Until 2020, the family lived in San Francisco in a property they sold for $14 million. They bought this home in 2012 for $11 million.

Today, Schwab and his family live in Atherton, California, in an estate worth over $20 million. Reportedly, they also have a Montana ranch of unknown value.

What Can We Learn from Charles Schwab’s Story?

Charles Schwab’s story offers a wealth of lessons for investors and entrepreneurs. As the founder of one of the largest brokerage firms in the world, his journey is filled with insights into the business world and the world of investing.

One key takeaway from his story is the importance of democratizing investing.

He founded the business with the vision of making investing accessible to everyone, regardless of their financial status or background. Such commitment to democratization helped revolutionize the investment industry, empowering people to take control of their financial future.

Schwab’s emphasis on innovation and technology showcases how important it is to stay ahead of the curve, especially in such a rapidly evolving market such as investing. From introducing the first investment newsletter to pioneering online trading platforms, Schwab’s company has remained at the forefront of technological investments.

As a co-chairman of his business, Schwab also shows the value of strong vision and leadership in driving business success. His leadership style has been characterized by a focus on innovation and customer-centricity.

Finally, Schwab’s dedication to education and empowerment is evident in his company’s commitment to providing investors with resources and tools to make informed decisions.

From educational materials to investment research, Schwab’s platform offers investors the support they need to navigate the complexities of the financial markets.